Hudson's Bay Portfolio: 65 Leases Drawing Buyer Attention

Table of Contents

The Allure of Prime Retail Locations within the Hudson's Bay Portfolio

The primary driver of interest in the Hudson's Bay portfolio is the exceptional quality of its 65 leases. These properties are strategically located in high-demand areas across Canada, representing a rare opportunity for investors.

Strategic Locations

The 65 leases are situated in key metropolitan areas across Canada, boasting high foot traffic and strong demographics. This prime real estate translates into significant potential for rental income and property appreciation.

- Major City Centers: Toronto, Vancouver, Calgary, Edmonton, Montreal, and Ottawa are all represented, placing the properties in the heart of major consumer markets.

- High-Performing Malls: Many leases are located within top-performing shopping malls, benefiting from established customer bases and strong anchor tenants. Specific examples include [insert specific mall examples if available – this adds local SEO value].

- High-Street Retail Frontages: Several leases also occupy prime high-street retail locations in bustling city centers, attracting both local residents and tourists.

Owning properties in these locations offers significant advantages. The consistent high foot traffic translates directly into strong rental income potential, while the prime locations ensure substantial appreciation over time. This makes the Hudson's Bay portfolio an exceptionally attractive investment for those seeking strong, stable returns.

Strong Tenant Occupancy and Lease Agreements

The portfolio's attractiveness is further enhanced by strong tenant occupancy and favorable lease agreements. This ensures consistent rental income and minimizes vacancy risk, making it a low-risk, high-reward investment.

- High-Credit Tenants: The portfolio boasts a mix of established anchor stores and high-end retailers, all with strong credit ratings and long-term lease agreements.

- Long-Term Leases: The average lease duration is significantly long, providing investors with predictable and sustained income streams. Occupancy rates are consistently high, minimizing risk.

- Diversified Tenant Mix: The mix of tenants provides additional stability, reducing the impact of potential economic downturns on individual tenants.

These factors significantly contribute to the portfolio's appeal for potential investors, painting a picture of a low-risk, high-return investment opportunity within the North American retail real estate market. The Hudson's Bay portfolio represents a significant opportunity for investors seeking stable, long-term income.

Potential Buyer Profiles and Investment Strategies

Given the scale and quality of the Hudson's Bay portfolio, a range of potential buyers with diverse investment strategies are showing considerable interest.

Real Estate Investment Trusts (REITs)

REITs are particularly well-suited to acquire this portfolio. The diverse range of properties across key Canadian markets allows for portfolio diversification, while the existing strong tenancy provides a reliable high yield.

- Portfolio Diversification: Adding the Hudson's Bay portfolio allows REITs to significantly expand their holdings and geographically diversify their investment.

- High Yield Potential: The strong tenant occupancy and favorable lease terms promise significant and reliable returns.

- Long-Term Growth Potential: The prime locations and potential for future redevelopment offer further opportunities for long-term capital appreciation.

Acquiring this portfolio aligns perfectly with the core investment objectives of most REITs, offering immediate income generation with long-term growth prospects.

Private Equity Firms

Private equity firms are interested in the Hudson's Bay portfolio due to the potential for value creation through active management and redevelopment.

- Value Enhancement Strategies: Private equity firms can leverage their expertise to improve the portfolio's value through various strategies such as lease renegotiations, property renovations, and potential mixed-use developments.

- Portfolio Diversification: The portfolio complements their existing investment portfolios, providing geographic and asset class diversification.

- Return on Investment: Private equity firms can maximize ROI through a combination of active management, redevelopment, and eventual resale at a higher valuation.

High-Net-Worth Individuals

For high-net-worth individuals, the Hudson's Bay portfolio represents a substantial real estate investment with significant tax advantages and long-term appreciation potential.

- Tax Advantages: Real estate investments often offer attractive tax benefits, making it a compelling option for high-net-worth individuals.

- Tangible Asset: Owning a portfolio of prime retail properties provides a tangible, valuable asset that can be passed down through generations.

- Prestige and Diversification: Owning a portfolio of this size and quality is a prestigious investment and adds significant diversification to their investment portfolio.

Market Conditions and Future Outlook for the Hudson's Bay Portfolio

The current market context and future potential further enhance the attractiveness of the Hudson's Bay portfolio.

Current Market Dynamics

While interest rates and inflation present challenges, the underlying strength of the Canadian economy and the resilience of prime retail properties position this portfolio favorably.

- Strong Canadian Economy: Canada's robust economy supports continued strong consumer spending, which benefits retail properties.

- Prime Retail Resilience: Even in economic downturns, high-quality retail properties in prime locations generally maintain their value and continue to attract tenants.

- Interest Rate Considerations: While higher interest rates impact borrowing costs, the strong income generated by the portfolio helps offset these costs.

These factors demonstrate that the Hudson's Bay portfolio remains a desirable asset even within the current market dynamics.

Potential for Future Development and Redevelopment

The portfolio presents considerable opportunities for future development and redevelopment, further enhancing its long-term value.

- Mixed-Use Developments: Several properties have the potential for conversion to mixed-use developments, incorporating residential or office space alongside retail.

- Residential Conversions: Some properties could be effectively converted into high-demand residential units, capitalizing on urban densification trends.

- Renovations and Modernization: Renovating and modernizing existing properties can attract new, higher-paying tenants and increase rental income.

These potential projects could significantly increase the overall value of the portfolio, creating further returns for investors.

Conclusion

The Hudson's Bay portfolio, with its 65 prime leases, presents a compelling investment opportunity for a variety of buyers. The strategic locations, strong tenant occupancy, and potential for future development make it an attractive asset in the current market. Whether it's REITs seeking diversification, private equity firms aiming for value creation, or high-net-worth individuals looking for a substantial real estate investment, the future of this portfolio is bright. If you are interested in learning more about the potential acquisition of the Hudson's Bay portfolio or other prime commercial real estate opportunities, contact us today to discuss your investment strategy and explore the possibilities. Don't miss out on this lucrative opportunity to invest in the highly desirable Hudson's Bay Portfolio.

Featured Posts

-

Living With A 77 Inch Lg C3 Oled The Good The Bad And The Ugly

Apr 24, 2025

Living With A 77 Inch Lg C3 Oled The Good The Bad And The Ugly

Apr 24, 2025 -

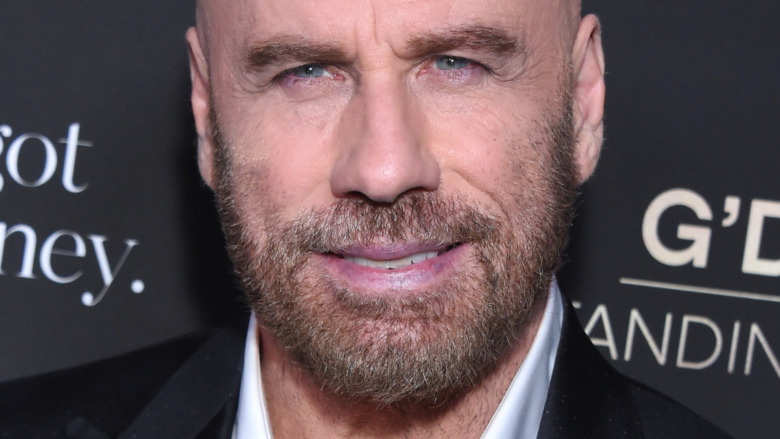

Ella Bleu Travolta Nevjerojatna Transformacija Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Nevjerojatna Transformacija Kceri Johna Travolte

Apr 24, 2025 -

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025

Nba All Star Game 2024 Additions Of Green Moody And Hield

Apr 24, 2025 -

John Travolta Shares A Photo To Remember Late Son Jett On His Birthday

Apr 24, 2025

John Travolta Shares A Photo To Remember Late Son Jett On His Birthday

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025