Ignoring HMRC Letters Could Cost You: A UK Household Warning

Table of Contents

Types of HMRC Letters You Shouldn't Ignore

Ignoring any communication from Her Majesty's Revenue and Customs (HMRC) can be a costly mistake. Several critical types of HMRC letters demand your immediate attention.

Tax Return Reminders & Demands

Promptly responding to tax return requests is crucial. The self-assessment tax system relies on individuals submitting their returns by the deadline. Ignoring reminders or demands can result in severe penalties.

- Late filing penalties: HMRC imposes significant penalties for late submission, increasing with each day of delay.

- Interest charges: You'll also accrue interest on any unpaid tax owed, adding to your financial burden.

- Potential legal action: In severe cases of non-compliance, HMRC may take legal action, resulting in further penalties and potentially impacting your credit rating. This can include County Court Judgements (CCJs) which can negatively affect future credit applications. This is why understanding your HMRC debt is vital.

National Insurance Contributions (NIC) Notices

Ignoring notices about National Insurance Contributions (NICs) can have far-reaching implications. These notices often relate to arrears or discrepancies in your NIC payments.

- NIC arrears: Unpaid NICs accumulate, leading to substantial arrears that need to be settled.

- Late payment penalties: Similar to tax returns, late NIC payments attract penalties, compounding your debt.

- Impact on state pension entitlement: Your NIC contributions directly affect your state pension entitlement. Ignoring these notices could reduce your future pension income.

Tax Rebates & Refunds

Conversely, some HMRC letters may offer tax rebates or refunds. Ignoring these means you miss out on money rightfully owed to you.

- Claiming refunds: HMRC might identify overpayments or adjustments you're entitled to.

- Missed opportunities: Failing to respond could mean losing out on potentially significant financial benefits.

- Verifying details: You may need to respond to confirm your banking details or other personal information to process the repayment.

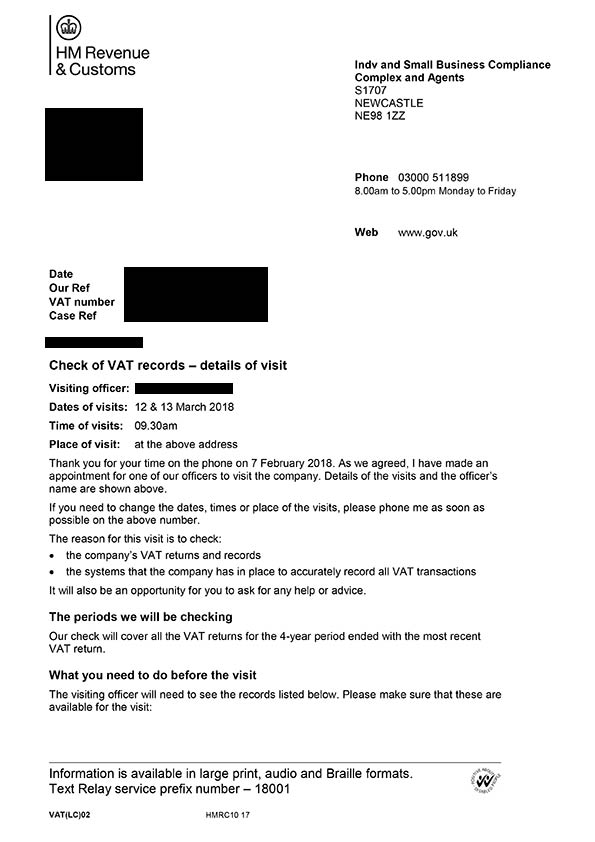

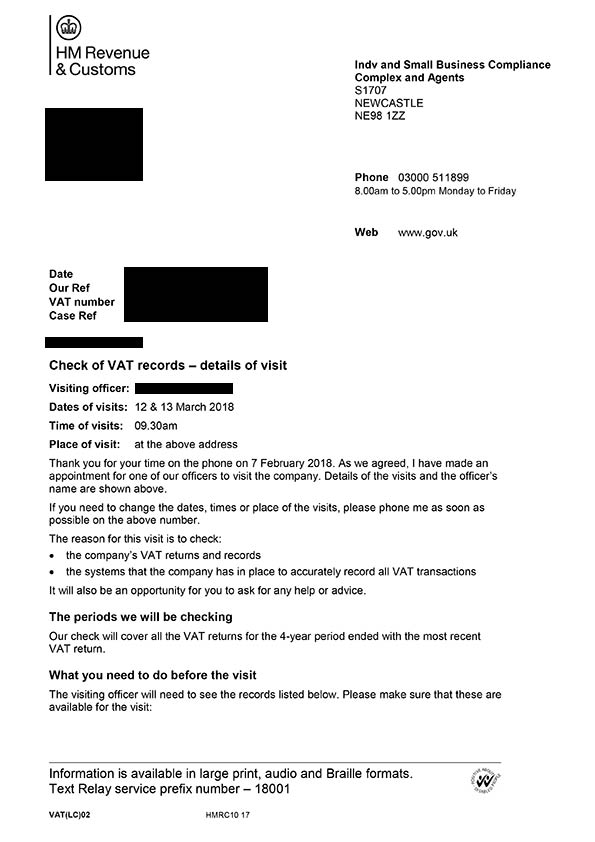

Tax Investigations & Audits

Receiving a letter initiating a tax investigation or audit is a serious matter. Ignoring this communication will only worsen the situation.

- Cooperation with HMRC: A cooperative approach during a tax investigation is crucial. Ignoring the investigation will not make it go away.

- Potential penalties: Non-cooperation or providing inaccurate information can result in substantial penalties.

- Legal representation: Seeking professional legal advice from a solicitor specialising in tax law is strongly recommended during a tax investigation or audit.

What to Do If You Receive an HMRC Letter

Receiving an HMRC letter can be daunting, but a proactive response is essential.

Understand the Letter's Content

Carefully read and understand the letter's content before taking any action.

- Identify the issue: Clearly understand the reason for the communication.

- Deadlines: Note all important deadlines for responding or taking action.

- Contact details: Identify the relevant contact details within the letter should you need to clarify anything.

Respond Promptly and Accurately

Timely and accurate responses are vital in avoiding further complications.

- Meeting deadlines: Respond by the specified deadline to avoid penalties.

- Providing supporting documentation: Gather and submit any necessary supporting documents as requested.

- Contacting HMRC directly: If you have questions or need clarification, contact HMRC directly using the provided contact details.

Seek Professional Help if Needed

If the letter's content is complex or unclear, seek professional assistance.

- Tax advisors: A qualified tax advisor can provide expert guidance and support.

- Accountants: Accountants can help you understand your tax obligations and prepare the necessary responses.

- Professional help: Don't hesitate to seek help if you are struggling to understand HMRC communications.

- Seeking advice: Getting professional advice can help prevent costly mistakes and future problems.

Conclusion

Ignoring HMRC letters can lead to significant financial penalties, increased debt, and potential legal action. Don't let ignoring HMRC letters cost you – act now! Open and respond to all HMRC correspondence promptly, providing accurate information and meeting all deadlines. If you're struggling to understand a letter or need assistance, seek professional help from a tax advisor or accountant. Remember, proactive engagement with HMRC communications is key to avoiding unnecessary financial problems. For further assistance, visit the official HMRC website: [Insert Link to HMRC Website Here].

Featured Posts

-

Meta Monopoly Trial A Look At The Ftcs Defense

May 20, 2025

Meta Monopoly Trial A Look At The Ftcs Defense

May 20, 2025 -

Pronostic Pro D2 Huit Equipes A 8 Points Analyse Du Calendrier Et Des Chances De Maintien

May 20, 2025

Pronostic Pro D2 Huit Equipes A 8 Points Analyse Du Calendrier Et Des Chances De Maintien

May 20, 2025 -

Preparing For School Delays During Winter Weather Advisories

May 20, 2025

Preparing For School Delays During Winter Weather Advisories

May 20, 2025 -

Crisis Amorosa Mick Schumacher Aparece En Aplicacion De Citas Tras Separacion

May 20, 2025

Crisis Amorosa Mick Schumacher Aparece En Aplicacion De Citas Tras Separacion

May 20, 2025 -

Isabelle Nogueira Confirma Maiara E Maraisa No Festival Da Cunha 90 Gratuito Em Manaus

May 20, 2025

Isabelle Nogueira Confirma Maiara E Maraisa No Festival Da Cunha 90 Gratuito Em Manaus

May 20, 2025