IMCD N.V. AGM 2024: Shareholders Approve All Proposed Resolutions

Table of Contents

Key Resolutions Approved at the IMCD N.V. AGM 2024

The AGM is a crucial event for shareholders, providing a platform to review the past year's performance, approve key resolutions, and engage directly with the company's management. Shareholder approval on the proposed resolutions is essential for maintaining sound corporate governance and ensuring the company's continued success. The IMCD N.V. AGM 2024 saw the successful approval of all proposed resolutions, demonstrating strong support from shareholders. These key resolutions included:

- Dividend Approval: The proposed dividend policy for the fiscal year was overwhelmingly approved, reflecting the company's commitment to returning value to its shareholders. The specific dividend payout details were announced and well-received.

- Appointment of Directors: The reappointment and appointment of directors to the board were approved, ensuring continuity of leadership and expertise in guiding the company's strategic direction. This reinforces the robust corporate governance structure of IMCD N.V.

- Discharge of Management: Shareholders approved the discharge of the management board, signifying their confidence in the management team's performance and stewardship of the company. This is a vital element of shareholder approval and corporate accountability.

Each resolution received a significant majority vote, showcasing the high level of shareholder confidence in IMCD N.V.'s current trajectory. The detailed voting results were made available to all shareholders following the meeting.

Financial Performance Review and Outlook Presented at the IMCD N.V. AGM 2024

The AGM provided a comprehensive review of IMCD N.V.'s financial performance in 2023. The presentation highlighted strong financial results, with impressive revenue growth and improved profitability. Key financial highlights included:

- Revenue Growth: Significant year-on-year revenue growth was reported, exceeding expectations and demonstrating the company's robust market position. Specific figures were presented, showcasing healthy expansion across various sectors.

- Profitability: Improved profitability metrics, including increased margins and strong earnings per share, were presented and analyzed. This reflects effective cost management and successful strategic initiatives.

- Key Performance Indicators (KPIs): Positive trends were observed across several key performance indicators, demonstrating the company's overall operational efficiency and strategic execution.

- Market Outlook: Management presented a positive outlook for the coming year, based on market analysis and the company's strategic plans. This provided shareholders with confidence in the company's future prospects.

IMCD N.V.'s Strategic Initiatives and Future Plans Discussed at the AGM 2024

The IMCD N.V. AGM 2024 also provided a platform to discuss the company's ongoing strategic initiatives and future plans. A key focus was on sustainable growth and expansion into new markets. The presentation outlined several key strategic objectives, including:

- Market Expansion: IMCD N.V. outlined plans for expansion into new geographical markets and further penetration of existing regions. Specific target markets and strategies were detailed.

- Innovation: Investment in research and development and innovation were highlighted as key drivers of future growth. The company showcased its commitment to staying at the forefront of technological advancements within its industry.

- Strategic Acquisitions: The potential for strategic acquisitions to further enhance the company's market position and expand its product portfolio was discussed. This underscores IMCD N.V.'s proactive approach to growth.

- Sustainable Growth: A strong commitment to sustainable practices and environmental responsibility was emphasized. This reflects IMCD N.V.'s dedication to long-term value creation.

Shareholder Engagement and Q&A Session at the IMCD N.V. AGM 2024

The Q&A session at the IMCD N.V. AGM 2024 demonstrated a high level of shareholder participation and engagement. Shareholders actively engaged with the management team, posing insightful questions concerning the company's strategy, financial performance, and future outlook. Management provided comprehensive and transparent responses, underscoring IMCD N.V.'s commitment to open communication and corporate responsibility. The overall atmosphere was one of constructive dialogue and collaborative engagement, showcasing a strong relationship between the company and its shareholders.

Conclusion: IMCD N.V. AGM 2024: A Vote of Confidence

The IMCD N.V. AGM 2024 was a resounding success. The unanimous approval of all proposed resolutions demonstrated a clear vote of confidence from shareholders in the company's leadership and strategic direction. The positive financial results, ambitious strategic initiatives, and strong shareholder engagement all paint a picture of a company well-positioned for continued growth and success. To stay informed about future IMCD N.V. announcements and events, including upcoming AGMs, please visit the IMCD N.V. investor relations section on their website for IMCD N.V. shareholder information and details on upcoming IMCD N.V. events.

Featured Posts

-

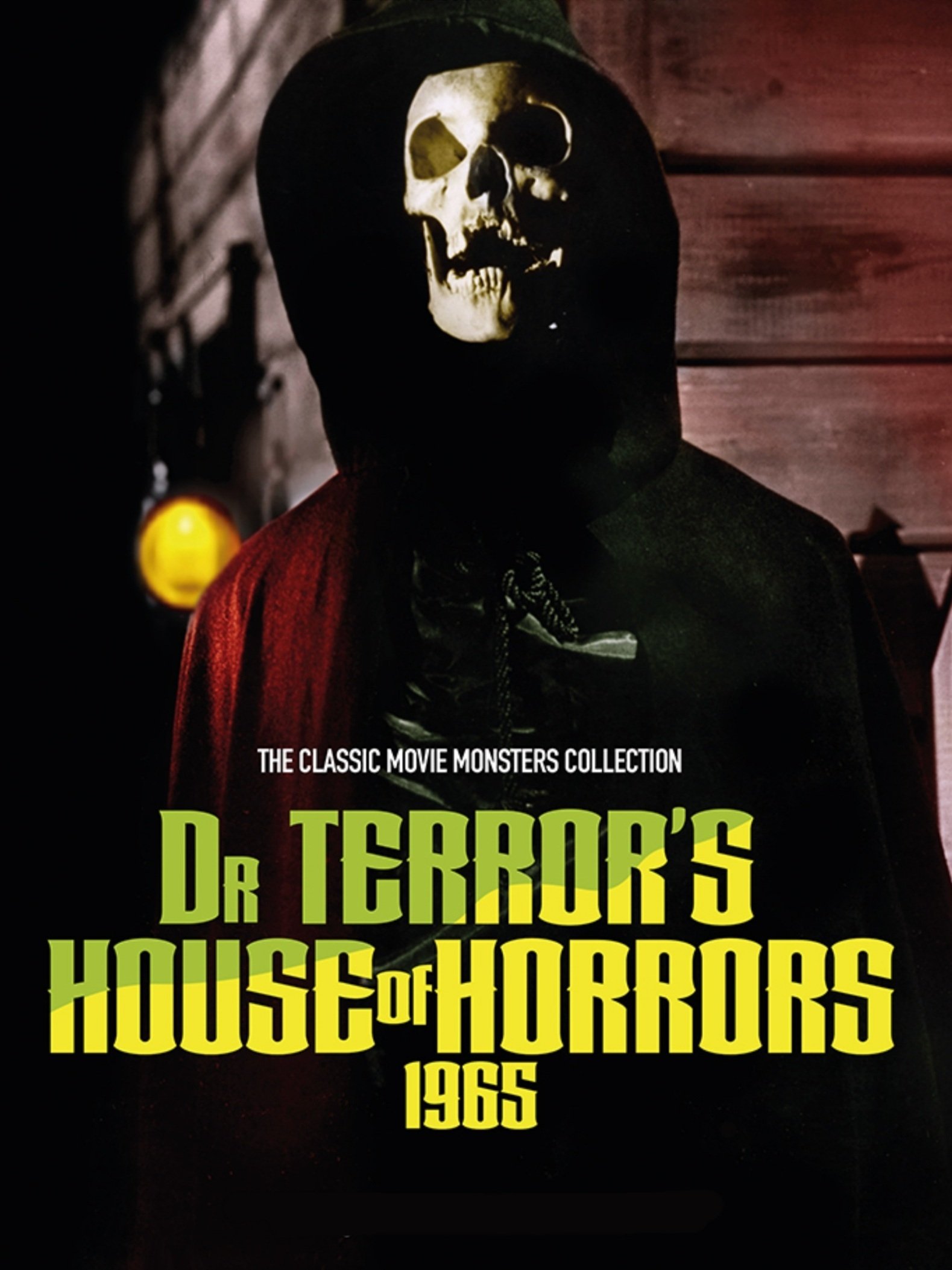

Exploring Dr Terrors House Of Horrors What To Expect

May 25, 2025

Exploring Dr Terrors House Of Horrors What To Expect

May 25, 2025 -

Recent Shooting At Southern Vacation Hotspot Sparks Safety Debate

May 25, 2025

Recent Shooting At Southern Vacation Hotspot Sparks Safety Debate

May 25, 2025 -

Exploring Jensons Fw 22 Extended Line Features And Innovations

May 25, 2025

Exploring Jensons Fw 22 Extended Line Features And Innovations

May 25, 2025 -

Hells Angels Mourn Member Killed In Motorcycle Crash

May 25, 2025

Hells Angels Mourn Member Killed In Motorcycle Crash

May 25, 2025 -

Toto Wolff Defends George Russell Lucky To Have Him

May 25, 2025

Toto Wolff Defends George Russell Lucky To Have Him

May 25, 2025