Impact Of China-US Trade Talks On Copper Market

Table of Contents

China's Role as a Major Copper Consumer

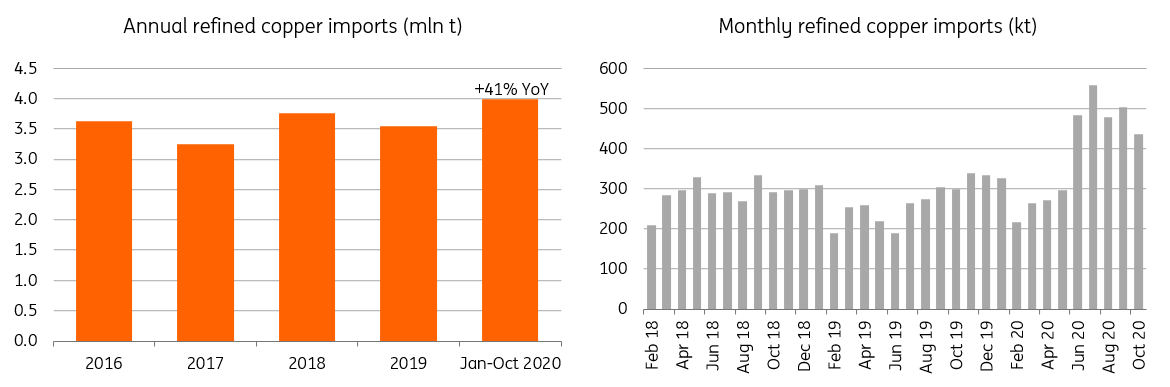

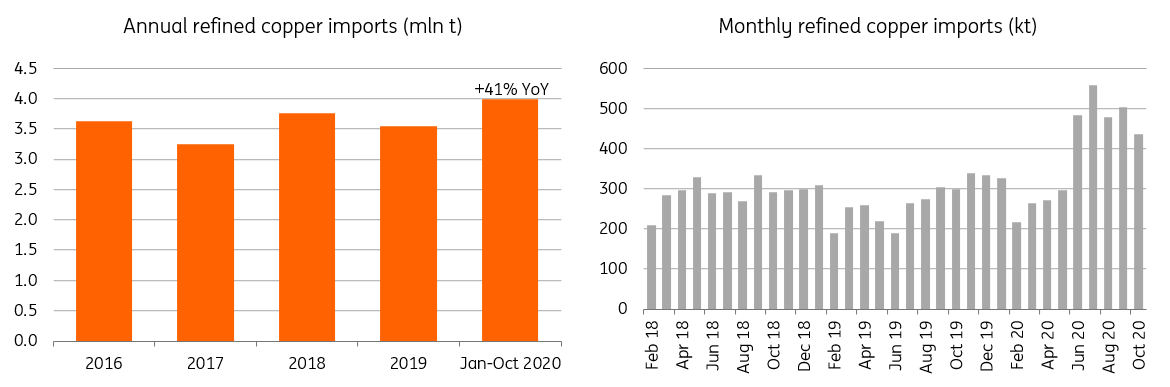

China's voracious appetite for copper, fueled by its rapid industrialization and infrastructure development, makes it a dominant force in the global copper market. Any disruption to its copper imports directly impacts global prices and market stability.

Impact of Tariffs and Trade Restrictions on Chinese Copper Imports: Tariffs and trade restrictions imposed during periods of heightened China-US trade tension can significantly impact the volume of copper imported by China.

- Increased costs: Tariffs directly increase the cost of imported copper, making it less competitive compared to domestically produced copper or alternatives.

- Reduced import volumes: Higher costs can lead to a decrease in the quantity of copper imported by China, impacting suppliers and potentially slowing down certain sectors.

- Potential for substitution with domestic sources: China may prioritize domestic copper production to reduce reliance on imports, potentially impacting the global supply chain.

- Impact on Chinese manufacturing sectors relying on copper: Industries like construction, electronics, and renewable energy in China are heavily reliant on copper. Trade restrictions can hinder their growth and competitiveness.

Chinese Economic Growth and Copper Demand: China's economic growth is intrinsically linked to its copper consumption. Periods of strong GDP growth typically translate into increased demand for copper, while economic slowdowns have the opposite effect. Trade talks and resulting uncertainty can significantly affect this relationship.

- Correlation between GDP growth and copper consumption: Historically, a strong positive correlation exists between China's GDP growth and its copper consumption.

- Impact of trade uncertainties on investment and infrastructure projects: Trade uncertainties can dampen investor confidence, leading to delays or cancellations of infrastructure projects, thereby impacting copper demand.

- The role of stimulus packages: Government stimulus packages aimed at boosting economic growth can significantly increase copper demand, counteracting the negative effects of trade tensions.

The US as a Significant Copper Producer and Consumer

The US, while a significant copper producer, is also a substantial consumer, with its domestic consumption heavily influenced by its economic activity and trade policies.

Impact of Trade Talks on US Copper Production and Exports: Trade negotiations between the US and China directly affect US copper production and export patterns.

- Effect on domestic copper mining operations: Trade tensions can impact the profitability of US copper mining operations, influencing investment decisions and production levels.

- Potential for increased exports to other markets: If trade relations with China sour, the US may redirect its copper exports to other global markets, affecting prices and supply chains worldwide.

- The role of US trade policies in shaping global copper supply: US trade policies, whether protectionist or free-market oriented, significantly influence the global supply and demand dynamics for copper.

US Copper Consumption and its Relation to Trade Talks: The health of the US economy, a major consumer of copper, is strongly linked to its copper consumption. Trade tensions and uncertainties impact this consumption.

- Impact on US construction, manufacturing, and other industries using copper: Uncertainty stemming from trade talks can impact investment and expansion plans in these sectors, directly influencing copper demand.

- The influence of consumer confidence and investment: Trade wars and related uncertainties can negatively impact consumer confidence and business investment, dampening demand for copper.

- The role of government policies on infrastructure projects: Government policies regarding infrastructure investment significantly influence copper demand in the US, with trade talks often impacting the scale and timeline of such projects.

Global Copper Market Dynamics and Trade War Uncertainty

The uncertainty surrounding China-US trade talks creates significant volatility in the global copper market.

Price Volatility and Market Fluctuations: Trade-related news often triggers speculative trading, leading to significant price swings in the copper market.

- Speculative trading driven by trade news: Market participants react to news regarding trade talks, driving up or down copper prices based on their perception of the outcome.

- Hedging strategies employed by market participants: Companies involved in the copper industry employ hedging strategies to mitigate the risks associated with price volatility caused by trade uncertainty.

- The influence of other global economic factors on copper prices: While trade talks are a major influence, other factors, such as global economic growth, inflation, and currency fluctuations, also play a significant role in shaping copper prices.

Supply Chain Disruptions and Geopolitical Risks: Trade tensions can cause disruptions to the global copper supply chain, increasing geopolitical risks.

- Impact on logistics and transportation: Trade restrictions and tariffs can complicate logistics and transportation, increasing costs and delivery times.

- Potential for sourcing challenges: Companies may face challenges sourcing copper from reliable suppliers due to disruptions caused by trade tensions.

- The role of alternative copper suppliers: Trade disputes can accelerate the search for alternative copper suppliers, reshaping the global supply chain landscape.

- The impact of political instability on copper production and trade: Geopolitical instability arising from trade tensions can disrupt copper production and trade in various regions.

Conclusion

The interplay between China-US trade talks and the copper market is complex and multifaceted. These negotiations significantly influence copper prices, global supply chains, and overall economic growth. Understanding the dynamics of these relationships is essential for navigating the fluctuating copper market. Tariffs, economic growth projections, and geopolitical risks all play significant roles in shaping the price and availability of copper. China’s immense consumption and the US’s production and consumption capabilities are central to these dynamics.

Call to Action: Stay updated on the latest developments in China-US trade talks and their impact on the copper market by regularly consulting reliable economic news sources and market analysis reports. Understanding the intricacies of China-US trade relations is crucial for navigating the fluctuations in the copper market and making well-informed decisions.

Featured Posts

-

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025

6 99 Festival Featuring Sabrina Carpenter What You Need To Know

May 06, 2025 -

Chris Pratt Reacts To Patrick Schwarzeneggers White Lotus Role

May 06, 2025

Chris Pratt Reacts To Patrick Schwarzeneggers White Lotus Role

May 06, 2025 -

Le Depart De Popovich Les Spurs Cherchent Un Nouvel Entraineur

May 06, 2025

Le Depart De Popovich Les Spurs Cherchent Un Nouvel Entraineur

May 06, 2025 -

Pesona Batu Akik Yaman Di Kalangan Kolektor Indonesia

May 06, 2025

Pesona Batu Akik Yaman Di Kalangan Kolektor Indonesia

May 06, 2025 -

Keistimewaan Batu Akik Yaman Panduan Untuk Kolektor Indonesia

May 06, 2025

Keistimewaan Batu Akik Yaman Panduan Untuk Kolektor Indonesia

May 06, 2025