Impact Of Slowing Growth: SSE Cuts Spending By £3 Billion

Table of Contents

The Reasons Behind SSE's Spending Reduction

SSE's official statement cites a need to adjust its investment strategy in response to the challenging economic climate. However, several contributing factors underpin this £3 billion spending cut. These factors represent a confluence of macroeconomic pressures and industry-specific concerns.

-

Reduced energy demand due to economic slowdown: A weakening economy naturally translates to lower energy consumption by businesses and households, impacting revenue projections and the need for large-scale investment.

-

Increased inflation and rising interest rates affecting investment: The current inflationary environment and the Bank of England's response through higher interest rates significantly increase the cost of borrowing, making large-scale infrastructure projects less financially viable. This impacts the return on investment (ROI) calculations making projects less attractive.

-

Uncertainty in the energy market and regulatory changes: The energy market is facing significant volatility due to geopolitical factors and evolving regulatory frameworks. This uncertainty makes long-term investment planning considerably riskier. The changing regulatory landscape adds another layer of complexity to investment decisions.

-

Focus on core business and debt reduction: SSE may be prioritizing its core business operations and focusing on reducing its debt levels to improve its financial stability in the face of economic headwinds. This strategic shift involves scaling back on less crucial projects.

The exact financial implications are complex, but the £3 billion figure represents a substantial adjustment to SSE's investment pipeline, reflecting a cautious approach to capital allocation in the current economic climate. Keywords: investment cuts, energy market uncertainty, inflation impact, interest rates, regulatory changes.

Wider Implications for the UK Energy Sector

SSE's decision to cut spending has ripple effects across the UK energy sector. The reduced investment will likely lead to:

-

Reduced investment in renewable energy infrastructure: This could delay the UK's transition to net-zero emissions, impacting the country's climate change goals.

-

Potential delays in the energy transition: Delays in renewable energy projects will hinder progress towards a more sustainable energy system. This could lead to the reliance on fossil fuels for longer.

-

Impact on employment within the energy sector: Job losses are a potential consequence of project cancellations and reduced investment, creating further economic uncertainty.

The energy sector is a significant contributor to the UK's GDP, and this slowdown in investment could negatively impact overall economic growth. The knock-on effects on related industries, like construction and manufacturing, should also be considered. Keywords: renewable energy, energy transition, net-zero targets, UK energy sector, job losses.

Economic Indicators Pointing to Slowing Growth

SSE's actions are consistent with broader economic indicators suggesting a slowing UK economy. Several key metrics point towards this trend:

-

GDP growth figures for the last few quarters: Recent data from the Office for National Statistics (ONS) shows a slowdown in GDP growth, indicating a weakening economy.

-

Inflation rate and its impact on consumer spending: High inflation is eroding consumer purchasing power, reducing overall demand and impacting business investment.

-

Business investment trends in the UK: Business investment is a key driver of economic growth, and a decline in this area suggests a lack of confidence in future economic prospects.

These economic indicators paint a picture of a UK economy grappling with challenges, contributing to the context of SSE's substantial spending cut. Keywords: GDP growth, inflation, consumer spending, business investment, economic indicators, UK economy.

Potential Future Scenarios and SSE's Response

The future for SSE and the UK energy sector depends heavily on the evolving economic climate. Several scenarios are possible:

-

Potential for further spending cuts: If economic conditions worsen, further cuts could be unavoidable.

-

Strategies for cost optimization and efficiency improvement: SSE will likely focus on improving efficiency and reducing costs to navigate the challenging environment.

-

Opportunities for diversification within the energy sector: SSE may explore diversification strategies to mitigate risks and capitalize on emerging opportunities. This could involve acquisitions or expansion into new areas within the energy market.

SSE's response will likely involve a combination of these strategies, ensuring its long-term sustainability and resilience in a rapidly changing economic landscape. Keywords: SSE strategy, future outlook, mergers and acquisitions, cost optimization, energy sector diversification.

Conclusion: The Significance of SSE's Spending Cuts and What it Means for the Future

SSE's £3 billion spending cut is a significant event, highlighting the impact of the slowing UK economy on even major players in the energy sector. The reduced investment in renewable energy infrastructure poses challenges to the UK's net-zero targets. The potential job losses and delays in crucial energy projects raise wider economic concerns. It's crucial to monitor economic indicators closely to understand the full extent of the impact and adapt to the evolving situation. Stay informed about the evolving situation and the implications of slowing growth for the UK energy sector and SSE's future strategy by following the news and reviewing SSE's financial reports. Understanding the impact of SSE spending cuts and the ongoing economic slowdown is vital for navigating the future of the energy sector analysis.

Featured Posts

-

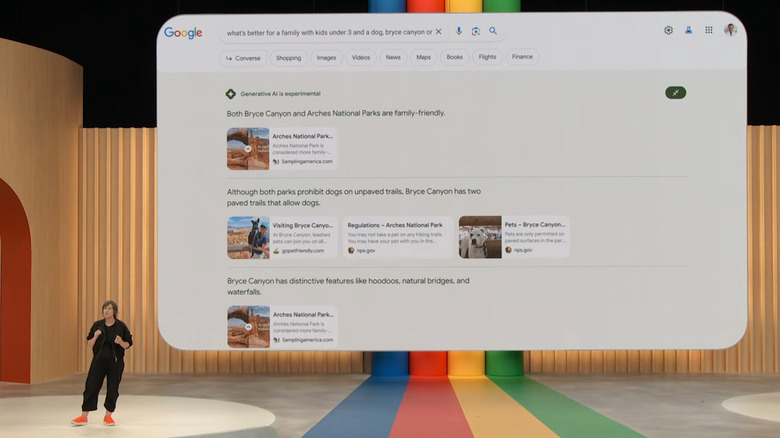

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025

Is Ai Mode The Future Of Google Search A Deep Dive

May 22, 2025 -

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025

Racial Hatred Tweet Former Tory Councillors Wifes Appeal Delayed

May 22, 2025 -

Abn Amro Opslag Hulp Bij Online Betalingsproblemen

May 22, 2025

Abn Amro Opslag Hulp Bij Online Betalingsproblemen

May 22, 2025 -

Tory Politicians Wife Remains Jailed After Migrant Rant In Southport

May 22, 2025

Tory Politicians Wife Remains Jailed After Migrant Rant In Southport

May 22, 2025 -

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 22, 2025

French Prosecutors Implicate Malaysias Najib Razak In 2002 Submarine Bribery Case

May 22, 2025