Impact Of Tariffs On Canadian Businesses: Uncertainty And Economic Outlook (StatCan)

Table of Contents

Increased Input Costs and Reduced Profit Margins

Tariffs directly increase the cost of doing business for many Canadian companies. This is particularly true for businesses that rely on imported goods for production or resale. The resulting higher input costs often translate into reduced profit margins and, ultimately, economic hardship.

Impact on Manufacturing

Tariffs on imported raw materials and intermediate goods directly increase production costs for Canadian manufacturers. This has a ripple effect throughout the economy.

- Higher prices for steel and aluminum significantly impact automotive manufacturing. The automotive sector, a major contributor to the Canadian economy, is particularly vulnerable to fluctuations in the price of raw materials. Increased input costs can lead to decreased production and job losses.

- Increased costs are often passed onto consumers, leading to reduced demand. While manufacturers try to absorb some costs, many pass them on to consumers in the form of higher prices. This can lead to reduced consumer spending and decreased market demand.

- Reduced competitiveness in global markets due to higher production costs. Canadian manufacturers face increased competition from companies in countries with lower production costs. Tariffs exacerbate this issue, making Canadian-made goods less competitive on the global stage.

Impact on Retail and Consumer Goods

Tariffs on imported consumer goods directly impact retailers and, consequently, consumers. The higher prices reduce consumer purchasing power and affect sales across various retail sectors.

- Increased prices for clothing and electronics hurt consumer spending. These are two large sectors significantly impacted by import tariffs. Higher prices force consumers to cut back on spending, impacting the overall economy.

- Retailers struggle to maintain profit margins while facing increased costs. Retailers are caught in a difficult position: absorb the increased costs and reduce profit margins or pass them on to consumers, risking lower sales.

- Shift to domestically produced alternatives (if available) may alleviate some pressure, but not entirely. While some businesses might switch to domestic suppliers, this is not always feasible due to limited domestic production capacity or higher domestic prices.

Supply Chain Disruptions and Trade Diversification

Tariffs often lead to significant disruptions in established supply chains, forcing businesses to adapt and find new ways of operating.

Challenges to Established Supply Chains

The imposition of tariffs disrupts carefully planned and optimized supply chains, leading to various challenges.

- Longer lead times for imported goods. Sourcing alternative suppliers often involves longer lead times, impacting production schedules and potentially leading to stockouts.

- Increased logistical complexities and transportation costs. Finding alternative suppliers and managing new logistics networks increases complexity and costs associated with transportation and delivery.

- Potential for disruptions in production due to supplier instability. Switching suppliers introduces a degree of uncertainty and potential instability, increasing the risk of production disruptions.

Opportunities for Trade Diversification

While challenging, tariffs can also incentivize Canadian businesses to explore new trade partnerships and diversify their supply chains.

- Increased focus on sourcing materials from countries with preferential trade agreements. Businesses actively seek alternative suppliers in countries with favorable trade agreements to mitigate the impact of tariffs.

- Opportunities to develop new markets and reduce reliance on specific trading partners. Diversification strengthens resilience and reduces dependence on single sources of supply or specific markets.

- Government initiatives to support trade diversification should be explored. Governments can play a vital role by providing support and incentives to encourage businesses to diversify their operations.

Uncertainty and Investment Decisions

The uncertainty surrounding tariffs significantly impacts business investment decisions, hindering economic growth.

Impact on Business Investment

The unpredictability associated with tariff policies creates hesitation among businesses regarding long-term investments.

- Businesses delay expansion plans due to unpredictable costs. The uncertainty surrounding future tariffs makes it difficult for businesses to accurately forecast costs and plan for expansion.

- Reduced hiring and job creation as a result of cautious investment strategies. With less investment, there's less need for hiring and expansion, impacting employment levels.

- Negative impact on economic growth due to decreased investment. Reduced investment in new projects and infrastructure slows down overall economic growth.

The Role of Government Policy

Government policies play a crucial role in shaping business confidence and mitigating the negative impacts of tariffs.

- Predictable and stable trade policies are essential for boosting confidence. Clear and consistent trade policies reduce uncertainty and encourage investment.

- Government support programs can mitigate some of the negative impacts of tariffs. Government assistance can help businesses adapt to the challenges posed by tariffs.

- Clear communication regarding trade negotiations is crucial. Transparency and effective communication from the government regarding trade negotiations build trust and reduce uncertainty.

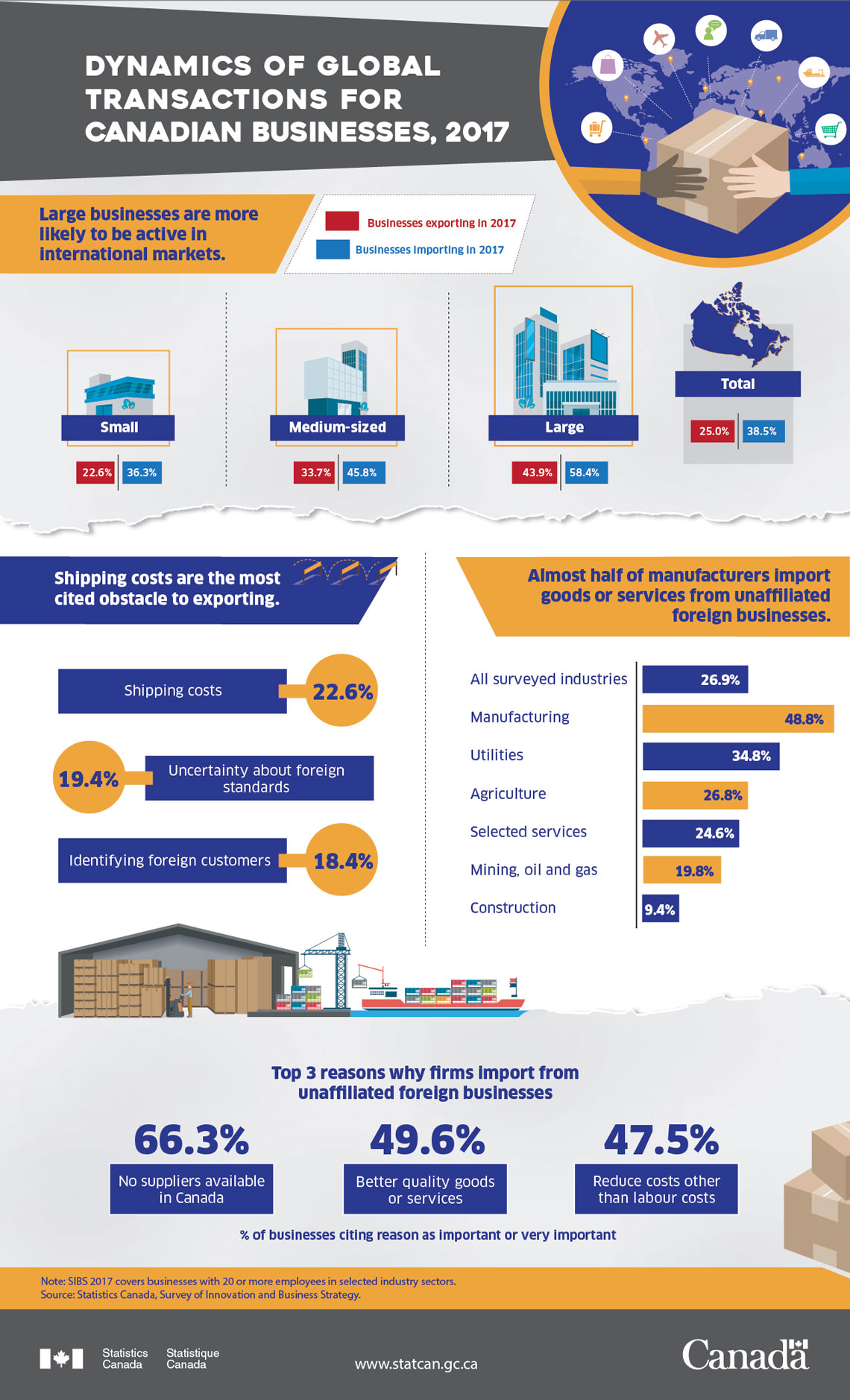

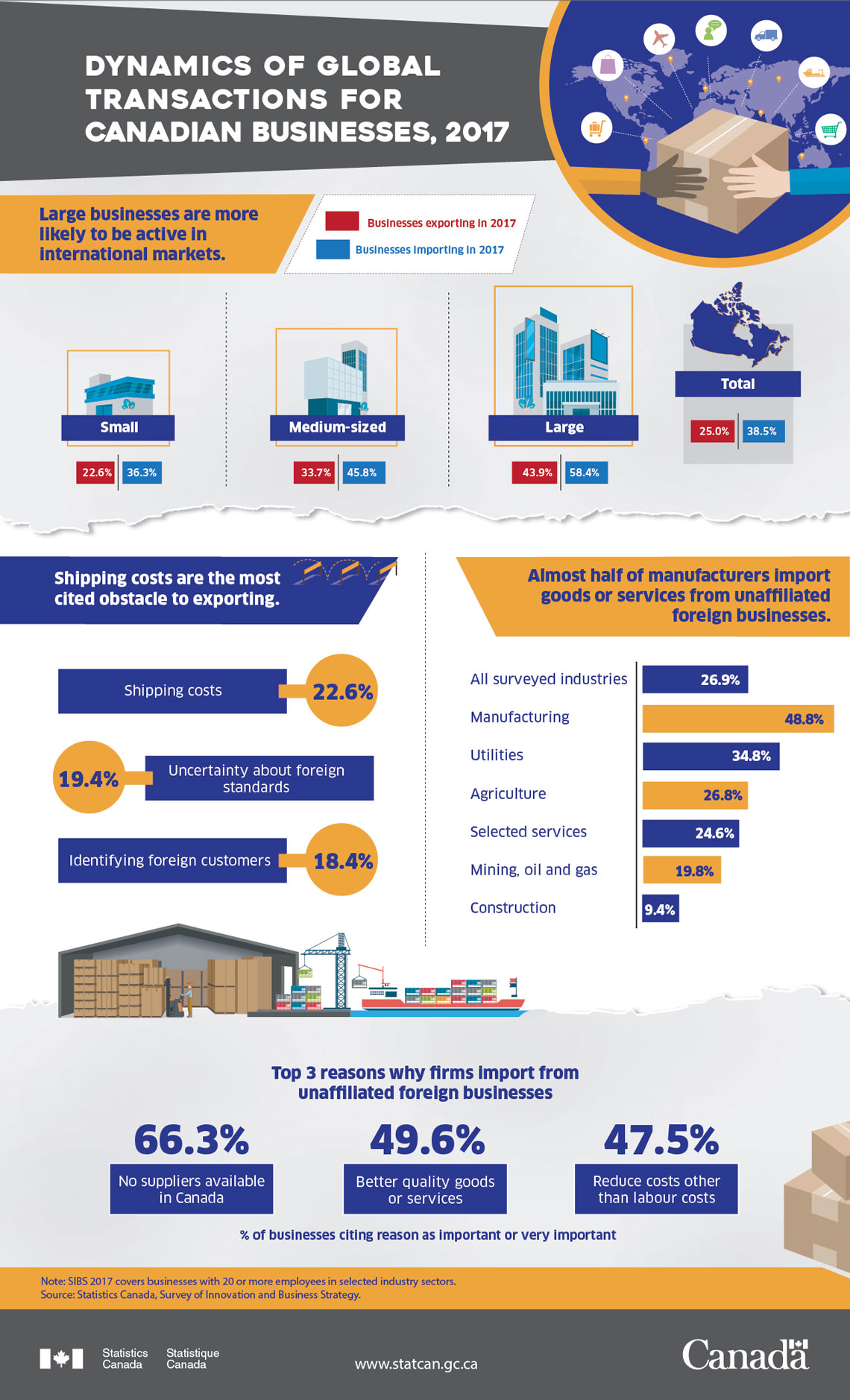

StatCan Data and Analysis

[This section would ideally include specific data and analysis from Statistics Canada reports, utilizing charts and graphs to illustrate the impact of tariffs on various sectors of the Canadian economy. Examples could include data on import/export values, changes in manufacturing output, and consumer spending patterns.]

Conclusion

The impact of tariffs on Canadian businesses is multifaceted, leading to increased costs, supply chain disruptions, and uncertainty regarding future investments. While some businesses may adapt and even find opportunities in trade diversification, the overall effect is a dampening of economic growth. Understanding the impact of tariffs, as detailed by StatCan data, is crucial for Canadian businesses to navigate these challenges effectively. Proactive strategies for mitigating the negative effects of tariffs are paramount for ensuring a resilient and prosperous Canadian economy. Further analysis of the impact of tariffs on Canadian businesses, and how they affect specific sectors, is critical for long-term economic planning. Understanding the full impact of tariffs and developing effective mitigation strategies is vital for the future of Canadian businesses.

Featured Posts

-

Hudsons Bay Announces Store Closures And Mass Layoffs

May 29, 2025

Hudsons Bay Announces Store Closures And Mass Layoffs

May 29, 2025 -

New York Rangers The Dominoes Begin To Fall

May 29, 2025

New York Rangers The Dominoes Begin To Fall

May 29, 2025 -

Reactie Van Der Gijp Op Potentiele Opvolger Farioli Kritisch En Afwijzend

May 29, 2025

Reactie Van Der Gijp Op Potentiele Opvolger Farioli Kritisch En Afwijzend

May 29, 2025 -

Inwestycje W Pcc Rokita Wplyw Decyzji O Dywidendzie Na Przyszlosc Spolki

May 29, 2025

Inwestycje W Pcc Rokita Wplyw Decyzji O Dywidendzie Na Przyszlosc Spolki

May 29, 2025 -

Quatro Jogadores Do Real Madrid Investigados Pela Uefa Mbappe E Vinicius Jr No Centro Das Atencoes

May 29, 2025

Quatro Jogadores Do Real Madrid Investigados Pela Uefa Mbappe E Vinicius Jr No Centro Das Atencoes

May 29, 2025