Impact Of The Amended Trump Tax Bill: House Vote Explained

Table of Contents

Key Changes Introduced by the House Amendments

The amendments to the Trump Tax Bill, primarily driven by [mention the driving political force, e.g., a specific party or faction], aimed to [state the overall purpose – e.g., broaden tax cuts for certain groups while narrowing them for others]. Specific areas targeted for revision included individual tax brackets, corporate tax rates, and several key deductions.

-

Individual Tax Brackets: The amendments adjusted the standard deduction, increasing it by [amount]% for [specify who – e.g., single filers] and decreasing it by [amount]% for [specify who – e.g., high-income earners]. The tax rates themselves were also altered; the highest bracket was reduced from [original percentage]% to [new percentage]%, while the lowest bracket saw a minor increase to [new percentage]%. These changes significantly impact tax liability for different income groups.

-

Corporate Tax Rates: The amendments slightly lowered the corporate tax rate from [original percentage]% to [new percentage]%. This change is intended to stimulate business investment and economic growth. However, concerns remain regarding the potential impact on the national debt.

-

Deductions: Significant changes affected deductions. The State and Local Tax (SALT) deduction, originally capped at $[amount], was [increased/decreased/eliminated]. The mortgage interest deduction was [modified – specify how]. These adjustments will directly affect homeowners and taxpayers in high-tax states.

-

Pass-Through Businesses: Amendments concerning pass-through businesses—such as sole proprietorships, partnerships, and S corporations—introduced [describe the changes, e.g., new deductions or tax credits]. This impacts millions of small business owners and self-employed individuals.

-

Estate Tax: The estate tax threshold was [increased/decreased/maintained] at $[amount], potentially affecting estate planning strategies for high-net-worth individuals.

Political Fallout and Party Divisions Following the Vote

The House vote on the amended Trump Tax Bill resulted in significant political fallout, largely along party lines. [Mention specific party’s] strongly supported the amendments, citing [their reasoning], while [mention other party’s] voiced strong opposition, highlighting [their concerns].

-

Party Reactions: [Quote a prominent Republican figure supporting the bill] and [Quote a prominent Democrat criticizing the bill]. These contrasting viewpoints underscore the deep partisan divisions surrounding the legislation.

-

Impact on Elections: The amended Trump Tax Bill is expected to be a key issue in upcoming elections. [Explain potential impact – e.g., how it might influence voter turnout or shape campaign strategies].

-

Legislative Path Forward: The amended bill now heads to the Senate, where its fate remains uncertain. [Discuss the likelihood of Senate approval, considering potential obstacles and political maneuvering]. The Senate may introduce further amendments, leading to further negotiations and potential delays.

Potential Economic Consequences of the Amended Trump Tax Bill

The economic consequences of the amended Trump Tax Bill are complex and uncertain. Short-term effects might include a [increase/decrease] in consumer spending due to [explain the reason]. However, the long-term impacts are difficult to predict precisely.

-

GDP Growth: Economists predict a [percentage]% increase/decrease in GDP growth within [timeframe] due to [explain reasons].

-

Job Creation: The amendments are expected to [positively/negatively] affect job creation, with predictions ranging from [low estimate] to [high estimate] new jobs.

-

National Debt: The amended bill is projected to [increase/decrease] the national debt by [amount] over [timeframe]. This will likely fuel ongoing debates about fiscal responsibility.

-

Inflation/Deflation: The potential impact on inflation is a subject of considerable debate. Some experts predict [reason for potential inflation/deflation].

Impact on Different Income Groups

The amended Trump Tax Bill’s impact varies significantly across income groups.

-

Low-Income Households: [Describe the impact – tax increase/decrease, percentage change, and explanation]. This could significantly impact their disposable income and financial stability.

-

Middle-Income Households: [Describe the impact – tax increase/decrease, percentage change, and explanation]. This group might experience [positive/negative] effects depending on specific circumstances.

-

High-Income Households: [Describe the impact – tax increase/decrease, percentage change, and explanation]. This group might see [significant/minor] tax savings or tax increases. Illustrate this with a simple chart comparing tax savings/increases across income brackets.

Conclusion

The House amendments to the Trump Tax Bill represent a substantial alteration of the original legislation. These changes impact various aspects of the economy, from individual tax burdens to corporate tax rates and deductions. The political ramifications are significant, highlighting deep party divisions and impacting the upcoming election cycle. The economic consequences remain subject to debate, with predictions varying regarding GDP growth, job creation, and the national debt. Furthermore, the bill’s impact is uneven across income groups, raising questions about its overall fairness and effectiveness. Understanding the intricacies of the Amended Trump Tax Bill is crucial for individuals and businesses alike. Stay informed about further developments and consult with tax professionals to navigate these significant changes. Continue your research on the Amended Trump Tax Bill to ensure you are fully prepared for the coming changes.

Featured Posts

-

The Jonas Brothers Joe And The Hilarious Couples Argument

May 24, 2025

The Jonas Brothers Joe And The Hilarious Couples Argument

May 24, 2025 -

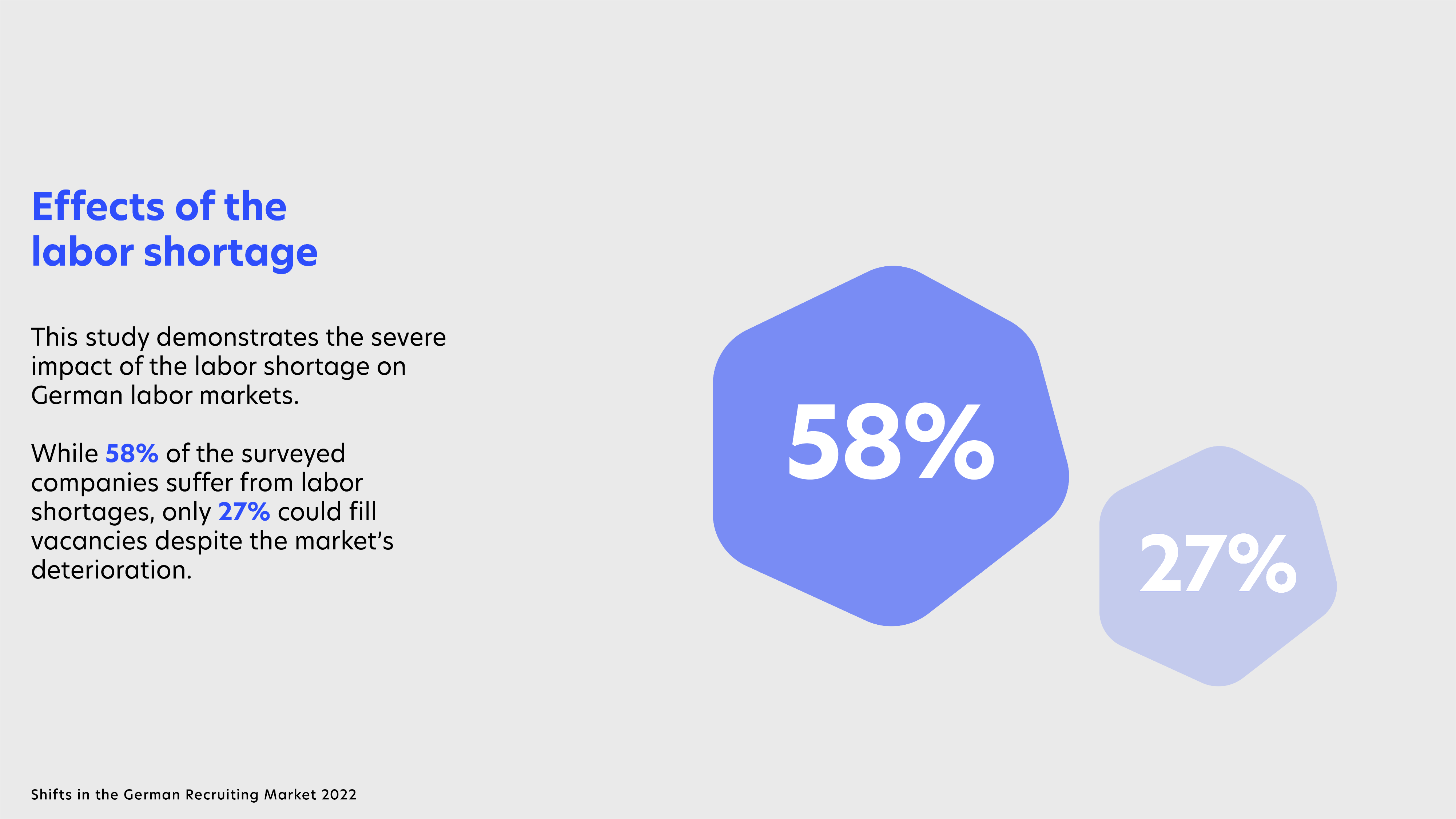

Preco Nemecke Firmy Rusia Pracovne Miesta Analyza Trendov

May 24, 2025

Preco Nemecke Firmy Rusia Pracovne Miesta Analyza Trendov

May 24, 2025 -

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025

Ferrari Nappasi 13 Vuotiaan Lupauksen Nimi Muistiin

May 24, 2025 -

Picture This Every Song Featured In The New Prime Video Rom Com

May 24, 2025

Picture This Every Song Featured In The New Prime Video Rom Com

May 24, 2025 -

Dazi Trump L Impatto Del 20 Sull Unione Europea E Il Settore Moda

May 24, 2025

Dazi Trump L Impatto Del 20 Sull Unione Europea E Il Settore Moda

May 24, 2025