Increased Retail Sales: Implications For Bank Of Canada Interest Rates

Table of Contents

The Relationship Between Retail Sales and Inflation

A direct correlation exists between strong retail sales and inflationary pressures. Increased consumer spending leads to higher demand for goods and services. When demand outstrips supply, businesses often respond by raising prices, contributing to inflation. This upward pressure on prices is a key factor the Bank of Canada considers when setting interest rates.

- Rising demand exceeding supply: A surge in retail sales indicates robust consumer demand. If supply cannot keep pace, shortages can occur, leading to price increases.

- Increased prices for goods and services: As businesses face higher demand and potentially limited supply, they pass increased costs onto consumers through higher prices.

- Contribution to the Consumer Price Index (CPI): Retail sales data is a significant component of the CPI, a key measure of inflation tracked by the Bank of Canada. Strong retail sales figures often translate to higher CPI growth.

- Impact on the Bank of Canada's inflation target: The Bank of Canada aims to keep inflation within a specific target range. Persistent high retail sales contributing to inflation above this target can trigger monetary policy adjustments.

Specific sectors play a disproportionate role in driving inflation. For example, strong sales in the automotive sector, particularly for durable goods, can significantly impact the CPI due to the relatively high price point of these items. Similarly, increases in spending on services, such as travel and hospitality, also contribute significantly to inflationary pressures. Analyzing these sector-specific trends is vital for understanding the overall impact of increased retail sales on inflation.

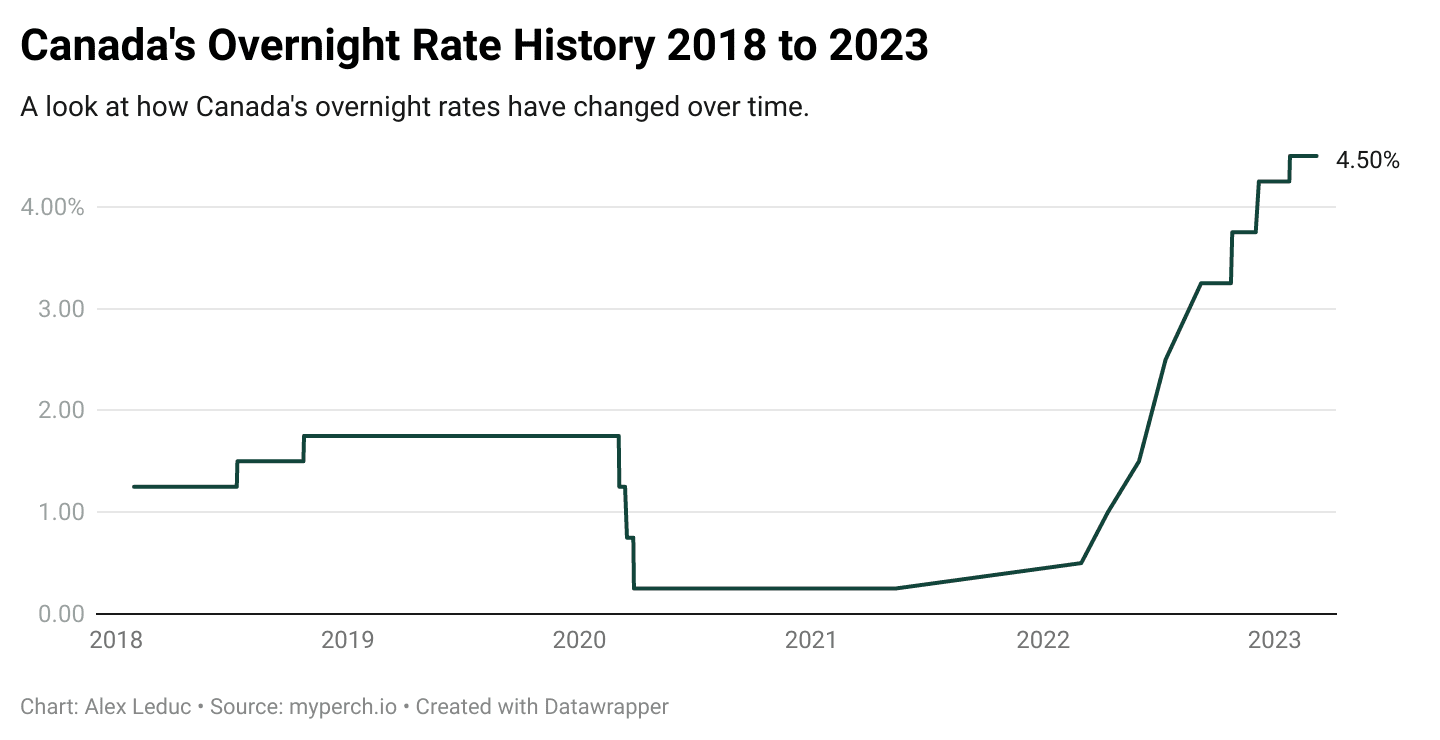

The Bank of Canada's Mandate and Reaction to Increased Retail Sales

The Bank of Canada's primary mandate is price stability. Sustained high retail sales, coupled with rising inflation, will likely prompt the Bank to act. The central bank uses various tools to manage inflation, primarily interest rate adjustments and quantitative tightening.

- The Bank of Canada's inflation target: The Bank aims to keep inflation within a predetermined range, typically around 2%. Deviations from this target, particularly persistent inflation above the target, necessitate intervention.

- Tools available to manage inflation: To combat inflation driven by strong retail sales and increased consumer spending, the Bank of Canada may raise interest rates. Higher interest rates increase borrowing costs, cooling down economic activity and reducing inflationary pressures. Quantitative tightening, another tool, involves reducing the money supply.

- Potential lag effects of interest rate changes: It's important to note that changes in interest rates don't have an immediate impact on the economy. There's a lag effect, meaning it takes time for these changes to fully influence consumer spending and inflation.

- Consideration of other economic indicators beyond retail sales: While retail sales are an important indicator, the Bank of Canada considers a broad range of economic indicators before making decisions on interest rates, including employment data, housing market activity, and business investment.

The Bank's actions will determine whether the economy achieves a "soft landing" (a slowdown in economic growth that reduces inflation without triggering a recession) or a more severe downturn. The overall economic climate and other influencing factors significantly contribute to this outcome.

Predicting Future Interest Rate Movements Based on Retail Sales Data

Retail sales data, while not the sole determinant, provides a valuable insight into the overall health of the economy and consumer confidence, which directly informs predictions regarding future interest rate adjustments.

- Analyzing trends in retail sales data over time: Examining trends and patterns in retail sales data over several months or quarters offers a clearer picture of consumer spending behaviour and its influence on inflation.

- Incorporating other economic indicators for a holistic view: To build more accurate models, analysts combine retail sales data with other economic indicators such as employment numbers, consumer confidence indices, and housing market data.

- The role of forward-looking indicators and market sentiment: Leading indicators, such as consumer expectations surveys, provide insights into future spending patterns. Market sentiment, reflected in stock prices and bond yields, also influences interest rate forecasts.

- Limitations of using retail sales data alone for prediction: It's crucial to remember that retail sales data provides only a partial view. Other economic factors and global events significantly impact interest rate decisions.

Sophisticated economic models and forecasting techniques are employed to analyze this data, offering a more comprehensive understanding of the potential impact of increased retail sales on future interest rate movements. The Bank of Canada meticulously considers various data points to arrive at its policy decisions.

The Impact on Businesses and Investors

Changes in interest rates, driven by increased retail sales and subsequent inflationary pressures, have significant implications for businesses and investors.

- Impact on borrowing costs for businesses: Higher interest rates increase borrowing costs for businesses, potentially impacting expansion plans, investment in new projects, and overall profitability.

- Effect on investment returns and asset prices: Interest rate hikes often lead to lower bond prices and can affect equity markets, impacting investment returns.

- Opportunities and risks for different investment classes: Different asset classes react differently to interest rate changes. Understanding these sensitivities is crucial for effective risk management.

- Strategic adjustments businesses can make: Businesses may need to adjust their pricing strategies, investment plans, and operational efficiency to adapt to changing interest rate environments.

Small businesses, in particular, may be more vulnerable to higher borrowing costs than larger corporations with better access to credit. Investors may need to reallocate their portfolios to mitigate the risks associated with rising interest rates, potentially favoring assets less sensitive to interest rate changes.

Conclusion

Increased retail sales represent a significant factor influencing the Bank of Canada's interest rate decisions. While robust consumer spending contributes to economic growth, it also fuels inflationary pressures, potentially prompting the Bank to implement measures to maintain price stability. Understanding the intricate relationship between increased retail sales and monetary policy is crucial for both businesses and investors to effectively navigate the current economic climate and make informed decisions. Stay informed about the latest retail sales figures and Bank of Canada announcements to proactively manage your investments and business strategies in response to changes in interest rates. Continuously monitor the impact of increased retail sales on the Canadian economy.

Featured Posts

-

Reliving The Glory Jenson Button And His Iconic 2009 Brawn Car

May 26, 2025

Reliving The Glory Jenson Button And His Iconic 2009 Brawn Car

May 26, 2025 -

Rtbf Precisions Sur L Avenir De La Semaine Des 5 Heures

May 26, 2025

Rtbf Precisions Sur L Avenir De La Semaine Des 5 Heures

May 26, 2025 -

Dc Black Pride A Convergence Of Culture Protest And Celebration

May 26, 2025

Dc Black Pride A Convergence Of Culture Protest And Celebration

May 26, 2025 -

The Art Of The Deal Trump And Republican Negotiations

May 26, 2025

The Art Of The Deal Trump And Republican Negotiations

May 26, 2025 -

Best Nike Running Shoes 2025 A Buyers Guide

May 26, 2025

Best Nike Running Shoes 2025 A Buyers Guide

May 26, 2025