Increased Trade Tensions Boost Gold Prices After Trump's EU Comments

Table of Contents

Trump's Comments and the Escalation of Trade Tensions

Trump's recent comments on the EU, while not explicitly announcing new Trump EU tariffs, significantly worsened the already strained trade relationship between the US and the EU. His remarks fueled uncertainty about the future of transatlantic trade, rekindling fears of a full-blown trade war. Existing trade tensions, including disagreements over agricultural subsidies, digital services taxes, and steel tariffs, were further exacerbated by these statements. While no specific new tariffs were immediately announced, the rhetoric itself was enough to trigger a market reaction.

- Specific quotes from Trump's statements: (Insert direct quotes from reputable news sources here, properly attributed).

- Examples of affected industries: (List specific industries potentially affected by increased trade tensions, e.g., agriculture, manufacturing, technology).

- Links to relevant news sources: (Insert links to relevant and credible news articles covering Trump's comments and their impact on trade relations).

Gold as a Safe-Haven Asset During Times of Uncertainty

Investors often turn to gold during periods of economic uncertainty and geopolitical instability. Gold's appeal as a safe haven asset stems from its inherent properties: it's a tangible asset, relatively scarce, and historically holds its value during times of crisis. The historical correlation between trade wars and gold price increases is well-documented. When markets become volatile, investors seek refuge in assets perceived as less risky, and gold often fits this bill.

- Explanation of gold's non-yielding nature: Gold doesn't pay interest or dividends, making it a store of value rather than an income-generating asset. This is particularly attractive during periods of low interest rates and high inflation.

- Discussion of diversification strategies including gold: Diversifying a portfolio with gold can help mitigate risk associated with other asset classes, such as stocks and bonds.

- Examples of past instances where gold acted as a safe haven: (Cite historical examples of gold price increases during periods of economic or geopolitical turmoil). Other factors influencing gold prices include inflation and interest rate changes. High inflation typically boosts gold's price, while rising interest rates can sometimes put downward pressure on it.

Market Reaction and Gold Price Movement

The immediate impact of Trump's comments was a noticeable gold price increase. (Insert a chart or graph here visually illustrating the price movement of gold following Trump's comments). The percentage increase should be clearly stated. The broader market reacted with a mix of fear and uncertainty. Stock markets experienced some volatility, while certain currencies fluctuated against the US dollar.

- Specific price changes in gold (percentage increase): (Quantify the increase in gold prices, using precise data from reputable sources).

- Mention other precious metals (silver, platinum) and their reactions: (Discuss how other precious metals responded to the news, noting any correlations or divergences from gold's price movement).

- Quotes from financial experts: (Include quotes from reputable financial analysts and economists offering their perspectives on the market reaction).

Future Implications for Gold and the Global Economy

The potential long-term effects of increased trade tensions on gold prices remain uncertain. However, sustained trade disputes could lead to further market volatility and a continued preference for safe haven assets like gold. This could result in sustained, although potentially fluctuating, gold price increases. The impact on global economic growth and stability depends largely on how the current trade disputes are resolved.

- Forecasts for gold prices in the short-term and long-term: (Offer cautious predictions for gold price movements based on current market conditions and potential future scenarios).

- Potential scenarios based on different resolutions to trade disputes: (Outline possible scenarios depending on the outcome of the trade negotiations, highlighting their potential effects on gold prices).

- Analysis of the risks and opportunities associated with investing in gold: (Discuss the potential risks and rewards of investing in gold, emphasizing the importance of conducting thorough research before making any investment decisions).

Conclusion: Increased Trade Tensions Continue to Boost Gold Prices

In summary, Trump's comments regarding the EU fueled market uncertainty, driving investors towards the safe haven asset, gold, resulting in a significant gold price increase. The relationship between trade tensions and gold prices remains strong, historically demonstrating a positive correlation. While predicting future gold price movements with certainty is impossible, the current geopolitical climate suggests that volatility may persist. To stay informed about gold price increases and trade war developments, regularly consult reputable financial news sources. Understanding the impact of market volatility on safe haven assets like gold is crucial for effective investment portfolio diversification. Consider diversifying your investments with gold to potentially mitigate risks associated with increased trade tensions.

Featured Posts

-

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal Match

May 25, 2025

Wta Italian Open Gauff Beats Zheng In Hard Fought Semifinal Match

May 25, 2025 -

Svadebniy Bum Na Kharkovschine 40 Par Vybrali Odnu I Tu Zhe Datu Foto

May 25, 2025

Svadebniy Bum Na Kharkovschine 40 Par Vybrali Odnu I Tu Zhe Datu Foto

May 25, 2025 -

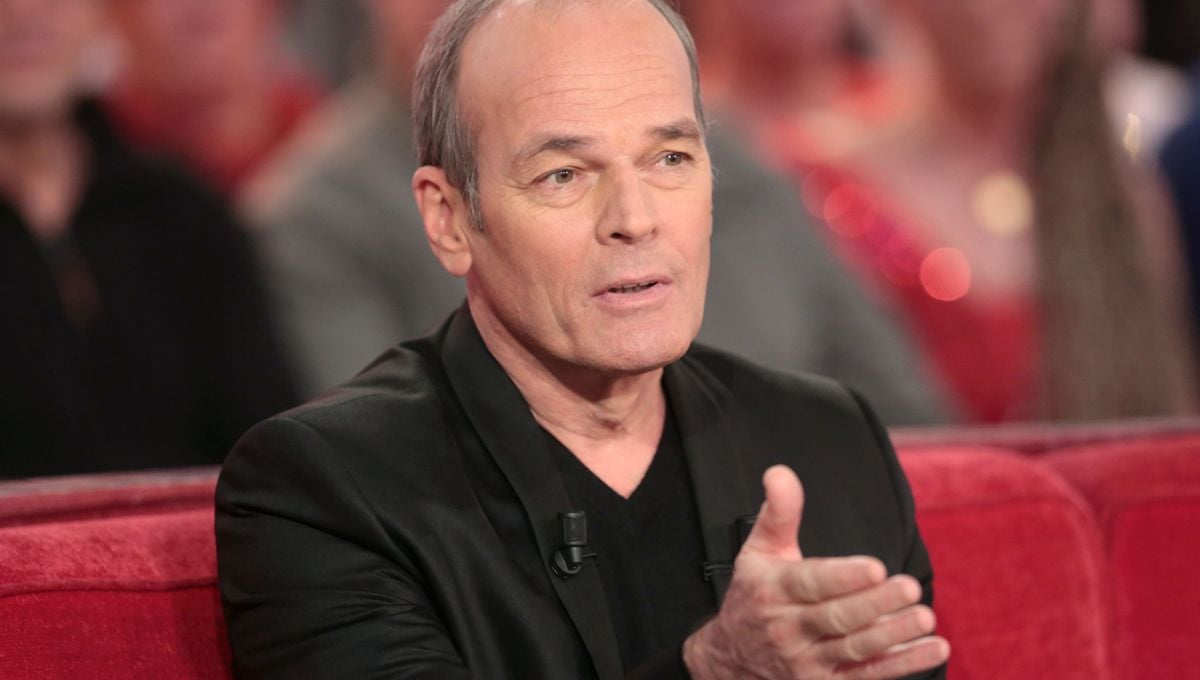

Le Clash Ardisson Baffie Retour Sur La Phrase Essaie De Parler Pour Toi

May 25, 2025

Le Clash Ardisson Baffie Retour Sur La Phrase Essaie De Parler Pour Toi

May 25, 2025 -

What Constitutes A Flash Flood Emergency A Detailed Explanation

May 25, 2025

What Constitutes A Flash Flood Emergency A Detailed Explanation

May 25, 2025 -

Bengalurus New Ferrari Service Centre A Detailed Overview

May 25, 2025

Bengalurus New Ferrari Service Centre A Detailed Overview

May 25, 2025