Increased XRP Trading Volume: Solana Falls Behind On ETF Buzz

Table of Contents

The Surge in XRP Trading Volume: A Deep Dive

The dramatic increase in XRP trading volume is a complex phenomenon with multiple contributing factors.

Factors Contributing to Increased XRP Trading Activity:

-

SEC Lawsuit Impact: The ongoing SEC lawsuit against Ripple has paradoxically fueled XRP trading activity. While some investors remain cautious, others see the potential for a positive outcome, betting on a Ripple victory that could legitimize XRP and unlock significant institutional investment. Conversely, some are using the uncertainty to speculate, leading to increased trading volume regardless of the ultimate ruling.

-

Anticipation of Ripple's Potential Victory: Positive developments in the SEC case, such as favorable court rulings or settlements, have historically led to spikes in XRP price and trading volume. The market is keenly awaiting a final decision and reacting accordingly.

-

General Market Sentiment Towards Altcoins: The broader cryptocurrency market's renewed interest in altcoins beyond Bitcoin and Ethereum has also contributed to increased XRP trading activity. Investors are seeking opportunities beyond the top two cryptocurrencies, and XRP, with its established market presence and established use cases, remains an attractive option.

-

Increased Institutional Interest: Whispers of increased institutional interest in XRP are further contributing to the rise in trading volume. While concrete evidence remains scarce, the potential for large-scale institutional adoption is a powerful catalyst for increased trading activity and price volatility. This is especially true given XRP's established role in cross-border payments.

The impact of these factors is clearly visible in XRP price movements and overall market capitalization, reflecting a dynamic and volatile market influenced by legal and regulatory developments. The correlation between positive news regarding the SEC lawsuit and surges in XRP price is undeniable. Data from various exchanges consistently shows a positive correlation between positive news events and significant increases in XRP trading volume and XRP price.

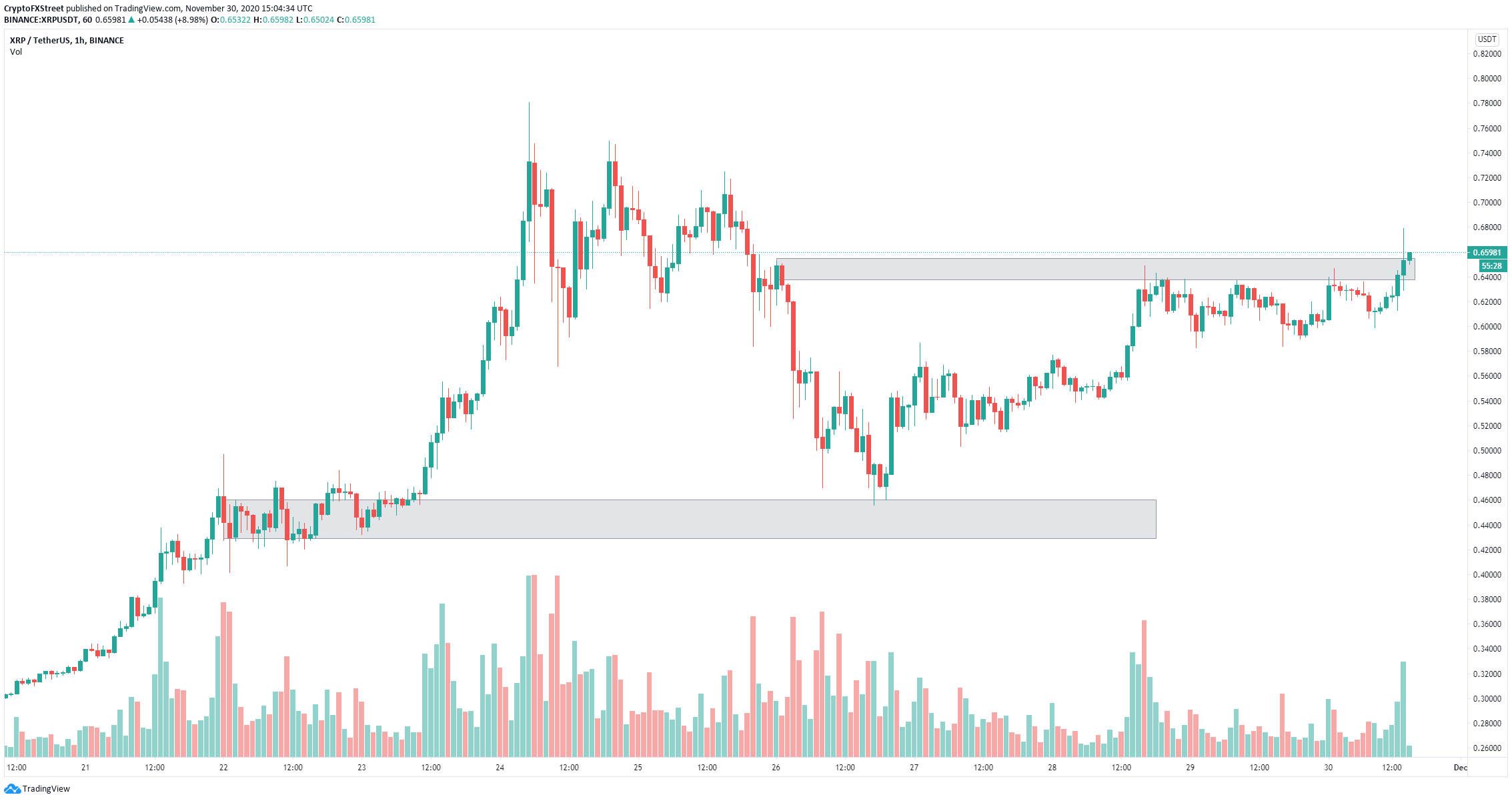

Technical Analysis of XRP Price Movements:

Analyzing XRP price charts reveals several key indicators. Support and resistance levels have shifted significantly, indicating increased volatility. Trading volume indicators, including on-chain data and exchange volume, demonstrate a clear upward trend, corroborating the observed surge in trading activity. (Insert relevant chart here). Current chart patterns suggest further potential for price appreciation, however, it is crucial to remember that the cryptocurrency market is notoriously volatile and predictions should always be treated with caution. Technical indicators such as RSI and MACD should be consulted for further analysis. Using indicators such as these, we can get a more nuanced understanding of market trends and price prediction.

Solana's Stalled Momentum Amidst the ETF Hype

While XRP trading volume soars, Solana's performance has been relatively subdued amidst the excitement surrounding potential Bitcoin and Ethereum ETFs.

Solana's Performance Compared to XRP:

-

Price Performance: A direct comparison of XRP and Solana price charts reveals a significant divergence. While XRP has experienced considerable price growth, Solana's price action has been much more muted.

-

Trading Volume: The disparity in trading volume is even more stark. XRP's trading volume has surged, far exceeding that of Solana.

-

Market Capitalization: The difference in market capitalization reflects the disparity in both price and trading volume, further emphasizing XRP's dominant position.

Solana's comparatively weaker performance can be attributed to several factors. Network congestion issues have plagued Solana in the past, hindering its scalability and user experience. Intense competition from other layer-1 blockchains, such as Avalanche and Polygon, vying for market share, has also contributed to Solana's less-than-stellar performance. The anticipation of ETFs based on Solana-based assets is not as pronounced as with Bitcoin or Ethereum.

The Impact of Bitcoin and Ethereum ETF Approvals on Solana:

The approval of Bitcoin and Ethereum ETFs would likely have a significant ripple effect across the entire crypto market. A positive ruling would likely increase overall market sentiment, potentially benefiting altcoins like Solana. However, this positive impact is less certain compared to the direct impact on the approved cryptocurrencies, as they'll receive immediate boosts in accessibility and thus value. Regulatory uncertainty remains a key factor influencing market sentiment, and it's difficult to ascertain the precise impact of ETF approval on Solana's price and trading volume.

The Broader Implications of the XRP and Solana Narrative

The contrasting performance of XRP and Solana provides valuable insight into the broader dynamics of the cryptocurrency market.

The Future of XRP and Solana in the Post-ETF Landscape:

-

Potential Future Scenarios: Depending on the outcome of the SEC lawsuit and the approval of Bitcoin and Ethereum ETFs, XRP and Solana could experience vastly different trajectories. A favorable ruling for Ripple could propel XRP to new heights, while Solana's fate depends on overcoming its technological challenges and attracting more users and developers.

-

Long-Term Price Predictions: Making long-term price predictions for any cryptocurrency is inherently speculative. However, based on current trends, XRP appears to have stronger short-term momentum, while Solana's long-term success depends heavily on its ability to improve its network scalability and attract widespread adoption.

-

Market Positioning: XRP’s current position as a prominent player in the cross-border payment space and potential increased institutional backing give it an edge. Solana, while technically innovative, needs to demonstrate sustained growth and overcome its scalability issues to compete effectively in the long run.

The narrative surrounding XRP and Solana highlights the complex interplay between legal uncertainty, technological innovation, and market sentiment in shaping the cryptocurrency landscape. This interplay will continue to influence the long-term value and potential for both cryptocurrencies.

Conclusion: Increased XRP Trading Volume and the Shifting Crypto Landscape

This analysis has highlighted the significant increase in XRP trading volume, overshadowing Solana's performance amidst the ongoing ETF buzz. The SEC lawsuit against Ripple, coupled with broader market sentiment and potential institutional interest, has fueled XRP's recent surge. Solana, on the other hand, faces challenges related to network scalability and competition from other layer-1 blockchains. The approval (or rejection) of Bitcoin and Ethereum ETFs will undoubtedly have a broader impact on the market, but the current momentum clearly favors XRP. Stay updated on the latest developments concerning XRP, Solana, and the overall crypto market by following future articles on this subject and conducting your own thorough research. Understanding the dynamics of XRP trading volume and its implications is crucial for navigating the ever-evolving cryptocurrency landscape.

Featured Posts

-

Ripple Xrp Breakout The Path To 3 40

May 08, 2025

Ripple Xrp Breakout The Path To 3 40

May 08, 2025 -

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 08, 2025

Could Buying Xrp Ripple Today Set You Up For Life A Realistic Look

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Basvuru Sartlari Ve Son Tarih

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Basvuru Sartlari Ve Son Tarih

May 08, 2025 -

Colin Cowherds Take On Jayson Tatums Performance In Game 1

May 08, 2025

Colin Cowherds Take On Jayson Tatums Performance In Game 1

May 08, 2025 -

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025

Trumps Crypto Advisors Unexpected Bitcoin Price Surge Prediction

May 08, 2025