India Market Update: Tailwinds Driving Nifty's Strong Performance

Table of Contents

Robust Domestic Economic Growth as a Key Driver

India's impressive GDP growth is a primary engine powering the Nifty's upward trajectory. The Indian economy continues to demonstrate resilience, fueled by robust domestic consumption and strategic government initiatives. This strong economic growth translates directly into increased corporate profits and investor confidence, bolstering the Nifty 50 index.

- Strong consumption demand driving growth: Rising disposable incomes and a burgeoning middle class are significantly boosting consumer spending across various sectors, from automobiles to consumer durables. This increased demand stimulates production and fuels economic expansion.

- Government initiatives boosting infrastructure development: Massive investments in infrastructure, including roads, railways, and digital connectivity, are creating employment opportunities and improving overall economic efficiency. These projects not only contribute directly to GDP growth but also attract further investment.

- Rising disposable incomes fueling consumer spending: As incomes rise, so does consumer spending, creating a virtuous cycle of economic growth. This increased purchasing power is a key indicator of a healthy and expanding economy.

- Increased foreign direct investment (FDI): India's attractive investment climate continues to draw significant FDI, further fueling economic expansion and supporting the Nifty's performance. This influx of capital contributes to infrastructure development and job creation.

Positive Global Sentiment and Foreign Institutional Investor (FII) Flows

The positive global sentiment towards emerging markets, coupled with substantial FII inflows, has played a significant role in boosting the Nifty. Reduced global uncertainties and a favorable outlook for the Indian economy have attracted substantial foreign investment.

- Reduced global uncertainties leading to increased investment: Periods of relative global stability tend to encourage investors to seek higher-growth opportunities, making India an attractive destination.

- Favorable global economic outlook attracting FII investments: A positive global outlook often translates into increased capital flows into emerging markets like India, further driving up the Nifty.

- Strong corporate earnings attracting foreign investment: Consistent and strong corporate earnings in India showcase the country's economic health and profitability, drawing in foreign investors.

- India's relatively stable political environment: Political stability is a critical factor for attracting foreign investment. India's relatively stable political climate instills confidence in investors.

Government Policies and Reforms Supporting Market Growth

Pro-business reforms and government initiatives aimed at improving the ease of doing business have significantly contributed to the positive market sentiment. These policies have fostered a more conducive environment for businesses to thrive and attract investment.

- Focus on ease of doing business reforms: Streamlining regulations and reducing bureaucratic hurdles have made it easier for businesses to operate and expand in India.

- Incentives to attract investment in specific sectors: Targeted incentives for key sectors like manufacturing and renewable energy have spurred growth and attracted significant investment.

- Digitalization initiatives boosting efficiency and transparency: Government initiatives promoting digitalization have improved efficiency and transparency across various sectors, making India a more attractive investment destination.

- Improved infrastructure projects: Continued investments in infrastructure development have improved the efficiency of logistics and transportation, contributing to overall economic growth.

Strong Corporate Earnings and Profitability

The strong performance of the Nifty is underpinned by robust corporate earnings and improved profitability across various sectors. Many companies have reported healthy growth, reflecting the overall positive economic environment.

- Robust earnings across major sectors: Strong earnings are being reported across diverse sectors, indicating broad-based economic strength.

- Increased profitability and margins: Improved operational efficiency and increased demand have led to higher profit margins for many companies.

- Positive outlook for future corporate earnings: Analysts predict continued strong earnings growth, further supporting the optimistic outlook for the Nifty.

- Improved operational efficiency: Businesses are increasingly focusing on streamlining operations, improving efficiency, and boosting profitability.

Conclusion: Understanding the Tailwinds Driving India's Nifty Performance

The Nifty 50's impressive performance is a result of a confluence of positive factors: robust domestic economic growth, positive global sentiment and significant FII inflows, supportive government policies, and strong corporate earnings. These tailwinds paint a positive picture for the Indian market, but it's vital for investors to stay informed about the evolving economic landscape. Understanding these key drivers is critical for making informed investment decisions in the Indian stock market. To stay updated on the India market update and the factors influencing the Nifty's performance, follow reputable financial news sources and consult with financial advisors. Regularly tracking the Nifty 50 index is essential for making strategic investment decisions and capitalizing on the ongoing growth in the Indian economy. Staying informed about the India market update and Nifty 50 index is key to making profitable investment choices.

Featured Posts

-

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025 -

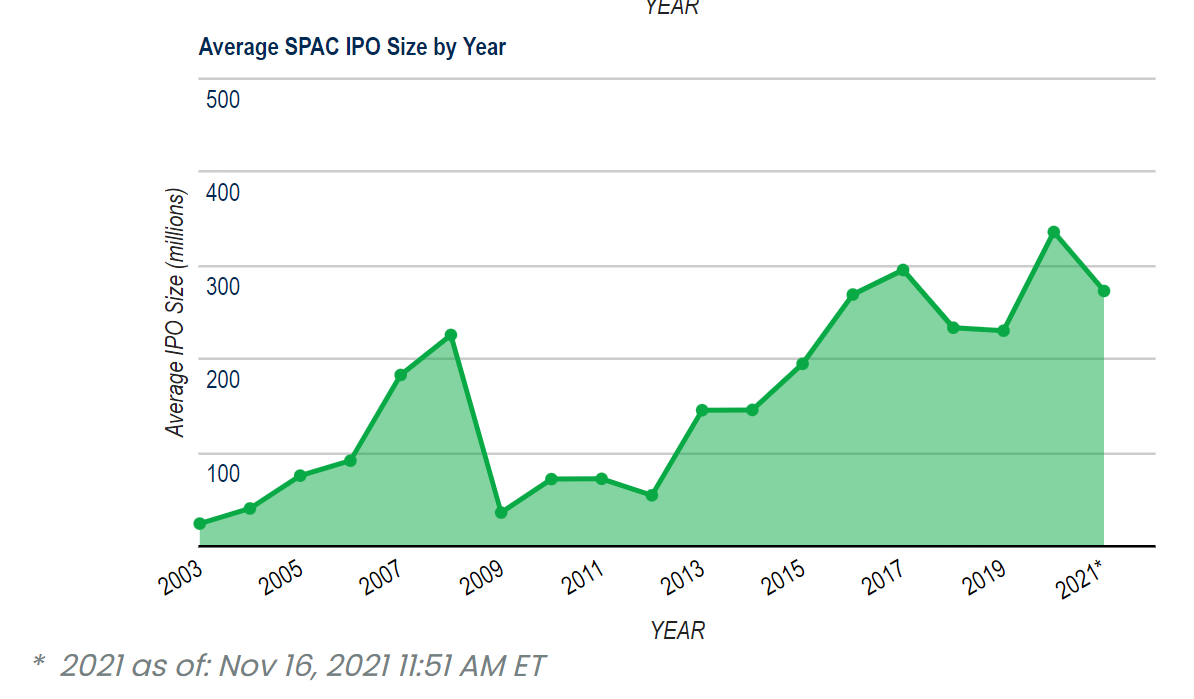

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Cantor Fitzgerald In Talks For 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

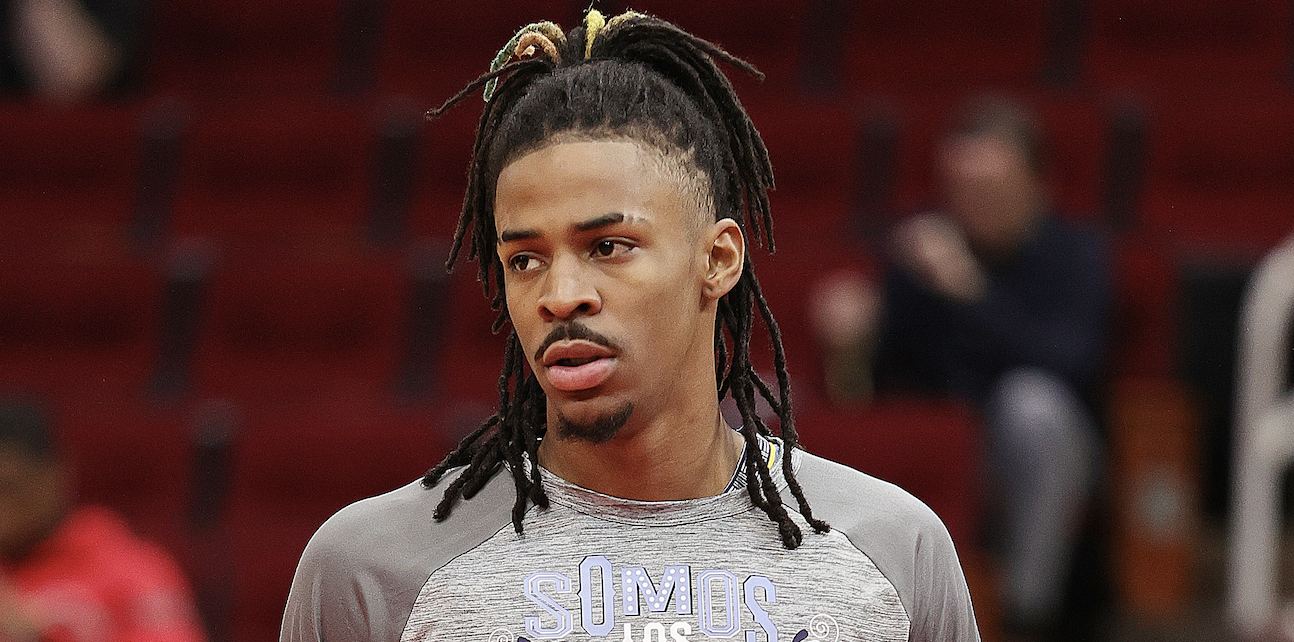

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025

Ja Morant Under Nba Investigation A Report On The Latest Developments

Apr 24, 2025 -

Toxic Chemical Contamination Months Long Impact Of Ohio Train Derailment

Apr 24, 2025

Toxic Chemical Contamination Months Long Impact Of Ohio Train Derailment

Apr 24, 2025 -

Golden States Bench Duo Hield And Payton Key To Win Against Portland

Apr 24, 2025

Golden States Bench Duo Hield And Payton Key To Win Against Portland

Apr 24, 2025