Indian Stock Market Update: Sensex And Nifty Record Significant Gains

Table of Contents

Key Factors Driving the Sensex and Nifty Gains

Several factors contributed to the robust performance of the Sensex and Nifty today. Let's break down the key drivers:

Strong Foreign Institutional Investor (FII) Inflow

Recent weeks have witnessed a significant inflow of foreign portfolio investment (FPI) into the Indian stock market. This FII investment has played a crucial role in boosting market sentiment and driving up indices.

- Increased Investment: FIIs pumped in ₹X billion (replace X with actual figure if available) into the Indian equity market in the last [Time Period, e.g., week/month], signaling strong confidence in the Indian economy.

- Positive Economic Indicators: Positive economic indicators, such as robust GDP growth and declining inflation, have attracted significant FII interest. The expectation of continued economic expansion is a major factor fueling this investment.

- Global Market Trends: Favorable global market trends and a relatively stable global economic outlook have also contributed to increased FII investment in the Indian stock market.

Positive Corporate Earnings

Strong quarterly results from several major Sensex and Nifty companies have further bolstered market sentiment. Many companies reported higher-than-expected profits, reflecting positive business conditions and strong consumer demand.

- IT Sector Strength: The IT sector continues to outperform, with several major players reporting significant profit growth driven by strong global demand for technology services. Company X saw a Y% increase in profits (replace X and Y with specific data).

- Banking Sector Resilience: The banking sector also performed strongly, with several banks reporting healthy loan growth and improved asset quality. This demonstrates the resilience of the Indian financial system.

- FMCG Sector Growth: The fast-moving consumer goods (FMCG) sector saw consistent growth, indicating strong consumer spending and confidence.

Government Policies and Initiatives

Supportive government policies and economic reforms have also contributed to the positive market sentiment. Investor confidence has been boosted by the government's focus on infrastructure development and ease of doing business.

- Infrastructure Spending: Increased government spending on infrastructure projects has created opportunities for growth and investment across various sectors.

- Tax Reforms: Recent tax reforms have streamlined processes and improved ease of doing business, creating a positive environment for businesses to expand and thrive.

- Regulatory Clarity: Clear and consistent regulatory policies have created a stable and predictable environment for investors, encouraging long-term investment.

Global Market Trends

Favorable global market trends have also played a role in the positive performance of the Indian stock market. A generally positive global economic outlook and stable global markets have helped attract international investment.

- Stable Global Markets: Relatively stable global markets have reduced uncertainty and risk aversion, encouraging investors to allocate funds to emerging markets like India.

- US Market Performance: Positive performance in major global markets, particularly the US, has had a spillover effect on Indian equities.

- Commodity Prices: Stable commodity prices have also contributed to a positive market outlook.

Sector-Wise Performance Analysis

Analyzing performance on a sector-by-sector basis provides a more granular understanding of the market's movement.

Top Performing Sectors

The IT, banking, and FMCG sectors were among the top performers today, driven by the factors outlined above. These sectors collectively contributed significantly to the overall market gains.

- IT Sector: Strong growth in the IT sector, fueled by global demand, was a major driver of market gains.

- Banking Sector: Robust loan growth and improved asset quality boosted the performance of the banking sector.

- FMCG Sector: Healthy consumer demand and strong sales growth fueled the FMCG sector's positive performance.

Underperforming Sectors

While many sectors performed strongly, some lagged behind the overall market. Further analysis is needed to understand the reasons for underperformance in these sectors.

- Real Estate: The real estate sector saw comparatively weaker performance, potentially due to ongoing regulatory changes and interest rate adjustments.

- Pharmaceuticals: The pharmaceutical sector also experienced relatively slower growth compared to other sectors, possibly due to pricing pressures and increased competition.

Implications for Investors

The current market conditions present both opportunities and challenges for investors.

Investment Strategies

Based on the current positive market outlook, investors should consider a balanced approach to their investment strategies.

- Diversification: Maintaining a diversified portfolio across different sectors and asset classes remains crucial to mitigate risk.

- Long-Term Perspective: Investors with a long-term perspective should consider this a positive sign and continue investing in quality stocks.

- Risk Management: While the outlook is positive, it’s important to manage risk effectively by setting stop-loss orders and avoiding excessive leverage. Consult a financial advisor before making significant investment decisions.

Conclusion

The Indian stock market's impressive gains in the Sensex and Nifty are driven by a confluence of factors including strong FII inflows, positive corporate earnings, supportive government policies, and favorable global market trends. While certain sectors outperformed others, the overall picture indicates a robust and positive market outlook. However, it is essential to approach the market with a balanced and informed strategy.

Call to Action: Stay informed about the latest developments in the Indian stock market by regularly checking our updates for the most current information on Sensex and Nifty performance. Understanding the dynamics of the Indian stock market and its fluctuations is crucial for making informed investment decisions. Learn more about the Indian Stock Market and its future potential.

Featured Posts

-

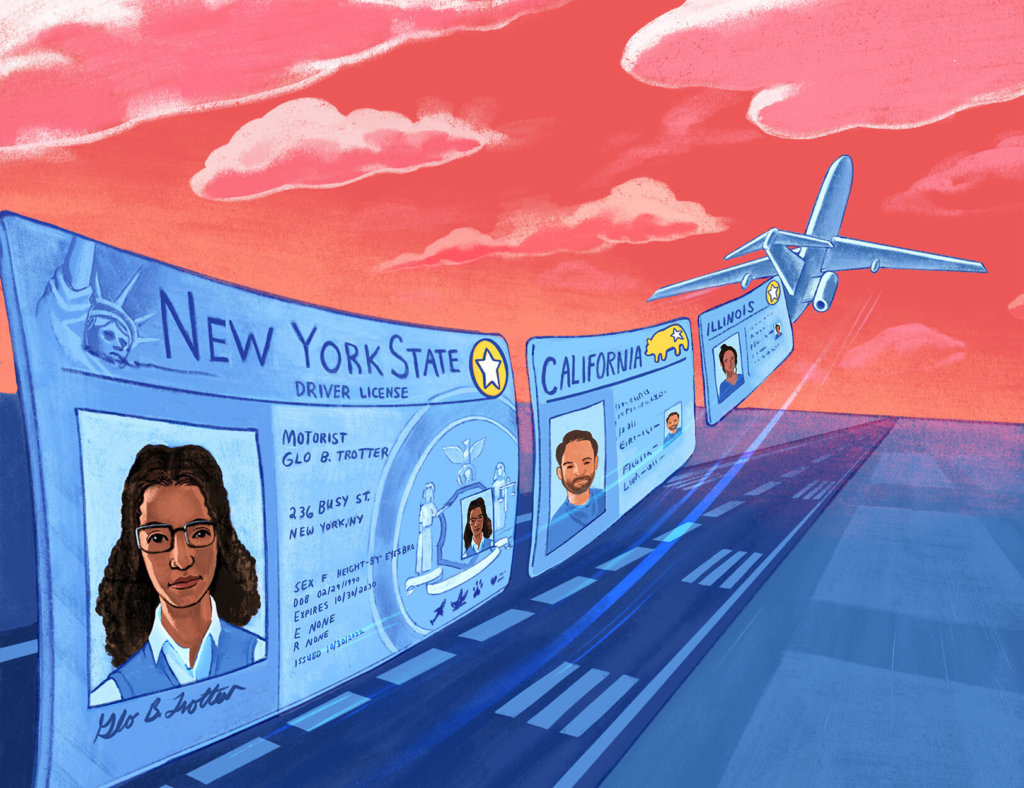

Preparing For Real Id Enforcement Your Summer Travel Checklist

May 10, 2025

Preparing For Real Id Enforcement Your Summer Travel Checklist

May 10, 2025 -

New Music Young Thugs Loyalty To Mariah The Scientist Revealed In Snippet

May 10, 2025

New Music Young Thugs Loyalty To Mariah The Scientist Revealed In Snippet

May 10, 2025 -

Hl Yhqq Barys San Jyrman Hlmh Alawrwby

May 10, 2025

Hl Yhqq Barys San Jyrman Hlmh Alawrwby

May 10, 2025 -

Harry Styles Reaction To A Failed Snl Impression

May 10, 2025

Harry Styles Reaction To A Failed Snl Impression

May 10, 2025 -

Did Pam Bondi Possess The Epstein Client List Examining The Evidence

May 10, 2025

Did Pam Bondi Possess The Epstein Client List Examining The Evidence

May 10, 2025