India's Real Estate Sector: A 47% Investment Boost In January-March 2024

Table of Contents

Driving Forces Behind the Investment Boom

Several factors converged to create this unprecedented surge in investment in India's real estate sector during Q1 2024.

Increased Government Initiatives

The Indian government has implemented several supportive policies and infrastructure development projects that have significantly boosted investor confidence. These initiatives have created a favorable environment for real estate investment.

- Affordable Housing Schemes: Initiatives like the Pradhan Mantri Awas Yojana (PMAY) have incentivized developers to focus on affordable housing, increasing the overall housing supply and making homeownership more accessible. This has directly impacted the affordable housing projects India segment.

- Tax Benefits: Various tax benefits and deductions for homebuyers and developers have made real estate investment more attractive. These government policies real estate India have reduced the financial burden and stimulated demand.

- Infrastructure Development: Massive investments in infrastructure projects, including roads, railways, and metro systems, have improved connectivity and boosted property values in several key locations, further fueling infrastructure investment India.

Rising Demand and Urbanization

India's rapid urbanization and burgeoning population are key drivers of the increased demand for both residential and commercial real estate. The migration of people from rural areas to urban centers is creating a significant housing shortage, pushing up prices and driving investment.

- Urban Population Growth: India's urban population is growing at an unprecedented rate, leading to increased demand for housing, offices, and retail spaces.

- Migration Trends: Significant internal migration from rural areas to urban centers is a major factor contributing to the housing shortage and boosting housing demand India.

- Increased Disposable Incomes: Rising disposable incomes among the middle class are fueling demand for better housing and improved living standards, further increasing pressure on the real estate market trends India.

Improved Consumer Sentiment & Lower Interest Rates

Positive economic indicators and a reduction in interest rates have played a crucial role in improving consumer sentiment and incentivizing investment in the real estate sector. Lower interest rates have made home loans more affordable, making property purchases more accessible to a wider range of buyers.

- Reduced Interest Rates: Lower interest rates on home loans have significantly increased affordability, encouraging more people to invest in property prices India.

- Positive Economic Outlook: Positive economic forecasts and improved consumer confidence have boosted investor sentiment, leading to increased investment in the real estate sector.

- Improved Access to Finance: Easier access to home loans and other financing options has made it easier for individuals and developers to participate in the market.

Investment Breakdown Across Sectors

The 47% investment surge wasn't uniform across all sectors; certain segments saw more pronounced growth.

Residential Real Estate

The residential segment witnessed strong investment growth across all categories, with varying degrees of intensity.

- Luxury Apartments India: High-end luxury apartments continue to attract significant investment from high-net-worth individuals and foreign investors.

- Mid-Segment Housing: This segment showed healthy growth, driven by the growing middle class seeking improved living standards.

- Affordable Housing Projects India: Government initiatives and increased affordability have stimulated significant investment in this segment.

Commercial Real Estate

The commercial real estate sector also saw robust investment, driven by the expansion of businesses and the growing need for modern office spaces and retail outlets.

- Office Spaces India: Investment in office spaces in major cities remains strong, fueled by the growth of IT and other industries.

- Retail Property India: The retail sector is witnessing a revival, with increased investment in shopping malls and high-street retail spaces.

- Warehousing: The e-commerce boom has driven significant investment in warehousing and logistics facilities.

Land Acquisition and Development

Investment in land acquisition and development projects also increased significantly, reflecting the long-term potential of the Indian real estate market.

- Land Acquisition India: Strategic land acquisitions in prime locations are being made by both developers and investors, anticipating future growth.

- Real Estate Development India: Large-scale development projects are underway, contributing to the overall growth of the sector.

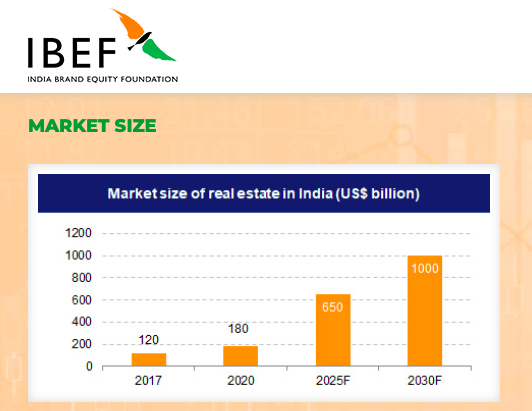

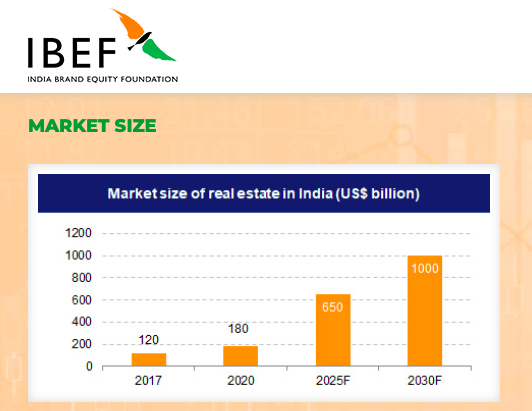

Future Outlook for India's Real Estate Sector

While the outlook for India's real estate sector is largely positive, certain challenges and opportunities need consideration.

Challenges and Opportunities

The future growth of the sector is likely to be shaped by several factors:

- Regulatory Hurdles: Streamlining regulatory processes and reducing bureaucratic hurdles are crucial for sustained growth.

- Material Costs: Fluctuations in material costs could impact profitability and development timelines.

- Market Volatility: Global economic conditions and domestic policy changes could influence market stability.

- Opportunities: The continued growth of the Indian economy, coupled with supportive government policies and rising urbanization, presents immense opportunities for further growth. The future of real estate India remains bright.

Conclusion: Capitalizing on the Growth of India's Real Estate Sector

The 47% investment boost in India's real estate sector during Q1 2024 is a testament to its resilience and growth potential. Driven by government initiatives, urbanization, and improved consumer sentiment, this surge points towards a vibrant and promising future. The India real estate sector presents significant opportunities for investors seeking strong returns. While challenges exist, the overall outlook remains positive, offering substantial prospects for both short-term and long-term gains. To explore the myriad investment opportunities in this dynamic market, connect with reputable real estate consultants and investment firms. Seize the current momentum and become a part of India's booming real estate investment landscape.

Featured Posts

-

Fortnites Cowboy Bebop Crossover Grab The Freebies Before They Re Gone

May 17, 2025

Fortnites Cowboy Bebop Crossover Grab The Freebies Before They Re Gone

May 17, 2025 -

Knicks Receive Encouraging Mitchell Robinson Update Following Losses

May 17, 2025

Knicks Receive Encouraging Mitchell Robinson Update Following Losses

May 17, 2025 -

Tvs Jupiter Cng R1

May 17, 2025

Tvs Jupiter Cng R1

May 17, 2025 -

Top Rated Online Casinos In New Zealand For Real Money In 2024

May 17, 2025

Top Rated Online Casinos In New Zealand For Real Money In 2024

May 17, 2025 -

Trumps Middle East Journey May 15 2025 A Presidential Overview

May 17, 2025

Trumps Middle East Journey May 15 2025 A Presidential Overview

May 17, 2025