Infineon (IFX) Stock: Sales Guidance Disappoints, Citing Tariff Concerns

Table of Contents

Infineon's Revised Sales Projections and the Impact on Stock Price

Infineon's revised sales projections paint a concerning picture for the near future. The company significantly lowered its sales guidance for the current fiscal year, revealing a substantial shortfall compared to previous forecasts and analyst expectations. This announcement resulted in an immediate and sharp decline in the IFX stock price, with a percentage drop [insert actual percentage here] observed within [timeframe, e.g., the first hour of trading]. Trading volume also spiked, indicating significant investor activity and a volatile market response.

- Specific downward revisions: Infineon reported downward revisions in sales figures for key product segments, including [mention specific segments like automotive, industrial, etc., and provide percentage decreases].

- Comparison to previous guidance: The revised guidance represents a [percentage] decrease compared to the previous forecast issued [date of previous forecast]. This significant discrepancy underscores the severity of the situation.

- Impact on overall financial outlook: The lowered sales forecast has a direct negative impact on the company's projected earnings and overall financial health, raising serious concerns among investors about the company's short-term and long-term prospects. The IFX stock forecast now looks considerably less optimistic than it did previously.

The plummeting Infineon stock price highlights the sensitivity of the semiconductor industry to macroeconomic factors and global trade uncertainties, impacting the Infineon stock forecast negatively.

The Role of Tariffs and Trade Wars in Infineon's Performance

The ongoing US-China trade war and related tariffs are playing a significant role in Infineon's underperformance. Specific tariffs imposed on [mention specific components or products] are increasing production costs and impacting Infineon's supply chain. The increased costs are squeezing profit margins, limiting the company's ability to compete effectively, and potentially leading to reduced market share.

- Specific tariffs: The imposition of tariffs on [mention specific components, e.g., power semiconductors imported from China to the US] directly increases the cost of goods sold for Infineon.

- Increased costs: These tariff-related expenses significantly impact Infineon's profitability, forcing them to either absorb the increased costs or pass them on to customers, potentially harming sales.

- Reduced market share: The price increase resulting from tariffs can make Infineon's products less competitive in the global marketplace, risking a loss of market share to competitors who may not be similarly affected.

The complexities of global trade disputes and their profound impact on the semiconductor industry are directly impacting the stability of the Infineon stock price and overall IFX stock forecast.

Analyst Reactions and Future Outlook for Infineon (IFX) Stock

The market reaction to Infineon's revised sales guidance has been swift and significant. Financial analysts have downgraded their price targets and ratings for IFX stock.

- Analyst quotes: [Include quotes from reputable analysts summarizing their opinions on the situation and their outlook for Infineon's future performance].

- Revised price targets: Several analysts have lowered their price targets for IFX stock, reflecting a less optimistic outlook. [Provide examples of price target adjustments from different analysts].

- Predictions for future growth: Forecasts for future sales growth and profitability are now more subdued, with many analysts predicting a slower recovery than previously anticipated. This impacts the reliability of the IFX stock forecast.

Investment Strategies in Light of the Current Situation

Given the current situation, investors need to carefully assess their risk tolerance and investment strategy concerning Infineon (IFX) stock. Buying, selling, or holding should be based on a thorough understanding of the risks and potential rewards.

- Consider your risk tolerance: Infineon stock is currently experiencing significant volatility. Investors with a low risk tolerance may consider reducing their exposure.

- Diversification: Diversifying your investment portfolio across different sectors and asset classes can help mitigate the risk associated with holding IFX stock.

- Long-term vs. short-term outlook: Consider your investment timeframe. A long-term investor might view the current downturn as a buying opportunity, while a short-term investor might prefer to wait for greater stability.

Careful consideration of these factors is crucial to forming an informed Infineon investment strategy.

Conclusion: Navigating the Uncertainty Surrounding Infineon (IFX) Stock

The disappointing sales guidance from Infineon, significantly impacted by tariffs and trade disputes, presents a challenging situation for investors. The immediate market reaction underscores the seriousness of the situation. Analyst reactions highlight a cautious outlook, with revised price targets and ratings reflecting uncertainty.

The future performance of Infineon (IFX) stock remains uncertain. Investors must carefully weigh the risks and rewards before making any investment decisions. It's crucial to conduct thorough research, stay informed about relevant financial news, and consider your risk tolerance before acting. Continue to follow further news and analysis regarding Infineon (IFX) stock to make informed decisions about your investment strategy.

Featured Posts

-

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 10, 2025

Indonesias Foreign Exchange Reserves Plunge Rupiah Weakness Takes Toll

May 10, 2025 -

Zasudzhennya Kingom Maska Ta Trampa Zrada Ta Proputinski Nastroyi

May 10, 2025

Zasudzhennya Kingom Maska Ta Trampa Zrada Ta Proputinski Nastroyi

May 10, 2025 -

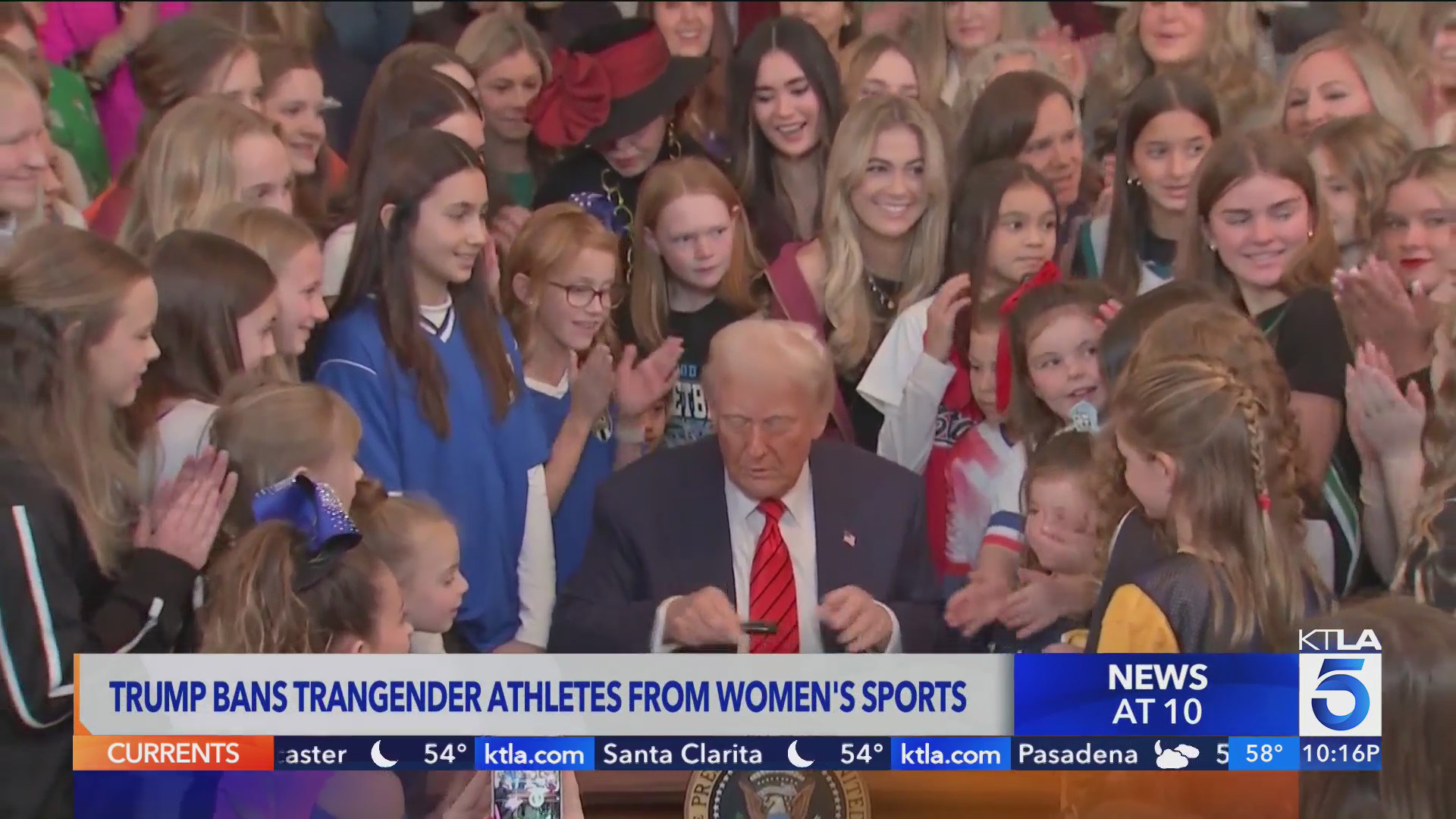

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025

Following Trump Order Ihsaa Bans Transgender Girls From Sports

May 10, 2025 -

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 10, 2025

Should I Buy Palantir Stock Now A 2025 Growth Projection Analysis

May 10, 2025 -

The Rise Of A Footballing Phenom Rejected By Wolves Now A European Icon

May 10, 2025

The Rise Of A Footballing Phenom Rejected By Wolves Now A European Icon

May 10, 2025