ING 2024 Form 20-F: Financial Report And Key Insights

Table of Contents

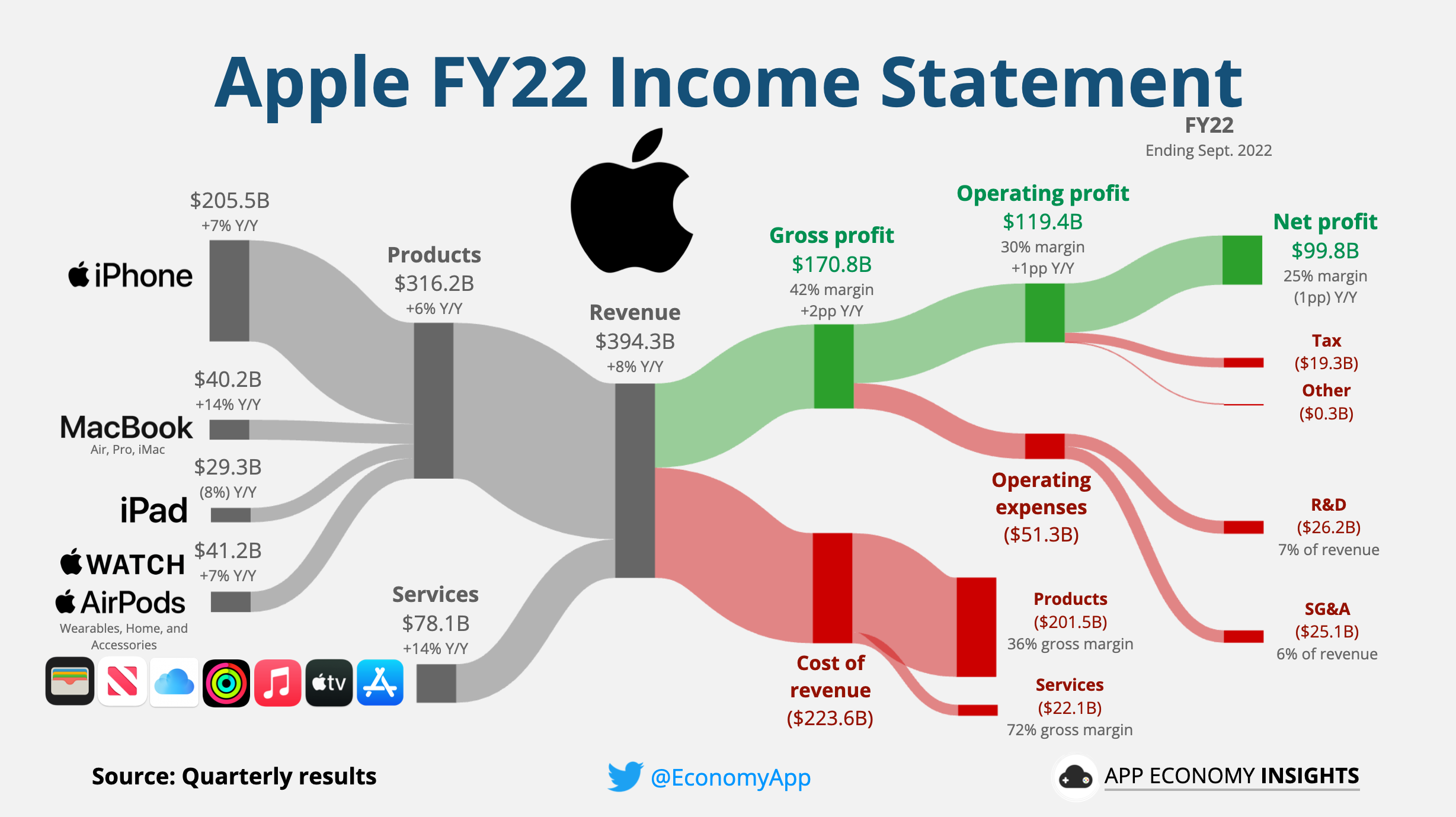

Overview of ING's 2024 Financial Performance: A Summary of Key Figures

ING's 2024 financial performance, as detailed in the 20-F filing, reflects [insert overall summary of performance, e.g., strong growth across key business segments despite a challenging macroeconomic environment]. Compared to 2023, [insert specific comparison, e.g., net income showed a significant increase, driven primarily by improved profitability in Wholesale Banking]. Several key financial metrics underscore this performance:

- Net Profit: [Insert figure and percentage change from 2023]

- Return on Equity (ROE): [Insert figure and percentage change from 2023]

- Earnings per share (EPS): [Insert figure and percentage change from 2023]

- Total Assets: [Insert figure and percentage change from 2023]

- Total Liabilities: [Insert figure and percentage change from 2023]

It's important to note [mention any significant accounting changes or extraordinary events impacting the financials, e.g., any one-off gains or losses, changes in accounting standards, or the impact of specific acquisitions or divestments]. Keywords: ING financials, financial results, key performance indicators (KPIs), financial statements, 2024 financial performance.

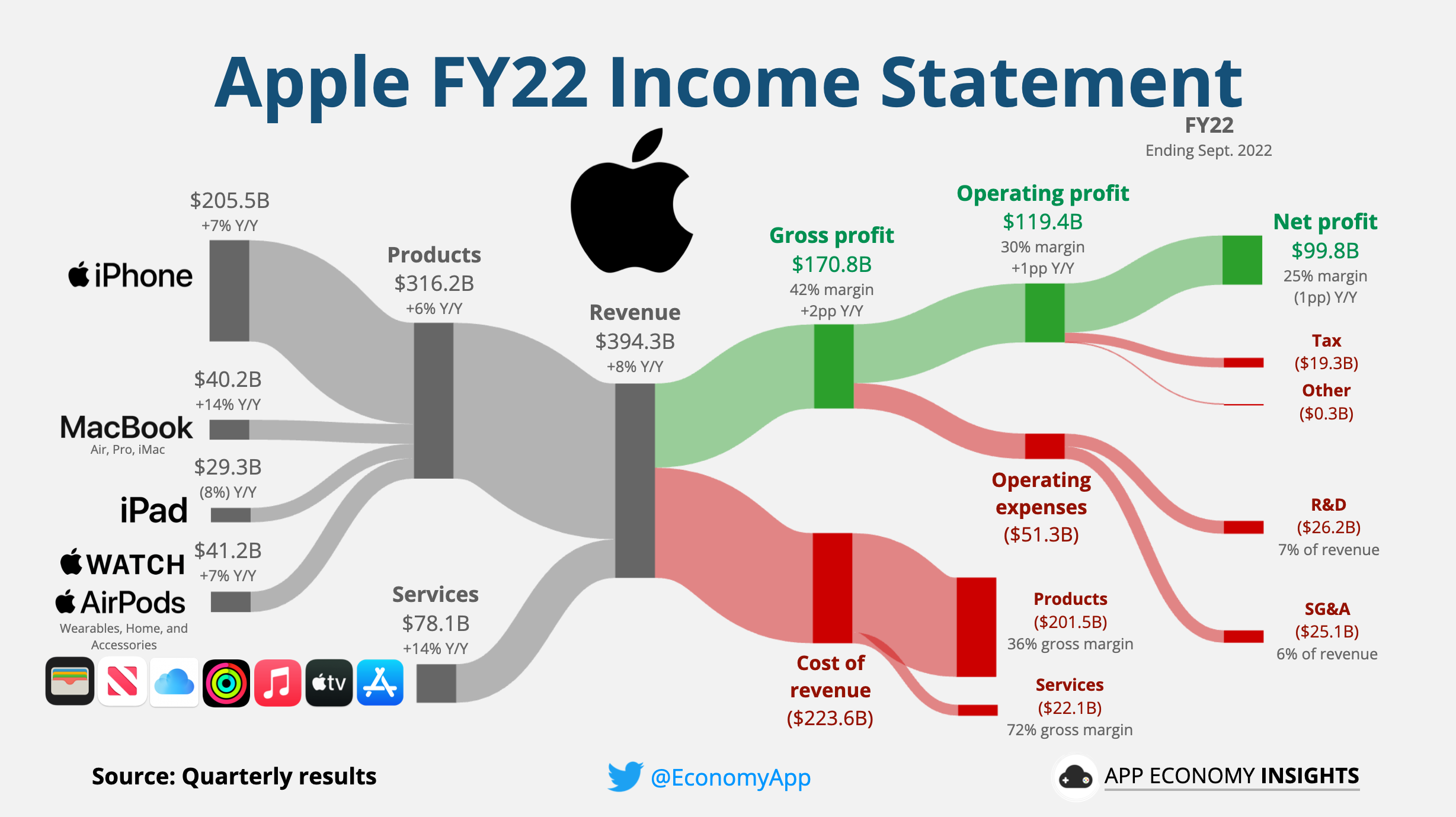

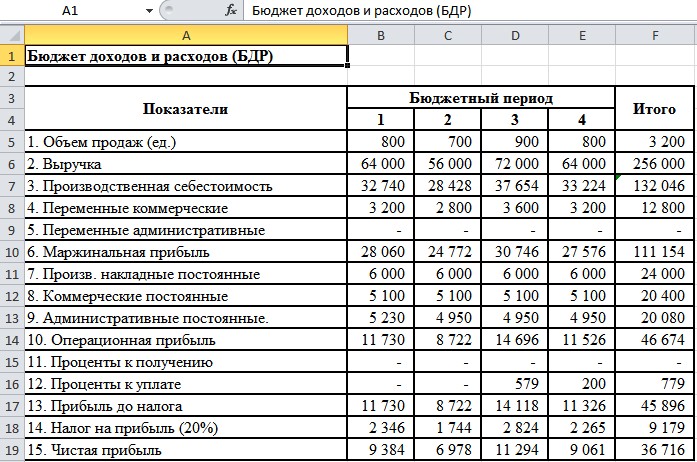

Analysis of ING's Revenue Streams and Growth Drivers in 2024

ING's revenue in 2024 is segmented across several key business areas. A detailed breakdown reveals:

- Wholesale Banking: This segment experienced [insert description of performance, e.g., robust growth] driven by [insert specific drivers, e.g., increased trading activity and strong corporate lending].

- Retail Banking: ING's retail banking arm showed [insert description of performance, e.g., steady growth] with notable success in [insert specific areas, e.g., mortgage lending and digital banking adoption]. Market share changes reflect [insert market share data and relevant context].

- Investment Management: This segment contributed [insert description of performance, e.g., significantly to overall revenue] boosted by [insert reasons, e.g., strong investment performance and increased assets under management].

Geographic trends show [insert details about geographic expansion or contraction of revenue, providing specific examples]. Keywords: ING revenue, revenue streams, business segments, revenue growth, market share, geographic expansion.

ING's Risk Management and Capital Adequacy in the 2024 Report

ING's 2024 Form 20-F details a comprehensive risk management framework covering credit risk, market risk, and operational risk. Key aspects of their approach include:

- Capital Adequacy Ratio (CAR): [Insert figure and commentary on its adequacy in relation to regulatory requirements].

- Credit Risk Exposure: ING reports [insert summary of credit risk exposure and any mitigation strategies].

- Liquidity Position: The company maintains a [insert description of liquidity position, emphasizing strength or weaknesses].

- Regulatory Compliance: ING demonstrates ongoing commitment to [mention specific regulatory compliance measures and achievements].

The 20-F also highlights [mention any significant risk events or challenges, and how they were managed]. Keywords: ING risk management, capital adequacy, credit risk, market risk, operational risk, regulatory compliance, risk assessment.

Dividend Policy and Shareholder Returns in ING’s 2024 Form 20-F

ING's 2024 dividend policy, as outlined in the 20-F, [summarize the policy, e.g., reflects a continued commitment to returning value to shareholders]. Specific details include:

- Dividend per share: [Insert figure]

- Dividend payout ratio: [Insert figure and comment on its implications]

- Share buyback program: [Insert details about any share buyback program, including the amount and rationale].

These actions collectively contribute to [explain the overall impact on shareholder returns]. Keywords: ING dividend, shareholder returns, dividend policy, share buyback, stock performance.

Conclusion: Key Takeaways and Call to Action: Understanding ING's 2024 20-F Report

ING's 2024 Form 20-F reveals a [summarize the overall financial health, e.g., financially strong and resilient company] navigating a complex economic landscape. Key highlights include [reiterate 2-3 most important findings, e.g., strong revenue growth, robust risk management, and a commitment to shareholder returns]. Understanding the ING 2024 20-F is crucial for making informed investment decisions. For a complete understanding of ING's financial performance and strategic direction, we strongly encourage you to download and review the full ING 2024 20-F document. Further research into ING's specific business segments and competitive landscape will provide even deeper insights. Keywords: ING 2024 20-F, financial analysis, investment decisions, annual report, financial insights.

Featured Posts

-

Remont Pivdennogo Mostu Prozorist Ta Kontrol Vitrat

May 21, 2025

Remont Pivdennogo Mostu Prozorist Ta Kontrol Vitrat

May 21, 2025 -

Betaalbare Huizen In Nederland Abn Amros Standpunt En De Reactie Van Geen Stijl

May 21, 2025

Betaalbare Huizen In Nederland Abn Amros Standpunt En De Reactie Van Geen Stijl

May 21, 2025 -

The Goldbergs Comparing The Show To Real Life Events Of The 80s

May 21, 2025

The Goldbergs Comparing The Show To Real Life Events Of The 80s

May 21, 2025 -

Moncoutant Sur Sevre Clisson Pres D Un Siecle De Diversification

May 21, 2025

Moncoutant Sur Sevre Clisson Pres D Un Siecle De Diversification

May 21, 2025 -

American Couple Arrested In Uk Following Bbc Antiques Roadshow Episode

May 21, 2025

American Couple Arrested In Uk Following Bbc Antiques Roadshow Episode

May 21, 2025