ING 2024 Form 20-F: Financial Statements And Key Metrics

Table of Contents

Key Highlights from ING's 2024 20-F Filing

ING's 2024 20-F filing reveals [Insert overall summary of performance - e.g., a year of solid growth despite challenging market conditions]. Key improvements or challenges should be mentioned here based on the actual filing. The following bullet points highlight some significant figures (replace with actual data from the 20-F):

- ING Revenue: [Insert Revenue Figure and percentage change YoY] – showcasing [brief description of growth/decline and contributing factors]

- ING Net Income: [Insert Net Income Figure and percentage change YoY] – reflecting [brief description of profitability trend and contributing factors]

- Return on Equity (ROE): [Insert ROE Figure] – indicating [brief interpretation of the ROE figure]

- Return on Assets (ROA): [Insert ROA Figure] – suggesting [brief interpretation of the ROA figure]

These figures provide a preliminary snapshot of ING's financial performance in 2024. A thorough review of the complete ING 20-F is necessary for a comprehensive understanding.

Analyzing ING's Revenue Streams in the 20-F

ING's revenue is generated across various segments. Understanding the contribution of each segment is essential for a holistic view of the ING 2024 financials. The following breakdown (replace with data from the 20-F) illustrates the revenue composition:

- ING Retail Banking: [Percentage] of total revenue – This segment focuses on [brief description and key performance indicators].

- ING Wholesale Banking: [Percentage] of total revenue – This division concentrates on [brief description and key performance indicators].

- ING Asset Management: [Percentage] of total revenue – This area includes [brief description and key performance indicators].

- Other Revenue Streams: [Percentage] of total revenue – encompassing [brief description of remaining revenue sources].

Analyzing this revenue breakdown provides valuable insights into ING's business diversification and the relative performance of each segment.

Scrutinizing ING's Balance Sheet and Liabilities (20-F)

The ING 20-F provides a detailed balance sheet, offering crucial information regarding the company's assets, liabilities, and overall financial strength. Key aspects to examine include liquidity and capital adequacy. The following ratios (replace with data from the 20-F) are particularly relevant:

- Loan-to-Deposit Ratio: [Insert Ratio] – This indicates [interpretation of the ratio and its implications for ING's liquidity].

- Leverage Ratio: [Insert Ratio] – This reflects [interpretation of the ratio and its implications for ING's financial stability].

Understanding these ratios is critical in assessing ING's ability to meet its short-term and long-term obligations and maintain financial stability.

Interpreting Key Financial Metrics from ING's 20-F

Investors use several key financial metrics to evaluate a company's performance. Analyzing these metrics from ING's 20-F offers valuable insights. (Replace with data from the 20-F):

- Earnings Per Share (EPS): [Insert EPS Figure] – This signifies [interpretation of the EPS figure and its implication for shareholders].

- Price-to-Earnings Ratio (P/E Ratio): [Insert P/E Ratio] – This suggests [interpretation of the P/E ratio in relation to ING's valuation and market expectations].

Comparing these metrics to previous years' performance and industry benchmarks provides a more comprehensive understanding of ING's financial position.

Understanding Risk Factors Disclosed in ING's 20-F

ING's 20-F transparently discloses various risk factors that could potentially impact its financial performance. Understanding these risks is crucial for a complete assessment. The following are some key risk factors identified (replace with specific risks from the 20-F):

- Credit Risk: [Description of ING's credit risk exposure and mitigation strategies].

- Market Risk: [Description of ING's market risk exposure and mitigation strategies].

- Operational Risk: [Description of ING's operational risk exposure and mitigation strategies].

- Regulatory Risk: [Description of ING's regulatory risk exposure and mitigation strategies].

A thorough review of these risks helps assess ING's preparedness and resilience in a dynamic financial environment.

Conclusion

ING's 2024 20-F filing provides a comprehensive overview of the company's financial performance, highlighting both strengths and potential risks. This analysis has touched upon key metrics, revenue streams, balance sheet information, and identified risk factors. However, this is just a summary. To gain a deeper understanding of ING's 2024 performance and make informed investment decisions, it is crucial to download and thoroughly review the complete ING 20-F document. Further research, considering individual investment goals and a comparative analysis against industry peers, is recommended. Download the full ING 20-F document for a complete financial analysis and gain a deeper understanding of ING's 2024 performance by reviewing the complete 20-F.

Featured Posts

-

Qmrt Qtr Ahtdan Snae Alaflam Alqtryyn

May 23, 2025

Qmrt Qtr Ahtdan Snae Alaflam Alqtryyn

May 23, 2025 -

Josh Healds Original Vision An Inside Look At The Cobra Kai Pitch

May 23, 2025

Josh Healds Original Vision An Inside Look At The Cobra Kai Pitch

May 23, 2025 -

Alhryt Lflstyn Sda Emlyt Washntn Wsrakh Rwdryghyz Yhzan Alealm Alrqmy

May 23, 2025

Alhryt Lflstyn Sda Emlyt Washntn Wsrakh Rwdryghyz Yhzan Alealm Alrqmy

May 23, 2025 -

Zimbabwe Cricket Fast Bowlers Impressive Ranking Surge

May 23, 2025

Zimbabwe Cricket Fast Bowlers Impressive Ranking Surge

May 23, 2025 -

Ranking Pete Townshend His 10 Best Songs Ever

May 23, 2025

Ranking Pete Townshend His 10 Best Songs Ever

May 23, 2025

Latest Posts

-

Why Current Stock Market Valuations Are Not A Threat A Bof A View

May 23, 2025

Why Current Stock Market Valuations Are Not A Threat A Bof A View

May 23, 2025 -

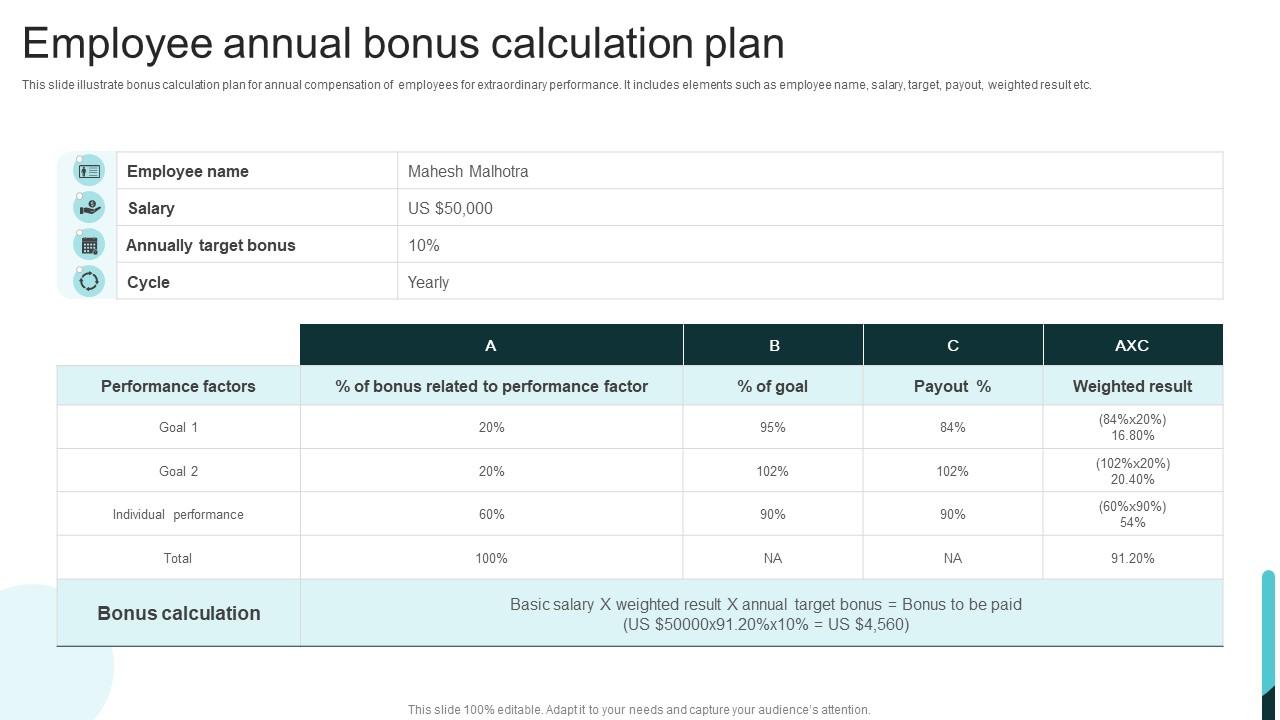

Thames Water Executive Compensation A Case Study In Corporate Governance

May 23, 2025

Thames Water Executive Compensation A Case Study In Corporate Governance

May 23, 2025 -

Investigating Thames Water The Controversy Surrounding Executive Bonuses

May 23, 2025

Investigating Thames Water The Controversy Surrounding Executive Bonuses

May 23, 2025 -

The Thames Water Bonus Debate Examining Executive Compensation

May 23, 2025

The Thames Water Bonus Debate Examining Executive Compensation

May 23, 2025 -

Thames Water Executive Bonus Scandal Analysis And Reaction

May 23, 2025

Thames Water Executive Bonus Scandal Analysis And Reaction

May 23, 2025