ING Group's 2024 Financial Performance: Form 20-F

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

This section examines the core financial results reported by ING Group in its 2024 20-F filing. We analyze revenue, net income, and key profitability metrics to assess the bank's overall financial health.

Revenue and Net Income Analysis: Unpacking ING Group's Financial Results

ING Group's 2024 financial performance, as detailed in the 20-F, reveals [insert actual data from 20-F, e.g., a specific percentage change] in revenue compared to 2023. This change can be attributed to several factors:

- Impact of Interest Rate Hikes: The increase/decrease in interest rates significantly affected ING Group's net interest income, impacting overall revenue. [Insert specific data and analysis based on the 20-F].

- Wholesale Banking Performance: The Wholesale Banking division contributed [insert percentage] to overall revenue, showcasing [growth/decline and reasons].

- Retail Banking Performance: Retail Banking revenue experienced [growth/decline] due to [specific factors, e.g., mortgage market fluctuations, consumer spending patterns]. [Insert data from 20-F].

- Investment Management Performance: The Investment Management segment showed [growth/decline] in revenue, driven by [e.g., changes in AUM, market conditions]. [Insert data from 20-F].

Net income for 2024 was [insert data from 20-F], reflecting [insert analysis based on the 20-F, e.g., the impact of specific items, cost-cutting measures, or market conditions]. This represents a [percentage change] compared to the previous year. Analyzing ING Group revenue and net income provides a critical understanding of the bank's financial strength.

Profitability and Efficiency Metrics: Assessing ING Group's ROE, ROA, and NIM

Key profitability indicators offer further insights into ING Group's financial health. The 20-F provides data on:

- Return on Equity (ROE): [Insert data from 20-F and analysis, comparing to previous years and industry benchmarks]. A higher ROE suggests better utilization of shareholder equity.

- Return on Assets (ROA): [Insert data from 20-F and analysis, comparing to previous years and industry benchmarks]. ROA measures the efficiency of asset utilization in generating profit.

- Net Interest Margin (NIM): [Insert data from 20-F and analysis]. NIM reflects the difference between interest earned and interest paid.

Furthermore, ING Group’s efficiency ratios, such as the cost-to-income ratio, [Insert data from 20-F and analysis]. This shows the bank's success in controlling operational costs. Comparing these metrics to industry competitors paints a clearer picture of ING Group's performance within the financial landscape.

Capital Adequacy and Risk Management: Analyzing ING Group's CET1 Ratio and Risk Strategies

The 20-F provides vital information on ING Group's capital adequacy and risk management. Key aspects include:

- Common Equity Tier 1 (CET1) Ratio: This key metric, indicating the bank's financial strength, stood at [insert data from 20-F] in 2024. [Analyze the implications of this ratio].

- Risk Management Strategies: The 20-F details ING Group's approach to managing various risks, including credit risk, market risk, and operational risk. [Summarize key risk management strategies and their effectiveness based on the 20-F].

- Regulatory Changes: Any significant regulatory changes impacting ING Group's capital requirements or risk management practices should be highlighted. [Insert relevant information from the 20-F].

A robust capital position and effective risk management are critical for long-term stability and growth.

Segment Performance Deep Dive: ING Group's Business Units

ING Group operates across various segments, each contributing uniquely to the overall financial performance.

Wholesale Banking Performance: Analyzing ING's Corporate and Institutional Client Base

ING's Wholesale Banking division serves corporate and institutional clients globally. Key performance indicators (KPIs) to analyze from the 20-F include [List relevant KPIs from the 20-F, e.g., revenue growth, loan portfolio performance, and client acquisition]. Geographic focus and strategic initiatives within this segment should also be noted. [Insert relevant information from the 20-F].

Retail Banking Performance: Understanding ING's Consumer and Private Banking Activities

The Retail Banking segment focuses on consumer and private banking services. The 20-F should provide data on KPIs such as loan growth, customer acquisition, and digital banking adoption. [Insert relevant information and analysis from the 20-F]. The success of digital transformation efforts is also a key area to examine.

Investment Management Performance: Evaluating ING's AUM and Investment Strategies

ING's Investment Management division manages significant assets under management (AUM). The 20-F should detail the AUM figures, investment strategies, and performance against benchmarks. [Insert relevant information and analysis from the 20-F]. Analyzing these metrics provides insight into the profitability and growth potential of this segment.

Outlook and Future Prospects for ING Group based on the 20-F

Management's outlook for future performance, as outlined in the 20-F, is a critical consideration. Key factors to analyze include:

- Management Guidance: What are management's expectations for revenue growth, profitability, and capital ratios in the coming years? [Insert information from the 20-F].

- Potential Challenges: What significant challenges might ING Group face, such as economic downturns, regulatory changes, or increased competition? [Insert relevant information from the 20-F].

- Opportunities for Growth: What opportunities for growth does ING Group foresee? [Insert relevant information from the 20-F].

- Macroeconomic Factors: How might macroeconomic conditions, such as interest rate changes or global economic growth, impact ING Group's future performance? [Insert relevant information and analysis based on the 20-F].

Conclusion: Understanding ING Group's Financial Position via the 2024 Form 20-F

This analysis of ING Group's 2024 Form 20-F filing provides a comprehensive overview of its financial performance. While showing strengths in [mention positive aspects based on the analysis], areas for improvement include [mention areas needing attention based on the analysis]. Understanding this information is critical for investors and stakeholders to make informed decisions. To gain a complete understanding of ING Group’s financial health, dive deeper into ING Group's 2024 financial performance by downloading the complete ING Group 20-F report [Insert link to the official 20-F filing here]. Analyzing ING Group's financial statements is essential for informed investment decisions.

Featured Posts

-

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025 -

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025

Ser Aldhhb Fy Qtr Alywm Alithnyn 24 Mars 2024

May 23, 2025 -

Trumps Cuts And The Crisis Facing Americas Museums

May 23, 2025

Trumps Cuts And The Crisis Facing Americas Museums

May 23, 2025 -

Mc Larens Piastri Wins Thrilling Miami Grand Prix Battle Against Norris

May 23, 2025

Mc Larens Piastri Wins Thrilling Miami Grand Prix Battle Against Norris

May 23, 2025 -

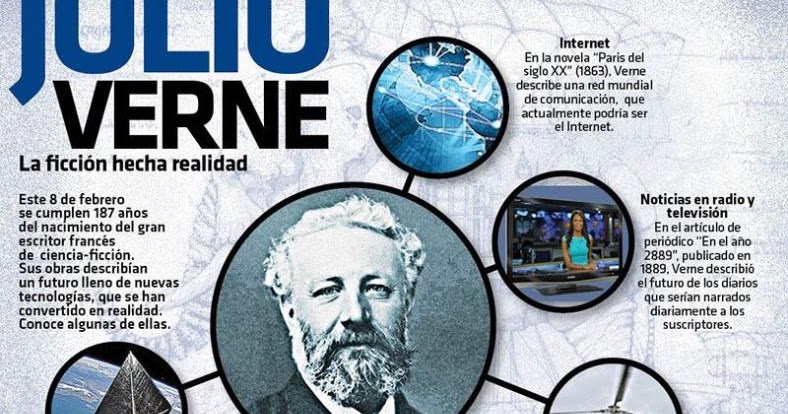

Ciencia Ficcion Hecha Realidad Motor Britanico Que Utiliza Particulas De Agua Como Combustible

May 23, 2025

Ciencia Ficcion Hecha Realidad Motor Britanico Que Utiliza Particulas De Agua Como Combustible

May 23, 2025