ING's 2024 Annual Report: Key Highlights From Form 20-F Filing

Table of Contents

Financial Performance Overview: Analyzing ING's 2024 Results

Revenue and Net Income

ING's 2024 financial performance, as detailed in its 20-F filing, reveals [Insert Actual Data if Available - e.g., "a 5% increase in total revenue to €[Amount] and a 7% rise in net income to €[Amount]"]. This positive performance can be attributed to several key factors:

- Strong Wholesale Banking performance: Driven by [Specific reason, e.g., increased trading activity and corporate lending].

- Resilient Retail Banking segment: Despite macroeconomic headwinds, Retail Banking demonstrated [Specific positive trend, e.g., consistent growth in customer deposits].

- Improved Investment Management results: Benefiting from [Specific reason, e.g., strong market conditions and successful investment strategies].

Year-over-year comparisons showcase [Insert specific data, e.g., a 3% increase in revenue from Wholesale Banking compared to 2023]. The impact of macroeconomic factors, such as [Mention specific factors like inflation or interest rate changes], played a significant role in shaping ING's overall financial results for 2024.

Key Financial Ratios

Analyzing key financial ratios provides a deeper understanding of ING's profitability and efficiency.

- Return on Equity (ROE): [Insert actual data and analysis, e.g., "The ROE increased to 12%, exceeding the industry average of 10%, indicating improved shareholder returns."]

- Return on Assets (ROA): [Insert actual data and analysis, e.g., "The ROA improved to 1.5%, reflecting enhanced asset utilization."]

- Net Interest Margin: [Insert actual data and analysis, e.g., "The net interest margin remained stable at 1.8%, demonstrating resilience in a changing interest rate environment."]

These ratios, compared to previous years and industry benchmarks, highlight ING's financial strength and its ability to generate returns.

Capital Adequacy and Liquidity

ING's 20-F filing showcases a robust capital position and strong liquidity.

- Common Equity Tier 1 (CET1) ratio: [Insert actual data and analysis, e.g., "The CET1 ratio stands at 14%, significantly above regulatory requirements, demonstrating ample capital to absorb potential losses."]

- Liquidity coverage ratio: [Insert actual data and analysis, e.g., "ING maintains a healthy liquidity coverage ratio, ensuring sufficient liquid assets to meet short-term obligations."]

These indicators demonstrate ING's ability to withstand potential financial shocks and maintain stability in challenging market conditions.

Business Segment Performance: A Sector-by-Sector Analysis

Wholesale Banking Performance

ING's Wholesale Banking segment contributed significantly to its overall performance in 2024. [Insert specific details about the performance, achievements, and challenges, mentioning specific sub-sectors like corporate banking and investment banking. Include data on revenue, profits, and key transactions if available].

Retail Banking Performance

The Retail Banking segment exhibited [Insert overall assessment, e.g., "steady growth"]. [Provide details about customer growth, loan growth, and deposit trends. Discuss the role of digital transformation and its impact on efficiency and customer acquisition].

Investment Management Performance

ING's Investment Management arm reported [Insert key performance indicators, e.g., "an increase in Assets Under Management (AUM) and strong investment returns,"]. [Provide specifics on investment strategies, market share, and competitive landscape].

Risk Management and Outlook: Navigating Future Challenges

Risk Management Strategies

ING's 20-F filing details its comprehensive approach to managing various risks, including:

- Credit risk: [Explain ING's credit risk mitigation strategies.]

- Market risk: [Explain ING's market risk management approaches.]

- Operational risk: [Explain ING's operational risk management measures.]

- Regulatory risk: [Explain how ING addresses regulatory compliance.]

These risk management strategies are designed to ensure the long-term stability and sustainability of the institution.

Future Outlook and Guidance

ING's management provides [Insert summary of the outlook and future guidance provided in the 20-F filing. Mention projected growth, profitability targets, and any significant challenges anticipated]. Potential risks and uncertainties impacting future performance include [List potential risks, e.g., macroeconomic instability, geopolitical events, and competitive pressures].

Conclusion: Key Takeaways from ING's 2024 20-F Filing and Next Steps

ING's 2024 20-F filing reveals a year of [Overall assessment of the performance, e.g., "solid performance" or "strong growth"]. The bank demonstrated robust financial results, driven by strong performance across several key business segments and a proactive approach to risk management. The information presented in the 20-F report is vital for investors and stakeholders in making informed decisions. To gain a more comprehensive understanding of ING's 2024 performance and strategic direction, access ING's 2024 20-F report and learn more about ING's financial performance. Deep dive into the ING 2024 annual report for a complete analysis.

Featured Posts

-

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

May 21, 2025

The Buy Canadian Movement How Tariffs Affect The Local Beauty Industry

May 21, 2025 -

Adentrate En El Misterio 5 Podcasts De Suspenso Y Terror Que Te Atraparan

May 21, 2025

Adentrate En El Misterio 5 Podcasts De Suspenso Y Terror Que Te Atraparan

May 21, 2025 -

Reddits Top 12 Ai Stocks For 2024 A Deep Dive

May 21, 2025

Reddits Top 12 Ai Stocks For 2024 A Deep Dive

May 21, 2025 -

V Mware Costs To Soar At And T Details Extreme Price Hike Under Broadcom

May 21, 2025

V Mware Costs To Soar At And T Details Extreme Price Hike Under Broadcom

May 21, 2025 -

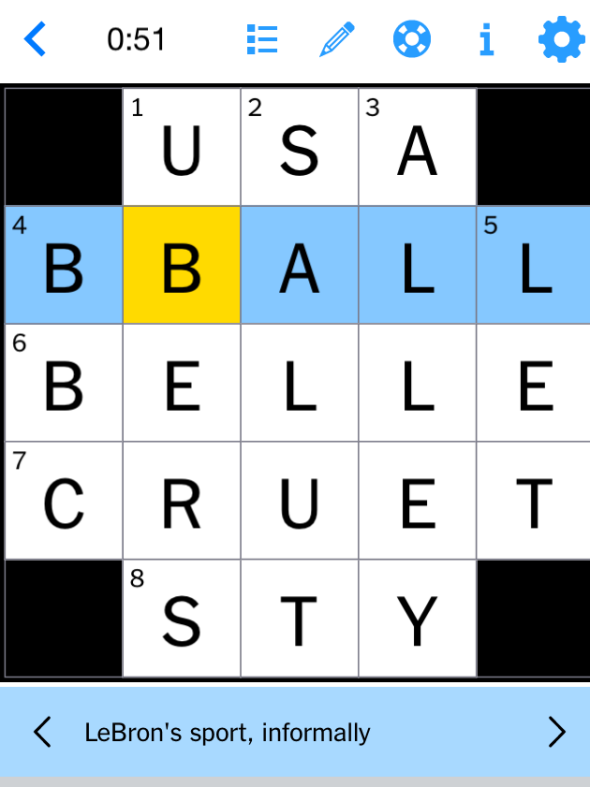

Solve The Nyt Mini Crossword April 20 2025 Hints And Answers

May 21, 2025

Solve The Nyt Mini Crossword April 20 2025 Hints And Answers

May 21, 2025