Interpreting The Dax: The Significance Of Bundestag Elections And Economic Data

Table of Contents

The Impact of Bundestag Elections on the DAX

Bundestag elections significantly impact the DAX, creating periods of volatility and uncertainty before and after the voting. The German stock market, like many others, reacts strongly to political shifts due to the potential for policy changes impacting various sectors.

Pre-Election Volatility

The period leading up to a Bundestag election is often characterized by increased market uncertainty.

- Increased market uncertainty: Investor confidence can waver as different political parties present their platforms, potentially leading to price fluctuations in the DAX. This uncertainty stems from the unknown economic policies of the future government.

- Investor sentiment influenced by polling data and political rhetoric: Public opinion polls and campaign statements influence investor sentiment, causing short-term DAX movements based on perceived election outcomes. A perceived swing towards a particular political ideology might drive up or down certain sectors of the DAX.

- Potential for sharp DAX movements based on perceived election outcomes: The closer the election gets, the more pronounced this effect becomes. Unexpected election results can lead to significant and immediate shifts in the DAX.

- Example: The 2017 German federal election saw some volatility in the lead-up, but the eventual coalition government led to a period of relative stability for the DAX. Analyzing past election cycles reveals similar patterns, although the intensity of the response varies.

Post-Election Market Reactions

The immediate aftermath of a Bundestag election often sees significant, albeit short-term, DAX reactions, followed by longer-term adjustments.

- Initial reactions to election results: A clear victory for a particular party or coalition often leads to swift market reactions, either positive or negative, depending on the perceived investor-friendliness of the winning party’s platform.

- Long-term effects of policy changes on specific DAX sectors: Once a new government is formed, its policies on issues like taxation, regulation, and social spending will have a sustained impact on specific sectors represented in the DAX. For example, environmentally-focused policies might boost green energy companies but potentially harm others.

- Analysis of government formation processes and their market implications: The time it takes to form a coalition government also matters. Prolonged negotiations can extend the period of uncertainty and volatility in the DAX.

- Examples of policies impacting specific DAX-listed companies: Changes to corporate tax rates or environmental regulations will directly influence specific companies listed on the DAX.

- Fiscal policy and its effect on investor confidence: Expansionary fiscal policies often positively affect investor confidence, while austerity measures might have the opposite effect.

- Impact of regulatory changes on specific sectors: Increased regulation in a particular sector might lead to lower valuations for companies operating within that sector, influencing the overall DAX performance.

Key Economic Data Influencing the DAX

Beyond politics, several key economic indicators directly influence the DAX's performance. These indicators paint a picture of the overall health of the German economy and thereby influence investor behavior.

GDP Growth

German GDP growth has a strong, direct correlation with DAX performance.

- Direct correlation between German GDP growth and DAX performance: Stronger GDP growth generally translates to improved corporate earnings and higher investor confidence, leading to DAX increases.

- Analyzing GDP forecasts and their impact on investor expectations: Pre-released GDP forecasts significantly shape investor expectations. Positive forecasts typically boost the DAX, while negative ones may suppress it.

- Impact of global economic factors on German GDP and DAX: Germany's export-oriented economy is sensitive to global economic fluctuations. A global recession, for example, could negatively impact German GDP and subsequently depress the DAX.

- Examples of past GDP releases and their subsequent effect on the DAX: Historical data clearly shows a positive correlation between GDP growth and DAX performance.

Inflation Rates

Inflation rates and the European Central Bank's (ECB) monetary policy significantly affect the DAX.

- The European Central Bank's monetary policy and its influence on inflation and the DAX: ECB interest rate decisions to combat inflation directly impact borrowing costs for companies, affecting their investment decisions and potentially impacting the DAX.

- Impact of rising inflation on corporate profits and investor sentiment: High inflation erodes corporate profits and reduces investor confidence, potentially leading to a DAX decline.

- Analysis of inflation expectations and their impact on DAX valuations: Markets anticipate future inflation; if inflation is expected to rise significantly, this can negatively impact DAX valuations even before it materializes.

- Examples of how inflation rates have historically influenced the DAX: Periods of high inflation in Germany have historically been correlated with lower DAX performance.

Unemployment Figures

Unemployment data provides insight into consumer spending and its impact on companies.

- Correlation between unemployment rates and consumer spending, impacting company performance: Lower unemployment usually means increased consumer spending, benefiting companies and positively impacting the DAX.

- Analysis of unemployment data and its effect on investor confidence: Rising unemployment signals weakened consumer demand and can negatively impact investor confidence, potentially depressing the DAX.

- Impact of structural unemployment on specific DAX sectors: Specific sectors might be more vulnerable to structural unemployment than others, leading to sector-specific DAX performance changes.

- Examples of how changes in unemployment have affected the DAX in the past: Recessions characterized by high unemployment levels are usually correlated with DAX declines.

Analyzing the Interplay Between Politics and Economics on the DAX

The DAX’s performance is not determined by politics or economics alone; the interplay between these factors is crucial.

- How political stability and economic performance interact to shape the DAX: A stable political environment generally fosters economic growth and investor confidence, leading to a healthier DAX. Conversely, political instability often leads to economic uncertainty and negatively impacts the DAX.

- Examples of instances where political uncertainty amplified economic concerns, impacting the DAX: Periods of political uncertainty have often exacerbated existing economic anxieties, resulting in sharp DAX drops.

- Discussion of how specific government policies influence particular sectors within the DAX: Government policies targeted at certain sectors can disproportionately impact those sectors within the DAX.

- The importance of considering both political and economic factors for accurate DAX interpretation: A holistic approach that considers both political and economic factors is crucial for a more accurate DAX interpretation.

Conclusion

The DAX is a complex index influenced by a multitude of factors, most significantly Bundestag elections and key economic data. Understanding the interplay between these elements is vital for interpreting DAX movements and making informed investment decisions. By carefully analyzing pre- and post-election market sentiment, GDP growth, inflation rates, and unemployment figures, investors can gain a clearer picture of the DAX's trajectory. Learning to effectively interpret the DAX requires continuous monitoring of both political and economic developments in Germany. Stay informed and master the art of interpreting the DAX to improve your understanding of this crucial market indicator.

Featured Posts

-

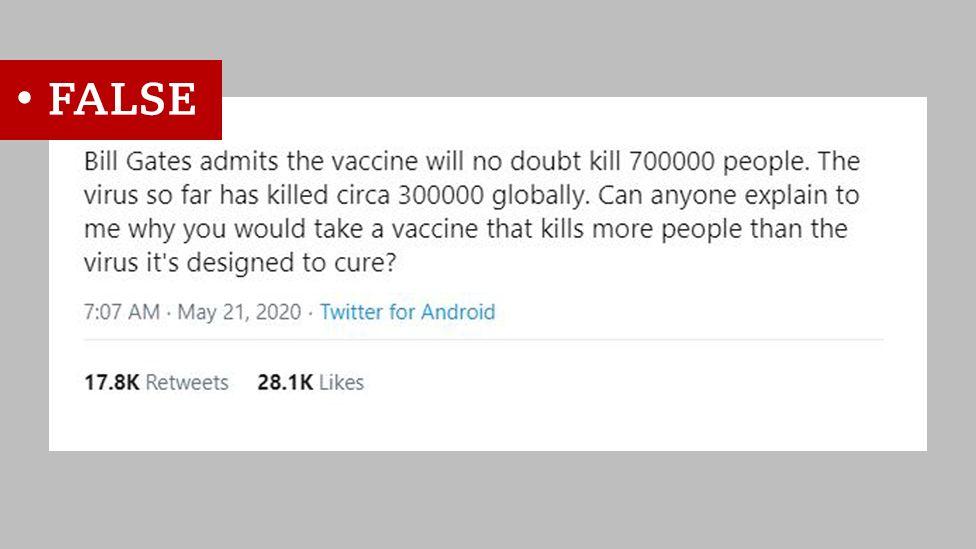

Controversial Hhs Decision Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025

Controversial Hhs Decision Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025 -

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025

Revealed Patrick Schwarzeneggers Missing Part In Ariana Grandes White Lotus

Apr 27, 2025 -

Pegula Claims Charleston Victory Over Defending Champion Collins

Apr 27, 2025

Pegula Claims Charleston Victory Over Defending Champion Collins

Apr 27, 2025 -

Canadian Consumers Show Less Interest In Electric Vehicles

Apr 27, 2025

Canadian Consumers Show Less Interest In Electric Vehicles

Apr 27, 2025 -

Canadas Tourism Surge A Look At The Numbers

Apr 27, 2025

Canadas Tourism Surge A Look At The Numbers

Apr 27, 2025