Investing In Amundi MSCI World Catholic Principles UCITS ETF Acc: Monitoring NAV

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc

The Amundi MSCI World Catholic Principles UCITS ETF Acc is a unique investment vehicle designed for socially responsible investors, particularly those guided by Catholic values. This Unit Trust invests in a globally diversified portfolio of companies, mirroring the MSCI World Index, but with a crucial distinction: it screens companies based on their adherence to specific Catholic principles. This ensures that your investments are aligned with your values.

The ideal investor profile for this ETF includes:

- Faith-based investors: Individuals seeking investments aligned with their religious beliefs.

- Socially responsible investors (SRI): Investors prioritizing ethical and sustainable investment options.

- Long-term investors: Those seeking exposure to a globally diversified portfolio with a focus on long-term growth.

Key features of the Amundi MSCI World Catholic Principles UCITS ETF Acc include:

- Investment Objective: To provide long-term capital growth while adhering to Catholic social principles.

- ESG (Environmental, Social, and Governance) Considerations: Rigorous screening ensures alignment with ESG criteria informed by Catholic social teaching.

- Geographical Diversification: Exposure to a wide range of global markets through the MSCI World Index.

- Currency Exposure: Primarily denominated in a single currency (likely EUR), but subject to currency fluctuations if held in a different currency.

- UCITS Structure: Complies with the Undertakings for Collective Investment in Transferable Securities (UCITS) regulations, providing regulatory oversight and investor protection.

- Accessibility: Usually available through major brokerage platforms, offering ease of access for investors.

- Low Expense Ratio: Typically competitive expense ratios, ensuring a larger proportion of returns is passed on to investors.

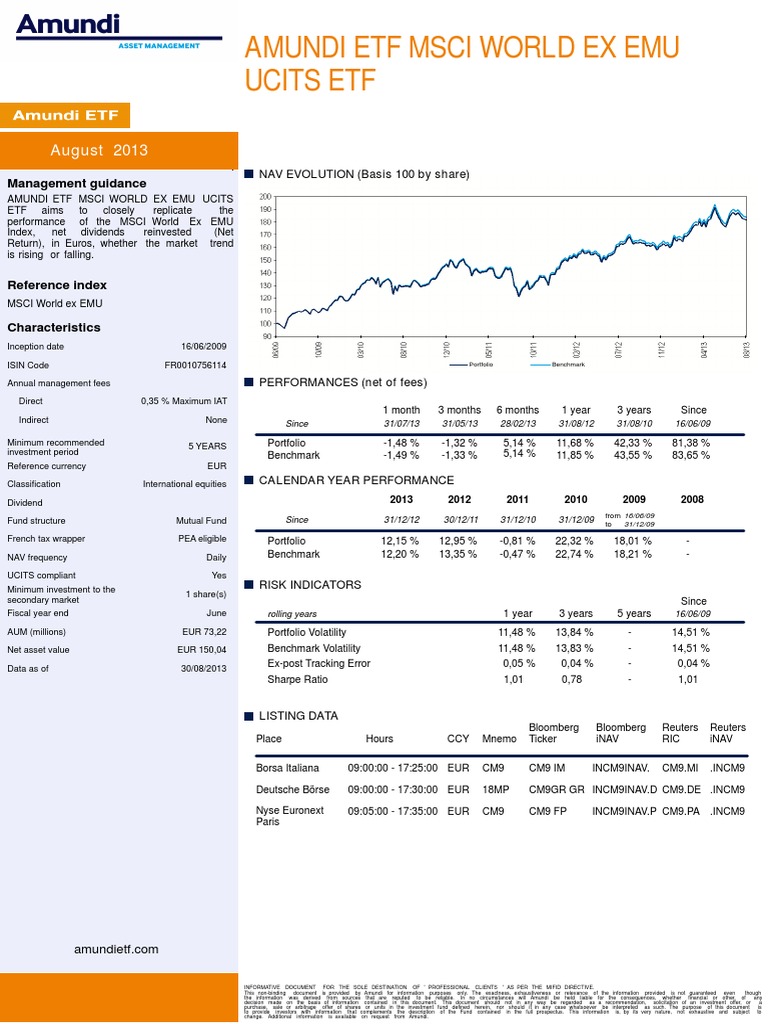

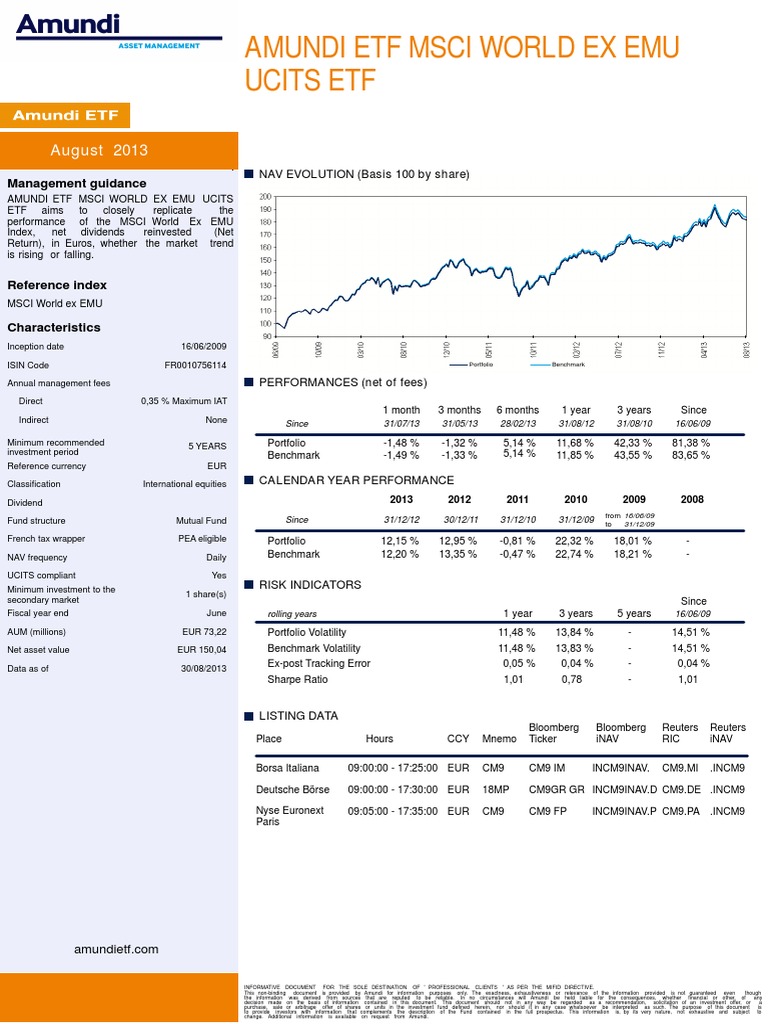

Factors Influencing the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc

The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is dynamic and influenced by several interconnected factors:

Market Performance: Global market fluctuations significantly impact the ETF's NAV. A bull market generally leads to NAV increases, while a bear market may result in declines.

Underlying Asset Performance: The performance of individual companies within the index directly affects the overall NAV. Strong performance by constituent companies will positively impact the NAV, and vice versa.

Currency Exchange Rates: While primarily denominated in a base currency, fluctuations in exchange rates against your local currency will affect the value of your investment when you convert it back.

- Global Market Trends: Broad economic conditions and investor sentiment heavily influence market movements.

- Sector Performance: Specific sectors within the global economy may outperform or underperform, affecting the ETF's NAV.

- Individual Company News and Announcements: Positive or negative news about specific companies in the portfolio can impact their share prices and, consequently, the ETF's NAV.

- Economic Indicators: Macroeconomic data, such as inflation, interest rates, and GDP growth, influence investor sentiment and market movements.

How to Monitor the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc

Monitoring the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV is crucial for effective investment management. You can access real-time or daily NAV data from several reliable sources:

- The ETF Provider's Website: Amundi's official website will provide up-to-date NAV information.

- Financial News Websites: Reputable financial news sources frequently publish ETF data.

- Brokerage Platforms: Your brokerage account will display the current NAV of your holdings.

Frequency of Monitoring: While daily monitoring might seem ideal, a weekly or even monthly review is often sufficient for most investors, depending on your investment strategy and risk tolerance. More frequent checks might be warranted during periods of significant market volatility.

Interpreting NAV Changes: Analyze NAV changes in the context of broader market movements and the performance of comparable indices. Consider sector-specific news and economic factors when interpreting fluctuations.

Tools and Resources: Utilizing charting software and financial calculators can aid in visualizing NAV trends, comparing performance to benchmarks, and projecting potential returns.

- Accessing Real-Time NAV Data: Use your brokerage platform or a dedicated financial data provider.

- Using Financial Charting Tools: Tools like TradingView or similar platforms allow for detailed analysis of NAV trends over time.

- Comparing NAV to Benchmark Indices: Compare the ETF's performance to broader market indices to assess relative performance.

- Analyzing Long-Term NAV Trends: Focus on long-term trends rather than short-term fluctuations when evaluating investment performance.

Risks Associated with Investing in the Amundi MSCI World Catholic Principles UCITS ETF Acc

As with any investment, the Amundi MSCI World Catholic Principles UCITS ETF Acc carries certain risks:

Market Risk: Investing in equities inherently involves market risk, meaning the possibility of losing some or all of your investment.

Specific Risks: While adhering to Catholic principles aims to reduce certain risks, the ETF is still subject to market volatility and the performance of its underlying assets. There's a potential risk of underperformance relative to broader market indices if companies adhering to the selection criteria underperform.

Diversification: It's crucial to diversify your investment portfolio. This ETF, while globally diversified, should be one component of a larger, well-diversified portfolio to mitigate risk.

- Market Volatility: The NAV can fluctuate significantly due to market conditions.

- ESG Risks: Companies may face reputational or financial damage due to ESG-related issues.

- Currency Risk: Fluctuations in exchange rates can impact returns, particularly for international investors.

- Liquidity Risk: While generally liquid, there's a risk of difficulty selling the ETF quickly during periods of market stress.

Conclusion: Making Informed Investment Decisions with Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Monitoring

Regular monitoring of the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV is essential for informed investment decision-making. Remember that the NAV is influenced by global market performance, the underlying assets' performance, and currency exchange rates. By understanding these factors and utilizing available resources for tracking NAV data, you can make better-informed investment choices. Actively monitor your investment, consider your risk tolerance, and ensure this ETF aligns with your broader investment goals. Further research into the Amundi MSCI World Catholic Principles UCITS ETF Acc and its suitability for your specific circumstances is strongly recommended. Consistent Amundi MSCI World Catholic Principles UCITS ETF Acc NAV monitoring is key to achieving your long-term investment objectives within the framework of ethical and responsible investing.

Featured Posts

-

Country Living Vs City Life Is An Escape To The Country Right For You

May 24, 2025

Country Living Vs City Life Is An Escape To The Country Right For You

May 24, 2025 -

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025

Mest Myagkovu Kak Brezhnev Spas Garazh Ryazanova Ot Tsenzury

May 24, 2025 -

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025

M56 Traffic Delays Live Updates Following Serious Crash

May 24, 2025 -

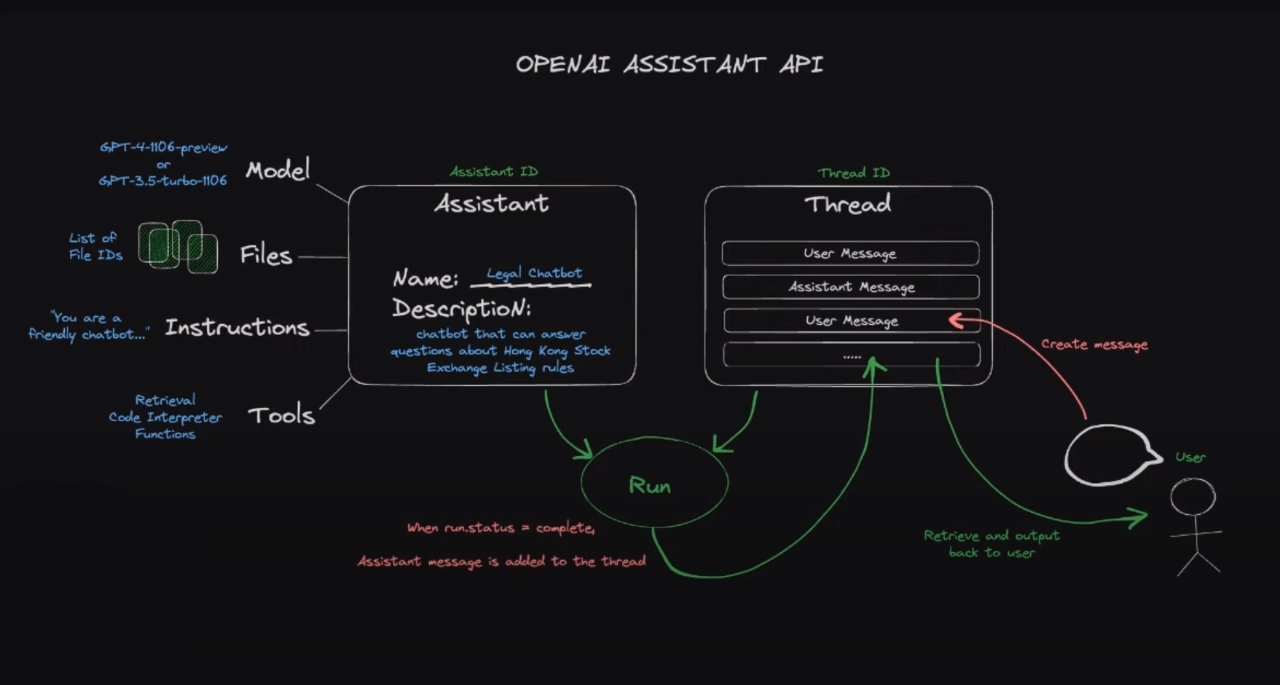

Build Voice Assistants With Ease Key Announcements From Open Ais 2024 Developer Event

May 24, 2025

Build Voice Assistants With Ease Key Announcements From Open Ais 2024 Developer Event

May 24, 2025 -

Hamilton Faces Backlash Ferrari Chief Denounces Unfair Statements

May 24, 2025

Hamilton Faces Backlash Ferrari Chief Denounces Unfair Statements

May 24, 2025