Investing In Palantir: Weighing The Potential For 40% Growth By 2025

Table of Contents

Palantir's Business Model and Competitive Advantage

Palantir's core offerings, Gotham and Foundry, are powerful data integration and analytics platforms. Gotham primarily serves government agencies, assisting in counter-terrorism, cybersecurity, and other critical missions. Foundry caters to the commercial sector, empowering businesses with advanced data analytics capabilities across various industries. Palantir’s competitive advantage stems from several key factors:

-

Unparalleled Data Integration: Palantir excels at integrating data from disparate sources, a crucial capability for extracting valuable insights. This strength forms a significant barrier to entry for competitors.

-

AI-Powered Analytics: The platforms leverage advanced AI and machine learning algorithms to provide actionable intelligence, far surpassing the capabilities of simpler business intelligence tools.

-

Strong Government Contracts: Palantir's significant presence in the government sector provides a stable revenue stream and a strong foundation for future growth. This positions them as a critical player in national security and intelligence operations.

-

Defensibility of its Moat: Palantir's integrated platform, coupled with its deep domain expertise and long-standing relationships, creates a significant barrier to entry for competitors. Switching costs for clients are high, due to the complexity of data integration and the specialized knowledge required to operate the platforms.

-

Key Differentiators: Unlike competitors like Snowflake or Databricks, which focus primarily on data warehousing and cloud infrastructure, Palantir offers a complete, end-to-end data analytics solution with an emphasis on complex data integration and AI-driven insights. This focus on sophisticated analytical solutions caters to a niche market with high barriers to entry.

-

Increasing Demand: The increasing demand for sophisticated data analytics and AI-powered solutions across both the public and private sectors fuels Palantir's growth trajectory.

Analyzing Palantir's Financial Performance and Growth Trajectory

Reviewing Palantir's recent financial reports reveals a mixed picture. While revenue has shown consistent growth, profitability remains a work in progress. Analyzing key metrics such as revenue growth, operating margins, and customer acquisition costs is essential to assess the sustainability of this growth.

-

Data Points: [Insert specific data points here, such as revenue figures for the last few quarters, year-over-year growth rates, and operating margins. Include links to official Palantir financial reports]. Visualizing this data with charts and graphs will provide a clearer picture of Palantir's growth trajectory.

-

Historical Growth vs. Projected Growth: Comparing Palantir's historical growth rate to the projected 40% increase by 2025 requires a careful examination of potential growth catalysts and headwinds. While past performance isn’t indicative of future results, it does provide a baseline for analysis.

-

Growth Catalysts: Several factors could drive Palantir's growth, including:

- Expansion into new commercial markets.

- Strategic partnerships with technology giants.

- Successful product launches, incorporating cutting-edge AI and machine learning capabilities.

-

Risks: Slowing economic growth, particularly a reduction in government spending, could significantly impact Palantir's revenue and profitability, especially given their reliance on government contracts.

Evaluating the Risks Associated with Investing in Palantir

Investing in Palantir, like any technology stock, carries inherent risks. High-growth companies, in particular, are often volatile. Specific risks associated with Palantir include:

-

Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. Changes in government priorities or budget cuts could severely impact the company's performance.

-

Competition: The data analytics market is highly competitive, with established players and numerous startups vying for market share. Maintaining its competitive edge will be crucial for Palantir's continued success.

-

Valuation: Palantir’s current valuation might be considered high by some investors, implying a high level of risk relative to potential returns.

-

Stock Price Volatility: Palantir's stock price has historically been volatile, reflecting the inherent risks associated with investing in a high-growth technology company. Investors should be prepared for significant price fluctuations.

-

Geopolitical Factors and Regulatory Changes: Changes in geopolitical landscapes and regulatory environments can influence government spending on defense and intelligence, thus impacting Palantir's revenue streams.

Future Predictions and Market Outlook for Palantir

Industry analysts offer varying predictions regarding Palantir's future growth. [Cite reputable sources such as investment banks, research firms, and industry publications here, and summarize their forecasts].

-

Impact of Technological Advancements: Advancements in AI, machine learning, and big data technologies will be crucial for Palantir’s continued success. Staying ahead of the curve and adapting to emerging technologies will be critical.

-

Emerging Technologies: The emergence of new technologies could disrupt Palantir's market, presenting both opportunities and threats.

-

Likelihood of 40% Growth: Based on the analysis presented, achieving a 40% growth in Palantir's stock value by 2025 appears ambitious but not impossible. The outcome hinges on several factors, including successful execution of its growth strategy, navigating competitive pressures, and maintaining its position in the evolving data analytics market.

Conclusion: Is Investing in Palantir Right for You?

Palantir offers a compelling investment proposition, with a strong business model, a competitive advantage in data analytics, and significant growth potential. However, investors must carefully weigh these potential rewards against the significant risks involved. The 40% growth target by 2025 is ambitious and hinges on a number of favorable factors.

While a 40% growth in Palantir by 2025 is ambitious, thorough due diligence on Palantir stock is crucial before making an investment decision. Consider your risk tolerance and investment timeframe before committing any capital. Remember to consult with a qualified financial advisor before making any investment decisions related to Palantir or any other stock.

Featured Posts

-

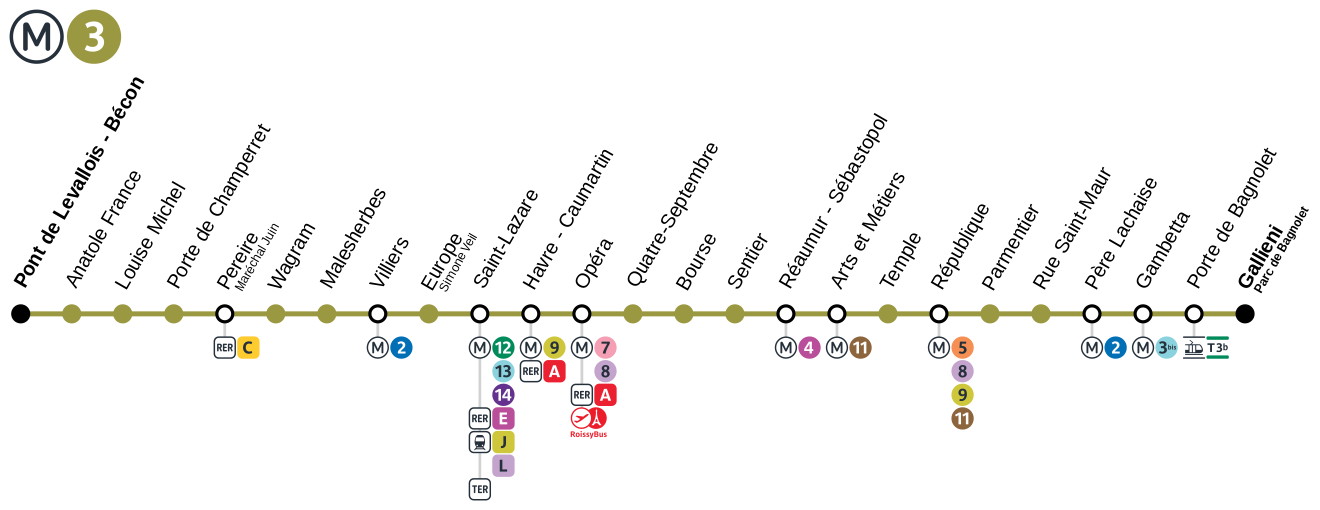

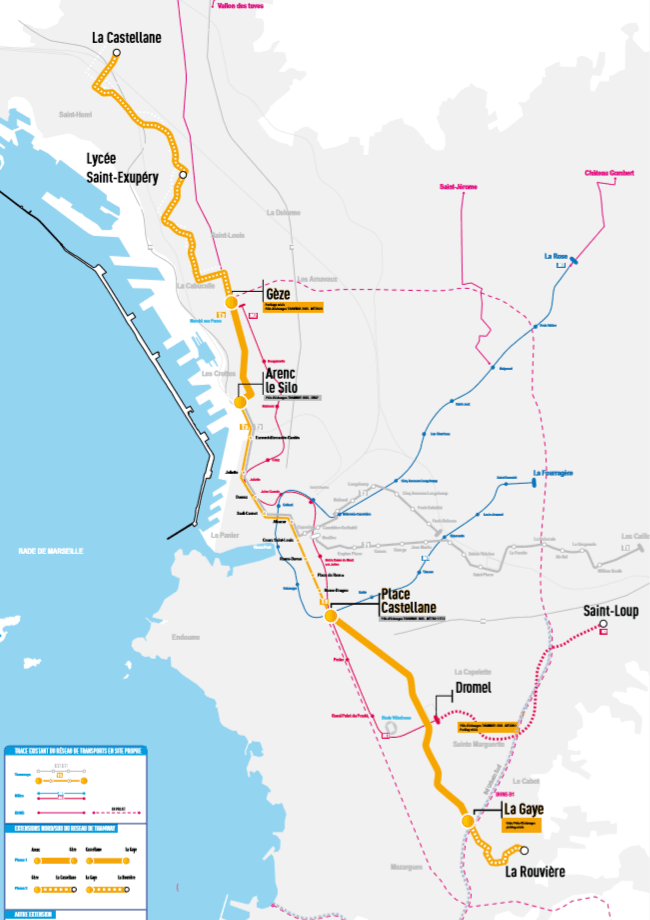

Conseil Metropolitain De Dijon Concertation Sur La Ligne 3 De Tram Lancee

May 09, 2025

Conseil Metropolitain De Dijon Concertation Sur La Ligne 3 De Tram Lancee

May 09, 2025 -

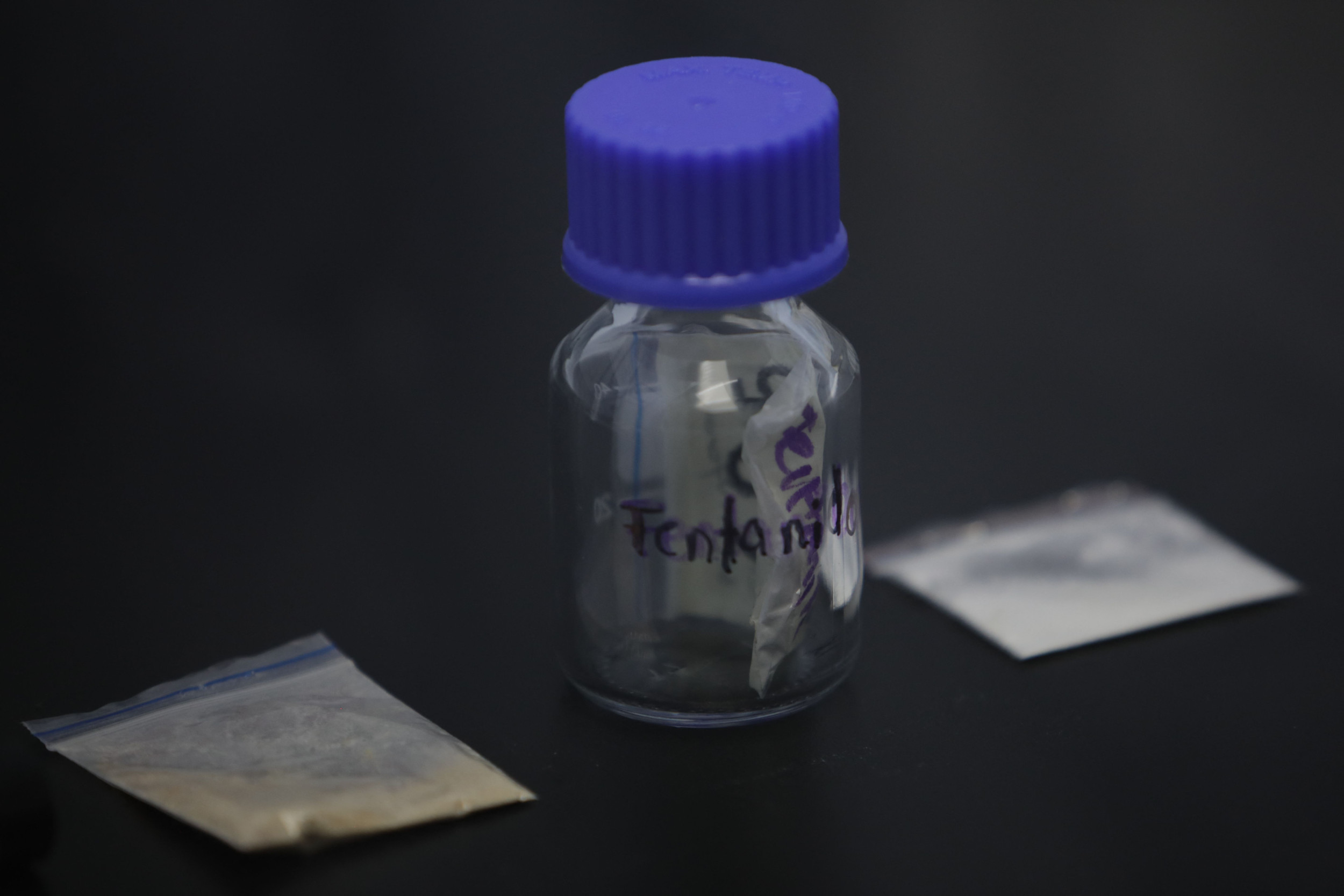

How The Fentanyl Crisis Reshaped The Landscape Of Us China Trade

May 09, 2025

How The Fentanyl Crisis Reshaped The Landscape Of Us China Trade

May 09, 2025 -

Nottingham Attacks Police Misconduct Meeting Scheduled

May 09, 2025

Nottingham Attacks Police Misconduct Meeting Scheduled

May 09, 2025 -

Le Tramway Dijonnais Adoption Du Projet De Ligne 3 Et Concertation Citoyenne

May 09, 2025

Le Tramway Dijonnais Adoption Du Projet De Ligne 3 Et Concertation Citoyenne

May 09, 2025 -

Sensex Surges 1400 Points Nifty 50 Above 23800 Top 5 Reasons For Todays Market Rise

May 09, 2025

Sensex Surges 1400 Points Nifty 50 Above 23800 Top 5 Reasons For Todays Market Rise

May 09, 2025