Investing In Riot Platforms (RIOT): Assessing The Risks And Rewards Near 52-Week Lows

Table of Contents

Understanding Riot Platforms (RIOT) and its Business Model

Riot Platforms' core business is Bitcoin mining. Their operations involve using specialized hardware to solve complex cryptographic problems, earning them Bitcoin as a reward. This process, crucial to the Bitcoin network's security, is energy-intensive.

Core Business Operations:

Riot Platforms boasts a substantial mining infrastructure. Key aspects include:

- Scale of Operations: RIOT operates at a significant scale, possessing a large fleet of ASIC (Application-Specific Integrated Circuit) miners. The sheer number of these machines directly impacts their Bitcoin mining hash rate.

- Geographical Diversification of Mining Facilities: To mitigate risk and ensure operational continuity, RIOT strategically locates its mining facilities across various regions, reducing reliance on any single location.

- Energy Consumption and Sourcing Strategies: Energy costs are a major factor in Bitcoin mining profitability. RIOT is increasingly focusing on renewable energy sources to lower its operational expenses and reduce its environmental impact. This includes exploring and utilizing sources such as solar and wind power, aiming for greater sustainability in their Bitcoin mining operations. Energy efficiency is paramount in their operational strategy.

Financial Performance and Recent Earnings:

Analyzing RIOT's financial performance requires scrutiny of several key metrics. Recent financial reports should be carefully reviewed to understand:

- Revenue Growth/Decline: Revenue is directly tied to Bitcoin's price and the efficiency of RIOT's mining operations. Trends in revenue growth (or decline) provide insights into the company's performance.

- Profitability Margins: The difference between revenue and operational costs determines profitability. Tracking these margins reveals the financial health and efficiency of their Bitcoin mining activities.

- Debt-to-Equity Ratio: A high debt-to-equity ratio indicates higher financial risk. Analyzing this ratio helps investors assess RIOT's financial stability.

- Cash Flow Analysis: Positive cash flow is vital for sustainability and reinvestment. Analyzing RIOT's cash flow provides crucial information about its ability to generate income and fund future operations.

Competition within the Bitcoin Mining Sector:

RIOT faces competition from other major players in the Bitcoin mining sector, such as Marathon Digital Holdings. Competitive analysis involves:

- Market Capitalization Comparison: Comparing RIOT's market capitalization against its competitors provides context to its overall size and valuation within the industry.

- Hashing Power Comparison: Hashing power is a key indicator of a mining company's capacity to mine Bitcoin. Comparing RIOT's hashing power with competitors helps to determine its competitiveness.

- Cost Advantages: Companies with lower operational costs generally enjoy greater profitability. Identifying any cost advantages that RIOT may possess provides a key competitive edge assessment.

- Technological Advancements: Continuous innovation in mining hardware and software can improve efficiency and profitability. RIOT's commitment to technological advancements is crucial for long-term competitiveness.

Assessing the Risks of Investing in RIOT at 52-Week Lows

Investing in RIOT at its 52-week low presents several significant risks:

Volatility of Cryptocurrency Prices:

Bitcoin's price is highly volatile. This volatility directly impacts RIOT's stock price because the value of Bitcoin mined is a primary revenue source.

- Price Correlation Analysis: Analyzing the historical correlation between Bitcoin's price and RIOT's stock price is crucial to understanding the risk.

- Historical Volatility Data: Studying past price fluctuations provides insights into the potential for future price swings.

- Potential for Significant Price Drops: Sharp drops in Bitcoin's price can significantly impact RIOT's revenue and stock value, leading to substantial losses for investors.

Regulatory Uncertainty in the Cryptocurrency Industry:

The regulatory environment for cryptocurrencies is constantly evolving and uncertain. Changes in regulations can negatively impact RIOT's operations and profitability.

- Government Regulations on Cryptocurrency Mining: New regulations could increase operating costs or restrict operations altogether.

- Potential for Increased Taxation: Higher taxes on Bitcoin mining profits would reduce RIOT's profitability.

- Legal Challenges Faced by the Company: Legal disputes and regulatory investigations could negatively impact RIOT's stock price and operations.

Energy Costs and Environmental Concerns:

Bitcoin mining is energy-intensive, making it susceptible to rising energy costs and environmental concerns.

- Energy Price Volatility: Fluctuations in energy prices directly impact RIOT's profitability.

- Carbon Footprint Concerns: Growing environmental awareness might lead to increased scrutiny of Bitcoin mining's energy consumption and carbon footprint.

- Potential for Increased Regulatory Scrutiny on Energy Consumption: Governments may impose stricter regulations on energy usage, increasing operational costs for Bitcoin mining companies.

Evaluating the Potential Rewards of Investing in RIOT at Current Prices

Despite the risks, investing in RIOT at its current low price may offer potential rewards:

Discounted Valuation and Potential for Growth:

The current low stock price may present a discounted valuation compared to RIOT's intrinsic value or future potential.

- Price-to-Earnings Ratio: A low P/E ratio could suggest that the stock is undervalued.

- Discounted Cash Flow Analysis: A DCF analysis can provide an estimate of RIOT's future value based on projected cash flows.

- Potential for Future Bitcoin Price Appreciation: If Bitcoin's price rises, RIOT's revenue and profitability would also increase, potentially leading to significant stock price appreciation.

Bitcoin's Long-Term Potential:

Many believe Bitcoin has long-term growth potential, which could benefit RIOT.

- Adoption of Bitcoin as a Store of Value: Increased adoption as a store of value would drive demand and price.

- Institutional Investment in Bitcoin: Growing institutional investment increases market stability and demand.

- Potential for Increased Demand: Wider adoption and use cases for Bitcoin could significantly increase demand.

Technological Advancements and Efficiency Improvements:

RIOT's ability to improve mining efficiency and reduce costs is crucial for its future success.

- Investment in New Mining Hardware: Upgrading to more efficient mining hardware can significantly reduce operational costs.

- Optimization of Mining Processes: Streamlining processes and improving operational efficiency can boost profitability.

- Potential for Increased Profitability Through Technological Improvements: Technological advancements can provide a competitive edge and increase the company's profitability.

Conclusion:

Investing in Riot Platforms (RIOT) near its 52-week lows presents a complex scenario with both significant risks and potential rewards. The volatility of Bitcoin's price, regulatory uncertainty, and energy costs pose considerable challenges. However, the possibility of a discounted valuation, Bitcoin's long-term growth potential, and RIOT's potential for efficiency improvements could offer substantial upside. Before investing in RIOT, carefully analyze its financial performance, understand the competitive landscape, and assess your own risk tolerance. Remember that cryptocurrency mining stocks are inherently high-risk investments.

Call to Action: Investing in Riot Platforms (RIOT) requires careful consideration of the inherent risks and potential rewards. Conduct thorough due diligence and assess your own risk tolerance before making any investment decisions related to RIOT or other cryptocurrency mining stocks. Consider consulting with a financial advisor before investing in Riot Platforms (RIOT) or any other high-risk investment.

Featured Posts

-

Souness On Arsenal A Champions League Rivals Superior Form

May 02, 2025

Souness On Arsenal A Champions League Rivals Superior Form

May 02, 2025 -

See How Harry Potters Crabbe Looks Now A Stunning Before And After

May 02, 2025

See How Harry Potters Crabbe Looks Now A Stunning Before And After

May 02, 2025 -

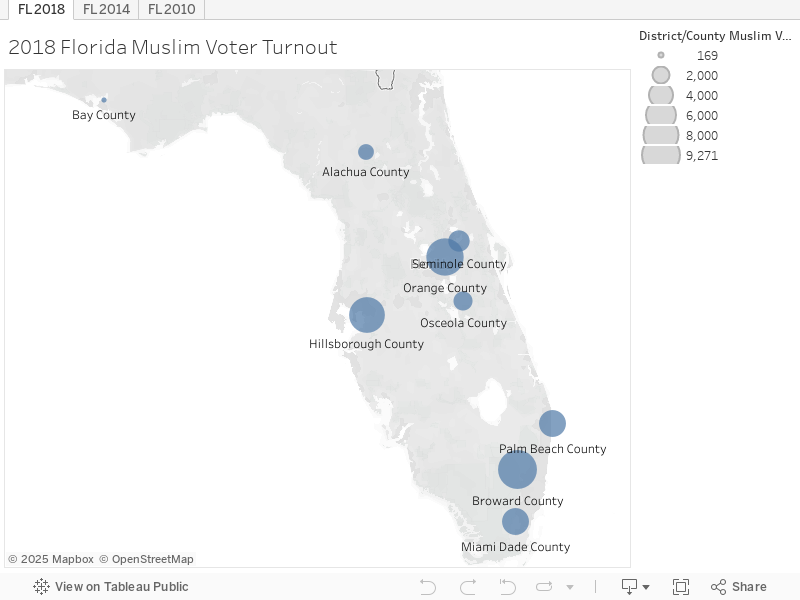

Decoding The 2024 Political Climate Examining Voter Turnout In Florida And Wisconsin

May 02, 2025

Decoding The 2024 Political Climate Examining Voter Turnout In Florida And Wisconsin

May 02, 2025 -

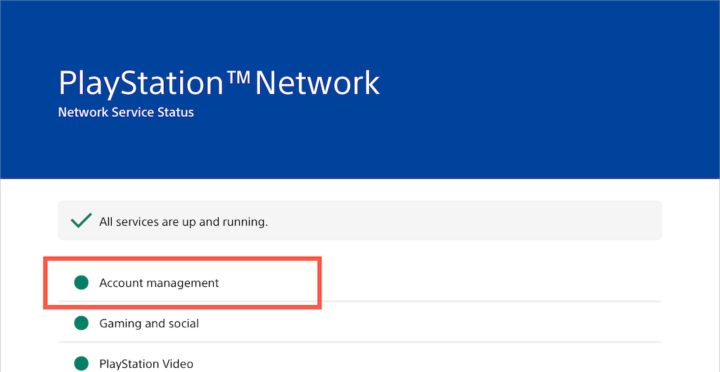

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025

Play Station Network E Giris Adim Adim Kilavuz

May 02, 2025 -

Play Station Network Sorun Giderme Ve Giris Yapma

May 02, 2025

Play Station Network Sorun Giderme Ve Giris Yapma

May 02, 2025