Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Table of Contents

What is NAV and Why is it Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the collective value of the underlying stocks that make up the Dow Jones Industrial Average, held within the ETF's portfolio. It's essentially the value of the assets the ETF owns, divided by the number of outstanding shares.

The Amundi Dow Jones Industrial Average UCITS ETF's NAV is calculated daily by Amundi, the fund manager, by taking the closing market prices of all the constituent stocks in the Dow Jones Industrial Average, and deducting any ETF expenses. This daily calculation provides transparency into the underlying value of your investment.

It's crucial to understand the difference between NAV and the ETF's market price. While the NAV aims to reflect the intrinsic value of the ETF, the market price is determined by supply and demand in the secondary market. Discrepancies between NAV and market price can occur due to factors such as trading volume, investor sentiment, and market efficiency.

- NAV reflects the underlying asset value of the ETF. It's a snapshot of the true worth of the holdings.

- Daily NAV calculations provide transparency. Investors can easily track the value of their investment.

- Market price fluctuations can deviate from NAV due to supply and demand. This is typical for all exchange-traded products.

- Understanding NAV helps investors make informed buy/sell decisions. While not the sole factor, it provides critical context.

Analyzing NAV Trends for the Amundi Dow Jones Industrial Average UCITS ETF

Tracking NAV changes over time is essential for evaluating the performance of the Amundi Dow Jones Industrial Average UCITS ETF. You can access historical NAV data through several resources, including the official Amundi website, reputable financial news websites, and many brokerage platforms. These resources often provide charts and graphs that visually represent NAV fluctuations.

While short-term NAV fluctuations are normal and expected due to market volatility, focusing on long-term NAV trends is key. A consistent upward trend indicates strong overall performance, reflecting the growth of the Dow Jones Industrial Average itself. Conversely, a prolonged downward trend may signal underlying issues with the market or the ETF's performance.

- Regular monitoring helps identify potential investment opportunities. Observing trends can help you capitalize on dips in the market.

- Long-term trends reveal the ETF's overall performance. This provides a realistic view of investment returns.

- Short-term volatility is normal and shouldn't necessarily trigger immediate action. Avoid emotional trading decisions.

- Comparing NAV to the Dow Jones Industrial Average index provides context. This helps you assess how well the ETF is tracking its benchmark.

Using NAV in your Investment Strategy for the Amundi Dow Jones Industrial Average UCITS ETF

While some investors might attempt to use NAV to implement a buy-low/sell-high strategy, relying solely on short-term NAV fluctuations for market timing is generally risky and often unsuccessful. The market is influenced by numerous complex factors beyond NAV alone.

Instead, focus on using NAV as one element of a broader, well-diversified investment strategy. NAV helps to determine potential gains or losses and provides insight into the value of your investment. However, this should be considered alongside a comprehensive analysis of your risk tolerance, investment timeline, and other market indicators.

- Avoid emotional decision-making based solely on short-term NAV fluctuations. Stick to your long-term plan.

- Consider dollar-cost averaging to mitigate risk. Regularly invest a fixed amount, regardless of NAV fluctuations.

- Align your investment strategy with your long-term financial goals. NAV is a tool; your goals define success.

- NAV is just one factor to consider; assess other market indicators. Don't rely on it in isolation.

Risks Associated with Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Investing in the Amundi Dow Jones Industrial Average UCITS ETF, like any investment, carries inherent risks. Market risk, the potential for losses due to unfavorable market conditions, directly impacts the NAV. A decline in the Dow Jones Industrial Average will generally lead to a decrease in the ETF's NAV.

Furthermore, currency risk might apply if you're investing in a currency different from your home currency. Fluctuations in exchange rates can affect your returns. Understanding your own risk tolerance is crucial before investing in any ETF, including the Amundi Dow Jones Industrial Average UCITS ETF.

Conclusion

This article has highlighted the significance of understanding Net Asset Value (NAV) when investing in the Amundi Dow Jones Industrial Average UCITS ETF. By regularly monitoring NAV trends and incorporating this data into your overall investment strategy, alongside other relevant market indicators, you can make more informed decisions and potentially maximize your returns. Remember that a long-term perspective and diversification are key to successful ETF investing.

Call to Action: Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV by visiting [link to relevant resource]. Start making informed investment decisions based on a thorough understanding of Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 24, 2025

Low Gas Prices Forecast For Memorial Day Weekend Travel

May 24, 2025 -

Porsche Now Labubu

May 24, 2025

Porsche Now Labubu

May 24, 2025 -

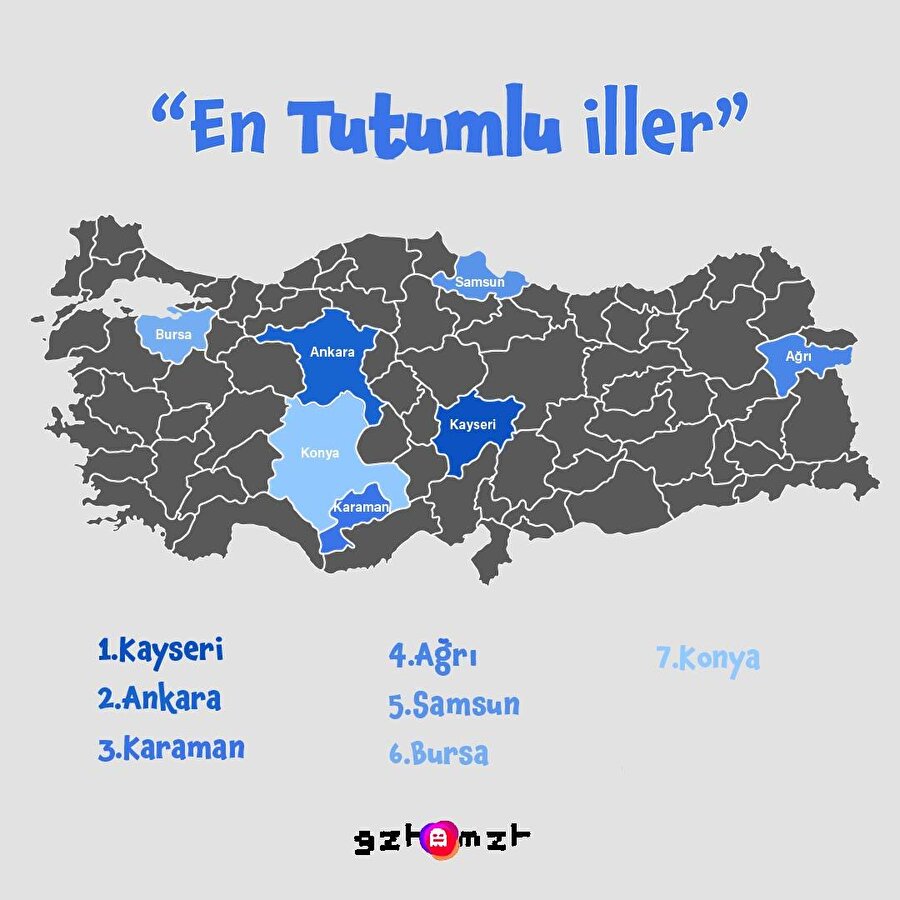

3 En Tutumlu Burc Zengin Olmanin Sirri

May 24, 2025

3 En Tutumlu Burc Zengin Olmanin Sirri

May 24, 2025 -

Best Memorial Day 2025 Sales Laptops Beauty And More

May 24, 2025

Best Memorial Day 2025 Sales Laptops Beauty And More

May 24, 2025 -

How Joe Jonas Defused A Couples Argument About Him

May 24, 2025

How Joe Jonas Defused A Couples Argument About Him

May 24, 2025