Investing In The Future: Identifying The Country's Newest Business Hubs

Table of Contents

Identifying Key Indicators of Emerging Business Hubs

Pinpointing the next wave of business hubs requires a data-driven approach. Several key economic indicators and demographic trends signal areas primed for growth. Understanding these indicators is crucial for smart investment decisions in emerging markets.

-

Analyze GDP growth rates and projections for different regions: Rapid and sustained GDP growth is a fundamental indicator of a thriving economy. Look for regions with consistently high growth rates and positive future projections. Government reports and independent economic analyses provide valuable data for this assessment.

-

Examine population growth and demographic shifts, focusing on young, skilled workers: A growing population, particularly a young and well-educated workforce, fuels economic dynamism. Regions with a high concentration of skilled workers and a robust education system are more attractive to businesses.

-

Assess infrastructure development, including transportation, communication, and utilities: Reliable and efficient infrastructure is vital for business operations. Assess the quality of transportation networks (roads, railways, airports), communication systems (internet access, broadband availability), and utility services (electricity, water).

-

Evaluate the availability of a skilled workforce and educational institutions: A skilled workforce is a major driver of economic growth. Analyze the quality of educational institutions, the availability of specialized training programs, and the overall skillset of the workforce. A strong talent pool attracts businesses and fosters innovation.

-

Research government policies, tax incentives, and business-friendly regulations: Government support plays a crucial role in fostering business growth. Investigate government initiatives aimed at promoting entrepreneurship, attracting foreign investment, and streamlining business regulations. Look for attractive tax incentives and supportive policies.

-

Look for clusters of innovation and emerging industries: Clusters of innovative companies and emerging industries signify a dynamic and growing business ecosystem. Identify regions specializing in sectors such as technology, renewable energy, biotechnology, or advanced manufacturing.

-

Study the availability of venture capital and angel investors: Access to funding is critical for startups and growing businesses. Areas with a strong presence of venture capital firms and angel investors offer better prospects for entrepreneurs and attract more investment.

Analyzing Promising Locations for Investment

[Country Name] boasts several regions showing immense promise as new business hubs. Let's analyze some key areas, focusing on their unique strengths and investment opportunities:

[Region A]: A Tech-Driven Boom

[Region A] is experiencing a rapid expansion of its technology sector. Several factors fuel this growth:

- Presence of leading tech companies: [Mention specific prominent companies and their contributions].

- Strong university partnerships: [Highlight collaborations between universities and businesses leading to innovation].

- Government support for tech startups: [Detail any relevant government initiatives and incentives for the tech sector].

- Booming real estate market: The demand for office space and commercial real estate is surging, presenting opportunities for real estate investment.

[Region B]: A Hub for Sustainable Industries

[Region B] is emerging as a center for sustainable businesses and green initiatives. Key factors driving this trend include:

- Government focus on renewable energy: [Mention specific government policies supporting renewable energy development].

- Growing number of green technology companies: [Showcase prominent companies in the sustainable sector].

- Investment in green infrastructure: [Discuss ongoing investments in renewable energy sources and environmentally friendly infrastructure].

- Attractive tax incentives for sustainable businesses: [Highlight tax benefits and incentives available for businesses operating in the green sector].

[Region C]: A Thriving Manufacturing Center

[Region C] is experiencing a resurgence in manufacturing, driven by several factors:

- Modernization of infrastructure: [Discuss upgrades in transportation, utilities, and communication networks].

- Reshoring of manufacturing activities: [Highlight the return of manufacturing operations from overseas].

- Skilled labor force: [Mention the availability of skilled workers and specialized training programs].

- Government support for industrial development: [Discuss government incentives and policies aimed at fostering manufacturing growth]. Increased investment in industrial parks and related infrastructure projects further enhances its appeal.

Mitigating Investment Risks in Emerging Markets

Investing in emerging markets offers significant opportunities, but it's essential to mitigate potential risks. Thorough due diligence and a comprehensive risk management strategy are vital.

-

Conduct thorough market research and due diligence before investing: Detailed research on market conditions, competitor analysis, and financial projections is crucial.

-

Assess the political and economic stability of the region: Political stability and economic volatility are key factors to consider. Analyze the political landscape, economic indicators, and potential risks associated with political instability or economic downturns.

-

Understand the regulatory environment and potential legal risks: Familiarize yourself with the local laws, regulations, and potential legal complexities. Seek legal counsel to ensure compliance and minimize legal risks.

-

Consider diversifying investments across different sectors and locations: Diversification helps to reduce the impact of potential losses in a single sector or region.

-

Develop a comprehensive risk management plan: A well-defined plan should outline strategies to address potential risks, including political risks, economic downturns, and regulatory changes.

-

Seek expert advice from financial advisors and legal professionals: Consulting with professionals can provide valuable insights and guidance in navigating the complexities of investing in emerging markets.

Conclusion

Identifying the country's newest business hubs requires a strategic approach combining careful analysis of key economic indicators and a deep understanding of regional dynamics. By focusing on regions exhibiting strong growth potential, robust infrastructure, and a supportive business environment, investors can capitalize on lucrative opportunities and contribute to the nation's economic expansion. Remember to conduct thorough due diligence and manage risks effectively when investing in emerging markets. Start your journey of discovering the best investment opportunities by researching the promising business hubs highlighted in this article. Invest wisely in the future by identifying the country's newest business hubs today!

Featured Posts

-

Caida Ticketmaster 8 De Abril Ultimas Noticias Y Actualizaciones Grupo Milenio

May 30, 2025

Caida Ticketmaster 8 De Abril Ultimas Noticias Y Actualizaciones Grupo Milenio

May 30, 2025 -

Ruuds Knee Injury Costs Him French Open Match Against Borges

May 30, 2025

Ruuds Knee Injury Costs Him French Open Match Against Borges

May 30, 2025 -

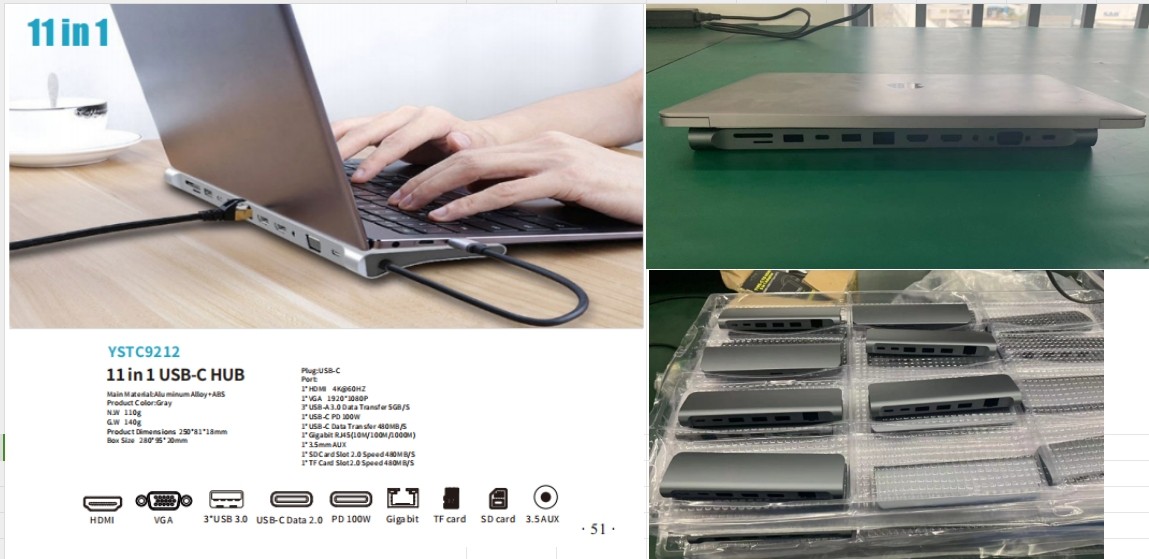

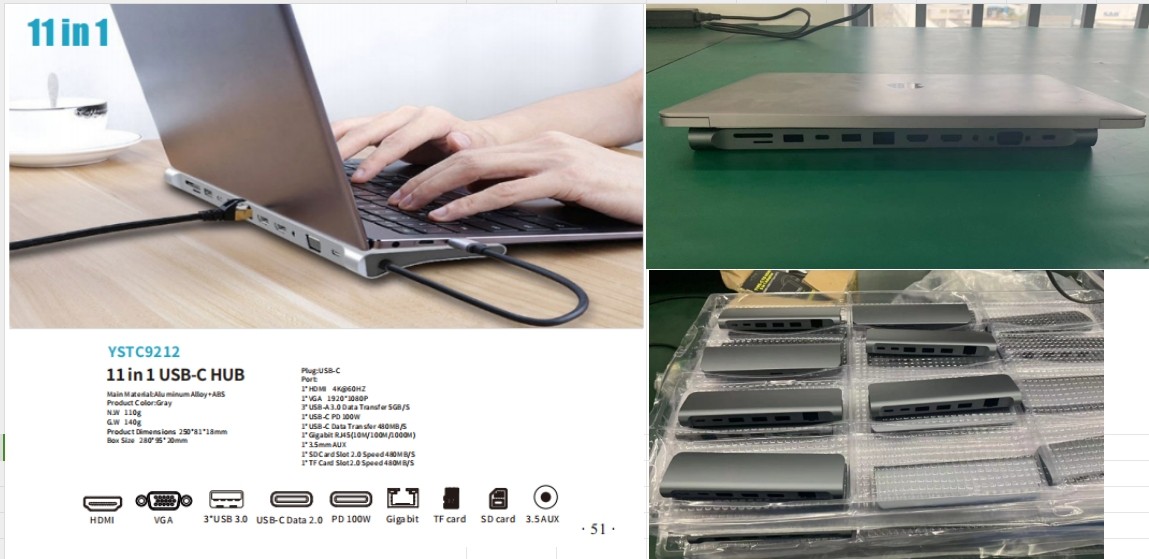

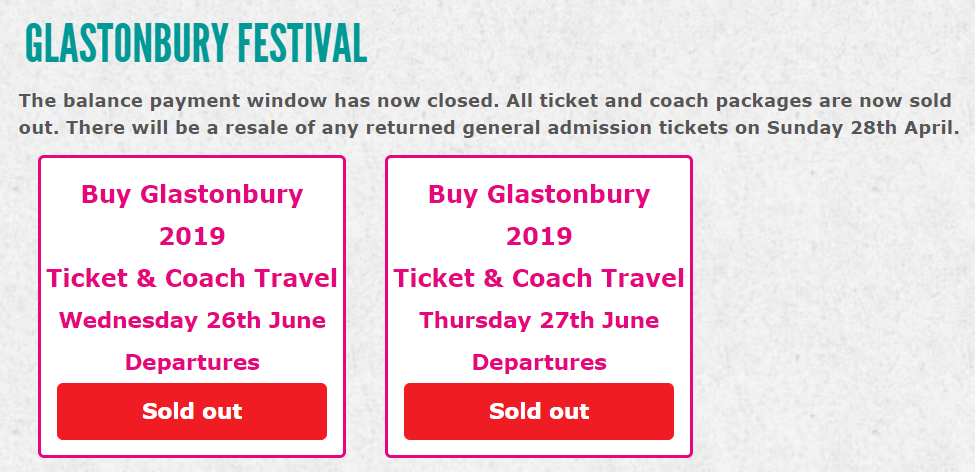

Secure Your Glastonbury Coach Ticket Resale Information And Tips

May 30, 2025

Secure Your Glastonbury Coach Ticket Resale Information And Tips

May 30, 2025 -

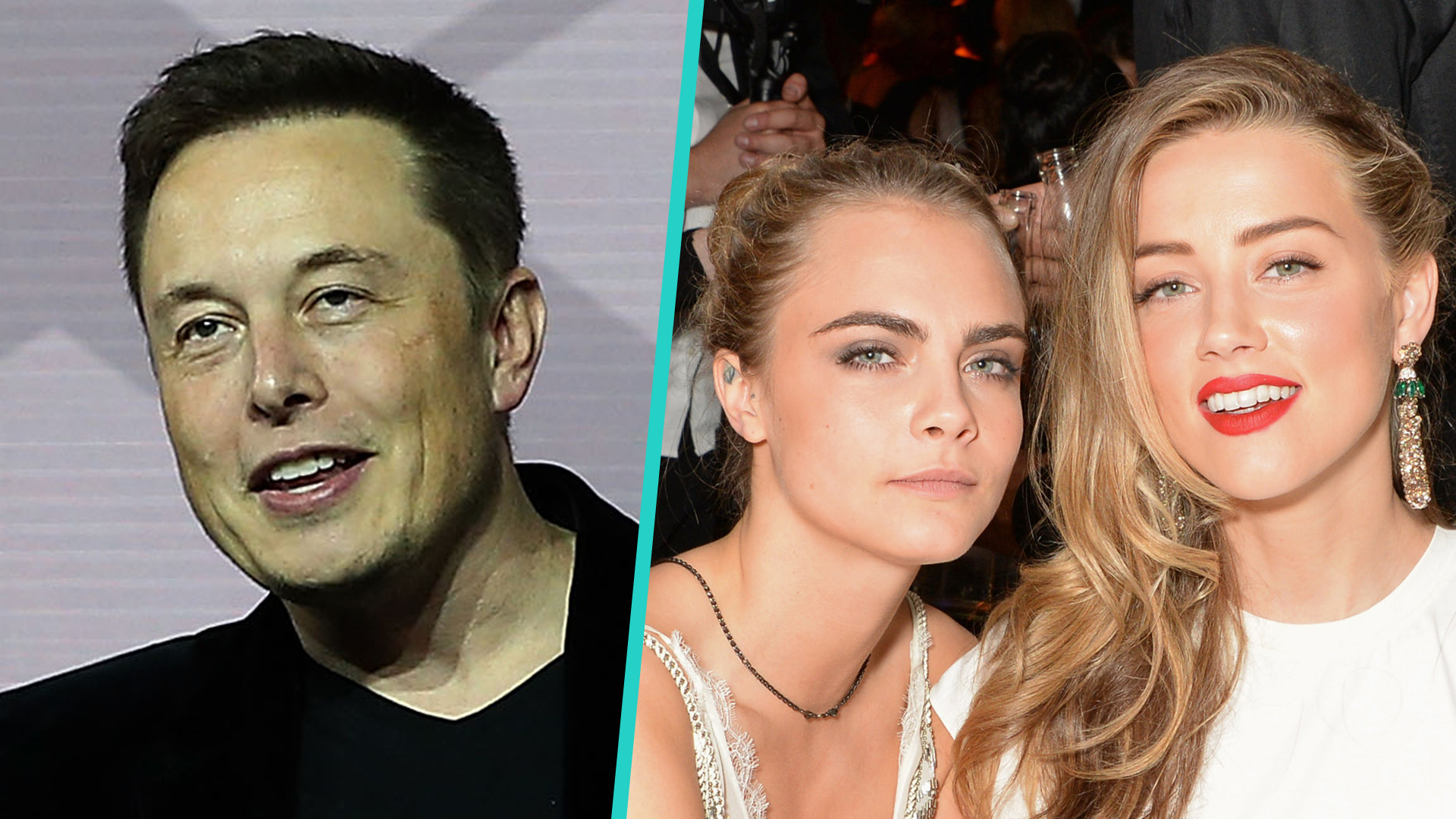

Elon Musk Denies Fathering Amber Heards Twins Embryo Dispute Aftermath

May 30, 2025

Elon Musk Denies Fathering Amber Heards Twins Embryo Dispute Aftermath

May 30, 2025 -

Palavra De Amorim Bruno Fernandes Imovel No United

May 30, 2025

Palavra De Amorim Bruno Fernandes Imovel No United

May 30, 2025