Investing In The Future: Mapping The Country's New Business Centers

Table of Contents

Identifying Emerging Business Hubs Based on Key Indicators

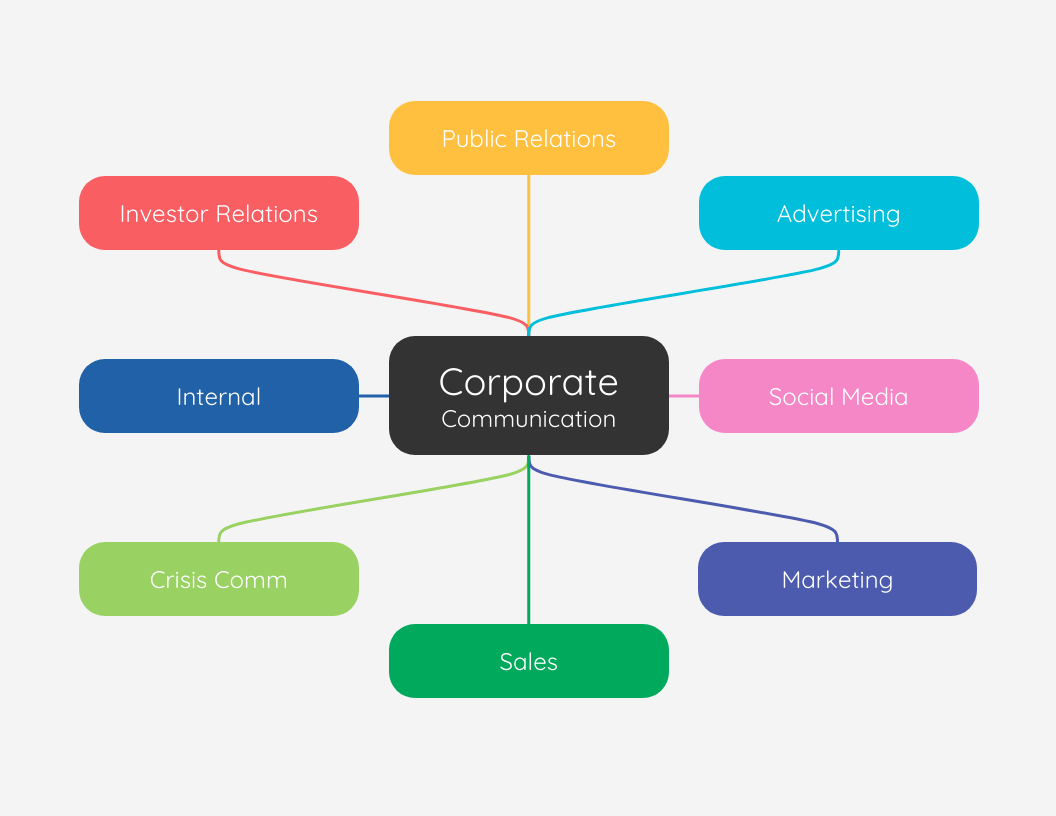

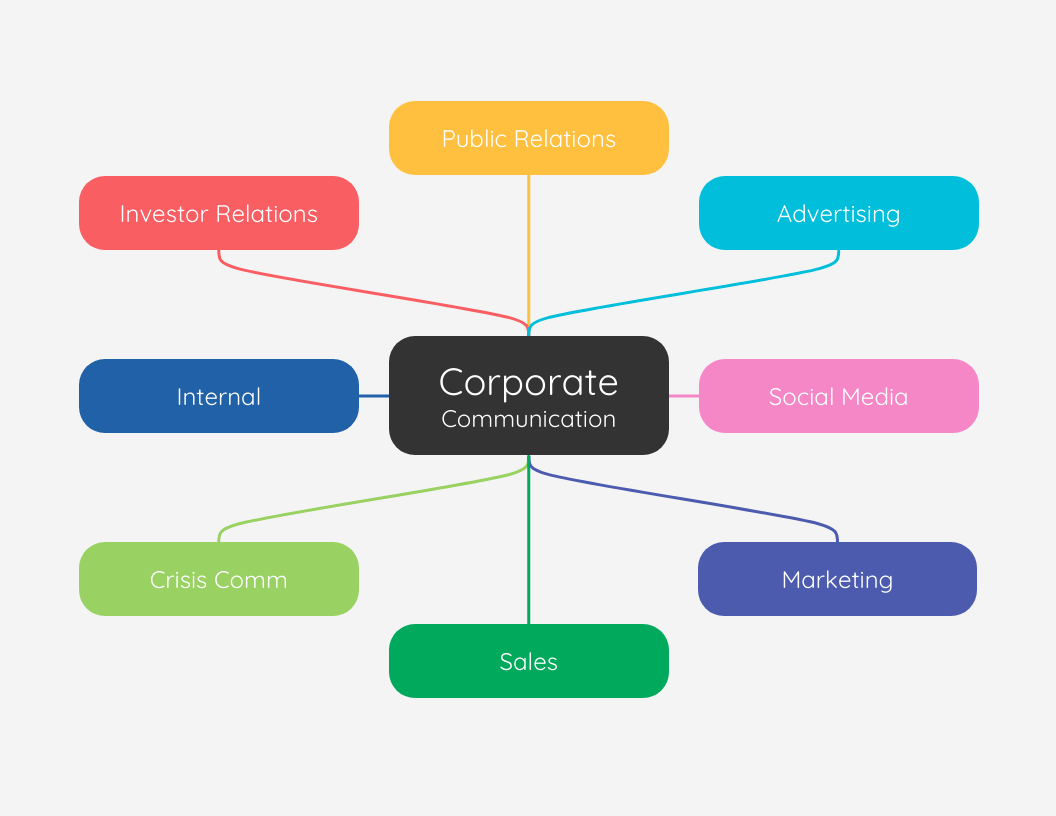

Identifying promising business centers requires a multifaceted approach, focusing on key indicators of economic vitality and future growth. This involves examining technological innovation, infrastructure development, and the availability of a skilled workforce.

Technological Innovation and Startup Ecosystems

A thriving tech hub is characterized by a dense concentration of tech startups, incubators, accelerators, and a robust flow of venture capital and angel investors. These ecosystems foster innovation and create high-paying jobs.

- Examples: City X, known for its burgeoning fintech scene, attracted $5 billion in venture capital last year, creating over 10,000 new jobs. Region Y, a leader in biotech innovation, boasts a cluster of successful startups developing cutting-edge medical technologies. City Z's thriving game development industry has seen several successful IPOs in the past five years.

- Data: A recent report shows that City X's patent applications have increased by 30% year-over-year, underscoring its growing innovation capacity.

Successful case studies include AlphaTech, a City X-based fintech startup that secured Series B funding of $100 million, and BioGenesis, a Region Y biotech company recently acquired for $2 billion.

Infrastructure Development and Connectivity

Reliable digital infrastructure and efficient transportation networks are crucial for attracting and retaining businesses. High-speed internet access, modern transportation systems, and streamlined logistics are essential for competitiveness.

- Examples: Region Y's investment in high-speed rail has significantly reduced transportation times, boosting its attractiveness to businesses. City Z’s recent upgrade to its fiber optic network has resulted in significantly faster internet speeds, making it a hub for remote work and technology-driven companies.

- Data: City X boasts average internet speeds of 500 Mbps, significantly higher than the national average. Region Y's improved logistics network has reduced delivery times by 20%, making it a more cost-effective location for businesses.

Talent Pools and Skilled Workforce

A readily available pool of skilled labor is a critical factor in attracting businesses. Strong educational institutions and workforce development programs contribute to a robust talent pipeline.

- Examples: City X is home to several leading universities with strong engineering and computer science programs, providing a steady stream of talented graduates. Region Y has invested heavily in vocational training programs, upskilling its workforce to meet the demands of emerging industries.

- Data: City X boasts an unemployment rate of just 2%, reflecting the strong demand for skilled workers. Region Y's investment in workforce development programs has led to a 15% increase in employment in tech-related fields.

Analyzing Investment Opportunities in New Business Centers

Investing in these emerging business centers presents a range of opportunities, but careful analysis is crucial. This involves assessing real estate potential, venture capital prospects, and the role of government support.

Real Estate Investment Potential

Commercial real estate in rapidly developing business centers can offer high returns, but careful market research is crucial. Analyzing property values, rental yields, and potential for appreciation is vital before investing.

- Examples: Office space in City X’s central business district is commanding premium rents due to high demand. Industrial properties in Region Y are seeing strong growth due to the expansion of manufacturing and logistics operations.

- Data: Cap rates in City X’s commercial real estate market are currently averaging 6%, indicating a strong investment opportunity.

Venture Capital and Private Equity Opportunities

Investing in startups and small businesses in these burgeoning centers can yield substantial returns. Identifying promising companies with strong growth potential is paramount.

- Examples: Several venture capital firms have established offices in City X, actively investing in promising startups. Private equity firms are increasingly targeting high-growth companies in Region Y.

- Data: Total venture capital investments in City X increased by 40% last year.

Government Incentives and Support Programs

Many governments offer incentives and support programs to attract businesses to emerging centers. These can significantly reduce investment costs and increase profitability.

- Examples: City X offers substantial tax breaks for businesses investing in renewable energy technologies. Region Y provides grants and subsidies to startups developing innovative products.

Challenges and Mitigation Strategies for Investing in New Business Centers

While the opportunities are significant, investing in new business centers also presents certain challenges that require careful consideration and mitigation strategies.

Infrastructure Gaps and Development Challenges

Despite progress, infrastructure gaps may persist in some regions. This requires careful assessment and consideration of potential delays or cost overruns.

Competition and Market Saturation

Rapid growth can lead to increased competition and potential market saturation in specific sectors. Thorough market research is essential to identify niche opportunities.

Risk Assessment and Due Diligence

Investing in emerging markets inherently involves higher risk. Thorough due diligence, robust risk assessment, and diversification are crucial for mitigating potential losses.

Conclusion

Investing in the country's new business centers offers substantial opportunities for significant returns. By carefully mapping these areas, understanding their strengths and weaknesses, and conducting thorough due diligence, investors can position themselves for success. However, awareness of the inherent challenges and careful mitigation strategies are crucial. Start exploring the potential of Investing in the Future: Mapping the Country's New Business Centers today!

Featured Posts

-

Christian Yelichs First Homer Since Back Surgery A Welcome Return

Apr 23, 2025

Christian Yelichs First Homer Since Back Surgery A Welcome Return

Apr 23, 2025 -

Sf Giants Flores And Lee Shine In Win Vs Brewers

Apr 23, 2025

Sf Giants Flores And Lee Shine In Win Vs Brewers

Apr 23, 2025 -

Comprendre L Uvre De Dominique Carlach A Travers Sa Carte Blanche

Apr 23, 2025

Comprendre L Uvre De Dominique Carlach A Travers Sa Carte Blanche

Apr 23, 2025 -

Ontario Eases Internal Trade Restrictions Focus On Alcohol And Labour

Apr 23, 2025

Ontario Eases Internal Trade Restrictions Focus On Alcohol And Labour

Apr 23, 2025 -

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Pleine Expansion

Apr 23, 2025

Tournee Minerale Et Dry January Un Marche Du Sans Alcool En Pleine Expansion

Apr 23, 2025