Investing In Uber: A Detailed Look At UBER Stock

Table of Contents

Understanding Uber's Business Model and Revenue Streams

Uber's primary revenue streams are multifaceted, extending beyond its iconic ride-sharing service. Understanding these diverse income generators is key to assessing the overall health and potential of UBER stock.

Ride-Sharing Services

Uber's core business, ride-sharing, remains a significant revenue driver. Its global presence allows it to capitalize on diverse markets, but this reach also exposes it to varying regulatory landscapes and economic conditions.

- Market share: Uber's market dominance varies geographically, facing strong competition in certain regions. Maintaining and growing market share is vital for future UBER stock performance.

- Geographic diversification: Operating in numerous countries mitigates risk associated with relying on a single market, yet each region presents unique challenges and opportunities.

- Impact of regulations: Stringent regulations concerning driver classification, licensing, and pricing can significantly impact profitability and overall UBER stock valuation. Changes in these regulations represent a key risk factor.

Uber Eats and Food Delivery

Uber Eats, Uber's food delivery service, has experienced substantial growth, though profitability remains a challenge. Competition from established players like DoorDash and Grubhub necessitates ongoing innovation and efficiency improvements.

- Market penetration: Uber Eats continues to expand its reach, aiming for wider market penetration and increased order volume, crucial for improving the UBER stock outlook.

- Customer acquisition costs: Attracting new customers is expensive, impacting profitability. Strategic marketing and efficient operations are vital to reduce these costs.

- Delivery efficiency: Optimizing delivery routes and times is essential for customer satisfaction and cost reduction, directly influencing the bottom line and UBER stock's trajectory.

Freight and Other Services

Uber Freight, targeting the logistics industry, and other emerging services represent potential avenues for future growth. Their success could significantly boost the value of UBER stock in the long term.

- Market opportunity: The freight market is vast, offering substantial growth potential for Uber's expansion and diversification.

- Technological advancements: Uber's technological capabilities are crucial for optimizing logistics and streamlining operations, key to competitive advantage in this sector.

- Competitive landscape: Competition from established players in the freight industry necessitates a strong strategic approach and innovative solutions.

Analyzing UBER Stock Performance and Financial Health

Analyzing UBER stock requires a careful examination of key financial metrics and historical performance. Understanding these factors is essential for making informed investment decisions.

Key Financial Metrics

Investors should closely monitor several key financial indicators to gauge the financial health of Uber and its potential for future growth.

- Revenue growth rate: Sustained revenue growth indicates a healthy business, attracting investor confidence and potentially driving up the UBER stock price.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): EBITDA provides insight into operational profitability, independent of financing and accounting choices.

- Net income: Net income, the bottom line, reflects overall profitability after all expenses are deducted. A consistent positive net income is a positive sign for UBER stock.

- Debt-to-equity ratio: This ratio helps determine the company's financial leverage and its ability to manage debt. High levels of debt can pose a risk for UBER stock.

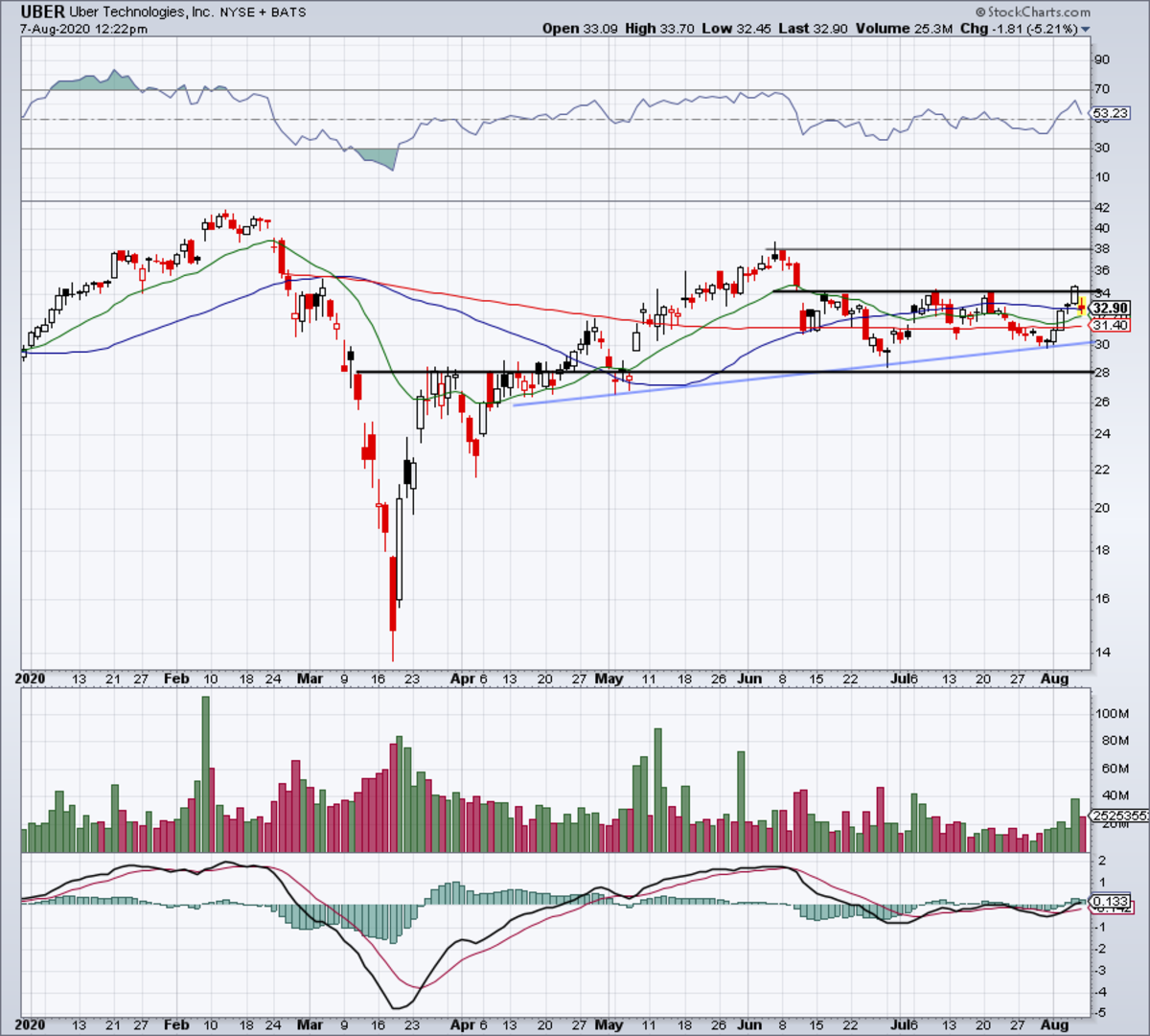

Stock Price Volatility and Historical Trends

UBER stock is known for its volatility. Studying past performance helps understand potential future fluctuations.

- 52-week high/low: Analyzing the highest and lowest prices over the past year offers insights into price swings.

- Average trading volume: High trading volume can indicate strong investor interest, potentially driving price changes.

- Significant price movements and their causes: Understanding the reasons behind past price changes, such as earnings reports or regulatory announcements, is crucial for future predictions.

Analyst Ratings and Future Projections

Financial analysts offer diverse opinions on UBER stock, providing valuable perspectives on its future prospects.

- Consensus price target: The average price target set by analysts gives a general sense of the expected future price.

- Range of analyst ratings (buy, hold, sell): Understanding the distribution of analyst opinions provides a more comprehensive view.

- Potential catalysts for price changes: Identifying potential events (positive or negative) that could impact the UBER stock price is crucial for strategic investment decisions.

Risks and Opportunities Associated with Investing in UBER Stock

Investing in UBER stock carries both substantial risks and significant potential rewards. A comprehensive understanding of these factors is paramount.

Regulatory Risks

Government regulations pose a considerable risk to Uber's operations and profitability.

- Impact of different regulations in various countries: Navigating differing regulations across global markets presents significant challenges.

- Potential legal challenges: Ongoing legal battles concerning driver classification and other issues pose a threat.

- Lobbying efforts: Uber's active lobbying efforts to influence regulatory decisions are a key factor in its long-term sustainability.

Competitive Landscape

The ride-sharing and food delivery markets are fiercely competitive, impacting UBER stock performance.

- Market share comparisons: Uber faces intense competition from established players and new entrants.

- Competitive pricing strategies: Price wars and competitive pressures can squeeze profit margins.

- Technological innovations: Competitors’ technological advancements can threaten Uber's market position.

Technological Disruptions

Technological advancements present both risks and opportunities for Uber.

- Impact of self-driving technology: The development of autonomous vehicles could drastically change the ride-sharing landscape.

- Emerging transportation solutions: Alternative transportation options, such as electric scooters and bikes, pose competitive threats.

- Adaptation to technological changes: Uber's ability to adapt to and integrate new technologies is crucial for its long-term success.

Growth Opportunities

Despite the risks, several potential growth areas exist for Uber.

- Expansion into new markets: Further global expansion presents substantial growth opportunities.

- Development of new services: Diversification into new service areas can drive revenue and mitigate risk.

- Strategic partnerships: Collaborations with other companies can unlock synergies and expand market reach.

Conclusion

Investing in UBER stock involves navigating a complex landscape of opportunities and risks. Understanding Uber's diverse business model, financial health, and the competitive pressures it faces is crucial. While the potential for growth is significant, regulatory hurdles, technological disruptions, and intense competition represent considerable challenges. Remember to conduct thorough due diligence and consider consulting with a financial advisor before making any investment decisions. Make informed decisions about your UBER stock investment today.

Featured Posts

-

Toekomst Maastricht Airport Minder Passagiers In Het Begin Van 2025

May 19, 2025

Toekomst Maastricht Airport Minder Passagiers In Het Begin Van 2025

May 19, 2025 -

Legendary Singer Johnny Mathis Announces Retirement From Touring

May 19, 2025

Legendary Singer Johnny Mathis Announces Retirement From Touring

May 19, 2025 -

Libraries Struggle After Federal Funding Cuts

May 19, 2025

Libraries Struggle After Federal Funding Cuts

May 19, 2025 -

Ufc 313 Fight Card Complete Guide To The Event Tickets And Viewing Options

May 19, 2025

Ufc 313 Fight Card Complete Guide To The Event Tickets And Viewing Options

May 19, 2025 -

The Trials Ending Unraveling Teahs Role And Family Secrets

May 19, 2025

The Trials Ending Unraveling Teahs Role And Family Secrets

May 19, 2025