Investment Analysis: CoreWeave (CRWV) Stock's Significant Gains Last Week

Table of Contents

Analyzing the Reasons Behind CRWV's Stock Surge

Several interconnected factors contributed to CoreWeave's impressive stock performance. Understanding these elements is crucial for assessing the sustainability of these gains and predicting future trajectory.

Positive Market Sentiment and Increased Investor Confidence

The tech sector, as a whole, has enjoyed a period of renewed investor confidence, positively impacting CRWV. This broader positive sentiment has created a fertile ground for growth stocks like CoreWeave to flourish. Several specific events further boosted confidence in CRWV:

- Increased demand for AI infrastructure: The burgeoning field of artificial intelligence is driving immense demand for the specialized cloud computing resources CoreWeave provides.

- Positive analyst ratings and price target increases: Several prominent financial analysts have issued positive ratings and increased their price targets for CRWV, signaling their belief in the company's growth potential.

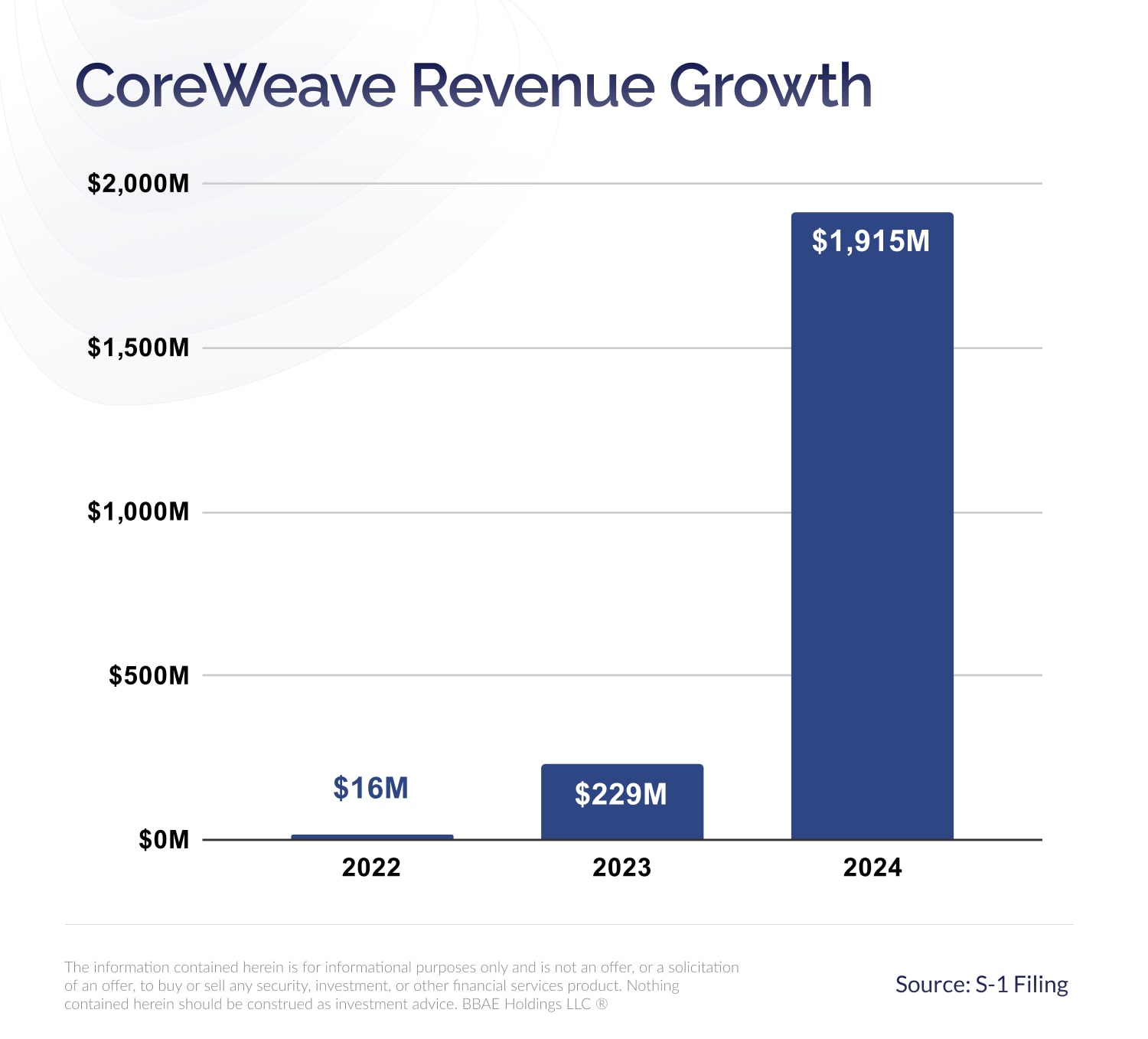

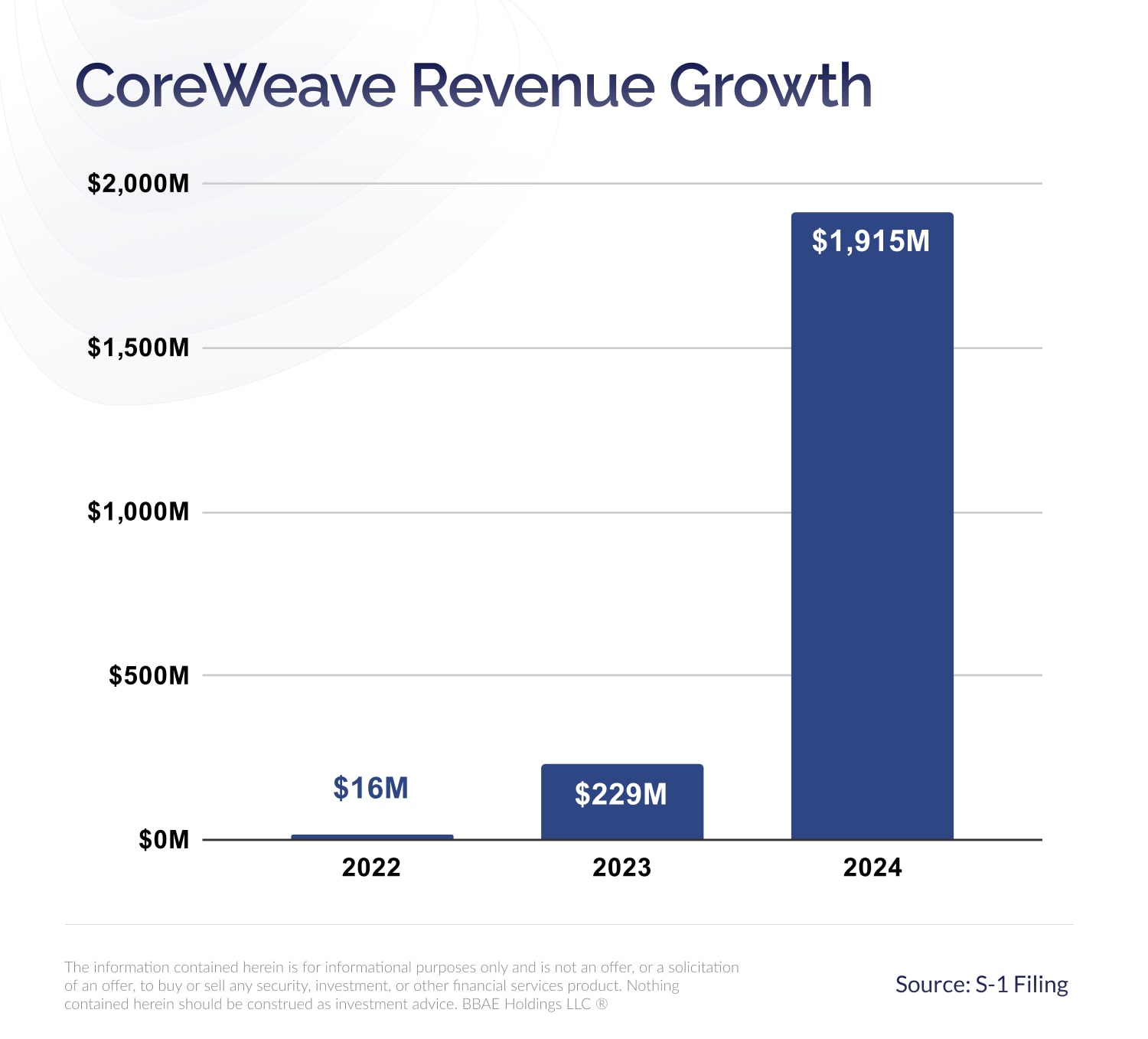

- Strong financial performance projections: CoreWeave's projected financial performance, showcasing strong revenue growth and increasing profitability, has solidified investor confidence.

Growth in the Cloud Computing and AI Infrastructure Markets

CoreWeave's success is intrinsically linked to the explosive growth of the cloud computing and AI infrastructure markets. These sectors are experiencing unprecedented expansion, fueled by the increasing reliance on data-intensive applications and AI-powered solutions.

- Market size and growth projections: Market research firms predict substantial growth for both cloud computing and AI infrastructure in the coming years, creating a vast addressable market for CoreWeave.

- CoreWeave's competitive advantages: CoreWeave differentiates itself through its specialized infrastructure, optimized for high-performance computing tasks, and its commitment to sustainability initiatives, appealing to environmentally conscious clients.

- Potential for market share expansion: With its strong technology and strategic partnerships, CoreWeave is well-positioned to capture a significant share of these expanding markets.

Strategic Partnerships and Technological Advancements

CoreWeave's recent stock surge can also be attributed to strategic partnerships and technological advancements. These collaborations and innovations solidify its position as a leader in the industry.

- Key partnerships and their significance: New partnerships with major players in the technology industry provide CoreWeave with access to wider markets and enhanced technological capabilities. These partnerships should be researched individually for a complete picture.

- New technologies and product launches: CoreWeave's continuous investment in research and development has resulted in the introduction of innovative technologies and products that are improving its offerings and attracting new clients.

- Impact on CRWV's growth prospects: These strategic partnerships and technological advancements significantly contribute to CoreWeave's future growth prospects, enhancing its competitive edge and market appeal.

Evaluating the Long-Term Investment Potential of CRWV

While CoreWeave's recent performance is impressive, a thorough evaluation of the long-term investment potential requires considering both opportunities and risks.

Risk Assessment and Potential Challenges

Investing in CRWV, like any stock, carries inherent risks. Potential challenges include:

- Competitive landscape analysis: The cloud computing and AI infrastructure markets are becoming increasingly competitive, with established players and new entrants vying for market share.

- Financial risk factors (debt, profitability): Investors should carefully analyze CoreWeave's financial statements to assess its debt levels, profitability, and overall financial health.

- Regulatory considerations: Changes in regulations related to data privacy, cybersecurity, and cloud computing could impact CoreWeave's operations and profitability.

Future Growth Projections and Investment Outlook

Despite the risks, CoreWeave's future growth potential remains significant. The company's strong technological foundation, strategic partnerships, and position within rapidly growing markets suggest a promising outlook.

- Projected revenue and earnings growth: Analysts predict continued strong revenue and earnings growth for CoreWeave in the coming years, driven by increasing demand for its services.

- Potential for further stock price appreciation: Based on current market trends and growth projections, there is potential for further stock price appreciation. However, this is not guaranteed.

- Comparison with competitors: Comparing CoreWeave's performance, financial health, and growth prospects with its key competitors is essential for a comprehensive investment analysis.

Conclusion: Investment Analysis: CoreWeave (CRWV) Stock's Future

CoreWeave's recent stock price increase is a result of positive market sentiment, growth in the cloud computing and AI markets, and the company's strategic partnerships and technological advancements. While the long-term investment potential of CRWV is promising, investors should carefully consider the inherent risks and conduct thorough due diligence before making any investment decisions. While this analysis provides valuable insights into CoreWeave's recent performance, thorough due diligence is crucial before making any investment decisions. Continue your research on CoreWeave (CRWV) and its potential for growth in the dynamic cloud computing and AI markets. Remember to consult with a financial advisor before making any investment choices.

Featured Posts

-

Pittsburgh Steelers Schedule Released A Deep Dive Into The Takeaways

May 22, 2025

Pittsburgh Steelers Schedule Released A Deep Dive Into The Takeaways

May 22, 2025 -

Karin Polman Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou

May 22, 2025

Karin Polman Nieuwe Directeur Hypotheken Intermediair Bij Abn Amro Florius En Moneyou

May 22, 2025 -

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 22, 2025

Aviva Stadium To Host Metallica For Two Nights In June 2026

May 22, 2025 -

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025

Festival Le Bouillon Spectacles Et Engagement A Clisson

May 22, 2025 -

Waarom Werkt Online Betalen Niet Voor Mijn Abn Amro Opslag

May 22, 2025

Waarom Werkt Online Betalen Niet Voor Mijn Abn Amro Opslag

May 22, 2025