Investment In Amundi DJIA UCITS ETF: Monitoring Net Asset Value (NAV)

Table of Contents

Understanding Amundi DJIA UCITS ETF NAV

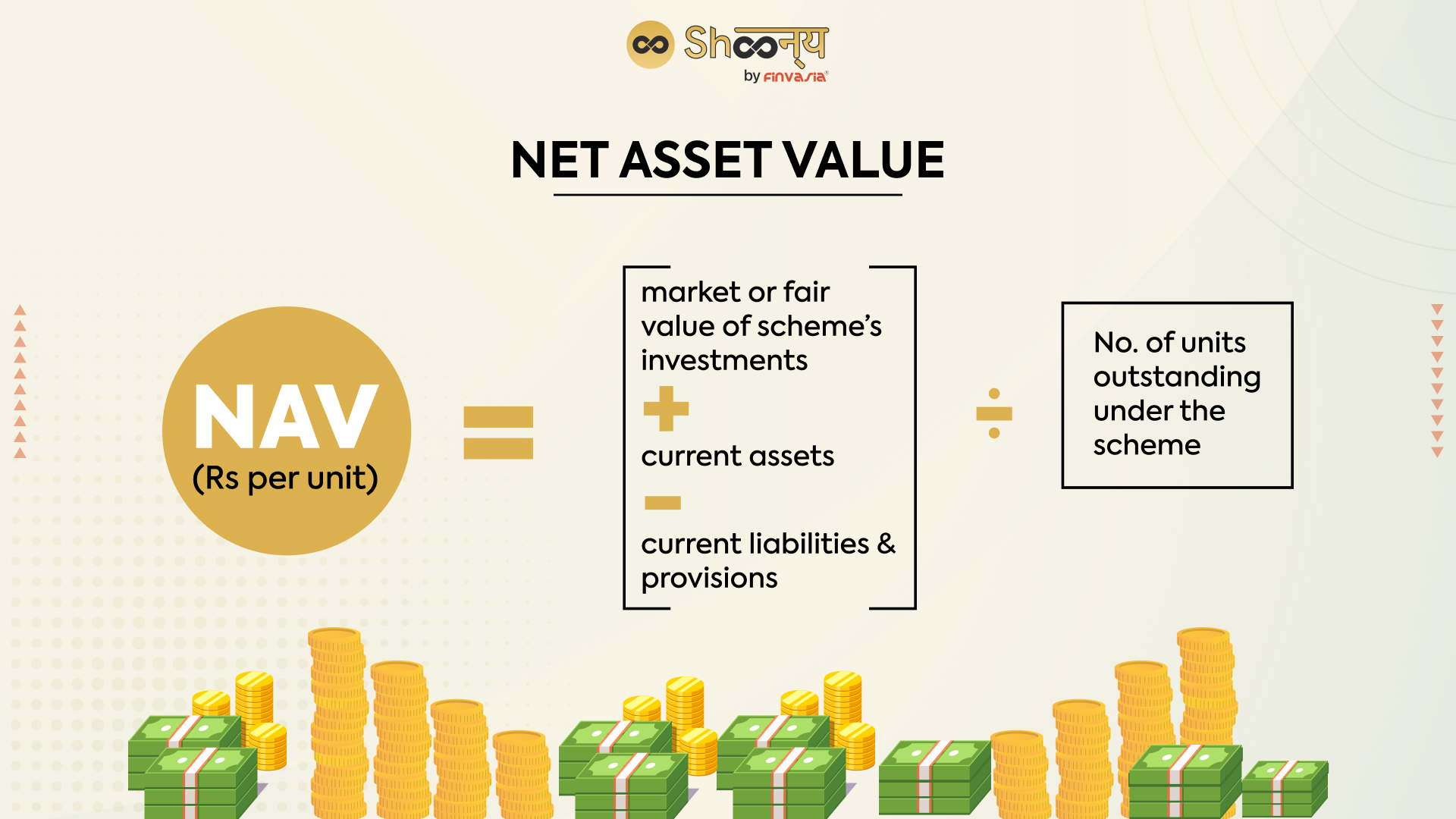

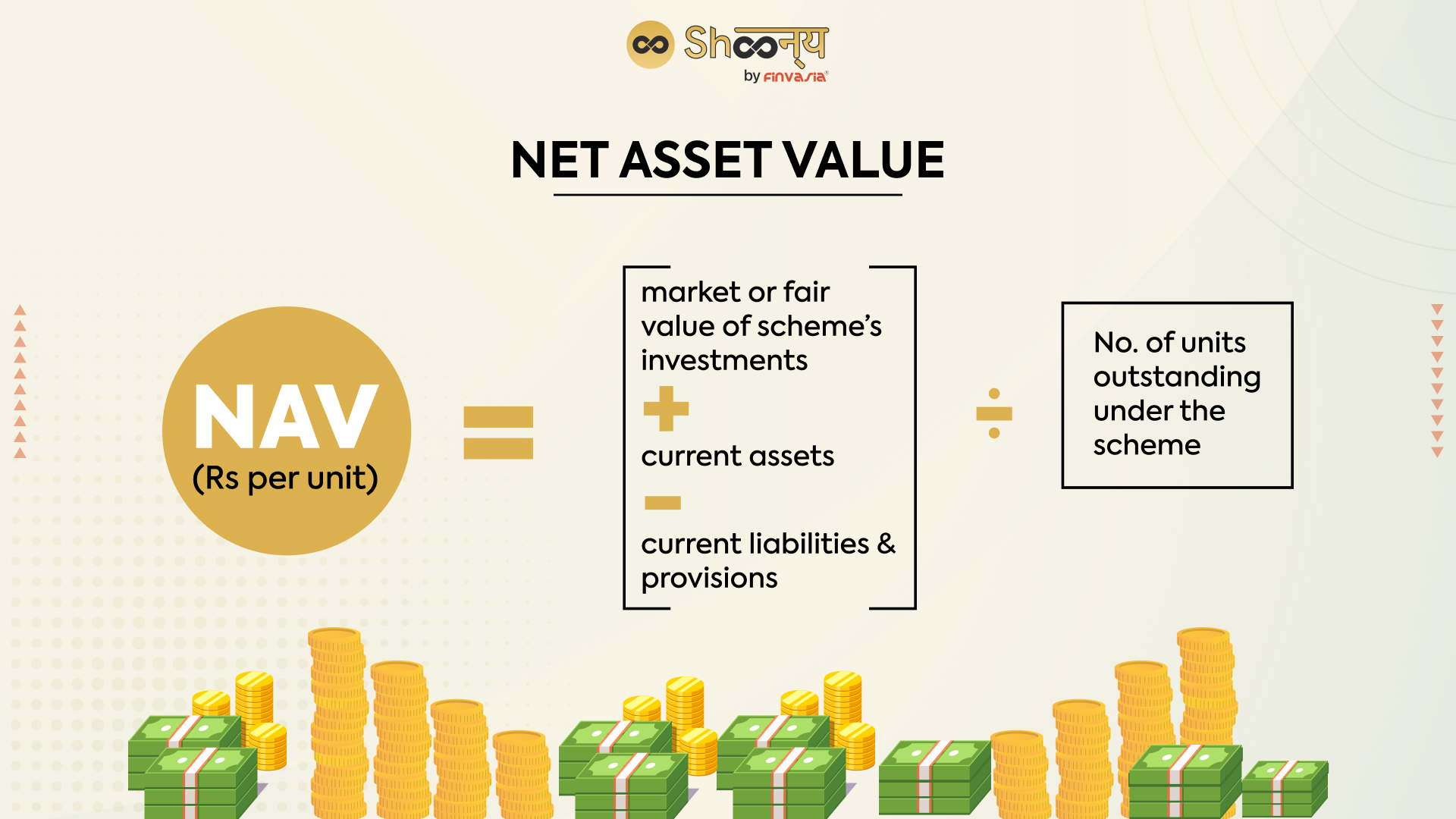

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets, minus any liabilities, divided by the number of outstanding shares. For ETFs like the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average, the NAV calculation involves determining the total value of the holdings mirroring the DJIA, factoring in any dividends received and expenses incurred. This value is typically calculated at the end of each trading day.

The significance of NAV for Amundi DJIA UCITS ETF investors is paramount. The NAV reflects the intrinsic value of your investment. While the market price of the ETF can fluctuate throughout the day, the NAV provides a more stable measure of the actual worth of the underlying assets.

The relationship between the market price and NAV is usually very close, though discrepancies can occur. A premium exists when the market price trades above the NAV, and a discount when it trades below. These differences can sometimes present arbitrage opportunities for sophisticated investors, though this requires significant market knowledge and expertise.

- NAV reflects the underlying asset value of the ETF.

- Daily NAV calculation ensures transparency and accountability.

- Discrepancies between market price and NAV can indicate arbitrage opportunities (for sophisticated investors).

- Regular NAV checks help assess ETF performance against its benchmark.

Accessing Amundi DJIA UCITS ETF NAV Data

Obtaining reliable Amundi DJIA UCITS ETF NAV data is straightforward. Several sources provide real-time and historical information.

The most direct source is Amundi's official website. Their investor relations section typically contains daily NAV updates, often downloadable in spreadsheet format for easy analysis.

Beyond Amundi's website, reputable financial news websites and brokerage platforms usually provide access to ETF NAV data, often including charts and graphs to visualize trends. Major financial data providers like Bloomberg and Refinitiv offer even more comprehensive data, including historical performance and detailed portfolio breakdowns.

- Amundi's official website provides daily NAV updates.

- Financial data providers (e.g., Bloomberg, Refinitiv) offer comprehensive data including historical data.

- Brokerage accounts usually display current and historical NAV information.

- Use reputable sources to avoid inaccurate data and ensure data integrity.

Interpreting Amundi DJIA UCITS ETF NAV Trends

Analyzing Amundi DJIA UCITS ETF NAV changes over time is crucial for understanding ETF performance. Tracking the NAV allows you to gauge the effectiveness of the ETF in tracking its benchmark, the Dow Jones Industrial Average.

To interpret NAV trends effectively, consider broader market conditions and economic factors. A downturn in the overall market will likely impact the DJIA and consequently the ETF's NAV. Comparing the NAV to past performance benchmarks and the performance of the Dow Jones Industrial Average itself provides valuable context.

Visualizing NAV trends using charts and graphs simplifies the process. Line charts are particularly useful for identifying upward or downward trends over time. More advanced investors might employ technical analysis tools to identify patterns and potential turning points.

- Compare NAV to past performance benchmarks, and compare to the Dow Jones Industrial Average.

- Consider broader market trends (e.g., Dow Jones performance, economic indicators, and global events).

- Identify potential upward or downward trends in the NAV.

- Use technical analysis tools (for experienced investors) to forecast future trends.

The Importance of Regular Amundi DJIA UCITS ETF NAV Monitoring for Investment Strategies

Regular monitoring of the Amundi DJIA UCITS ETF NAV is not just about tracking performance; it's a crucial component of sound investment management.

By consistently monitoring the NAV, investors can make more informed buy and sell decisions. For example, a significant drop in NAV might signal a buying opportunity for long-term investors, while a sustained period of high NAV might prompt considering partial profit-taking.

Furthermore, NAV tracking facilitates portfolio rebalancing. If a particular asset class, in this case represented by the Amundi DJIA UCITS ETF, becomes overweighted in your portfolio, regular NAV checks can help inform decisions to rebalance and align your holdings with your target asset allocation.

- Regular monitoring helps optimize investment timing, capitalizing on market fluctuations.

- It allows for proactive portfolio adjustments to maintain your desired asset allocation.

- It provides crucial data for evaluating investment success and making necessary adjustments.

- It facilitates risk management strategies by allowing for timely adjustments to mitigate potential losses.

Conclusion

Successfully investing in the Amundi DJIA UCITS ETF requires diligent monitoring of its Net Asset Value (NAV). By understanding how NAV is calculated, accessing reliable data sources, and interpreting NAV trends, investors can make informed decisions and optimize their investment strategies. Regular monitoring of your Amundi DJIA UCITS ETF NAV is crucial for long-term success. Start tracking your Amundi DJIA UCITS ETF NAV today and make smarter investment choices!

Featured Posts

-

Les Gens Dici Histoire Traditions Et Societe

May 25, 2025

Les Gens Dici Histoire Traditions Et Societe

May 25, 2025 -

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 25, 2025

Is Glastonbury 2025s Lineup The Strongest Ever Featuring Charli Xcx Neil Young And More Must See Acts

May 25, 2025 -

Naomi Kempbell Pokazala Povzroslevshikh Detey Slukhi O Romane S Millionerom Nabirayut Oboroty

May 25, 2025

Naomi Kempbell Pokazala Povzroslevshikh Detey Slukhi O Romane S Millionerom Nabirayut Oboroty

May 25, 2025 -

La Gestion De Florentino Perez Impacto En El Real Madrid

May 25, 2025

La Gestion De Florentino Perez Impacto En El Real Madrid

May 25, 2025 -

L Affaire Ardisson Le Temoignage De Laurent Baffie Et Les Accusations De Comportement Machiste

May 25, 2025

L Affaire Ardisson Le Temoignage De Laurent Baffie Et Les Accusations De Comportement Machiste

May 25, 2025