Investment Strategies: Swissquote Bank's Sovereign Bond Market Insights

Table of Contents

Understanding the Sovereign Bond Market

Sovereign bonds, also known as government bonds or treasury bonds, are debt securities issued by national governments to finance their spending. They represent a loan from an investor to a government, with the government promising to repay the principal plus interest at a specified date (maturity). Different types of sovereign bonds exist, each with its own characteristics:

- Government Bonds: These are generally long-term bonds issued by national governments.

- Treasury Bills: Short-term debt securities, typically maturing in less than a year.

- Treasury Notes: Medium-term bonds, usually maturing in 2-10 years.

- Treasury Bonds: Long-term bonds with maturities exceeding 10 years.

Several factors influence sovereign bond yields – the return an investor receives on their investment:

- Inflation: High inflation erodes the purchasing power of future interest payments, typically leading to higher bond yields.

- Interest Rates: Central bank interest rate adjustments directly impact bond yields. Rising interest rates usually lead to lower bond prices and higher yields on newly issued bonds.

- Credit Ratings: A sovereign's credit rating reflects its ability to repay its debt. Higher credit ratings generally result in lower yields, reflecting lower perceived risk.

Risk assessment in sovereign bond investing is crucial. Factors such as political stability, economic growth prospects, and the country's debt level significantly influence the risk profile of sovereign bonds.

Swissquote Bank's Approach to Sovereign Bond Investing

Swissquote Bank offers a sophisticated platform for sovereign bond investing, backed by robust research and analytical tools. Their expertise stems from years of experience in global financial markets, providing investors with access to a diverse range of sovereign bonds from various countries.

- Swissquote's research and analysis tools: Access to in-depth research reports, market analysis, and economic forecasts.

- Access to diverse sovereign bond markets: Swissquote provides access to a broad spectrum of sovereign bond issuers globally.

- Transparency and risk management strategies: Swissquote prioritizes transparency in its operations and provides investors with the tools necessary to effectively manage risks.

- Potential benefits of using Swissquote's platform: Competitive pricing, user-friendly interface, and access to expert support.

Swissquote’s investment philosophy emphasizes a balanced approach, considering risk, yield, and diversification. They provide investors with the necessary tools to construct and manage their portfolios effectively.

Strategic Investment Strategies Using Swissquote's Platform

Swissquote's platform enables investors to implement various strategic approaches for sovereign bond investing:

- Diversification across different sovereign issuers and maturities: Spreading investments across multiple countries and bond maturities reduces overall portfolio risk.

- Strategies for managing interest rate risk: Techniques like laddering bonds (investing in bonds with staggered maturities) can mitigate interest rate risk.

- Optimizing yield through strategic bond selection: Careful selection of bonds based on credit ratings, maturity, and yield-to-maturity can maximize returns.

- Utilizing Swissquote's tools for portfolio construction: Swissquote's platform provides tools to build and monitor diversified portfolios, facilitating strategic allocation and rebalancing. This includes utilizing Bond ETFs for efficient diversification.

Risk Management in Sovereign Bond Investments

Sovereign bonds, while generally considered less risky than corporate bonds, are not without risk:

- Interest rate risk: Changes in interest rates can significantly impact bond prices.

- Inflation risk: High inflation erodes the real value of future interest payments.

- Default risk: The risk that a government may fail to repay its debt.

- Currency risk: Fluctuations in exchange rates can affect the returns for investors holding bonds denominated in foreign currencies.

Mitigating these risks requires careful due diligence, including a thorough assessment of the issuer's creditworthiness, economic outlook, and political stability. Diversification is key to reducing risk exposure. Swissquote Bank provides various tools for risk assessment and management, including access to credit ratings, economic indicators, and risk-profiling tools.

Conclusion: Investment Strategies: Key Takeaways and Call to Action

This article highlighted the importance of understanding the sovereign bond market and how to utilize Swissquote Bank's platform for effective investment strategies. We discussed various sovereign bond types, influencing factors, and investment approaches, all while emphasizing risk management. Swissquote's resources, including research tools, diverse market access, and risk management capabilities, provide a valuable advantage for investors seeking to optimize their portfolios. Successfully navigating the sovereign bond market requires a strategic approach combined with access to the right tools and expertise.

Learn more about optimizing your investment strategies with Swissquote Bank's comprehensive sovereign bond market insights. Visit [link to Swissquote's relevant page] today! Start building a diversified investment portfolio leveraging the power of Investment Strategies: Swissquote Bank's Sovereign Bond Market Insights.

Featured Posts

-

Rafa Nadal Y El Fallecimiento De Una Leyenda Un Adios Al Tenis

May 19, 2025

Rafa Nadal Y El Fallecimiento De Una Leyenda Un Adios Al Tenis

May 19, 2025 -

Manuel Orantes Fallece El Iconico Tenista Espanol

May 19, 2025

Manuel Orantes Fallece El Iconico Tenista Espanol

May 19, 2025 -

Mets Among Teams Showing Interest In Luis Robert Jr

May 19, 2025

Mets Among Teams Showing Interest In Luis Robert Jr

May 19, 2025 -

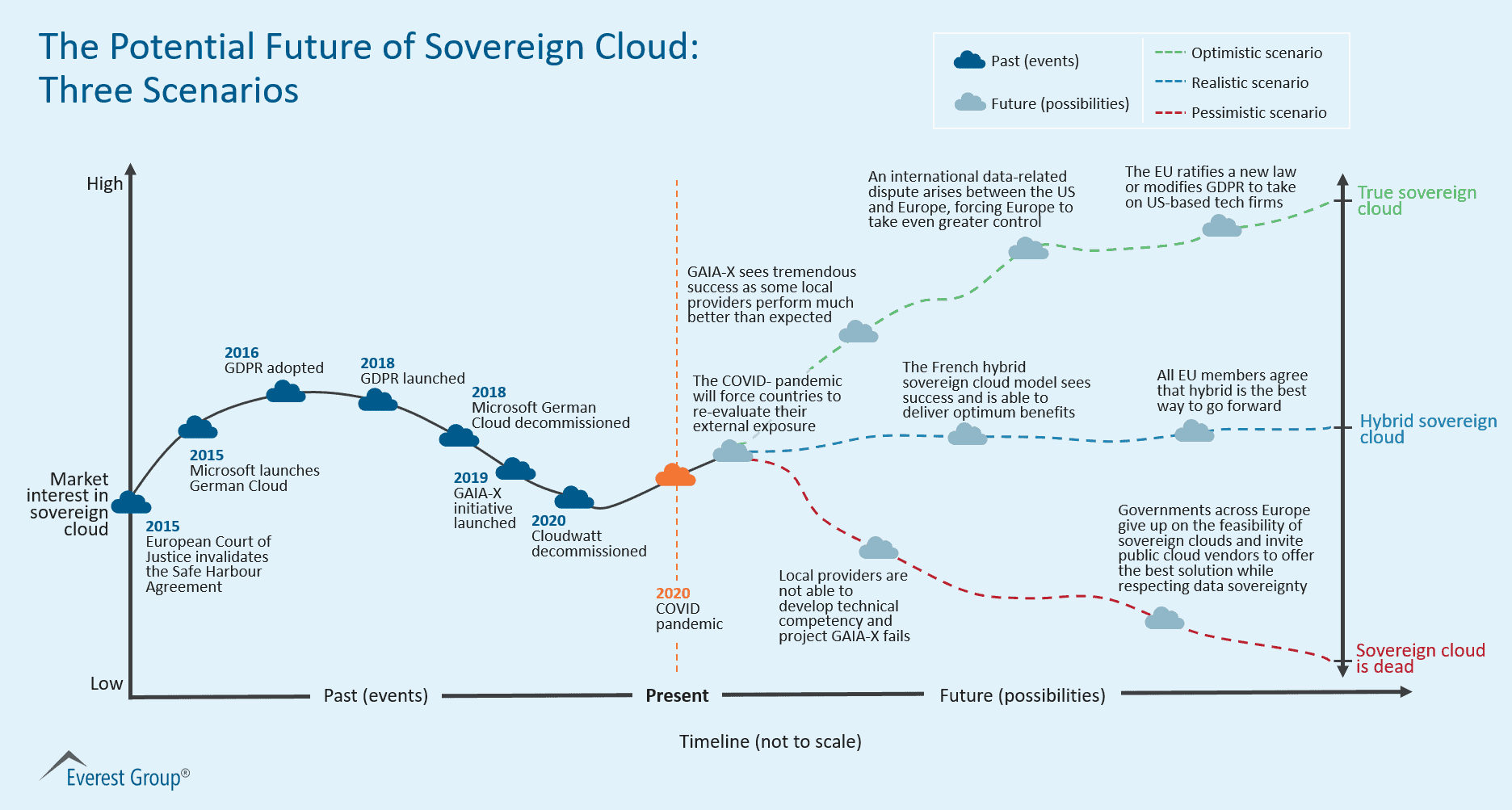

Death Toll Rises To 25 After Devastating Tornado Outbreak In Central Us

May 19, 2025

Death Toll Rises To 25 After Devastating Tornado Outbreak In Central Us

May 19, 2025 -

Meta Monopoly Trial Ftcs Defense Takes Center Stage

May 19, 2025

Meta Monopoly Trial Ftcs Defense Takes Center Stage

May 19, 2025