Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations is nuanced, acknowledging both the elevated levels and the contributing factors. While they haven't declared an outright bubble, they caution that valuations are stretched in several sectors, exceeding historical averages in some cases. Their analysis relies on a variety of key metrics, offering a comprehensive view rather than a simplistic "bubble or not" conclusion.

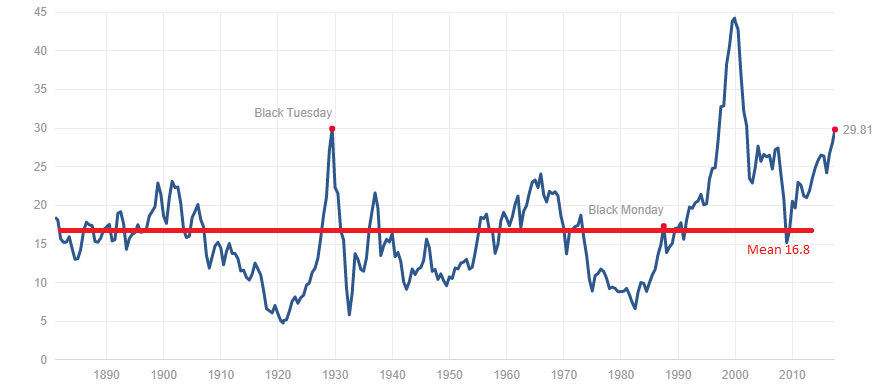

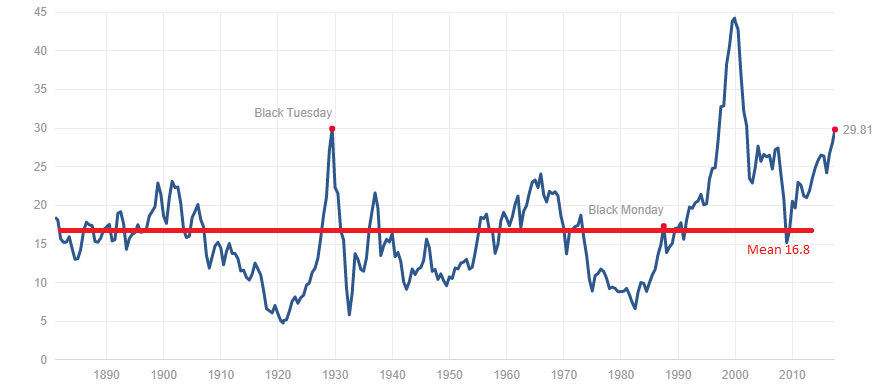

- Key Metrics: BofA utilizes a combination of metrics, including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and dividend yields, to assess valuations across different sectors and compare them to historical data. They also consider factors like earnings growth projections and interest rate expectations.

- Historical Comparisons: BofA's reports often compare current valuations to historical averages, highlighting sectors where valuations are significantly above long-term trends. This historical context helps investors understand whether current prices represent a genuine overvaluation or a temporary anomaly.

- Sector-Specific Analysis: BofA provides detailed analyses of specific sectors, identifying those deemed overvalued (potentially ripe for a correction) and those perceived as relatively undervalued and offering better risk-adjusted returns. For example, recent reports may highlight technology or certain consumer discretionary sectors as potentially overvalued while pointing to more defensive sectors as relatively more attractive.

Identifying Potential Risks Associated with High Valuations

BofA identifies several key risks associated with the current high stock market valuations. These risks, if they materialize, could significantly impact investor portfolios. Understanding these risks is crucial for developing a robust investment strategy.

- Market Correction: BofA's analysis suggests a degree of probability for a market correction, although the timing and magnitude remain uncertain. High valuations inherently increase the vulnerability to sharp declines, particularly if investor sentiment shifts negatively.

- Rising Interest Rates: Increased interest rates tend to reduce the attractiveness of stocks relative to bonds. Higher rates increase borrowing costs for companies, potentially impacting earnings and slowing economic growth, which can negatively affect stock valuations. BofA's analysis considers the impact of the Federal Reserve's monetary policy on stock market performance.

- Inflationary Pressures: Persistent inflation erodes corporate profitability by increasing input costs. BofA closely monitors inflation data and its potential impact on earnings growth, which directly influences stock prices.

- Geopolitical Uncertainties: Geopolitical events, such as international conflicts or trade disputes, can introduce significant volatility into the market. BofA's assessments incorporate geopolitical risk factors, analyzing their potential to disrupt supply chains and negatively affect investor confidence.

BofA's Recommended Investment Strategies in a High-Valuation Environment

Given the elevated valuations, BofA advocates for a more cautious and diversified investment approach. Their recommendations emphasize risk management and a long-term perspective.

- Diversification: BofA stresses the importance of diversifying across asset classes, sectors, and geographies to reduce overall portfolio risk. This includes incorporating assets less correlated to stocks, such as bonds and real estate.

- Sector Selection: Instead of broad market exposure, BofA suggests focusing on sectors that demonstrate greater resilience to economic downturns, such as consumer staples, healthcare, and utilities. These sectors are often seen as less sensitive to market cycles.

- Defensive Investing: BofA might advise investors to consider defensive investment strategies, prioritizing capital preservation over aggressive growth in the current climate. This could involve shifting towards lower-risk investments.

- Risk Management Strategies: BofA emphasizes the importance of employing various risk management strategies, such as stop-loss orders and hedging techniques, to mitigate potential losses during market corrections.

Comparing BofA's View with Other Market Analyses

While BofA's analysis provides valuable insights, it's essential to consider other perspectives. Many other financial institutions and analysts offer their own assessments of market valuations and potential risks.

- Differing Opinions: While there might be a general consensus on the elevated nature of valuations, differing opinions exist regarding the severity of the risk and the timing of any potential correction. Some analysts may be more optimistic, while others might be more bearish.

- Rationale for Discrepancies: Differences in analysis often stem from varying methodologies, assumptions about future economic growth, and interpretations of key economic indicators. Understanding these underlying differences is key to forming your own informed opinion.

- Examples: For example, Goldman Sachs or Morgan Stanley might have slightly different views on specific sector valuations or the likelihood of a market correction compared to BofA, reflecting their distinct analytical frameworks.

Conclusion: Navigating Investor Concerns About High Stock Market Valuations

BofA's analysis highlights the elevated nature of current stock market valuations and underscores the importance of prudent risk management. While not predicting an imminent crash, their assessment stresses the need for cautious diversification, sector-specific analysis, and a focus on long-term investment goals. Remember, BofA's analysis is just one perspective. It is crucial to conduct your own thorough research, consider other market analyses, and seek professional financial advice tailored to your individual circumstances before making any investment decisions. Stay informed about high stock market valuations and develop a robust investment strategy that addresses these concerns. For further reading, explore BofA's research publications and reports on market analysis for a deeper understanding of their perspective and methodology.

Featured Posts

-

Report Bianca Censori Seeks Divorce Amidst Kanye Wests Control

May 04, 2025

Report Bianca Censori Seeks Divorce Amidst Kanye Wests Control

May 04, 2025 -

Churchill Downs Renovations Kentucky Derby Preparations In Full Swing

May 04, 2025

Churchill Downs Renovations Kentucky Derby Preparations In Full Swing

May 04, 2025 -

Corinthians X Guarani Guia Completo Para Assistir Ao Jogo Do Paulistao 2025

May 04, 2025

Corinthians X Guarani Guia Completo Para Assistir Ao Jogo Do Paulistao 2025

May 04, 2025 -

Brasileirao Serie A Cbf Apresenta A Tabela Oficial Da Competicao

May 04, 2025

Brasileirao Serie A Cbf Apresenta A Tabela Oficial Da Competicao

May 04, 2025 -

Affordable Housing Progress In Tomatin Strathdearn Project Begins Construction

May 04, 2025

Affordable Housing Progress In Tomatin Strathdearn Project Begins Construction

May 04, 2025