Investor Concerns About Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Stock Market Valuations

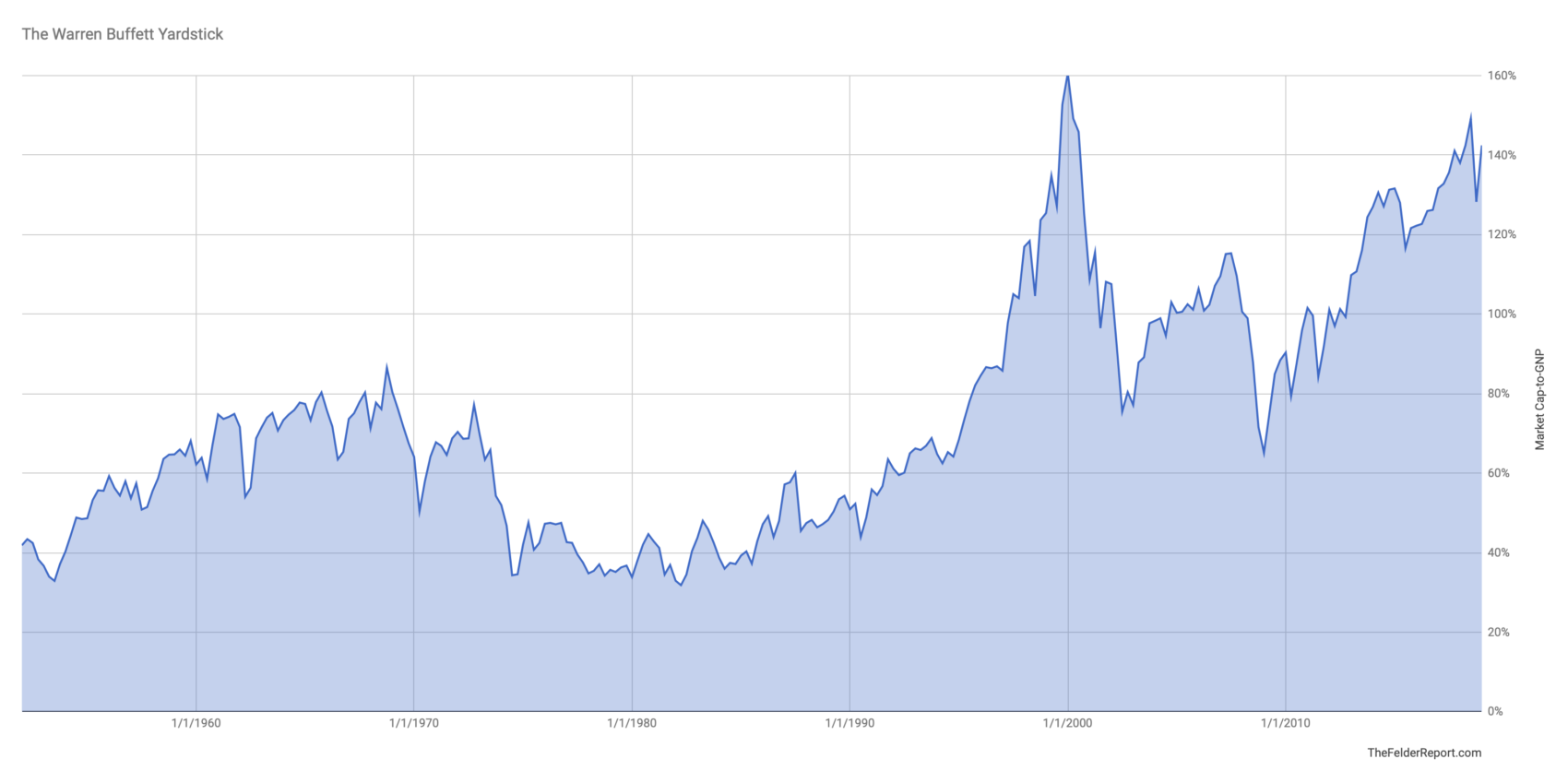

BofA's report paints a picture of a market characterized by elevated valuations across several key sectors. Understanding this assessment is crucial for developing a robust investment strategy.

Elevated Valuations Across Sectors

BofA highlights significant overvaluation in specific sectors. For example, the technology sector, fueled by recent advancements in artificial intelligence and continued strong earnings, shows elevated Price-to-Earnings (P/E) ratios compared to historical averages. Similarly, the consumer discretionary sector, while benefiting from post-pandemic spending, also exhibits signs of overvaluation based on Price-to-Sales (P/S) ratios.

- Valuation Metrics: BofA employs several key metrics, including P/E ratios, P/S ratios, and Price-to-Book (P/B) ratios, to assess valuations across various sectors. Their analysis indicates that many sectors are trading at multiples significantly higher than their long-term averages.

- Contributing Factors: The current high valuations are attributed to several factors: persistently low interest rates, robust corporate earnings growth in many sectors, and continued technological innovation driving future growth expectations.

Identifying Potential Risks

While high valuations reflect positive market sentiment and expectations, BofA rightly identifies several potential risks:

- Market Corrections: The report acknowledges the potential for a market correction or even a more significant downturn if investor sentiment shifts or interest rates rise unexpectedly.

- Inflation and Interest Rates: Rising inflation and subsequent interest rate hikes by central banks could significantly impact stock valuations, particularly those of growth companies whose valuations are heavily reliant on future earnings.

- Shifting Investor Sentiment: A sudden change in investor confidence, triggered by geopolitical events, economic slowdown, or unexpected company news, could lead to a rapid sell-off, impacting overall market valuations.

BofA's Recommended Investment Strategies

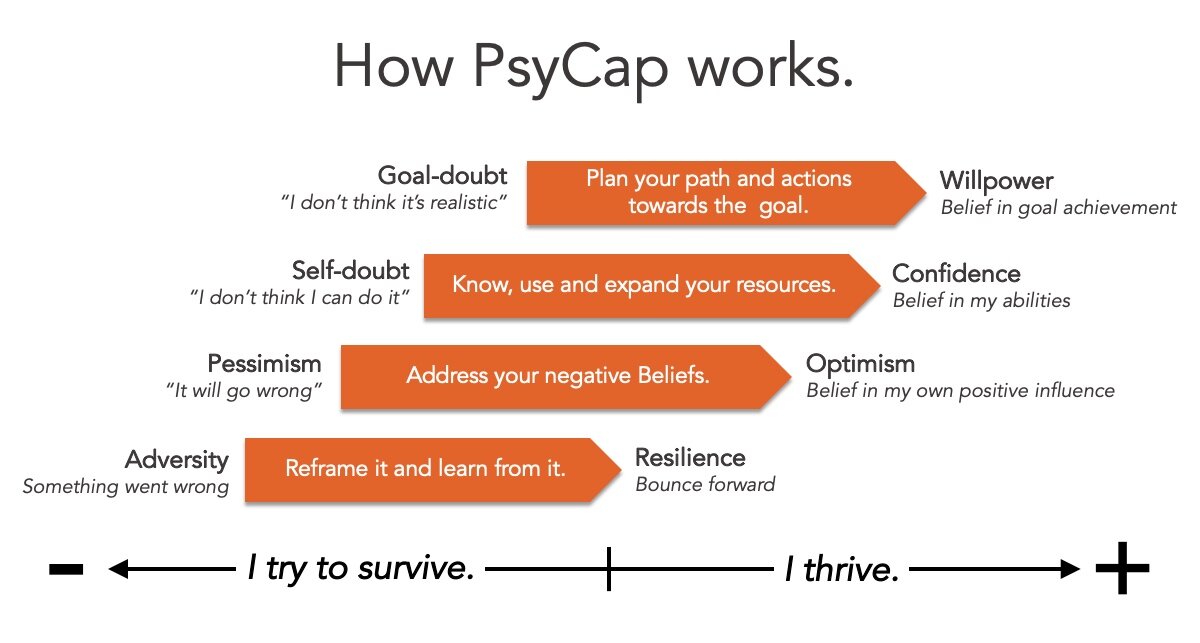

In light of these elevated valuations and inherent risks, BofA suggests a more cautious and strategic approach to investing.

Defensive Positioning Strategies

BofA recommends adopting a more defensive investment posture to mitigate potential downside risks:

- Diversification: Spread investments across various asset classes and sectors to reduce overall portfolio risk. Don't put all your eggs in one basket.

- Value Investing: Focus on companies trading at lower valuations relative to their fundamentals, offering a potentially higher margin of safety.

- Sector Rotation: Shift investments away from overvalued sectors towards those exhibiting more attractive valuations and growth prospects, such as healthcare or consumer staples. These sectors are often less sensitive to economic downturns.

Opportunities within Overvalued Sectors

Despite the overall concerns about overvaluation, BofA does not completely dismiss opportunities within sectors showing high valuations. Their analysis identifies specific companies with strong fundamentals and long-term growth potential that might still be attractive investments, even at current prices.

- Stock Selection: The report highlights several companies within seemingly overvalued sectors that exhibit exceptional financial strength, robust growth prospects, and innovative business models. These are identified based on BofA's rigorous internal research.

- Selection Criteria: The selection criteria for these identified opportunities include strong balance sheets, consistent earnings growth, a competitive moat (sustainable competitive advantage), and a clear path to future growth.

Comparing BofA's View with Other Market Analyses

It's important to note that BofA's assessment is not universally shared. While many analysts agree on the elevated valuations, other financial institutions and analysts hold varying perspectives on the severity of the risks and the appropriate investment strategies.

- Differing Viewpoints: Some analysts believe that current valuations are justified by strong economic growth and technological advancements, predicting continued upward momentum.

- Alternative Strategies: Other investment strategies, such as focusing on high-growth technology stocks or employing leveraged investing techniques, are also suggested by some, though these carry higher risk profiles.

Conclusion

BofA's analysis highlights legitimate concerns regarding stock market valuations, emphasizing the risks associated with current market conditions. While some sectors show signs of overvaluation, BofA recommends a cautious approach, emphasizing defensive strategies such as diversification and value investing. Although opportunities within overvalued sectors may exist for specific companies meeting stringent criteria, investors should proceed with caution. Remember to conduct your own thorough research, consult with a qualified financial advisor, and develop an investment strategy aligned with your personal risk tolerance and financial goals. Understanding investor concerns about stock market valuations and heeding insights from reputable sources like BofA is crucial for making informed investment decisions.

Featured Posts

-

Another 1 Billion Cut Trump Administration Targets Harvard Funding

Apr 22, 2025

Another 1 Billion Cut Trump Administration Targets Harvard Funding

Apr 22, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 22, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 22, 2025 -

Understanding The Value Of Middle Managers In Todays Workplace

Apr 22, 2025

Understanding The Value Of Middle Managers In Todays Workplace

Apr 22, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 22, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Their Properties

Apr 22, 2025 -

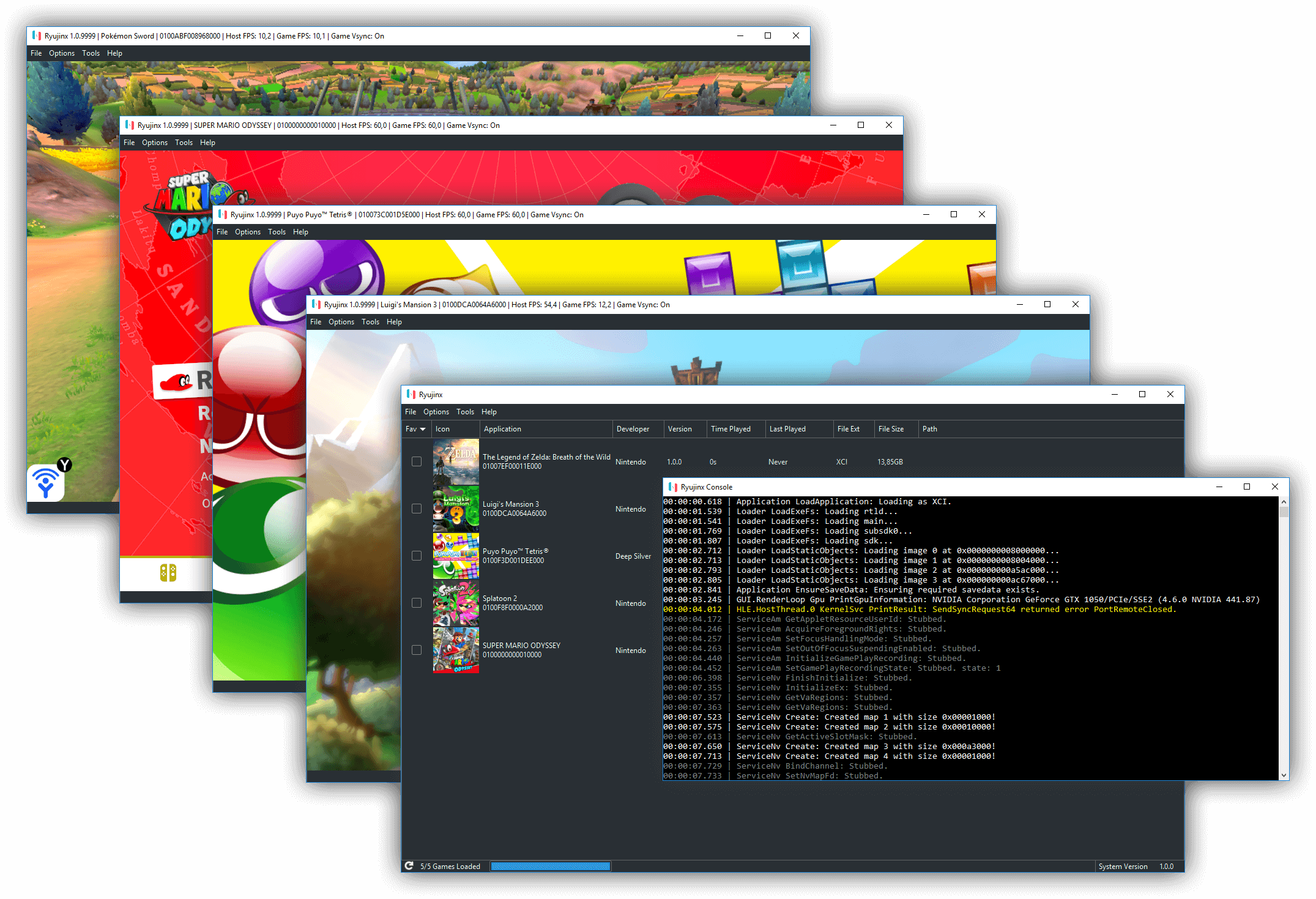

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025

Ryujinx Emulator Development Halted Nintendo Contact Confirmed

Apr 22, 2025