Investors: BofA's Reasons To Remain Calm Despite High Stock Market Valuations

Table of Contents

BofA's Bullish Outlook Despite Elevated Valuations

Despite acknowledging the elevated stock market valuations, BofA maintains a cautiously bullish outlook. Their reasoning rests on two significant pillars: robust corporate earnings growth and resilient consumer spending.

Strong Corporate Earnings Growth

BofA's analysts point to strong corporate earnings as a primary justification for current valuations. This isn't mere speculation; it's backed by concrete data and analysis.

- Sustained growth in key sectors: Sectors like technology, healthcare, and consumer staples continue to show impressive earnings growth, potentially offsetting the impact of inflationary pressures. This sustained growth is a key indicator of underlying economic strength.

- Strong balance sheets: Many corporations boast robust balance sheets, providing a significant buffer against potential economic downturns or unexpected market volatility. This financial resilience allows companies to weather storms and continue delivering strong performance.

- Positive future projections: BofA's analysis of recent earnings reports and future projections indicates continued growth, reinforcing their confidence in the market's underlying strength. Their models take into account various economic factors to arrive at this optimistic projection.

Resilient Consumer Spending

Despite persistent inflation, consumer spending remains surprisingly robust. This resilience contributes significantly to the continued economic growth that supports high stock market valuations.

- Strong consumer confidence: While inflation impacts purchasing power, certain key consumer confidence indicators remain relatively strong, suggesting a continued willingness to spend. This suggests consumers are not overly concerned about the immediate economic outlook.

- Underlying factors: Several factors contribute to this resilience, including pent-up demand from the pandemic, strong employment figures in many sectors, and government support measures in certain regions.

- Potential downsides acknowledged: BofA acknowledges the potential downsides, including the possibility of a slowdown in consumer spending if inflation persists or interest rates rise significantly. However, their analysis suggests that these risks are currently mitigated by the factors mentioned above.

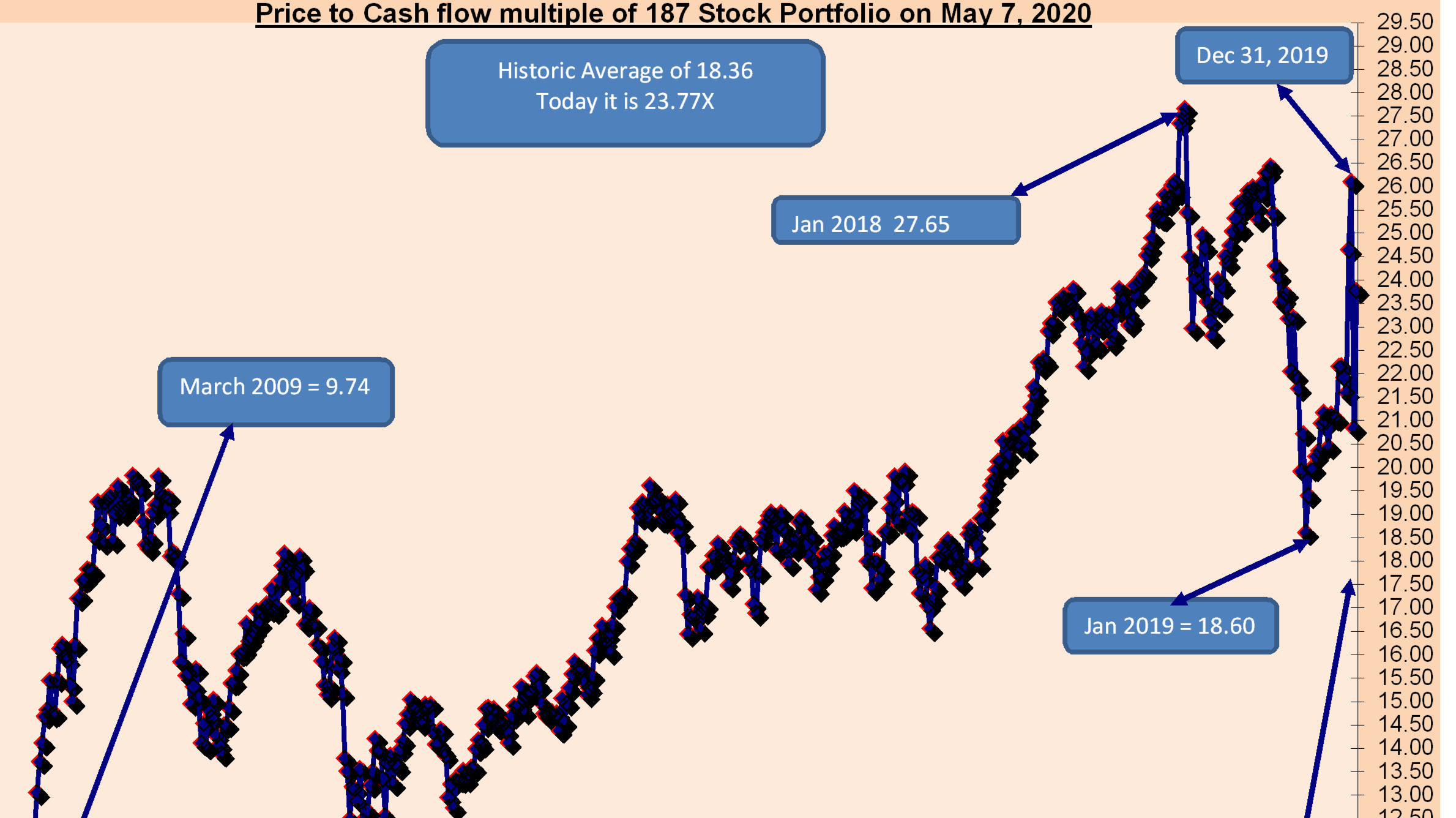

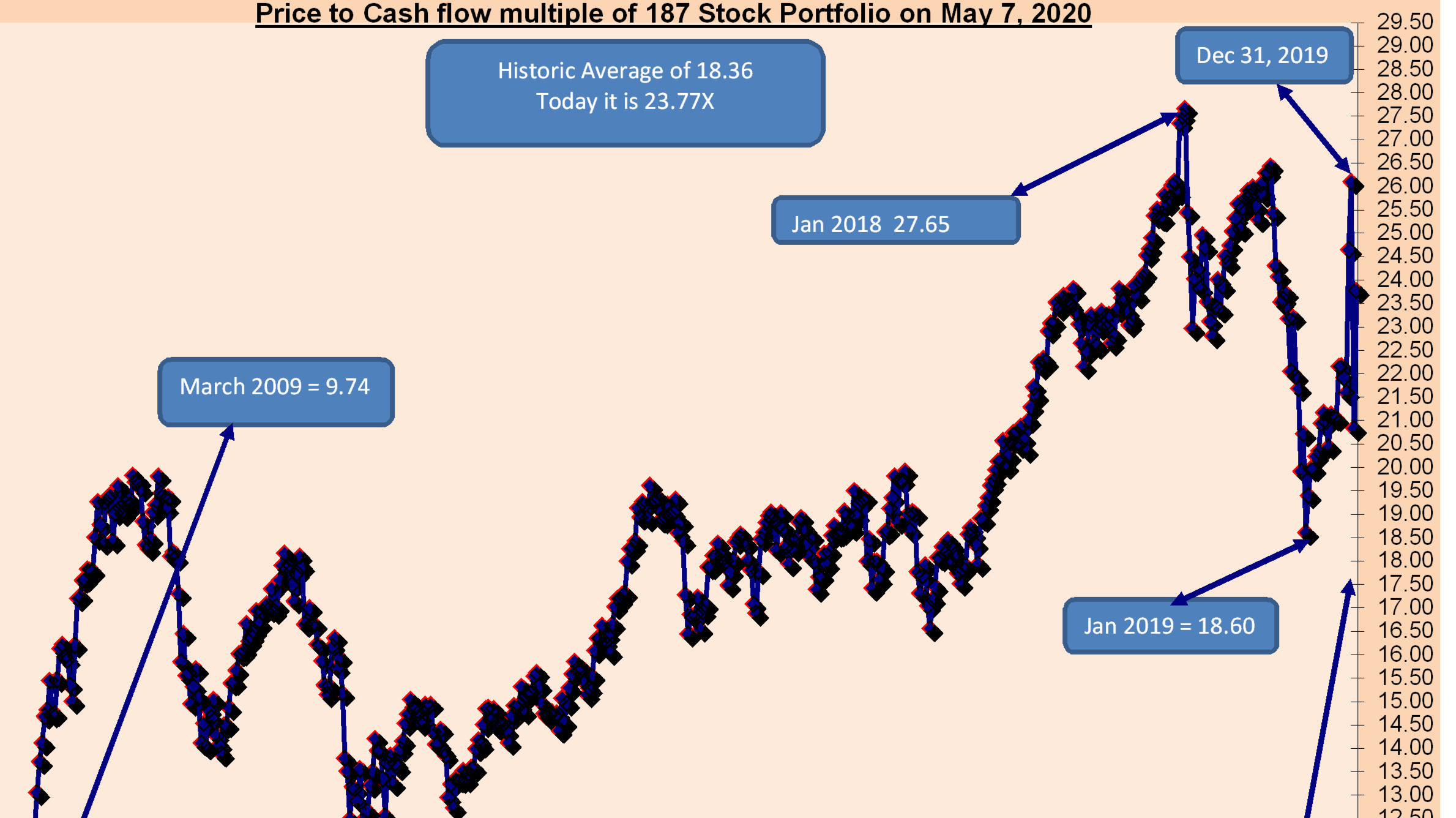

Addressing Concerns About High Stock Market Valuations

The concern about high stock market valuations is understandable. However, BofA addresses this concern by emphasizing long-term growth potential and strategies for managing market volatility.

Long-Term Growth Potential

BofA's analysts emphasize that focusing solely on current valuations can be misleading. They highlight the market's significant long-term growth potential, suggesting that current prices are justified by future prospects.

- High-growth sectors: Several sectors, particularly within technology and renewable energy, are poised for explosive long-term growth, potentially justifying higher valuations.

- Long-term investment strategies: BofA advocates for long-term investment strategies, emphasizing the benefits of riding out short-term market fluctuations to capture long-term gains. This approach minimizes the impact of short-term volatility.

- Statistical data and projections: Their analysis incorporates extensive statistical data and sophisticated forecasting models to support their long-term growth projections.

Managing Market Volatility

While acknowledging the inherent volatility of the stock market, BofA provides valuable insights into managing risk effectively.

- Portfolio diversification: Diversifying investments across various asset classes is crucial for mitigating risk. Spreading investments across stocks, bonds, and other assets reduces exposure to any single market segment's potential downturn.

- Long-term investment horizon: Maintaining a long-term investment horizon allows investors to weather short-term market fluctuations. Short-term market movements are less relevant over a longer investment timeframe.

- Risk management techniques: BofA's recommendations include detailed risk management techniques, such as stop-loss orders and hedging strategies, designed to protect investments during periods of increased volatility.

The Importance of a Balanced Investment Strategy

BofA underscores the critical role of a well-balanced and actively managed investment strategy in navigating the current market conditions.

Considering Different Asset Classes

Diversification is not just a buzzword; it's a cornerstone of responsible investing.

- Diversification strategies: BofA recommends detailed diversification strategies that consider risk tolerance and financial goals. This involves allocating funds across a variety of assets with differing risk profiles.

- Asset class examples: This could involve a mix of stocks (both large-cap and small-cap), bonds (government and corporate), real estate, and potentially alternative investments. Each asset class has a unique risk/reward profile.

- Alignment with BofA's recommendations: BofA's suggestions align with constructing a well-diversified portfolio that balances risk and return, in line with individual investor profiles.

Regular Portfolio Review and Adjustment

Investing is not a set-it-and-forget-it proposition. Active management is key.

- Regular review frequency: BofA recommends regular portfolio reviews, ideally quarterly or even more frequently depending on market conditions and individual circumstances.

- Factors to consider: These reviews should consider factors such as changes in market conditions, individual financial goals, and risk tolerance.

- Effective portfolio review: This process involves analyzing performance, reassessing risk exposure, and making necessary adjustments to maintain alignment with long-term goals.

Conclusion

BofA's comprehensive analysis suggests that while high stock market valuations are a valid concern, several compelling factors support a cautiously optimistic outlook. Strong corporate earnings, resilient consumer spending, and significant long-term growth potential all contribute to their recommendation to remain calm amidst market volatility. However, maintaining a balanced investment strategy, incorporating effective diversification and regular portfolio reviews, remains crucial for navigating the complexities of the market successfully.

Call to Action: Don't let high stock market valuations trigger panic selling. Follow BofA's advice and adopt a measured and informed approach to your investments. Learn more about building a robust and diversified investment strategy that can weather market fluctuations. Understand BofA's reasoning and develop your own calm and effective investment plan today.

Featured Posts

-

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025

Abu Dhabi Open Bencics Dominant Win

Apr 27, 2025 -

A Study Of Canadian Political Sentiment Anti Trump Views Across Provinces

Apr 27, 2025

A Study Of Canadian Political Sentiment Anti Trump Views Across Provinces

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025 -

Coalition Stability Amidst Bsw Leadership Change Crumbachs Departure And Spds Response

Apr 27, 2025

Coalition Stability Amidst Bsw Leadership Change Crumbachs Departure And Spds Response

Apr 27, 2025 -

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Latest Posts

-

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025

Proposed Starbucks Raise Rejected By Union

Apr 28, 2025 -

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 28, 2025 -

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 28, 2025

Unionized Starbucks Employees Turn Down Companys Pay Raise Proposal

Apr 28, 2025 -

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

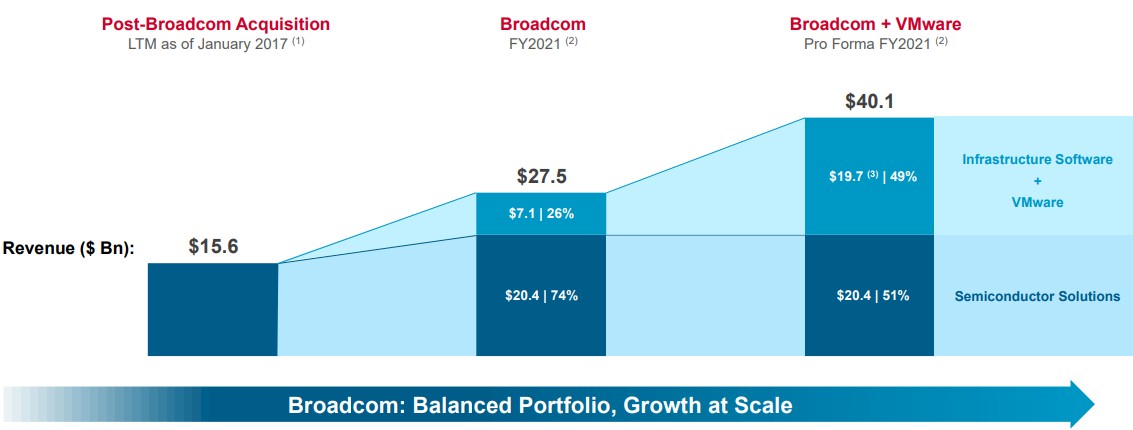

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025