Investors Pile Into ETFs: Record Inflows Despite Market Volatility

Table of Contents

Why are Investors Choosing ETFs in Volatile Markets?

Investors are increasingly turning to ETFs as a safe haven and a strategic tool during periods of market uncertainty. This preference stems from several key advantages ETFs offer over other investment vehicles.

Diversification and Risk Management

ETFs provide unparalleled diversification, allowing investors to spread their risk across various asset classes, sectors, and geographies. This is crucial in volatile markets, where individual stocks can experience significant price swings. Unlike painstakingly building a diversified portfolio by selecting individual stocks, ETFs offer instant diversification with a single purchase.

- Broad Market ETFs: These track major market indices like the S&P 500, providing exposure to a wide range of large-cap companies.

- Sector-Specific ETFs: These focus on specific industry sectors (e.g., technology, healthcare, energy), allowing investors to target particular market segments.

- International ETFs: These offer access to international markets, providing geographic diversification and reducing reliance on a single country's economic performance.

- Bond ETFs: These offer exposure to a diverse range of fixed-income securities, providing stability and income generation during equity market downturns.

The ease of achieving diversification through ETFs is a significant factor driving their popularity, especially among less experienced investors.

Cost-Effectiveness and Low Fees

ETFs are generally known for their low expense ratios compared to mutual funds and actively managed funds. These lower fees translate to greater long-term returns, a crucial advantage in any market environment, but particularly beneficial during periods of volatility when preserving capital is paramount.

- ETF Fees: Expense ratios for ETFs typically range from 0.05% to 0.5% annually, significantly lower than the fees associated with actively managed funds, which can often exceed 1%.

- Impact on Long-Term Returns: Even small differences in expense ratios can compound over time, leading to substantial differences in final investment values. Lower fees directly contribute to higher risk-adjusted returns.

The cost-effectiveness of ETFs makes them an attractive option for both seasoned and novice investors seeking to maximize their returns.

Liquidity and Accessibility

ETFs trade on major stock exchanges like stocks, offering high liquidity and flexibility. This means investors can buy and sell ETFs easily and quickly throughout the trading day, unlike less liquid investments such as real estate or private equity. This liquidity is particularly valuable in volatile markets, where investors may need to adjust their portfolios quickly.

- Ease of Trading: ETFs can be bought and sold through most brokerage accounts with ease, making them accessible to a broad range of investors.

- Accessibility for Retail Investors: Unlike some alternative investments requiring significant capital, ETFs are available to retail investors with even modest investment amounts.

This accessibility and liquidity are key factors contributing to the growing popularity of ETFs among everyday investors.

Which Types of ETFs are Seeing the Most Inflows?

While broad market ETFs remain popular, certain sectors are experiencing particularly strong inflows, reflecting evolving investor sentiment and market trends.

Growth of Specific ETF Sectors

Recent data reveals significant inflows into several ETF categories:

- Technology ETFs: Despite recent market corrections, technology remains a significant area of interest for investors, driving strong inflows into technology-focused ETFs.

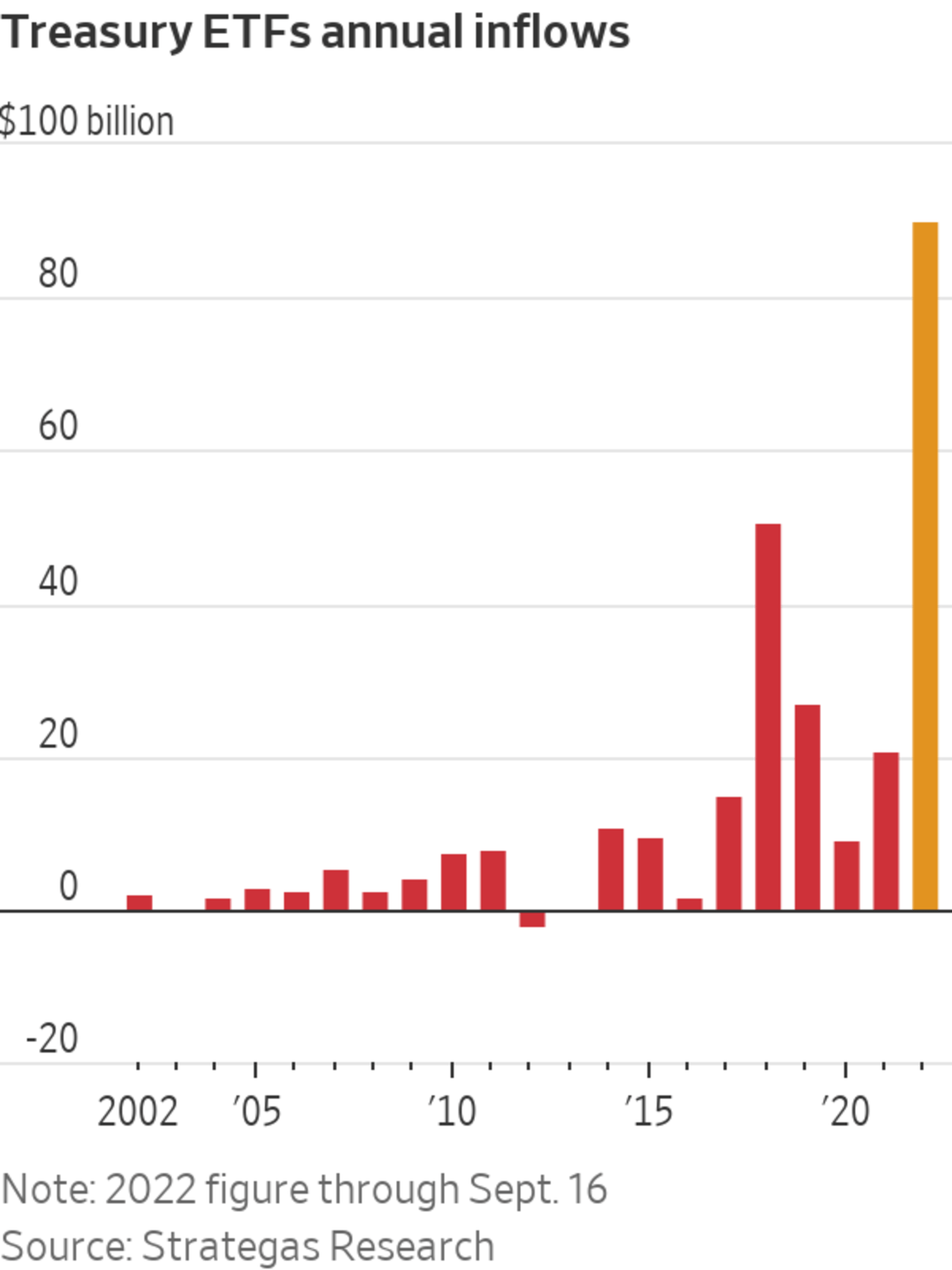

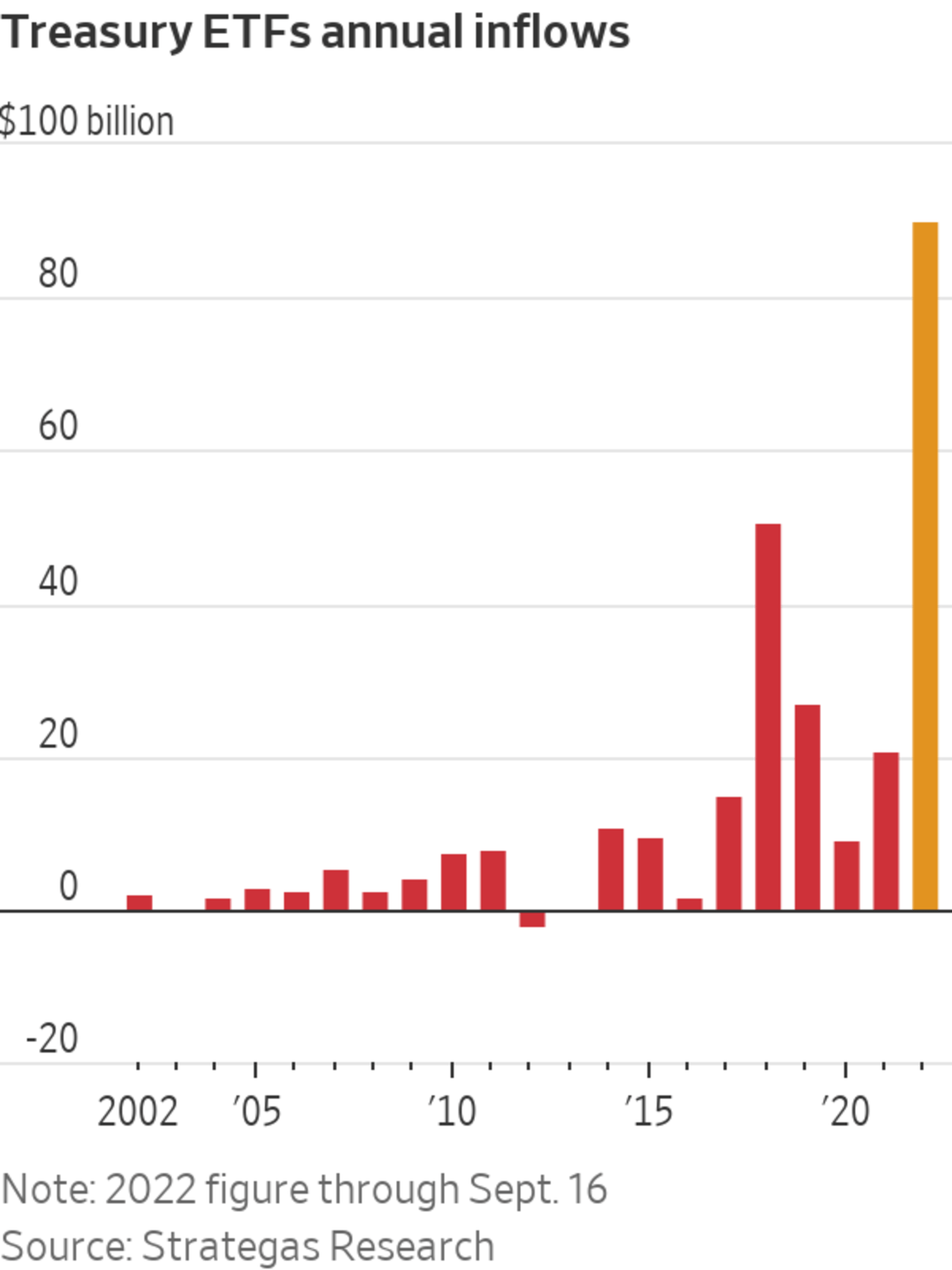

- Bond ETFs: As interest rates rise, investors are increasingly seeking the stability and income offered by bond ETFs. High-quality government bond ETFs and corporate bond ETFs have seen significant inflows.

- Sustainable/ESG ETFs: Growing environmental, social, and governance (ESG) concerns are fueling demand for ETFs that align with sustainable investment principles.

These trends highlight the dynamic nature of ETF investment, with investor preferences shifting based on prevailing economic and market conditions.

The Rise of Thematic ETFs

Thematic ETFs, which focus on specific investment themes or trends, are experiencing a surge in popularity. These ETFs provide exposure to companies involved in cutting-edge technologies and megatrends.

- Artificial Intelligence ETFs: The rapid advancement of artificial intelligence is driving significant investment in related technologies and companies.

- Renewable Energy ETFs: The global shift toward renewable energy sources is attracting considerable investor interest in this burgeoning sector.

Thematic ETFs appeal to investors seeking exposure to high-growth potential sectors, even during market volatility. However, it's crucial to remember that these ETFs can be more volatile than broad market ETFs due to their concentrated focus.

What Does This Trend Mean for the Future of Investing?

The current trend of record inflows into ETFs points to significant changes in the investment landscape.

The Continued Dominance of ETFs

The ongoing popularity of ETFs suggests they are poised for continued growth and market share dominance.

- Predictions for ETF Growth: Industry analysts anticipate substantial growth in the ETF market in the coming years, fueled by increasing investor awareness and demand for diversified, low-cost investment options.

- Impact on Broader Financial Markets: The increasing dominance of ETFs is likely to impact the broader financial markets, influencing pricing and liquidity dynamics.

The convenience, diversification, and cost-effectiveness of ETFs are likely to solidify their position as a leading investment vehicle.

Potential Risks and Considerations

While ETFs offer many advantages, investors should be aware of potential risks:

- Market Downturns: Even diversified ETFs are susceptible to market downturns.

- Sector-Specific Risks: Investors focusing on sector-specific ETFs should be aware of the inherent risks associated with those sectors.

- Understanding ETF Holdings: Investors need to carefully review the underlying holdings and expense ratios of ETFs before investing.

- Liquidity Risk in Unusual Markets: While usually liquid, extremely volatile periods may impact the ability to buy or sell at desired prices.

Diversification, dollar-cost averaging, and thorough due diligence are crucial strategies for mitigating these risks.

Investors Pile Into ETFs – A Smart Strategy for Uncertain Times?

In conclusion, the record inflows into ETFs highlight the appeal of their diversification benefits, cost-effectiveness, and liquidity, particularly in volatile market conditions. This trend is likely to shape the future of investing, solidifying ETFs' place as a cornerstone investment vehicle. Explore ETF investments to diversify your portfolio and navigate market uncertainties effectively. Learn more about investing in ETFs today to make informed decisions about your financial future. By understanding the advantages and potential risks, investors can leverage ETFs to build robust and resilient investment portfolios designed to weather market fluctuations.

Featured Posts

-

Prakiraan Cuaca Detail Jawa Barat 7 Mei Hujan Diperkirakan Sampai Sore

May 28, 2025

Prakiraan Cuaca Detail Jawa Barat 7 Mei Hujan Diperkirakan Sampai Sore

May 28, 2025 -

Ramalan Cuaca Sumatra Utara Update Terkini Medan Karo Nias Toba

May 28, 2025

Ramalan Cuaca Sumatra Utara Update Terkini Medan Karo Nias Toba

May 28, 2025 -

Samsung Galaxy S25 256 Go Le Top Produit A 775 00 E

May 28, 2025

Samsung Galaxy S25 256 Go Le Top Produit A 775 00 E

May 28, 2025 -

Arsenal Prepare Bid For Real Madrid Star Rodrygo

May 28, 2025

Arsenal Prepare Bid For Real Madrid Star Rodrygo

May 28, 2025 -

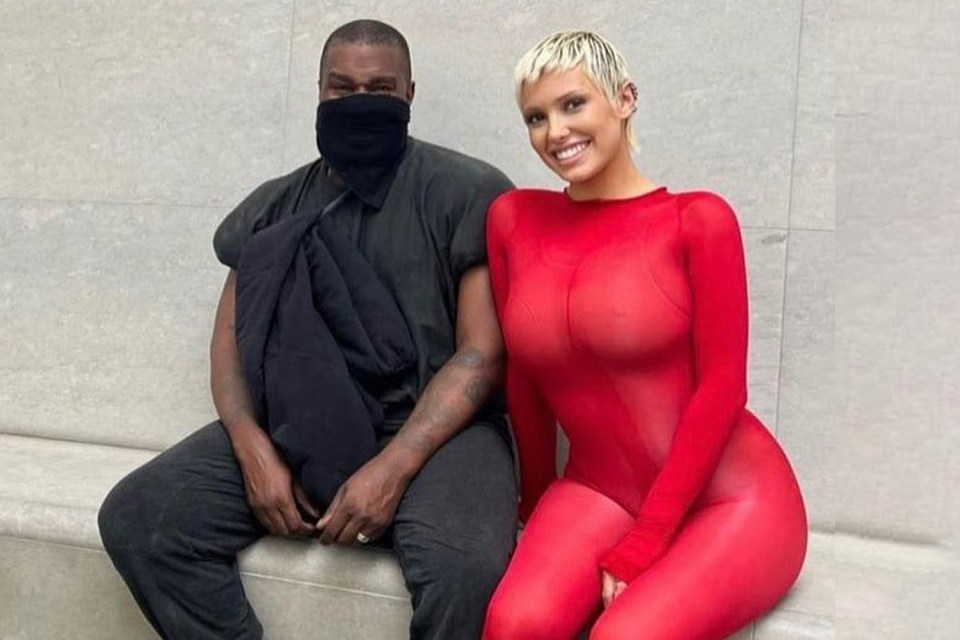

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025