Iron Ore Falls As China Curbs Steel Output: Impact And Analysis

Table of Contents

China's Steel Production Curbs: The Driving Force Behind the Iron Ore Price Drop

China's recent policies aimed at reducing steel production are the primary catalyst for the decline in iron ore prices. Driven by growing environmental concerns and a need to address overcapacity in the steel industry, the Chinese government has implemented several stringent measures. These include stricter environmental regulations targeting steel mills, production quotas imposed on major steel-producing regions, and a crackdown on illegal steel production.

- Specific government regulations impacting steel mills: These regulations focus on emission limits for pollutants like sulfur dioxide and particulate matter, leading to increased compliance costs and production limitations for many mills.

- Production quotas imposed on major steel-producing regions: Provinces like Hebei, a major steel-producing hub, have seen significant production cuts mandated by the government.

- Impact of environmental regulations on steel production capacity: The stricter environmental standards have forced many smaller, less efficient steel mills to shut down, further reducing overall production capacity.

- Statistics demonstrating the decrease in steel output: Data from [Source: Cite a relevant statistical source, e.g., the National Bureau of Statistics of China] shows a [Percentage]% decrease in steel output during [Time Period], directly correlating with the drop in iron ore prices.

Impact on Iron Ore Prices: A Supply and Demand Imbalance

The reduced demand for steel in China has directly translated into a sharp decrease in demand for iron ore, the primary raw material used in steelmaking. This supply and demand imbalance is the core reason behind the falling iron ore prices.

- Charts illustrating the price drop of iron ore: [Insert a chart showing the price fluctuation of iron ore, clearly showing the recent decline. Source the chart appropriately.]

- Impact on major iron ore mining companies: Major iron ore producers like BHP Group, Rio Tinto, and Vale have experienced significant revenue declines due to the lower prices.

- Analysis of supply chain disruptions: The price drop has led to disruptions in the global iron ore supply chain, with some miners forced to cut production or face financial losses.

- Speculation and its role in price volatility: Market speculation has exacerbated the price volatility, with traders reacting to news and forecasts regarding China's steel production and economic outlook. This amplifies the impact of the initial price drop.

Global Implications: Ripple Effects Across the Commodity Market

The decline in iron ore prices and China's steel production cuts have far-reaching global consequences, extending beyond the immediate iron and steel industry.

- Impact on shipping industries and freight rates: Reduced demand for iron ore transportation has led to lower freight rates, impacting shipping companies and related logistics businesses.

- Effects on construction projects globally: The higher cost of steel, a consequence of the iron ore price drop and reduced supply, will impact global construction projects, potentially delaying or downsizing some initiatives.

- Potential for job losses in related industries: The downturn could result in job losses within the mining, transportation, and construction sectors across countries reliant on iron ore exports and steel production.

- Geopolitical implications for iron ore-producing and importing nations: The reduced demand for iron ore could create economic strain on nations heavily reliant on iron ore exports, potentially leading to geopolitical tensions.

Forecasting Future Trends: Will Iron Ore Prices Recover?

Predicting the future of iron ore prices requires considering several factors. While the current downturn is significant, several scenarios could lead to a price recovery.

- Predictions for future iron ore demand from China and other countries: China's long-term economic growth and infrastructure development plans will significantly influence future iron ore demand. Growth in other developing economies will also play a role.

- The role of technological advancements in steel production: Innovations in steelmaking processes, such as the use of scrap metal and more efficient production methods, could impact future iron ore demand.

- Potential for increased investment in sustainable steel production: A shift towards greener steel production methods could create new demands for certain types of iron ore and influence market dynamics.

- Predictions regarding the recovery timeline for iron ore prices: The recovery timeline is uncertain and depends on the interplay of the factors mentioned above. However, experts predict a [Timeframe] for a potential recovery, based on [cite sources].

Conclusion: Navigating the Volatility – Understanding the Future of Iron Ore Falls and Steel Production

The fall in iron ore prices is undeniably linked to China's efforts to curb steel production. This action has created a global impact, affecting supply chains, related industries, and the global economy. While the immediate future remains uncertain, understanding the interplay between China's steel production policies, global demand, and technological advancements is crucial for navigating the volatility of the iron ore market. To stay informed about the evolving dynamics of the "Iron Ore Market Analysis," "China Steel Production Impact," and "Iron Ore Price Predictions," follow [Link to your website or relevant resource]. Understanding these complex relationships will be essential for informed decision-making in this dynamic sector.

Featured Posts

-

Real Id Enforcement Summer Travel Planning Guide

May 09, 2025

Real Id Enforcement Summer Travel Planning Guide

May 09, 2025 -

Why Is The Us Attorney General On Fox News Every Day A More Important Question Than Epstein

May 09, 2025

Why Is The Us Attorney General On Fox News Every Day A More Important Question Than Epstein

May 09, 2025 -

Silniy Snegopad Aeroport Permi Otmenil Reysy

May 09, 2025

Silniy Snegopad Aeroport Permi Otmenil Reysy

May 09, 2025 -

From 3 K Babysitter To 3 6 K Daycare A Financial Nightmare

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare A Financial Nightmare

May 09, 2025 -

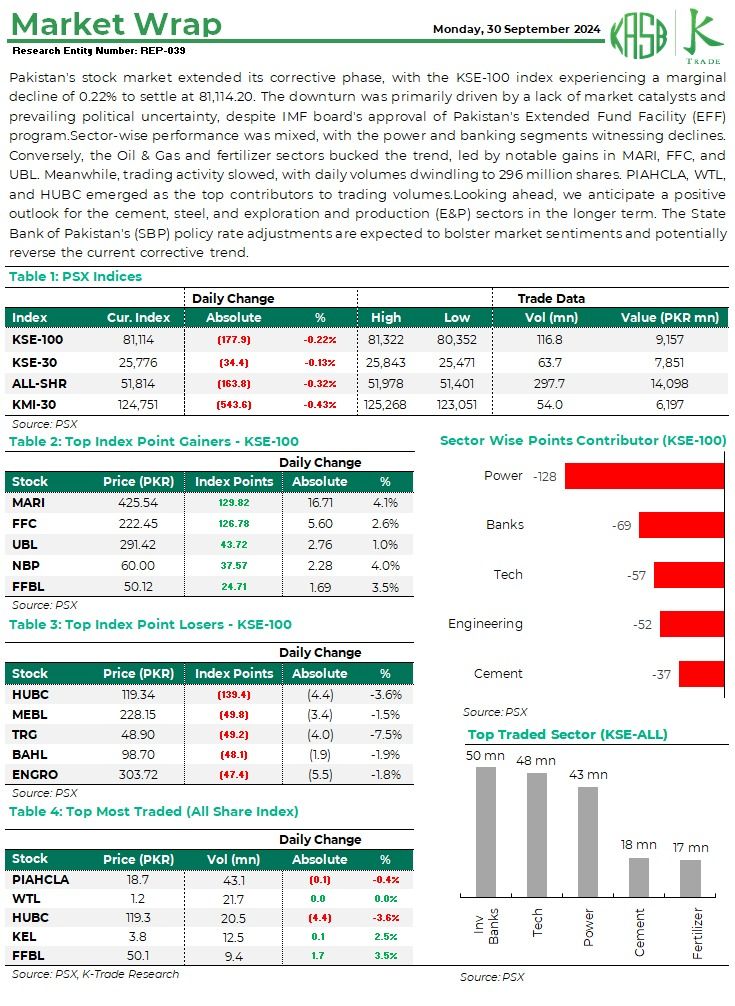

Opening The Stock Market Jazz Cash And K Trades Partnership

May 09, 2025

Opening The Stock Market Jazz Cash And K Trades Partnership

May 09, 2025