Iron Ore Market Volatility: Understanding China's Steel Production Cuts

Table of Contents

China's Steel Production Cuts: The Driving Force

China's recent reduction in steel production is the primary catalyst for the current iron ore market volatility. Several factors contribute to this significant decrease:

-

Increased environmental regulations: China's commitment to reducing carbon emissions has led to stricter environmental regulations on steel mills. These regulations limit production and impose hefty fines for non-compliance, directly impacting output. The goal is to achieve carbon neutrality, forcing a restructuring of the steel industry.

-

Slowdown in the Chinese real estate sector: The Chinese property market, a major consumer of steel, has experienced a significant slowdown. This reduced demand for construction materials has cascaded down the supply chain, resulting in lower steel production. Over-leveraged developers and government crackdowns on excessive borrowing contributed to this slowdown.

-

Government initiatives to curb excess steel production capacity: The Chinese government has actively worked to consolidate and streamline its steel industry, aiming to eliminate excess capacity and promote more efficient production. This involves shutting down inefficient or polluting steel mills, further reducing overall output.

Statistics reveal a significant drop in steel production. Estimates suggest a [Insert Percentage]% decrease in steel output during [Insert Time Period], representing a reduction of approximately [Insert Tonnage] tons. This directly impacts Chinese steel mills, many of which rely heavily on imported iron ore, significantly reducing demand and contributing to iron ore price fluctuations.

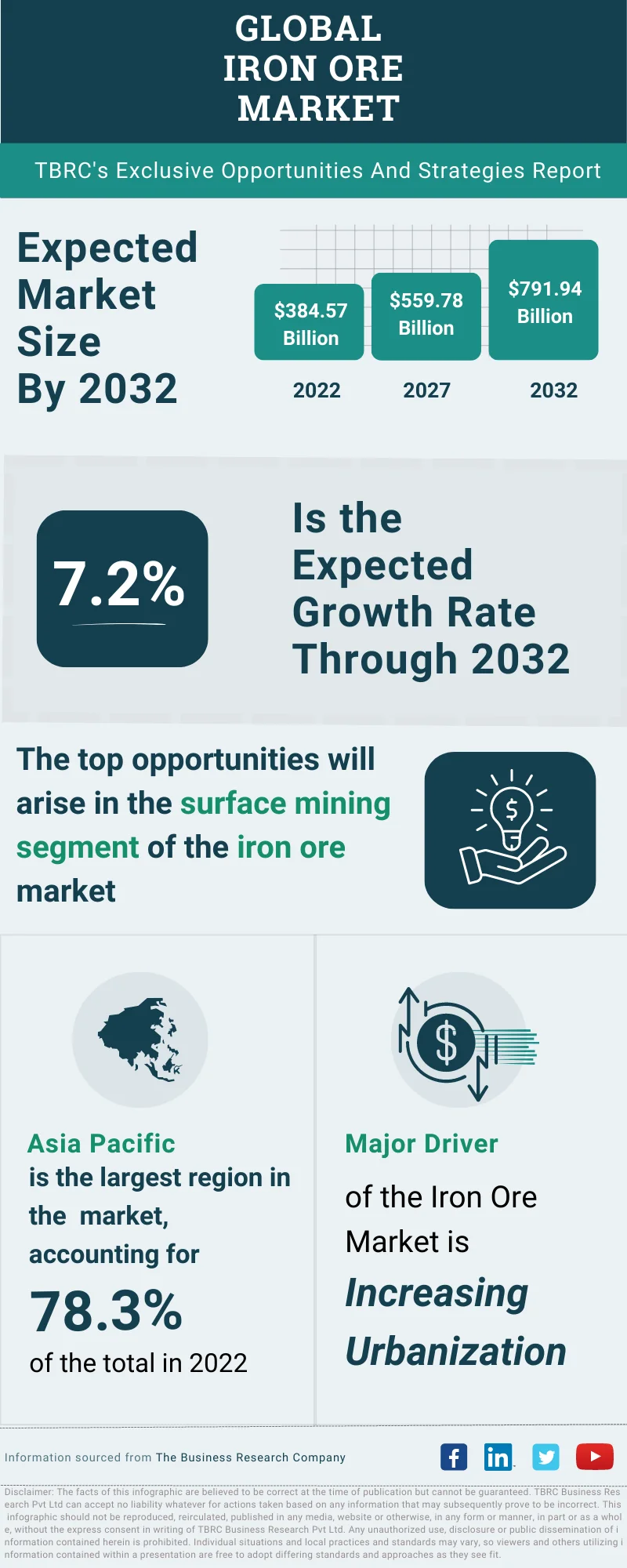

Impact on Global Iron Ore Prices

The direct correlation between reduced Chinese steel production and the price of iron ore is undeniable. The decreased demand from China, the world's largest steel producer and iron ore importer, has created a surplus in the global iron ore market. This surplus has led to a significant drop in iron ore prices.

The supply and demand dynamics are clear: a decrease in demand from China leads to lower iron ore prices. This impacts major iron ore producers like Australia and Brazil, who are heavily reliant on Chinese demand. The price volatility creates uncertainty for market participants, including investors, miners, and steel manufacturers, who face challenges in hedging against such dramatic price swings.

(Insert chart or graph illustrating iron ore price fluctuations during the relevant period)

Geopolitical Factors Influencing Iron Ore Market Volatility

Beyond domestic Chinese factors, geopolitical issues also contribute to iron ore market volatility:

-

International trade relations and potential trade disputes: Trade tensions between countries can significantly impact iron ore trade flows. Tariffs or trade restrictions can disrupt established supply chains and lead to price fluctuations.

-

Political risks in major iron ore producing regions: Political instability or unexpected policy changes in major producing countries can affect the supply of iron ore, creating uncertainty and price volatility. This includes factors such as mining regulations, labor disputes, and even geopolitical conflicts.

-

Currency fluctuations: Changes in the value of major currencies involved in iron ore trade (e.g., Australian dollar, Brazilian real, Chinese yuan) directly impact the price of iron ore, adding another layer of complexity to price forecasting.

Future Outlook for the Iron Ore Market

Predicting the future of iron ore prices requires careful consideration of several interconnected factors. While the current situation points towards a period of relatively low prices due to reduced Chinese demand, several factors may influence a potential recovery or further decline:

-

Projected growth in steel consumption in other regions: Increased steel consumption in countries like India and Southeast Asia could partially offset the reduced Chinese demand, offering some support to iron ore prices.

-

Technological advancements in steel production: Innovations in steelmaking technology, such as the adoption of more efficient and environmentally friendly processes, could influence future demand and production patterns.

-

Government policies and their influence on future steel demand: Government policies concerning infrastructure development, green initiatives, and overall economic growth in various countries will play a significant role in shaping future steel and, subsequently, iron ore demand.

Conclusion

China's steel production cuts are significantly impacting global iron ore market volatility through reduced demand. Geopolitical factors further contribute to the instability. Understanding these dynamics is crucial for investors and stakeholders in the iron ore industry. Iron ore price fluctuations are a constant challenge, requiring careful monitoring and strategic planning. Stay informed about the latest developments in the iron ore market volatility to make informed decisions and navigate the challenges of this dynamic market. Understanding iron ore price fluctuations is crucial for success in this sector. Follow [your website/source] for the latest analysis and updates on iron ore market trends.

Featured Posts

-

The Impact Of Caravan Sites Is This Uk City Becoming A Ghetto

May 09, 2025

The Impact Of Caravan Sites Is This Uk City Becoming A Ghetto

May 09, 2025 -

Summer Walker Shares Story Of Almost Dying In Childbirth

May 09, 2025

Summer Walker Shares Story Of Almost Dying In Childbirth

May 09, 2025 -

150 Million Payout For Credit Suisse Whistleblowers

May 09, 2025

150 Million Payout For Credit Suisse Whistleblowers

May 09, 2025 -

Scaling Tech And Innovation In Edmonton The New Unlimited Strategy

May 09, 2025

Scaling Tech And Innovation In Edmonton The New Unlimited Strategy

May 09, 2025 -

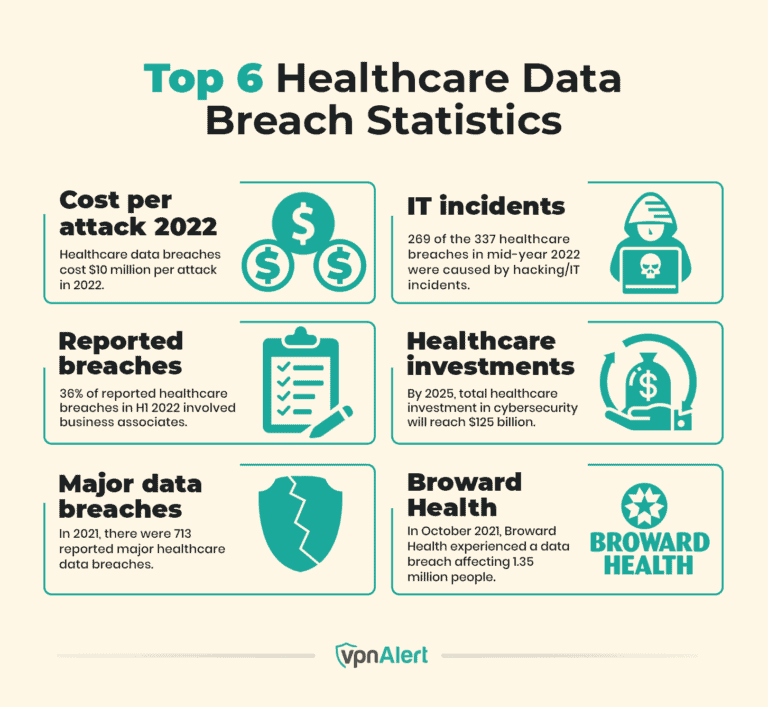

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025

Nottingham Hospital Data Breach Over 90 Nhs Staff Accessed Victim Records

May 09, 2025