Is $2,000 The Next Stop For Ethereum's Price? Analysis And Predictions

Table of Contents

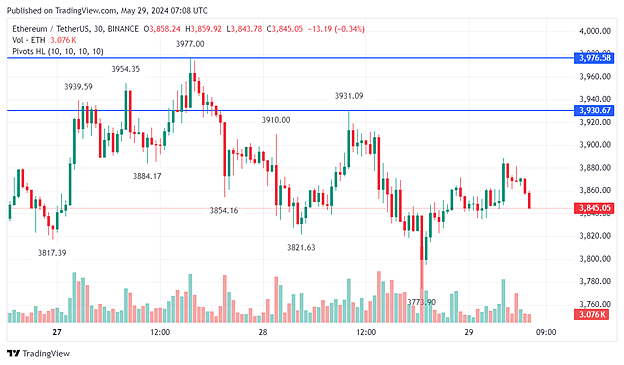

Analyzing Current Market Conditions for Ethereum

Several key factors shape the current market landscape for Ethereum and its potential price trajectory. Let's examine some of the most influential elements.

Ethereum's Technological Advancements

Ethereum 2.0, with its groundbreaking upgrades, is a major catalyst for potential price growth. The transition to a proof-of-stake consensus mechanism, sharding for improved scalability, and enhanced staking rewards are all significant improvements.

- Sharding: This innovative technology significantly increases transaction throughput, reducing congestion and lowering gas fees. This improved efficiency makes Ethereum more attractive for developers and users alike.

- Staking Rewards: The shift to proof-of-stake incentivizes users to lock up their ETH, reducing circulating supply and potentially increasing its value.

- Ethereum 2.0 Upgrades: The ongoing rollout of ETH 2.0 is a continuous process, with further enhancements and upgrades expected, promising even better performance and usability in the future. Keywords: Ethereum 2.0, ETH 2.0 upgrade, sharding, staking rewards, Ethereum scalability.

Adoption and DeFi Growth

The burgeoning Decentralized Finance (DeFi) ecosystem is intrinsically linked to Ethereum's success. The vast majority of DeFi applications are built on the Ethereum blockchain, driving substantial demand for ETH.

- Total Value Locked (TVL): A high Total Value Locked in DeFi protocols indicates strong user engagement and confidence in the Ethereum network, which generally correlates with price appreciation.

- Ethereum DeFi Applications: The continuous innovation and expansion of DeFi applications contribute significantly to Ethereum's adoption and network effects. This increasing utility is a key driver of long-term price growth. Keywords: DeFi, Decentralized Finance, Ethereum DeFi, Total Value Locked (TVL), DeFi growth, ETH adoption.

Macroeconomic Factors and Their Influence

External economic factors play a significant role in shaping cryptocurrency market trends. Global economic instability, inflation, and interest rate changes can dramatically influence investor sentiment and asset prices.

- Inflation and Interest Rates: High inflation and rising interest rates generally lead to a flight to safety, potentially impacting investor appetite for riskier assets like cryptocurrencies.

- Correlation with Traditional Markets: While cryptocurrencies exhibit a degree of independence, they are not entirely immune to the influence of traditional financial markets. Negative trends in the stock market or other asset classes can negatively impact the cryptocurrency market. Keywords: crypto market, Bitcoin price, macroeconomic factors, inflation, interest rates, cryptocurrency market analysis.

Predictive Models and Expert Opinions on Ethereum's Price

Predicting future prices with certainty is impossible, but various analytical methods and expert opinions can offer valuable insights.

Technical Analysis

Technical analysis uses charts and historical price data to identify patterns and predict future price movements.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can indicate trends and potential support/resistance levels.

- RSI and MACD: Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can help gauge momentum and potential price reversals. Keywords: Ethereum technical analysis, support level, resistance level, moving average, RSI, MACD, technical indicators.

Fundamental Analysis

Fundamental analysis focuses on the intrinsic value of Ethereum, examining its underlying technology, adoption rate, and future development prospects.

- Ethereum's Value Proposition: The inherent value of Ethereum lies in its robust and versatile blockchain technology, facilitating a wide range of applications.

- Adoption Rate: Continued widespread adoption by developers, businesses, and users is crucial for sustained price appreciation. Keywords: Ethereum fundamentals, Ethereum value proposition, long-term Ethereum price prediction, Ethereum adoption rate.

Expert Predictions and Market Sentiment

Tracking expert opinions and overall market sentiment can offer valuable context to price predictions.

- Analyst Forecasts: Leading cryptocurrency analysts often share their forecasts, providing diverse perspectives on Ethereum's future price.

- Market Sentiment: Positive market sentiment generally leads to increased demand and price appreciation, while negative sentiment can trigger sell-offs. Keywords: Ethereum expert predictions, cryptocurrency analyst, market sentiment, Ethereum forecast.

Ethereum's Path to $2,000 and Beyond

Considering the technological advancements, DeFi growth, and macroeconomic factors, the possibility of Ethereum reaching $2,000 is plausible, but not guaranteed. Reaching this price point hinges on sustained adoption, positive market sentiment, and the successful execution of Ethereum 2.0's roadmap. While considerable potential exists, significant challenges remain, including regulatory uncertainty and market volatility.

Ultimately, investing in Ethereum, or any cryptocurrency, involves inherent risk. The information presented here is for informational purposes only and should not be construed as financial advice.

Stay informed on the latest Ethereum price predictions and conduct thorough research before making any investment decisions in this dynamic cryptocurrency. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025 -

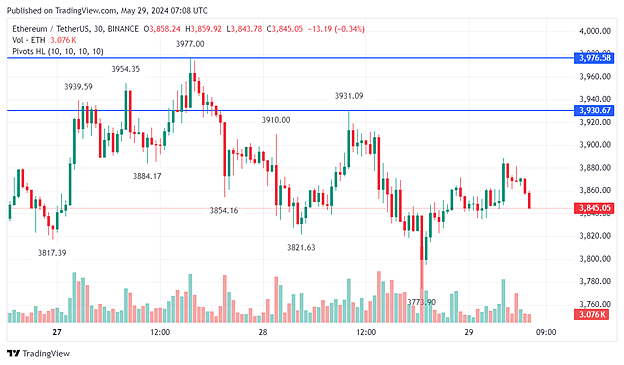

Star Wars Long Awaited Planet Is The Reveal Finally Here

May 08, 2025

Star Wars Long Awaited Planet Is The Reveal Finally Here

May 08, 2025 -

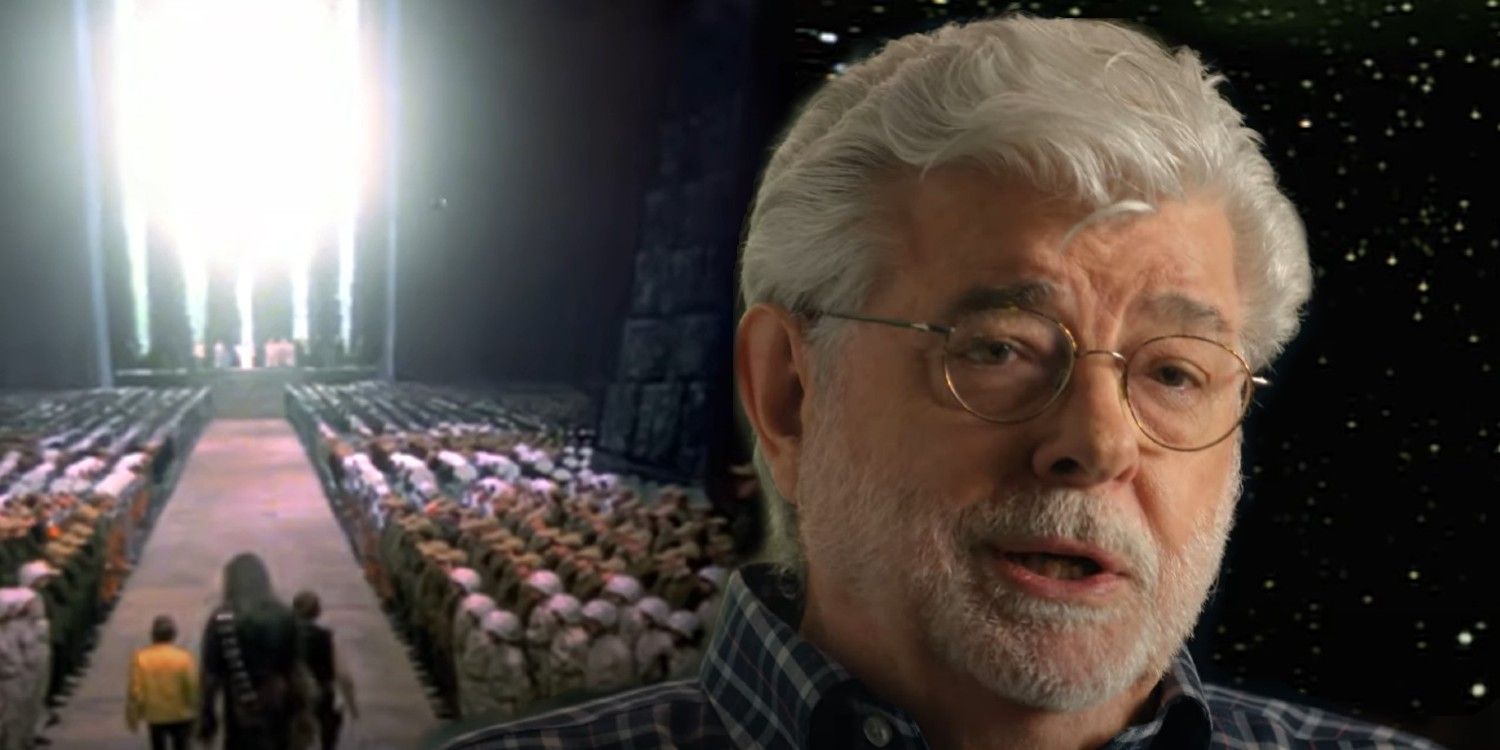

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025

Jayson Tatum Seemingly Confirms Sons Birth With Ella Mai In New Ad

May 08, 2025 -

Is Investing In Xrp Ripple A Smart Financial Decision For Your Future

May 08, 2025

Is Investing In Xrp Ripple A Smart Financial Decision For Your Future

May 08, 2025 -

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025

Jayson Tatum On Larry Bird Respect Inspiration And The Celtics Legacy

May 08, 2025