Is 40% Palantir Stock Growth In 2025 Achievable? Investment Analysis

Table of Contents

Palantir Technologies. The name conjures images of cutting-edge data analytics and lucrative government contracts. But can this translate into a significant 40% Palantir stock growth by 2025? The stock market is notoriously volatile, making precise predictions a fool's errand. This article delves into a comprehensive analysis to determine the feasibility of such ambitious Palantir stock growth, examining its current financial standing, market position, and the numerous factors influencing its future. We'll explore Palantir stock prediction models, considering both optimistic and pessimistic scenarios to offer a balanced perspective on Palantir investment opportunities.

2. Main Points:

2.1 Palantir's Current Market Position and Financial Performance:

H3: Analyzing Palantir's Recent Financials:

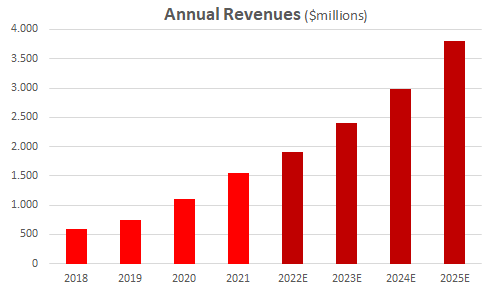

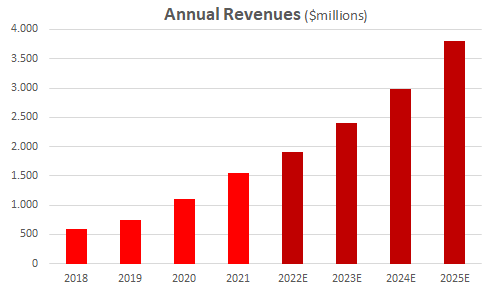

Palantir's recent financial performance provides a crucial baseline for any Palantir stock prediction. Examining quarterly and annual reports reveals key trends. Let's look at some concrete data points:

- Revenue Growth: While Palantir has shown consistent revenue growth, the rate of growth needs to be considered in relation to the ambitious 40% stock growth target. Analyzing the past few years' growth trajectories provides a crucial insight into sustainable growth potential.

- Profitability: Palantir's path to profitability is a critical factor. Analyzing net income, operating margins, and free cash flow provides a clear picture of its financial health and its capacity for future investments and returns. Positive trends here are vital for bolstering Palantir stock value.

- Key Performance Indicators (KPIs): Tracking KPIs such as customer acquisition cost, average revenue per user, and customer churn rate offers granular insights into the efficiency and sustainability of Palantir's business model. Improving KPIs strengthens the argument for future Palantir stock growth.

- Government vs. Commercial Sales: Palantir's reliance on government contracts influences its revenue stability and growth potential. A diversification toward commercial clients is vital for reducing risk and enhancing long-term growth.

H3: Competitive Landscape and Market Share:

Palantir operates in a fiercely competitive landscape dominated by tech giants. Understanding its competitive advantages and disadvantages is crucial for accurate Palantir stock prediction.

- Key Competitors: Palantir faces stiff competition from AWS, Google Cloud, Microsoft Azure, and other data analytics companies. Their established market share and extensive resources present significant challenges.

- Palantir's Unique Selling Propositions (USPs): Palantir's strengths lie in its specialized software for government and large enterprises, its strong security focus, and its ability to handle complex data sets. These USPs are vital for maintaining its market position.

- Potential Threats: New entrants, technological disruptions, and pricing pressure are potential threats that need to be carefully assessed when considering Palantir investment.

H3: Technological Innovation and Future Product Roadmap:

Palantir's commitment to innovation is a major driver of its potential for future Palantir stock growth.

- AI and Machine Learning: Palantir's integration of AI and machine learning capabilities in its products enhances its data analysis and provides new opportunities.

- Cloud Computing: A robust cloud infrastructure enhances scalability and accessibility, attracting more clients and contributing to revenue growth.

- Expansion into New Markets: Strategic expansion into new sectors and geographic markets broadens Palantir's revenue streams and reduces reliance on any single sector.

2.2 Factors Influencing Palantir Stock Growth:

H3: Macroeconomic Factors and Market Sentiment:

Broader economic trends significantly impact Palantir stock.

- Inflation and Interest Rates: High inflation and interest rates can dampen investor sentiment and affect spending on technology solutions, potentially impacting Palantir's growth.

- Recessionary Fears: Concerns about a potential recession can lead to a decline in investor confidence and lower Palantir stock valuations.

- Market Trends: Following overall market trends and investor sentiment towards the tech sector provides vital context for interpreting Palantir's stock performance.

H3: Geopolitical Risks and Government Regulations:

Geopolitical instability and regulatory changes pose risks to Palantir.

- Government Contract Dependence: Palantir's significant reliance on government contracts exposes it to political risks and changes in government priorities.

- Data Privacy and Security Regulations: Compliance with increasingly stringent data privacy and security regulations represents a considerable operational and financial challenge.

H3: Company-Specific Risks and Challenges:

Internal factors can also affect Palantir’s trajectory.

- Operational Challenges: Scalability issues, integration complexities, and client onboarding challenges can impact growth.

- Management Decisions: Strategic decisions concerning product development, market expansion, and resource allocation directly influence the company's future.

2.3 Probability of 40% Palantir Stock Growth in 2025:

Based on our analysis, achieving 40% Palantir stock growth by 2025 is a challenging, though not impossible, goal. Optimistic scenarios hinge on sustained high revenue growth, successful expansion into new markets, and positive macroeconomic conditions. Pessimistic scenarios include slower-than-expected growth, increased competition, and negative macroeconomic headwinds. The actual outcome will depend on a complex interplay of internal and external factors.

3. Conclusion: Is 40% Palantir Stock Growth Achievable? A Final Verdict

Our analysis suggests that while a 40% Palantir stock growth in 2025 is ambitious, it's not entirely unrealistic. Success hinges on continued technological innovation, successful navigation of the competitive landscape, and favorable macroeconomic conditions. However, significant risks remain, including macroeconomic uncertainty, geopolitical instability, and company-specific challenges. Ultimately, predicting stock market performance with certainty is impossible.

Conduct your own thorough research before investing in Palantir stock and carefully consider the potential risks involved in achieving significant Palantir stock growth. For continued Palantir stock analysis, explore reputable financial news sources and investment research platforms. Remember, responsible investing includes diversifying your portfolio and understanding your own risk tolerance.

Featured Posts

-

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025

Trumps Kennedy Center Visit Potential Les Miserables Cast Boycott

May 09, 2025 -

Characters Connections And The Ectomobile Arctic Comic Con 2025 Photo Highlights

May 09, 2025

Characters Connections And The Ectomobile Arctic Comic Con 2025 Photo Highlights

May 09, 2025 -

Quelles Chances Pour Les Ecologistes Aux Municipales De Dijon En 2026

May 09, 2025

Quelles Chances Pour Les Ecologistes Aux Municipales De Dijon En 2026

May 09, 2025 -

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za Deystviy S Sh A

May 09, 2025

V Germanii Opasayutsya Novogo Pritoka Ukrainskikh Bezhentsev Iz Za Deystviy S Sh A

May 09, 2025 -

West Ham United And The 25m Financial Gap What Next

May 09, 2025

West Ham United And The 25m Financial Gap What Next

May 09, 2025