Is $5 Possible? A Comprehensive XRP Price Prediction Following SEC Developments

Table of Contents

The cryptocurrency market is notorious for its volatility, and XRP is no exception. The rollercoaster ride of XRP's price, significantly impacted by the protracted SEC lawsuit, leaves many investors wondering: is a $5 XRP price a realistic possibility? This article delves into a comprehensive XRP price prediction, analyzing the post-SEC lawsuit landscape and exploring various factors influencing XRP's potential to reach this ambitious target. We'll examine the legal ramifications, technological advancements, market dynamics, and potential scenarios to provide a balanced perspective on the feasibility of $5 XRP.

H2: The SEC Lawsuit and its Impact on XRP Price

H3: The Case's Background and Key Arguments: The SEC's lawsuit against Ripple Labs, alleging that XRP is an unregistered security, cast a long shadow over the cryptocurrency's price. The core argument revolves around whether XRP sales constituted investment contracts, offering investors a reasonable expectation of profits based on Ripple's efforts.

- Arguments for the SEC: The SEC argued that Ripple's distribution and sale of XRP were akin to an unregistered securities offering, benefiting from investor contributions.

- Arguments for Ripple: Ripple countered that XRP is a decentralized digital asset, similar to Bitcoin and Ether, and not subject to SEC regulations.

- Key events included the initial filing of the lawsuit, various court filings, and ultimately, the partial summary judgment in July 2023, which declared XRP sales on exchanges were not securities.

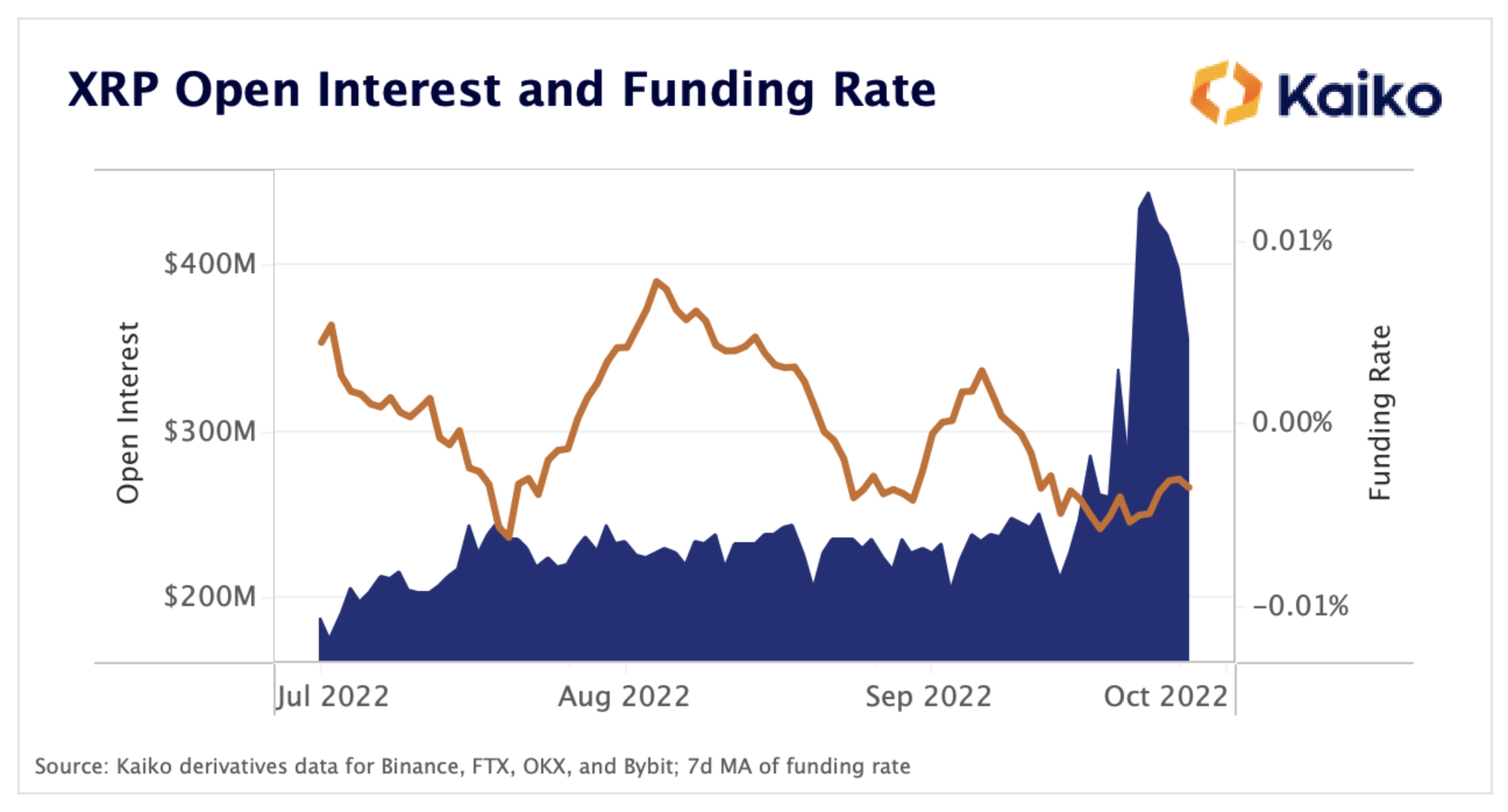

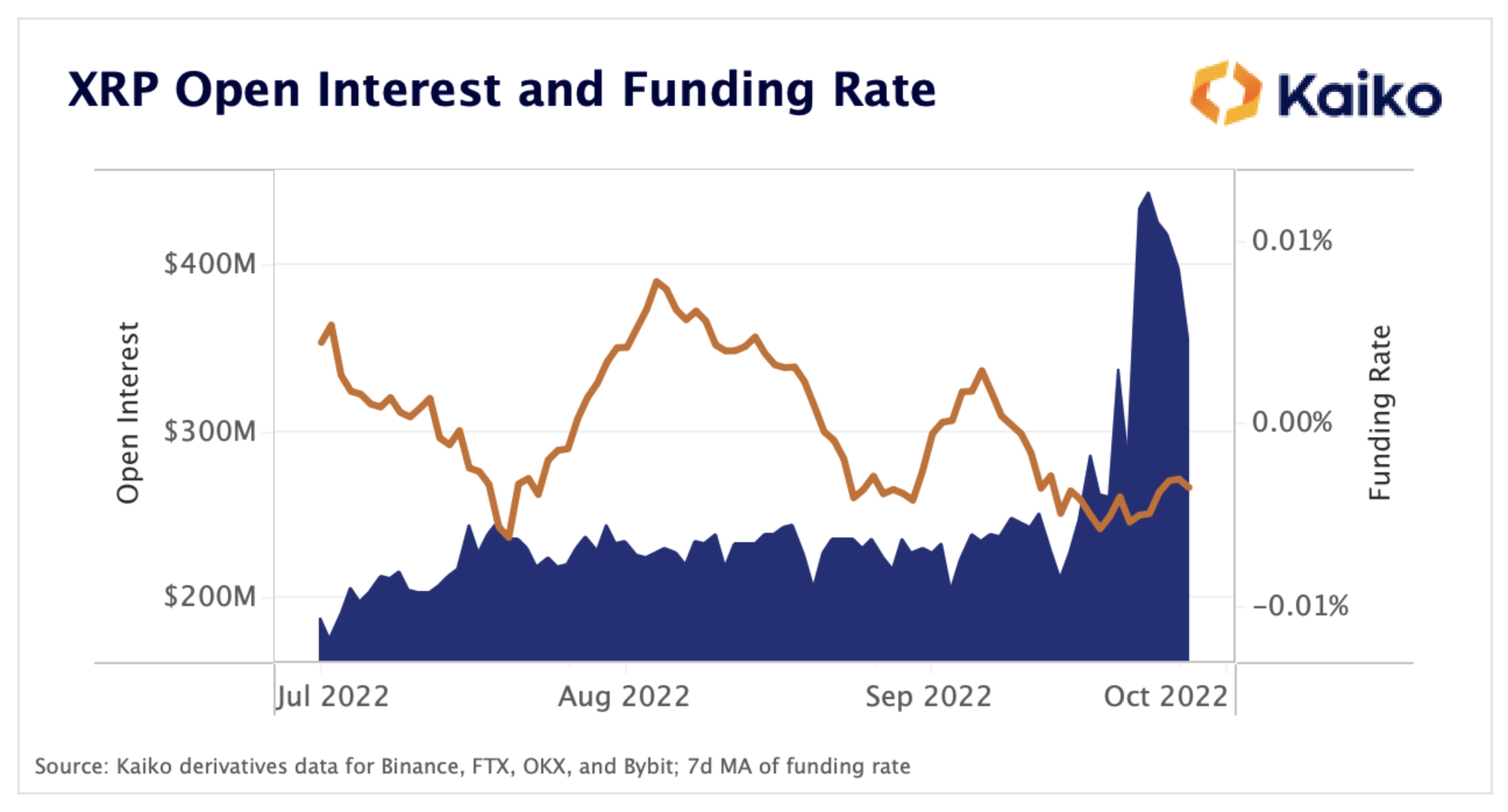

H3: Market Sentiment and Price Fluctuations: The SEC lawsuit significantly impacted XRP's price. Initial news of the lawsuit triggered a sharp decline. However, positive developments, such as favorable court rulings or announcements of institutional partnerships, led to price rallies.

- [Insert chart/graph showing XRP price fluctuations during the lawsuit period].

- Investor sentiment shifted dramatically throughout the case, moving from extreme pessimism to cautious optimism depending on legal developments.

H3: Post-Lawsuit Legal Landscape and Implications: The partial summary judgment offered some clarity but didn't entirely resolve the regulatory uncertainty surrounding XRP. The ongoing legal battles and potential future rulings will continue to impact the price.

- Potential Scenarios:

- Complete victory for Ripple could lead to a significant price surge.

- A less favorable ruling could result in continued price volatility and regulatory uncertainty.

- Increased regulatory clarity, regardless of the outcome, could potentially stabilize the price.

- Regulatory uncertainty remains a significant headwind, potentially hindering widespread adoption and price appreciation.

H2: Factors Influencing XRP's Potential to Reach $5

H3: Technological Advancements and Adoption: Ripple's technology, particularly its RippleNet platform for cross-border payments, has gained traction among financial institutions. Further technological advancements and increased adoption are crucial for price appreciation.

- Successful Use Cases: XRP has facilitated numerous cross-border transactions, showcasing its potential for efficiency and cost reduction.

- Upcoming Upgrades: Any significant technological improvements or new partnerships could significantly impact market perception and price.

H3: Market Capitalization and Supply Dynamics: Currently, XRP's market capitalization is significantly lower than Bitcoin or Ethereum. To reach $5, a substantial increase in market cap is required, considering its circulating supply.

- Calculations and Projections: Achieving a $5 price would require a massive increase in market capitalization, significantly outpacing current valuations.

- Tokenomics: XRP's tokenomics, including potential burning mechanisms or future token releases, will play a role in shaping its price trajectory.

H3: Wider Crypto Market Trends and Global Economic Factors: The overall cryptocurrency market sentiment and macroeconomic conditions significantly influence XRP's price.

- Correlation with Bitcoin: XRP tends to exhibit some correlation with Bitcoin's price movements.

- Macroeconomic Factors: Inflation, interest rates, and global economic stability can indirectly impact investor appetite for risky assets like cryptocurrencies.

H2: Realistic XRP Price Predictions and Scenarios

H3: Conservative Price Projections: Based on current market conditions and potential regulatory outcomes, a conservative projection might see XRP reaching $1-$3 in the mid-term (3-5 years). Reaching $5 would require exceptionally positive market developments and widespread adoption.

- Justification: This projection is based on moderate growth in market capitalization, increased institutional adoption, and a more stable regulatory environment.

- Price Ranges: Short-term price fluctuations are expected, but long-term price appreciation depends heavily on market conditions and broader crypto adoption.

H3: Bullish Scenarios and Potential Catalysts: A significant price surge to $5 is possible but relies on several factors aligning perfectly. Widespread adoption by major financial institutions, regulatory clarity, and positive macroeconomic conditions could act as catalysts.

- Driving Factors: Increased institutional investment, successful implementation of RippleNet, and a generally bullish cryptocurrency market could propel XRP's price.

- Hypothetical Scenarios: Positive court rulings, combined with significant market adoption, could lead to a rapid price increase.

H3: Bearish Scenarios and Potential Risks: Negative regulatory developments, prolonged market downturns, or a lack of widespread adoption could significantly hinder XRP's price growth.

- Regulatory Hurdles: Negative court rulings or stricter regulatory frameworks could suppress the price.

- Worst-Case Scenarios: A sustained bear market or a major security breach could negatively impact XRP's value.

3. Conclusion: Is $5 XRP a Realistic Goal? A Final Verdict

While a $5 XRP price is theoretically possible, it presents a significant challenge. Reaching this target would require a confluence of favorable factors, including a positive resolution to the SEC lawsuit, substantial increases in market capitalization, widespread institutional adoption, and a generally bullish cryptocurrency market. While there's potential for significant growth, investing in XRP carries inherent risks.

The journey to $5 XRP hinges on navigating the complex interplay of legal, technological, and market forces. Therefore, conduct thorough research before investing and stay updated on the latest XRP news and developments. Stay informed about the latest XRP price predictions and continue your research into the potential for $5 XRP. Make informed decisions about your XRP investments based on this comprehensive analysis of the potential for $5 XRP.

Featured Posts

-

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025

Urgent Action Needed The Overvalued Canadian Dollar And Its Economic Impact

May 08, 2025 -

Heres The Full List Of Ps Plus Premium And Extra March 2024 Games

May 08, 2025

Heres The Full List Of Ps Plus Premium And Extra March 2024 Games

May 08, 2025 -

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025

Jayson Tatums Honest Assessment Of Steph Curry After The All Star Game

May 08, 2025 -

Arsenal Ps Zh Golem Duel Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Duel Vo Ligata Na Shampionite

May 08, 2025 -

Arsenal News Expert Collymore Questions Artetas Tactics

May 08, 2025

Arsenal News Expert Collymore Questions Artetas Tactics

May 08, 2025