Is A XRP Bull Run Imminent? Recent Whale Activity Suggests So

Table of Contents

Understanding Whale Activity and its Impact on XRP Price

"Whales" in the cryptocurrency world are entities or individuals holding substantial amounts of a specific cryptocurrency, like XRP. These large XRP holders, often possessing millions or even billions of tokens, have the power to significantly influence the market. Their trading activities – buying, selling, or simply moving large quantities of XRP – can trigger substantial price fluctuations.

- Market Sentiment Manipulation: Whale activity can drastically alter market sentiment. Large buy orders can generate fear of missing out (FOMO), encouraging smaller investors to jump in, driving the price up. Conversely, large sell-offs can create panic selling, leading to price drops.

- Psychological Impact: The actions of XRP whales have a profound psychological impact on smaller investors. The sheer volume of their trades can overshadow other market forces, causing significant volatility and creating unpredictable price swings.

- Past Examples: Numerous instances exist where large XRP transactions have preceded significant price movements. Examining historical data provides insights into how whale actions have shaped the XRP market in the past. Analyzing these patterns helps in understanding potential future price trends.

Keywords: XRP whales, large XRP holders, market manipulation, XRP price volatility, FOMO (fear of missing out).

Recent XRP Whale Activity: A Detailed Analysis

Analyzing recent XRP whale activity requires examining various data points. We'll dissect large transactions, exchange flows, and social media sentiment to understand the potential implications.

Large XRP Transactions and Their Implications

Recent on-chain data reveals a series of significant XRP transactions. These transactions, often involving hundreds of millions or even billions of XRP, are carefully scrutinized for clues about the whales' intentions.

- Transaction Analysis: Tracking these transfers, noting their timing and potential destinations (exchanges, wallets), provides critical insights. Large transfers to exchanges could suggest upcoming sell pressure, while transfers to cold storage wallets might indicate accumulation.

- Data Visualization: Charts and graphs illustrating the volume and value of these transactions enhance understanding. Visual representation makes it easier to identify patterns and trends that may otherwise be missed.

- Interpretation: The interpretation of these transactions requires caution. While large inflows to exchanges might signal potential selling pressure, it's also possible these whales are simply reorganizing their holdings or preparing for future movements.

Keywords: XRP transactions, large XRP transfers, on-chain analysis, XRP accumulation, XRP distribution.

Examining Exchange Inflows and Outflows

Monitoring the movement of XRP into and out of major cryptocurrency exchanges is crucial for gauging market sentiment and potential whale activity.

- Inflows: Large inflows into exchanges often indicate potential selling pressure as whales prepare to liquidate their holdings. This could lead to a short-term price decline.

- Outflows: Conversely, significant outflows from exchanges suggest accumulation, potentially signaling bullish sentiment and upcoming price increases. Whales might be withdrawing their XRP to hold long-term, expecting price appreciation.

- Exchange Reserves: Observing changes in exchange reserves, the total amount of XRP held by exchanges, gives another perspective on potential buying or selling pressure. Decreasing reserves generally suggest buying pressure.

Keywords: XRP exchange inflows, XRP exchange outflows, exchange reserves, buying pressure, selling pressure.

Social Media Sentiment and Correlation with Whale Activity

Social media sentiment surrounding XRP can offer additional context, although it should be interpreted cautiously.

- Sentiment Analysis: Analyzing the tone of posts and discussions about XRP and recent whale activity on platforms like Twitter can reveal overall market sentiment. Positive sentiment may correlate with whale accumulation.

- Correlation, Not Causation: It's crucial to remember that correlation doesn't equal causation. While social media sentiment may reflect whale activity, it's not the sole determinant of price movements.

- Caution: Relying solely on social media for investment decisions is risky. It's essential to cross-reference social sentiment with other objective data points.

Keywords: XRP social media sentiment, Twitter sentiment analysis, XRP community, cryptocurrency news.

Factors Beyond Whale Activity Influencing a Potential XRP Bull Run

While whale activity is a significant factor, other external influences also play a crucial role in shaping XRP's price.

Ripple's Legal Battle and its Potential Outcome

The ongoing legal battle between Ripple and the SEC significantly impacts XRP's price.

- Positive Outcome: A favorable ruling could remove regulatory uncertainty, potentially leading to a significant price surge as institutional investors regain confidence.

- Negative Outcome: An unfavorable ruling could severely impact XRP's price, causing further uncertainty and potentially leading to a prolonged bear market.

- Uncertainty: The uncertainty surrounding the legal case creates volatility, making accurate predictions difficult.

Keywords: Ripple SEC lawsuit, Ripple legal battle, XRP regulatory uncertainty, SEC lawsuit impact.

Wider Cryptocurrency Market Trends

The broader cryptocurrency market significantly influences XRP's price.

- Market Sentiment: A bull market across the crypto space generally benefits altcoins like XRP, potentially boosting its price. Conversely, a bear market can negatively impact XRP's value.

- Bitcoin's Influence: Bitcoin's price movements often correlate with altcoin performance. A strong Bitcoin rally can trigger an altcoin season, benefiting XRP.

Keywords: Bitcoin price, cryptocurrency market cap, altcoin season, market sentiment, bull market, bear market.

Conclusion: Is an XRP Bull Run on the Horizon? Taking Informed Action

Analyzing recent XRP whale activity reveals intriguing signals, suggesting potential for a bull run. However, it's crucial to remember that the cryptocurrency market is highly volatile, and predictions are inherently uncertain. The outcome of the Ripple SEC lawsuit and broader market trends are additional key factors impacting XRP's future.

While the evidence points towards potential upside, conducting your own thorough research is crucial before making any investment decisions. Don't rely solely on this analysis. Stay updated on the latest XRP news and whale activity to make informed decisions about your investments. Is an XRP bull run imminent? Only time will tell, but understanding whale activity is a crucial component of navigating this exciting yet volatile market. Keywords: XRP price prediction, XRP investment, cryptocurrency trading, due diligence, risk management.

Featured Posts

-

John Wicks True Form One Appearance Across Four Films

May 07, 2025

John Wicks True Form One Appearance Across Four Films

May 07, 2025 -

Badanie Ib Ri S Dla Onetu Liderzy Rankingu Zaufania

May 07, 2025

Badanie Ib Ri S Dla Onetu Liderzy Rankingu Zaufania

May 07, 2025 -

The Superman Movie A Look At Hawkgirls Wing Design Courtesy Of James Gunn

May 07, 2025

The Superman Movie A Look At Hawkgirls Wing Design Courtesy Of James Gunn

May 07, 2025 -

Jenna Ortega And Sabrina Carpenter Snl 50s Unexpected Highlight

May 07, 2025

Jenna Ortega And Sabrina Carpenter Snl 50s Unexpected Highlight

May 07, 2025 -

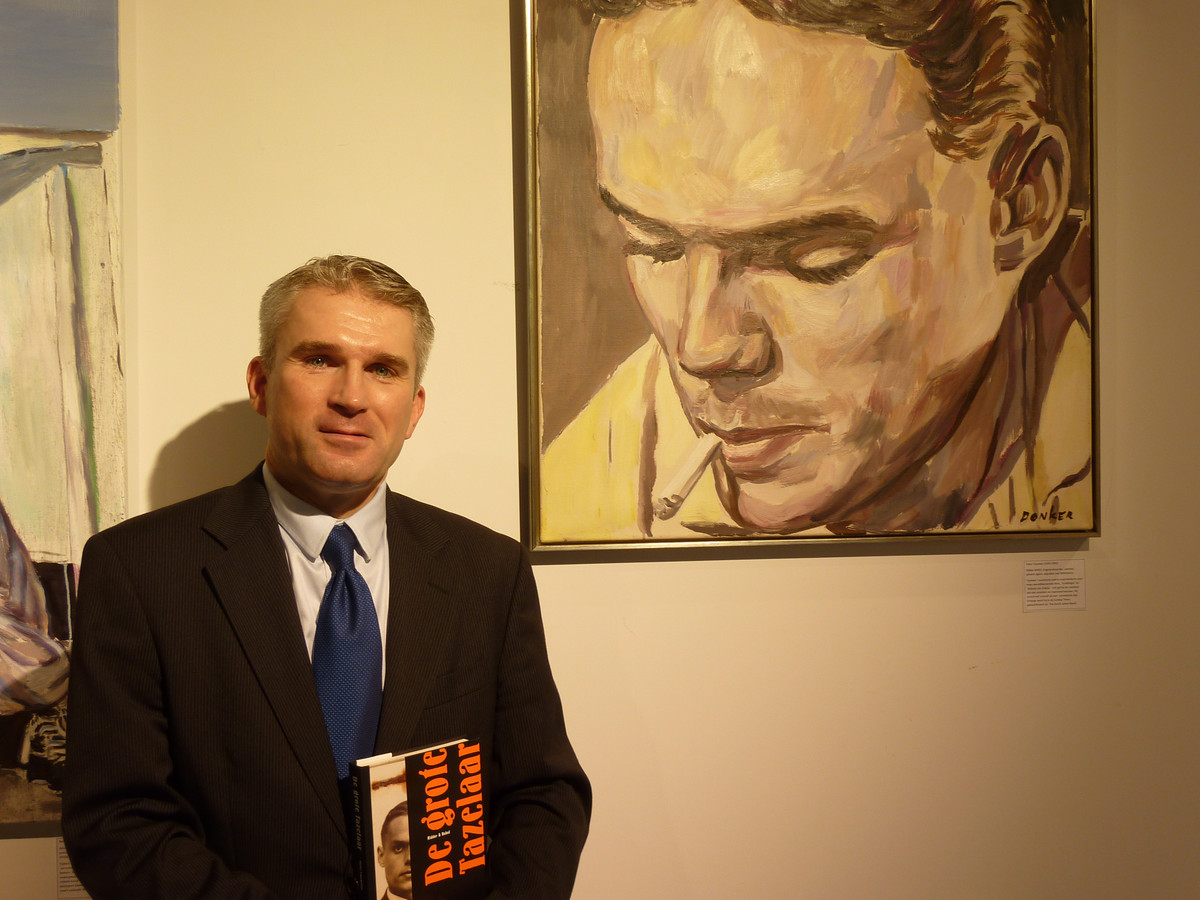

Spion Peter Tazelaar De Biografie Van Een Echte Soldaat Van Oranje

May 07, 2025

Spion Peter Tazelaar De Biografie Van Een Echte Soldaat Van Oranje

May 07, 2025