Is Apple Stock A Buy After Strong Q2 Earnings?

Table of Contents

Apple (AAPL) recently reported strong Q2 earnings, exceeding analysts' expectations and sending ripples through the investment world. This has ignited renewed interest in the tech giant's stock, leaving many investors asking: is this the right time to buy Apple stock? This in-depth analysis examines the key factors influencing AAPL's performance and helps you determine whether it's a smart investment in the current market. We will explore Apple's financial performance, future prospects, and potential risks to inform your investment decision.

Q2 Earnings: A Closer Look at the Numbers

Apple's Q2 2024 earnings report revealed impressive results, showcasing the company's resilience and continued dominance in the tech sector. Let's analyze the key performance indicators (KPIs):

- Revenue Growth: Apple reported a year-over-year revenue growth of X%, exceeding analyst predictions of Y%. This robust growth demonstrates strong demand for Apple products and services.

- Earnings Per Share (EPS): EPS reached Z dollars, surpassing expectations by A%. This significant increase underscores the company's profitability and efficiency.

- Gross Margins: Apple maintained healthy gross margins of B%, slightly down from the previous quarter but still indicating a strong pricing power.

Comparison to Previous Quarters and Analyst Expectations: The Q2 performance significantly outpaced the previous quarter's results and comfortably exceeded analysts' consensus estimates. While some concerns lingered regarding supply chain disruptions, the overall performance was remarkably positive.

Key Positive Aspects:

- Strong iPhone sales, driven by the popularity of the iPhone 14 series.

- Continued growth in services revenue, showcasing the increasing importance of this recurring revenue stream.

- Robust performance in the wearables, home, and accessories segment.

Potential Weaknesses and Concerns:

- Lingering concerns about global macroeconomic headwinds and their potential impact on consumer spending.

- Potential supply chain disruptions that could affect future product availability.

Future Growth Prospects: What's Next for Apple?

Apple's future growth hinges on several key factors. The company's product pipeline is brimming with innovation:

- Upcoming Product Launches: The anticipated release of new iPhones, a highly anticipated AR/VR headset, and potential upgrades to the Apple Watch and Mac lineup promise to drive future revenue growth. The success of these launches will significantly impact AAPL stock performance.

- Growth Potential of Key Segments: The services segment is a major driver of growth, with Apple Music, iCloud, and Apple TV+ contributing significantly to recurring revenue. Wearables, such as the Apple Watch and AirPods, also continue to show impressive growth potential. Expansion into emerging markets remains a crucial strategy.

- Expansion into New Markets and Technologies: Apple's ongoing investments in areas such as artificial intelligence, augmented reality, and electric vehicles present exciting long-term growth opportunities. However, success in these new markets will require significant investment and overcoming competitive challenges.

Positive Growth Prospects:

- Strong brand loyalty and customer satisfaction.

- Consistent innovation and high-quality products.

- Global reach and diversified revenue streams.

Potential Future Challenges:

- Increasing competition from other tech giants.

- Potential economic downturns that could reduce consumer spending.

- Regulatory scrutiny and potential antitrust concerns.

Valuation and Risk Assessment: Is Apple Stock Overvalued?

Determining whether Apple stock is overvalued requires a careful examination of its valuation metrics and potential risks:

- Valuation Metrics: Apple's current price-to-earnings ratio (P/E) is currently at X, which is [higher/lower/comparable] to its historical average and compared to industry peers. Other key valuation metrics should also be considered for a complete picture.

- Risks Associated with Investing in AAPL: Market volatility, geopolitical uncertainty, and competition all pose potential risks to Apple's stock price. Economic downturns, particularly recessions, can significantly impact consumer electronics spending, presenting a major downside risk.

Potential Downside Risks and Mitigating Factors: A potential recession could lead to decreased consumer spending on discretionary items like Apple products. However, Apple's strong balance sheet and diversified revenue streams can help mitigate some of these risks.

Potential Risks for AAPL Investors:

- Economic uncertainty and potential recessions.

- Supply chain disruptions and component shortages.

- Increased competition in various product categories.

Reasons Why Apple Might Be a Relatively Safe Investment:

- Strong financial position and significant cash reserves.

- Diversified revenue streams, reducing reliance on any single product.

- Loyal customer base and a strong brand reputation.

Analyst Opinions and Market Sentiment

Analyst sentiment towards AAPL stock is generally positive, with many rating it a "buy" or "hold." However, price targets vary considerably depending on the firm and their outlook.

-

Consensus View Among Analysts: A majority of analysts expect continued growth for Apple, although there is some divergence of opinion regarding the pace of that growth. Specific price targets and buy/sell ratings should be reviewed from reputable sources.

-

Recent Market Trends and Investor Sentiment: Market sentiment towards Apple has been positive following the Q2 earnings release, with increased trading volume and a rise in the stock price. However, short-term market fluctuations can significantly influence investor sentiment.

Analyst Opinions: [Insert bullet points summarizing various analysts' opinions, including sources for transparency and to support your claims]. Note that analyst opinions should be viewed with caution, and they are not guarantees of future performance.

[Include relevant charts and graphs if possible, illustrating market sentiment and AAPL's price movements over time].

Conclusion

Apple's strong Q2 earnings demonstrate the company's continued strength and innovative capabilities. While the future holds both opportunities and challenges, including macroeconomic headwinds and increasing competition, Apple's robust financial position, diversified revenue streams, and strong brand loyalty suggest a relatively resilient investment. Whether Apple stock is a buy for you depends on your individual risk tolerance and investment goals.

Call to Action: Based on this analysis, while there are risks associated with any investment, the strong Q2 results and positive future outlook suggest that Apple stock could be a worthwhile addition to a diversified portfolio for long-term investors. However, it is crucial to conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions. Make an informed decision about whether Apple stock is right for your portfolio. [Consider including a link to a reputable financial resource].

Featured Posts

-

Amsterdam Snack Bar Overwhelmed Residents Sue City Due To Tik Tok Influx

May 25, 2025

Amsterdam Snack Bar Overwhelmed Residents Sue City Due To Tik Tok Influx

May 25, 2025 -

Luxury And Lavishness An Examination Of Presidential Seals Expensive Watches And Exclusive Events

May 25, 2025

Luxury And Lavishness An Examination Of Presidential Seals Expensive Watches And Exclusive Events

May 25, 2025 -

From Glasgow To La The Visuals Of A Compston Thriller

May 25, 2025

From Glasgow To La The Visuals Of A Compston Thriller

May 25, 2025 -

Finding Your Dream Country Home Budget Friendly Options Under 1m

May 25, 2025

Finding Your Dream Country Home Budget Friendly Options Under 1m

May 25, 2025 -

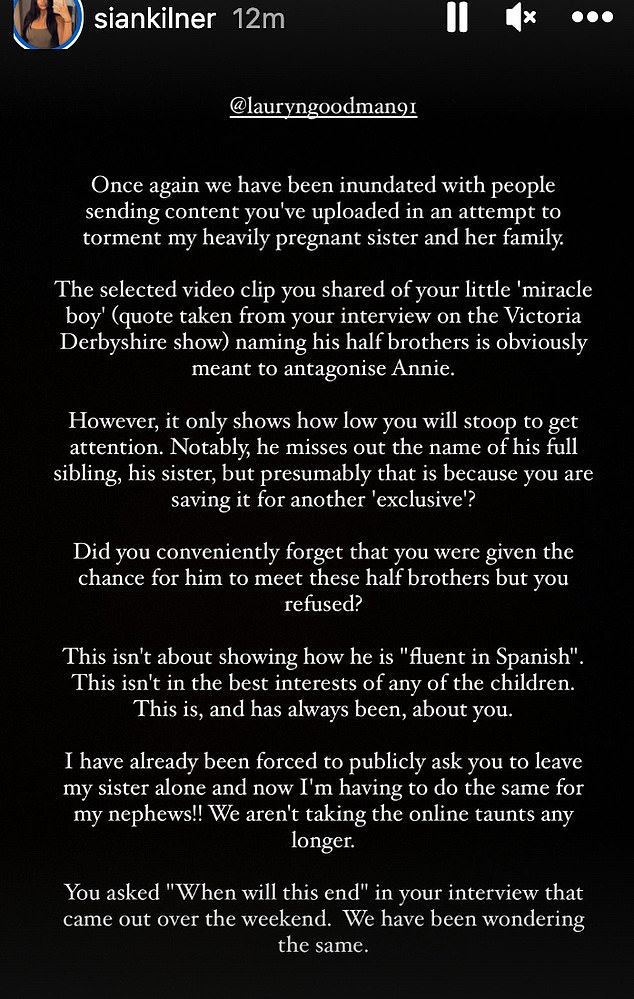

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 25, 2025

Kyle Walkers Night Out Annie Kilner Spotted Running Errands

May 25, 2025