Is BigBear.ai (BBAI) A Top Penny Stock To Watch?

Table of Contents

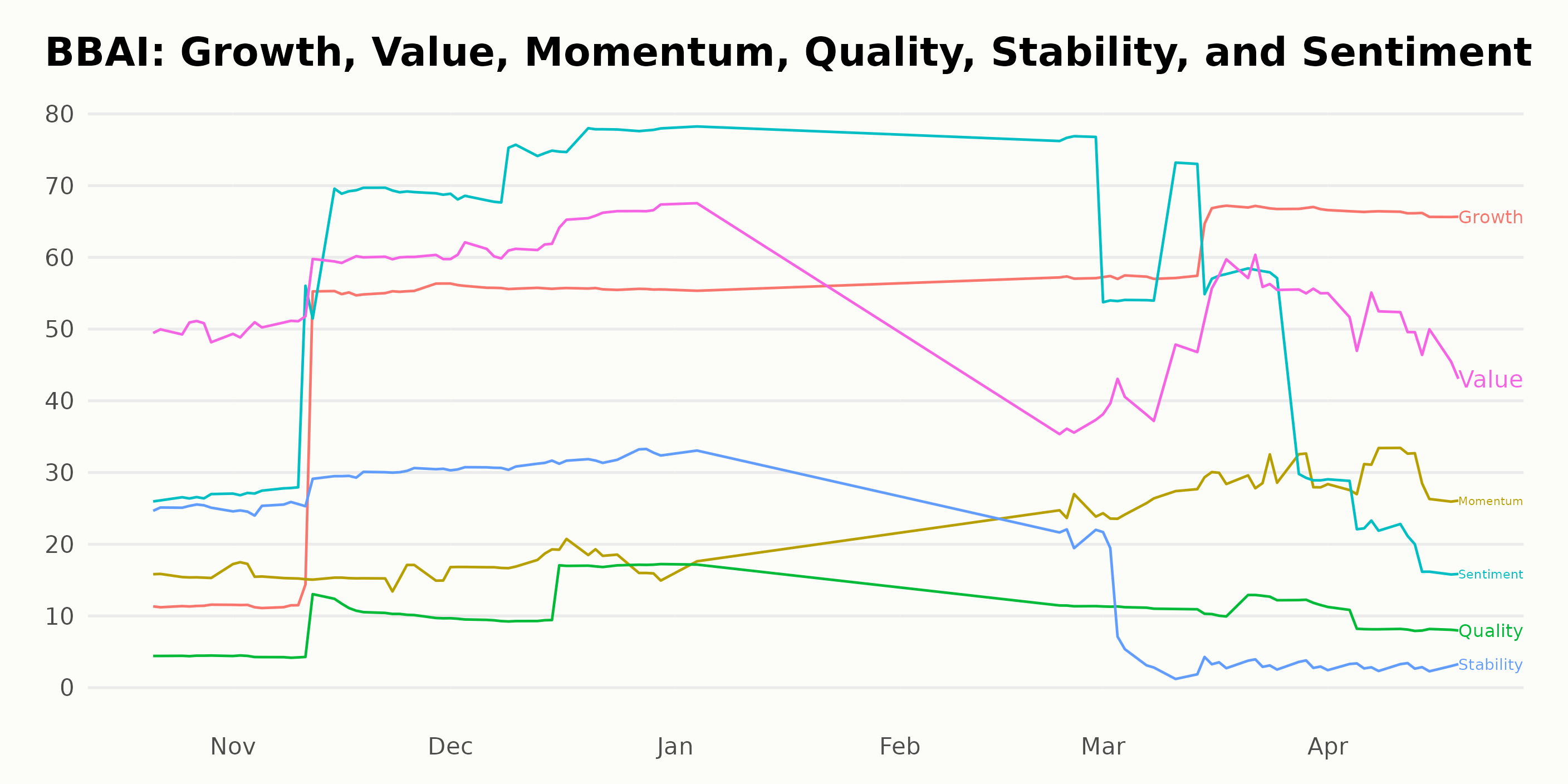

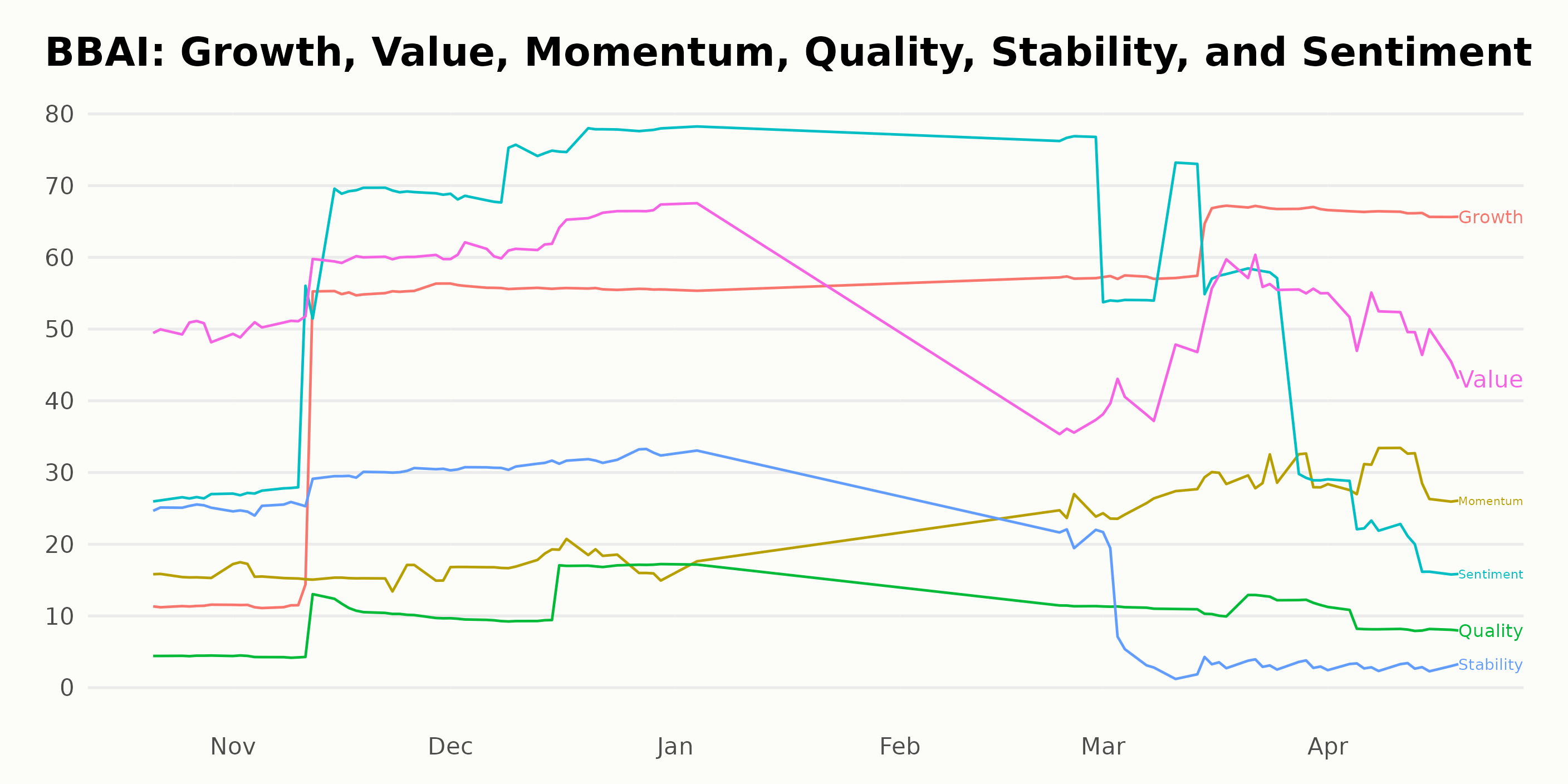

BigBear.ai's (BBAI) Business Model and Financial Performance

BigBear.ai (BBAI) provides advanced AI and data analytics services to both government and commercial clients. Its core business revolves around delivering sophisticated solutions for complex problems, leveraging cutting-edge technologies to extract insights from vast datasets. Revenue streams are primarily generated through contracts for services and software licensing.

Analyzing recent financial reports reveals a mixed picture. While revenue growth has shown some promise in certain quarters, profitability remains elusive. Key financial metrics to consider include:

- Revenue Growth: [Insert specific data on revenue growth from recent quarters, citing sources]. While there has been growth, it's important to examine the sustainability of this trend.

- Profitability: [Insert data on profit margins, net income, or losses. Cite sources]. Current profitability is [describe profitability – positive, negative, or breaking even].

- Debt Levels: [Insert data on debt-to-equity ratio and overall debt levels. Cite sources]. High debt can significantly impact the company's financial stability.

- Cash Flow: [Insert data on cash flow from operations. Cite sources]. Positive cash flow is crucial for sustained growth and operational viability.

Future financial projections are [describe projections - optimistic, cautious, or uncertain]. Analysts' forecasts vary, with some predicting [insert range of predictions for future growth], while others hold a more conservative outlook. Potential catalysts for growth include [mention potential catalysts, such as new contract wins, product launches, or expansion into new markets]. Analyzing BBAI financials is crucial for any investor.

Risk Assessment of Investing in BBAI

Investing in penny stocks like BBAI carries inherent risks. The high volatility characteristic of this market segment means significant price swings are common. Liquidity issues can make it difficult to buy or sell shares quickly, potentially impacting investment returns. Furthermore, penny stocks have a higher risk of failure compared to established, larger companies.

Specific risks related to BBAI include:

- Competition: The AI and data analytics market is highly competitive. BBAI faces competition from larger, more established players with greater resources.

- Regulatory Risk: Government regulations, particularly within the defense and intelligence sectors, can impact BBAI's contracts and operations.

- Contract Risk: BBAI's revenue is largely dependent on securing and delivering on government and commercial contracts. Failure to secure new contracts or delays in project execution can significantly impact financial performance.

BBAI's debt levels and financial stability, as previously discussed in the financial performance analysis, are key factors contributing to the overall risk profile. A thorough review of the company's credit rating and debt structure is highly recommended before investing. Understanding BBAI risk is essential for informed decision-making.

Market Sentiment and Analyst Opinions on BBAI Stock

Recent news and press releases concerning BBAI have [summarize recent news - positive, negative, or mixed]. This news has impacted investor sentiment, causing [describe the impact on the stock price]. It's essential to stay updated on BBAI news to gauge market reactions.

Analyst ratings on BBAI stock are [summarize analyst opinions – majority buy, sell, or hold]. Price targets range from [insert range of price targets]. This divergence in opinions underscores the uncertainty surrounding the stock's future performance. Analyzing BBAI stock forecast from different sources provides a more comprehensive view.

Social media sentiment towards BBAI has been [describe social media sentiment – positive, negative, or mixed]. Trading volume shows [describe trading volume – high, low, or average], which can indicate the level of investor interest and potential for price movements. Monitoring BBAI social media sentiment is important to understanding market psychology.

Comparing BBAI to Other Penny Stocks

Compared to other penny stocks in the AI and data analytics sector, BBAI [compare BBAI to competitors – stronger, weaker, or comparable]. [Mention specific competitors and highlight their similarities and differences]. This comparison allows for a relative assessment of BBAI's investment potential.

Considering growth potential, risk level, and valuation, BBAI presents [describe BBAI's attractiveness compared to alternatives – a higher, lower, or comparable investment opportunity]. A thorough analysis of BBAI valuation, compared to its competitors, is essential before making an investment decision.

Conclusion: Is BigBear.ai (BBAI) Right for Your Portfolio?

Investing in BigBear.ai (BBAI) presents a blend of potential rewards and significant risks. While the company operates in a promising sector with potential for future growth, its current financial performance and the inherent volatility of penny stocks must be carefully considered.

Based on the analysis, BBAI might be considered a worthwhile penny stock investment for those with a high-risk tolerance and a long-term investment horizon. However, it's crucial to diversify your portfolio and not over-allocate funds to a single penny stock.

Consider BigBear.ai (BBAI) as part of a diversified portfolio only after conducting thorough due diligence and assessing your own risk tolerance. Learn more about BBAI before investing. Remember, investing in penny stocks like BigBear.ai (BBAI) always involves significant risk.

Featured Posts

-

Abc News Show Cancellation Speculation After Staff Cuts

May 21, 2025

Abc News Show Cancellation Speculation After Staff Cuts

May 21, 2025 -

Dexters Revival The Return Of Two Iconic Villains

May 21, 2025

Dexters Revival The Return Of Two Iconic Villains

May 21, 2025 -

The Costco Campaign In Saskatchewan A Political Panel Discussion

May 21, 2025

The Costco Campaign In Saskatchewan A Political Panel Discussion

May 21, 2025 -

Canada Post Door To Door Mail Delivery Commission Report Recommends Phase Out

May 21, 2025

Canada Post Door To Door Mail Delivery Commission Report Recommends Phase Out

May 21, 2025 -

Analyzing The D Wave Quantum Qbts Stock Decline On Monday

May 21, 2025

Analyzing The D Wave Quantum Qbts Stock Decline On Monday

May 21, 2025