Is BigBear.ai (BBAI) One Of The Best AI Penny Stocks To Buy Right Now?

Table of Contents

BigBear.ai (BBAI) Business Model and Financial Performance

BigBear.ai's core business revolves around providing AI-powered solutions to a range of industries, with a significant focus on the defense and intelligence sectors. They leverage advanced algorithms and data analytics to deliver mission-critical capabilities for their clients. Understanding their financial performance is crucial for assessing the viability of BBAI as an investment.

Analyzing recent financial reports reveals a mixed picture. While revenue growth might show positive year-over-year increases (specific figures would need to be obtained from recent financial statements), profitability remains a challenge for the company. Key financial indicators to consider include:

- Revenue Growth Year-over-Year: [Insert data from recent financial reports. Example: "Showed a 15% increase in Q2 2024"]

- Profit Margins and Trends: [Insert data from recent financial reports. Example: "Operating margins remain negative, but show signs of improvement"]

- Debt-to-Equity Ratio: [Insert data from recent financial reports. Example: "A high debt-to-equity ratio indicates a higher level of financial risk."]

- Upcoming Catalysts: The success of new contract wins or the launch of innovative AI products will significantly influence BBAI's future financial performance. Any pipeline information from the company's investor relations would need to be considered.

Market Analysis and Competition

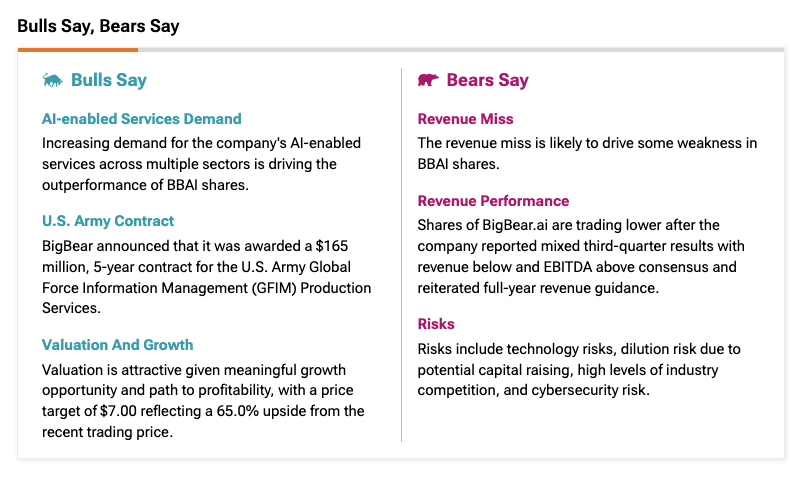

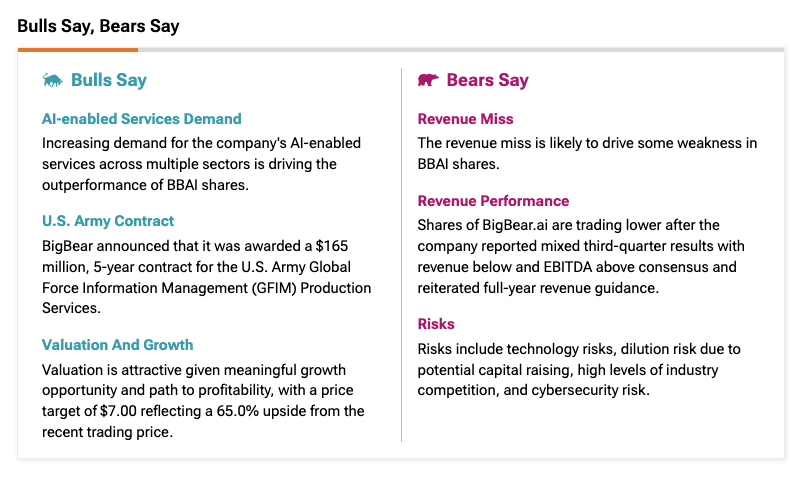

The market for AI solutions is experiencing explosive growth, presenting significant opportunities for companies like BigBear.ai. However, the competitive landscape is fiercely contested, with established tech giants and numerous smaller players vying for market share.

BigBear.ai possesses certain competitive advantages, including its specialized expertise in the defense and intelligence sectors and its proprietary AI algorithms. However, disadvantages include a relatively smaller market share compared to industry leaders and potentially lower brand recognition. Key threats include competition from larger, more established AI companies with greater resources and market reach.

Here’s a comparison with key competitors (this needs to be populated with relevant competitors and data):

| Competitor | Advantage | Disadvantage |

|---|---|---|

| [Competitor A] | [Their strengths] | [Their weaknesses] |

| [Competitor B] | [Their strengths] | [Their weaknesses] |

Risk Assessment of Investing in BBAI

Investing in penny stocks like BBAI inherently carries significant risk. These risks are amplified by several factors specific to BigBear.ai:

- Volatility: Penny stock prices can fluctuate dramatically in short periods.

- Liquidity: Trading volume might be low, making it difficult to buy or sell shares quickly.

- Financial Instability: The company’s financial health could impact its ability to meet obligations and maintain operations.

- Dependence on Government Contracts: A significant portion of BBAI's revenue may come from government contracts, creating exposure to changes in government spending or policy.

- Technological Disruption: Rapid advancements in AI technology could render BBAI's current offerings obsolete.

- Potential for Dilution: Further issuance of shares could dilute the value of existing shares.

These factors collectively indicate the potential for substantial investment losses.

Valuation and Potential Returns

Assessing BBAI's current valuation requires examining metrics like its price-to-earnings ratio (if applicable), market capitalization, and other relevant financial ratios. The absence of consistent profitability makes traditional valuation methods challenging.

Predicting future price appreciation or depreciation is inherently speculative. Several scenarios are possible, ranging from significant gains (driven by successful contract wins or technological breakthroughs) to substantial losses (due to unforeseen challenges or increased competition). The investment time horizon significantly influences the risk-reward profile. Long-term investors might tolerate more volatility, while short-term investors need to be acutely aware of the potential for rapid price swings. [Insert charts and graphs here if available; otherwise, remove this sentence].

Conclusion: Should You Invest in BigBear.ai (BBAI) Penny Stock?

BigBear.ai (BBAI) operates in a dynamic and rapidly growing market. However, its financial performance, significant competitive pressures, and inherent risks associated with penny stock investments must be carefully considered. While the potential for substantial returns exists, the possibility of significant losses is equally real.

This analysis weighs both the potential rewards and substantial risks of investing in BBAI. The company's future success hinges on factors like securing additional contracts, maintaining a competitive edge through technological innovation, and improving its financial health.

While BigBear.ai (BBAI) presents an intriguing opportunity in the burgeoning AI penny stock market, thorough due diligence is crucial before investing. Conduct your own research, carefully reviewing their financial statements and industry analysis, and consider consulting a financial advisor to determine if BBAI aligns with your risk tolerance and investment goals. Remember that AI penny stocks, including BBAI, carry substantial risk. Don't treat this as financial advice; conduct your own research before investing in any AI penny stock, including BBAI.

Featured Posts

-

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025 -

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Vel Tapo Mama Antrojo Vaiko Gimimas

May 20, 2025

Filmo Bado Zaidynes Zvaigzde Jennifer Lawrence Ir Vel Tapo Mama Antrojo Vaiko Gimimas

May 20, 2025 -

Hmrc Speeds Up Calls With New Voice Recognition Technology

May 20, 2025

Hmrc Speeds Up Calls With New Voice Recognition Technology

May 20, 2025 -

Weather Alert Take Action Now Strong Winds And Severe Storms Imminent

May 20, 2025

Weather Alert Take Action Now Strong Winds And Severe Storms Imminent

May 20, 2025 -

New Jersey Transit Strike Averted Tentative Deal Reached With Engineers Union

May 20, 2025

New Jersey Transit Strike Averted Tentative Deal Reached With Engineers Union

May 20, 2025