Is Homeownership In Canada Unaffordable Due To High Down Payments?

Table of Contents

The Impact of High Down Payments on Home Buyers

Current down payment requirements in Canada vary depending on the purchase price. For homes under $500,000, a 5% down payment is required on the first $500,000, and 10% on the portion above. For homes priced over $500,000, a 5% down payment is required on the first $500,000, and 10% on the portion between $500,000 and $1 million, while 20% is needed for the amount exceeding $1 million. These requirements represent a substantial financial hurdle for many Canadians.

Saving for a large down payment presents significant challenges:

- The time it takes to save: Accumulating a 20% down payment on a $1 million home requires saving $200,000, a process that can take many years, even with significant savings. This lengthy savings period delays the achievement of a major life goal for many.

- The impact on other financial goals: Saving for a down payment often necessitates putting other financial goals on hold, such as retirement savings, education funds for children, or paying off high-interest debt. The opportunity cost of prioritizing a down payment can be substantial.

- The potential for missed investment opportunities: The money tied up in savings for a down payment could potentially be invested, generating returns that could accelerate the home-buying process. However, many feel the risk of fluctuating investment markets makes this too risky, especially given the urgency of securing a property in a competitive market.

First-time homebuyers face even greater challenges. Government assistance programs, such as the Home Buyers' Plan (HBP), offer some relief, but they often have limitations, such as contribution limits and repayment schedules, that restrict their accessibility and overall effectiveness. Furthermore, rising interest rates exacerbate the problem, making mortgages more expensive and further increasing the financial strain on potential homebuyers trying to save for a large down payment.

Other Factors Contributing to Unaffordability in the Canadian Housing Market

While high down payments are a significant obstacle, they are not the sole factor driving the affordability crisis. Several other critical elements contribute to the high cost of homeownership in Canada:

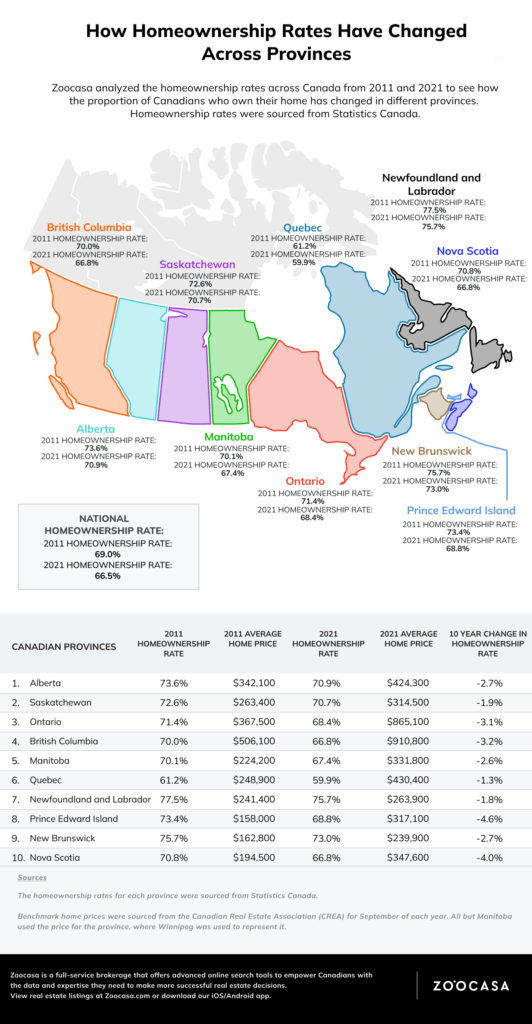

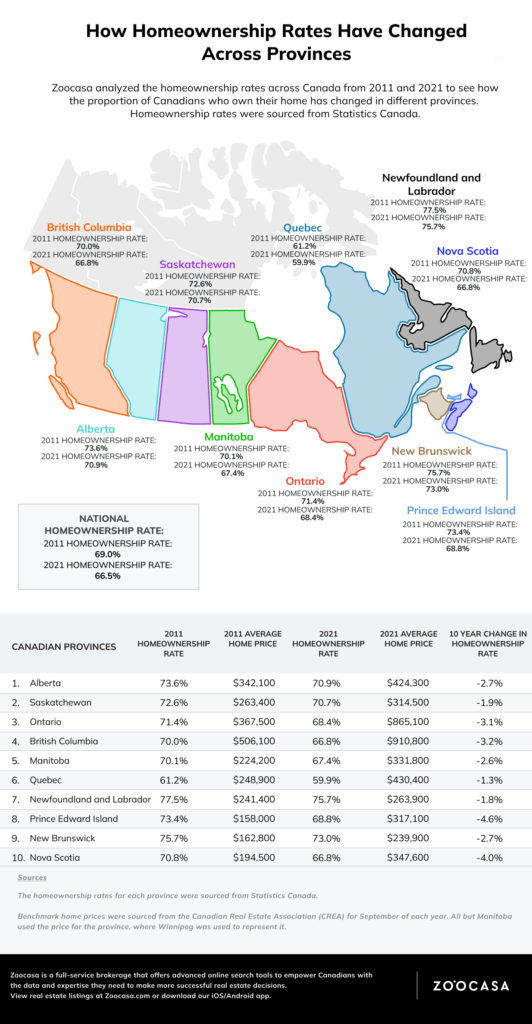

- Soaring housing prices in major cities: The price of homes in major urban centers like Toronto and Vancouver has skyrocketed in recent years, far outpacing wage growth. This makes even a smaller down payment an insurmountable hurdle for many.

- Limited housing supply: A shortage of housing inventory, particularly in desirable urban areas, fuels competition among buyers and drives prices upward. Increased construction is needed to alleviate this pressure.

- Rising interest rates and mortgage costs: Higher interest rates increase the cost of borrowing, making mortgages more expensive and reducing the affordability of homes for many buyers.

- Competition from investors and foreign buyers: Competition from investors and foreign buyers can inflate prices, making it more challenging for first-time homebuyers to enter the market.

- Property taxes and other associated homeownership costs: Beyond the mortgage, homeownership involves ongoing expenses like property taxes, insurance, maintenance, and utilities, which significantly impact overall affordability.

Strategies for Navigating High Down Payment Requirements

Overcoming the down payment hurdle requires proactive strategies:

- Explore government-assisted programs: Investigate programs like the HBP and other provincial initiatives to maximize available financial assistance.

- Consider alternative financing options: Explore options such as shared equity mortgages, where a lender provides a portion of the down payment in exchange for a share of the equity.

- Look at less expensive housing markets: Consider purchasing a home in a less expensive region or a smaller community outside of major urban centers. This is a less appealing but very practical option.

- Increase savings aggressively: Implement a robust savings plan with clear goals and timelines. This requires discipline and sacrifices but is crucial.

- Seek financial advice: Consult with mortgage brokers or financial advisors to develop a personalized financial plan and explore various options that best suit your circumstances.

The Role of Government Policy in Addressing Affordability

Government policies play a vital role in shaping housing affordability. Existing policies have had mixed success, and potential policy changes could include:

- Increasing funding for affordable housing initiatives.

- Implementing stricter regulations on foreign investment in the housing market.

- Incentivizing the construction of more affordable housing units.

- Revisiting down payment requirements to make them more accessible.

Is Homeownership in Canada Still Attainable Despite High Down Payments?

High down payments are a significant barrier to homeownership in Canada, but they are not the only factor. Soaring housing prices, limited supply, rising interest rates, and competition from investors all play a role. While high down payments undoubtedly contribute to the affordability crisis, they are not the sole culprit. A multifaceted approach is needed to address the issue.

Understanding the complexities surrounding high down payments is crucial for navigating the Canadian housing market. Don't let the challenges of high down payments discourage your dream of homeownership – take action today! Research your options, seek professional advice, and proactively plan for homeownership despite the challenges. The goal of homeownership may require adjustments, but it isn't necessarily out of reach.

Featured Posts

-

Stephen King Compares Stranger Things To It Key Similarities And Differences

May 10, 2025

Stephen King Compares Stranger Things To It Key Similarities And Differences

May 10, 2025 -

Measles Outbreak In North Dakota School Quarantine For Unvaccinated Children

May 10, 2025

Measles Outbreak In North Dakota School Quarantine For Unvaccinated Children

May 10, 2025 -

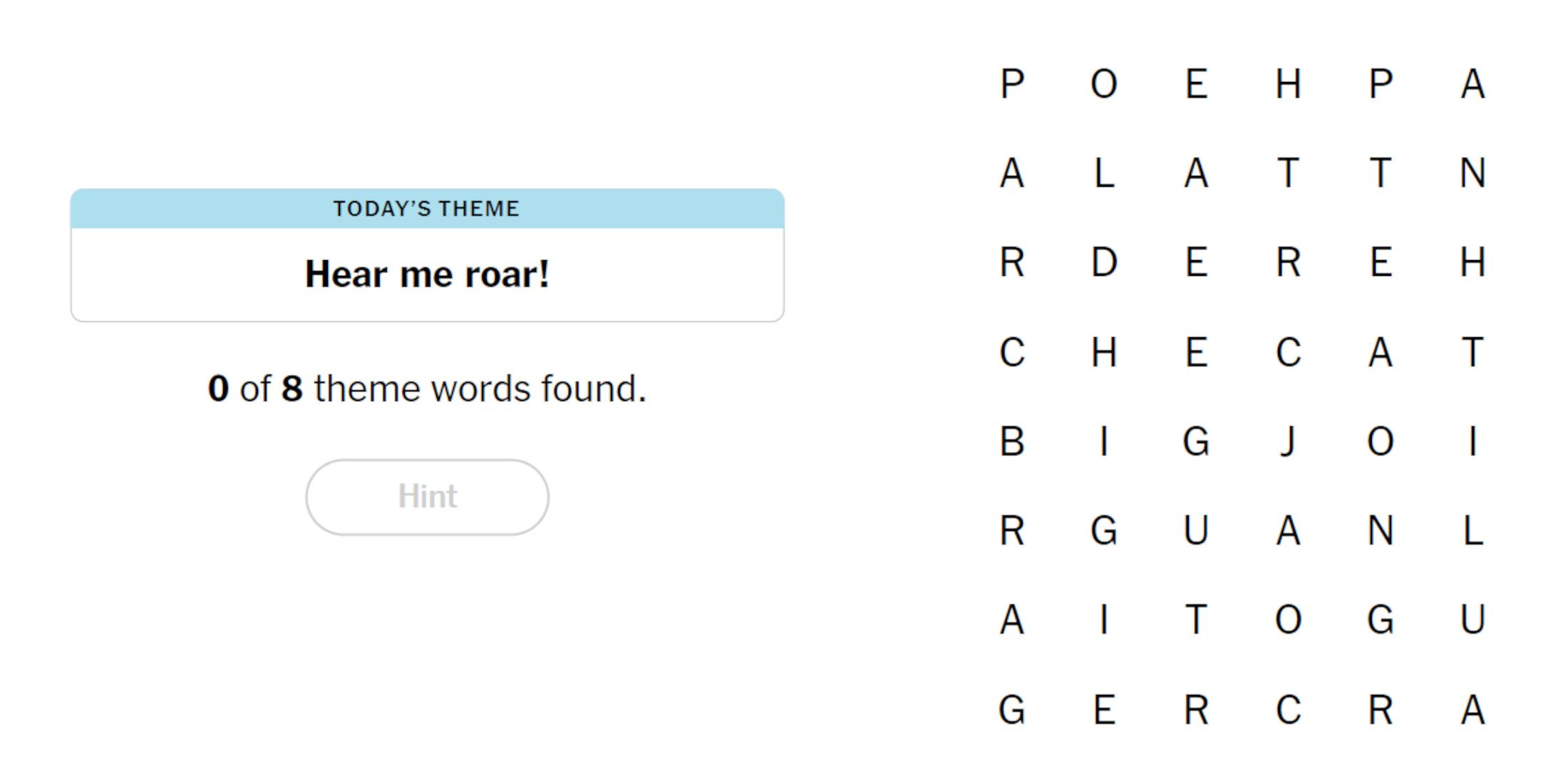

Nyt Strands April 9th 2024 Solutions Game 402

May 10, 2025

Nyt Strands April 9th 2024 Solutions Game 402

May 10, 2025 -

Transgenero Arrestada Por Usar Bano De Mujeres Analisis Del Incidente Universitario

May 10, 2025

Transgenero Arrestada Por Usar Bano De Mujeres Analisis Del Incidente Universitario

May 10, 2025 -

Amy Walsh Defends Wynne Evans Following Strictly Co Star Controversy

May 10, 2025

Amy Walsh Defends Wynne Evans Following Strictly Co Star Controversy

May 10, 2025