Is It A Real Safe Bet? Evaluating Low-Risk Investment Options

Table of Contents

Understanding Risk Tolerance and Investment Goals

Before diving into specific low-risk investment options, it's paramount to define your personal risk tolerance and investment goals. These factors significantly influence the types of investments that are appropriate for you. A higher risk tolerance might allow you to consider investments with potentially higher returns but also greater volatility, while a lower risk tolerance necessitates a focus on preservation of capital.

Your investment goals, whether short-term (e.g., saving for a down payment) or long-term (e.g., retirement planning), also play a critical role. Short-term goals often benefit from highly liquid, low-risk options, while long-term goals can afford a slightly longer time horizon, potentially allowing for slower-growing but safer investments.

- Consider your age and financial situation: Younger investors generally have a longer time horizon and can tolerate more risk, while those closer to retirement often prioritize capital preservation.

- Define your time horizon for investment returns: How long are you willing to tie up your money before needing access to it? This directly impacts the types of investments you should consider.

- Assess your comfort level with potential losses: How much potential loss are you willing to accept before feeling significant anxiety? Honesty in this assessment is critical for selecting appropriate investment vehicles.

Exploring Top Low-Risk Investment Options

Several reliable low-risk investment options offer varying degrees of safety, liquidity, and return. Let's explore some of the most popular choices:

High-Yield Savings Accounts

High-yield savings accounts offer a convenient and accessible way to save money while earning a competitive interest rate. These accounts are typically FDIC-insured, providing a safety net for your deposits. However, the interest rates, while higher than traditional savings accounts, are generally lower than other investment options. Accessibility is a major advantage, as funds can typically be withdrawn easily at any time.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits offered by banks and credit unions. You invest a fixed amount of money for a specific term (maturity period), and in return, you receive a fixed interest rate. CDs generally offer higher interest rates than savings accounts, but you'll typically face penalties for early withdrawal. This predictability makes them a reliable choice for those with a defined time horizon.

Money Market Accounts (MMAs)

Money market accounts (MMAs) combine the convenience of a checking account with the interest-earning potential of a savings account. They often offer check-writing capabilities and relatively higher interest rates than traditional savings accounts. While MMAs are considered low-risk, their value can fluctuate slightly based on market conditions.

Government Bonds

Government bonds, issued by the U.S. Treasury, are considered among the safest investments available. They are backed by the full faith and credit of the government, minimizing the risk of default. Different types of government bonds exist, including Treasury bills (short-term), notes (medium-term), and bonds (long-term), each with varying maturity dates and interest payments.

Low-Risk Mutual Funds and ETFs

Diversification is key to mitigating risk. Low-risk mutual funds and exchange-traded funds (ETFs) invest in a portfolio of low-risk assets, such as government bonds or large-cap stocks. This approach spreads your investment across multiple securities, reducing the impact of any single investment performing poorly. However, remember to factor in associated fees.

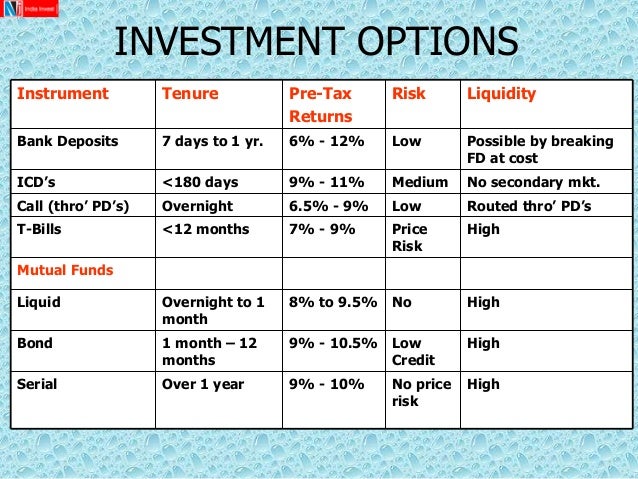

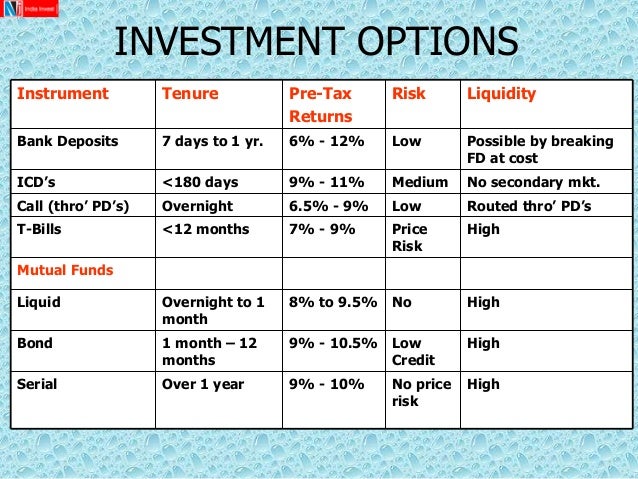

Comparing Low-Risk Investments

Choosing the right low-risk investment strategy requires careful comparison. Here's a summary table to help you assess your options:

| Investment Option | Return Potential | Risk Level | Liquidity | FDIC Insurance |

|---|---|---|---|---|

| High-Yield Savings Account | Low | Very Low | High | Yes |

| Certificate of Deposit | Low to Moderate | Very Low | Low | Yes |

| Money Market Account | Low to Moderate | Very Low | High | Yes |

| Government Bonds | Low to Moderate | Very Low | Varies | No |

| Low-Risk Mutual Funds/ETFs | Low to Moderate | Low | High | Varies |

The trade-offs between safety, liquidity, and return are evident. High liquidity often comes with lower returns, while higher returns may involve accepting slightly greater risk. Carefully weigh these factors against your specific needs and goals.

- Liquidity: How easily can you access your money without penalties?

- Return: What is the potential for growth of your investment?

- Fees: What are the associated costs of managing your investment?

Diversification for Enhanced Security

Even within a low-risk portfolio, diversification is crucial. Spreading your investments across different asset classes (e.g., combining high-yield savings accounts with government bonds) can further reduce your overall portfolio risk. Additionally, spreading investments across different financial institutions adds another layer of protection.

Conclusion

Choosing the right low-risk investment options requires a careful evaluation of your risk tolerance, investment goals, and the characteristics of various investment vehicles. Remember to prioritize understanding your individual circumstances before making any investment decisions. By understanding the features and limitations of high-yield savings accounts, CDs, MMAs, government bonds, and diversified low-risk mutual funds/ETFs, you can build a portfolio that aligns with your financial objectives. Start building your low-risk investment portfolio today and explore the best low-risk investment options for your needs. Secure your financial future with a well-planned, low-risk approach.

Featured Posts

-

Exploring The Business Empire Of Samuel Dickson Canadian Lumber Industry

May 10, 2025

Exploring The Business Empire Of Samuel Dickson Canadian Lumber Industry

May 10, 2025 -

Rumors Squashed Young Thug Not On Upcoming Blue Origin Trip

May 10, 2025

Rumors Squashed Young Thug Not On Upcoming Blue Origin Trip

May 10, 2025 -

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 10, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Matchups

May 10, 2025 -

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025

International Transgender Day Of Visibility 3 Ways To Be A Better Ally

May 10, 2025 -

Bert Kreischers Netflix Comedy How His Wife Feels About The Jokes

May 10, 2025

Bert Kreischers Netflix Comedy How His Wife Feels About The Jokes

May 10, 2025