Is Jim Cramer Right About CoreWeave (CRWV)? Analyzing The AI Infrastructure Landscape

Table of Contents

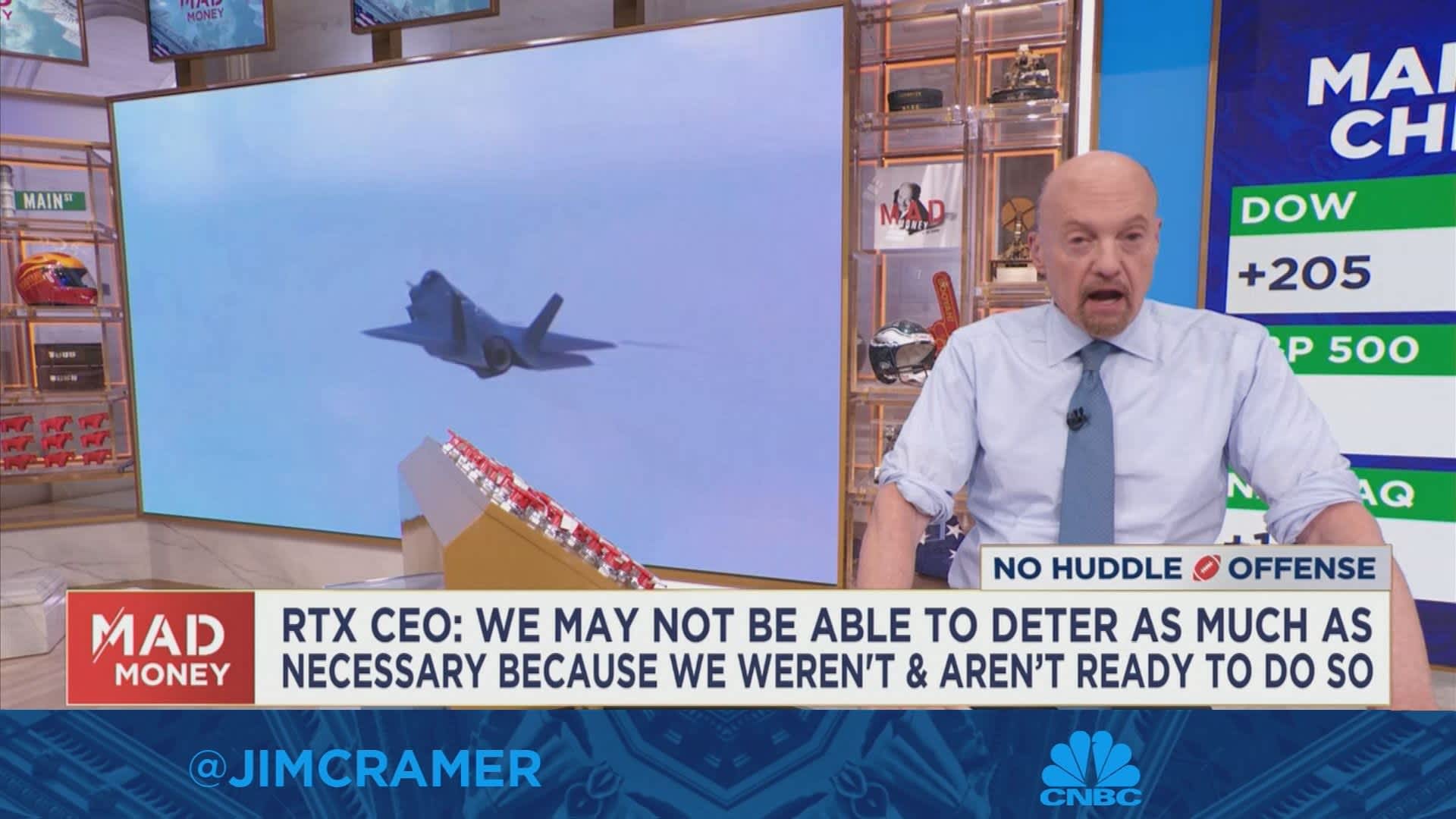

Jim Cramer, the often-controversial but always-watched television personality, has offered his opinion on CoreWeave (CRWV), a company making waves in the rapidly expanding AI infrastructure market. But is his assessment a reliable guide for investors? This in-depth analysis will dissect CoreWeave's position within the fiercely competitive AI landscape, examining its strengths, weaknesses, and future prospects to help you decide whether investing in CRWV aligns with your investment strategy. We’ll explore the factors fueling its growth, the inherent risks, and ultimately, determine if Cramer's take is a sound basis for your investment decisions.

CoreWeave's Business Model and Competitive Advantages

CoreWeave has carved a niche for itself by providing specialized cloud computing infrastructure optimized for the demanding needs of artificial intelligence. Understanding its business model is crucial to evaluating its potential.

Leveraging NVIDIA GPUs for AI Workloads

CoreWeave's core strength lies in its extensive utilization of NVIDIA GPUs, the workhorses behind many AI breakthroughs. These powerful graphics processing units are essential for training complex AI models and executing inference tasks, particularly in the realms of large language models (LLMs) and generative AI. CoreWeave offers direct access to these GPUs, enabling clients to scale their AI workloads efficiently. This contrasts with some competitors who might offer less direct or less optimized access. This direct access translates to:

- Direct access to NVIDIA hardware: Minimizing latency and maximizing performance.

- Optimized for AI workloads: Specialized configurations and software tailored for AI training and inference.

- Superior performance benchmarks: Offering potentially faster training times and reduced costs compared to less specialized solutions.

Compared to giants like AWS, Google Cloud, and Azure, CoreWeave often positions itself as a more agile and specialized provider, focusing intently on the specific needs of AI developers and researchers. This targeted approach is a key differentiator.

Targeting the High-Growth AI Market

The AI market is experiencing explosive growth, fueled by advancements in deep learning, natural language processing, and computer vision. CoreWeave is strategically positioned to capitalize on this expansion by focusing on:

- Focus on cutting-edge AI applications: Serving companies developing LLMs, generative AI tools, and other advanced AI solutions.

- Rapid expansion into new markets: Actively seeking new clients and expanding its infrastructure to meet the ever-increasing demand.

- Partnerships with leading AI companies: Collaborating with key players in the AI industry to enhance its offerings and reach.

This focus on the leading edge of AI development offers significant growth potential, but also exposes CoreWeave to the inherent volatility of this rapidly evolving technology sector.

Analyzing the Risks Associated with Investing in CRWV

While the opportunities are significant, several risks accompany investment in CoreWeave (CRWV). A thorough understanding of these is vital for informed decision-making.

Market Volatility and Competition

The technology stock market is inherently volatile, and the cloud computing sector is no exception. CoreWeave faces intense competition from established players like AWS, Google Cloud, and Azure, each possessing vast resources and extensive market reach. This competitive pressure could:

- High competition: Lead to price wars and pressure on profit margins.

- Market fluctuations impacting stock price: Result in significant price swings based on overall market sentiment and competitive pressures.

- Dependence on NVIDIA technology: Create vulnerability if NVIDIA's technology or market position shifts.

Financial Performance and Future Projections

A careful analysis of CoreWeave's financial statements is crucial. Investors should examine:

- Revenue growth trajectory: Is revenue growing at a sustainable pace?

- Profitability margins: Is the company achieving profitability, and what are its projected margins?

- Cash flow analysis: Is the company generating sufficient cash flow to support its growth and operations?

Understanding these financial indicators, alongside projections for future performance, will offer a clearer picture of CoreWeave's financial health and long-term viability.

Evaluating Jim Cramer's Assessment of CoreWeave (CRWV)

Jim Cramer's opinions, while influential, are just one piece of the puzzle. His specific statements regarding CoreWeave (CRWV) need to be compared to the analysis presented above. For example, if he emphasizes the potential of the AI market, that aligns with the assessment of strong growth potential. However, if he overlooks the competitive landscape or financial risks, a more cautious approach is warranted.

- Cramer's specific recommendations: Carefully examine the reasoning behind his recommendations.

- Alignment with your own assessment: Compare his views with your independent analysis of the company’s fundamentals.

- Divergent viewpoints and their reasoning: Explore differing opinions and the rationale behind them to build a comprehensive understanding.

Conclusion

This analysis of CoreWeave (CRWV) highlights its potential within the burgeoning AI infrastructure market. Its specialization in NVIDIA GPUs, focus on the high-growth AI sector, and potential for significant expansion offer compelling opportunities. However, the intense competition, inherent market volatility, and the need for sustained profitability warrant careful consideration. While Jim Cramer's opinion can offer valuable context, it's crucial to conduct thorough due diligence, including a comprehensive analysis of financial statements and future projections, before making any investment decisions regarding CoreWeave (CRWV) or other AI infrastructure stocks. Remember, further research into CoreWeave (CRWV) and the broader AI infrastructure market is essential for informed and successful investment.

Featured Posts

-

Family First Blake Lively Finds Comfort Amidst Reported A List Fallout

May 22, 2025

Family First Blake Lively Finds Comfort Amidst Reported A List Fallout

May 22, 2025 -

The Countrys Rising Business Stars A Geographic Overview

May 22, 2025

The Countrys Rising Business Stars A Geographic Overview

May 22, 2025 -

Pronghorn Antelope Recovery A New Documentary From The University Of Wyoming

May 22, 2025

Pronghorn Antelope Recovery A New Documentary From The University Of Wyoming

May 22, 2025 -

Occasionverkoop Abn Amro Impact Van De Stijging Van Autobezit

May 22, 2025

Occasionverkoop Abn Amro Impact Van De Stijging Van Autobezit

May 22, 2025 -

Unian Linsi Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini

May 22, 2025

Unian Linsi Grem Zaklikaye Do Vidnovlennya Viyskovoyi Dopomogi Ukrayini

May 22, 2025