Is Joe Biden Responsible For The Slowing US Economy? A Critical Analysis

Table of Contents

H2: Biden's Economic Policies and Their Impact

President Biden's economic agenda has been characterized by significant government spending aimed at stimulating economic growth and addressing social needs. However, the impact of these policies on the slowing US economy is a subject of ongoing debate.

H3: The American Rescue Plan (ARP)

The American Rescue Plan, a $1.9 trillion stimulus package passed in early 2021, aimed to provide Covid-19 relief and boost the economy. While it undeniably provided short-term relief and supported job creation, critics argue it contributed to inflationary pressures.

- Increased Government Spending: The ARP injected a massive amount of money into the economy, increasing aggregate demand.

- Potential Inflationary Pressures: This surge in demand, coupled with supply chain disruptions, contributed to a significant rise in inflation. The Consumer Price Index (CPI) soared in the months following the ARP's passage.

- Short-Term Job Creation: The ARP did create jobs in the short term, particularly in sectors impacted by the pandemic.

- Long-Term Debt Implications: The ARP significantly increased the national debt, raising concerns about long-term economic sustainability. The Congressional Budget Office (CBO) provides detailed analysis of these debt projections.

H3: Infrastructure Investment and Jobs Act (IIJA)

The bipartisan Infrastructure Investment and Jobs Act, a $1.2 trillion investment in infrastructure projects, aims to create jobs and improve long-term economic productivity. However, its impact on the current economic slowdown is less immediate.

- Job Creation in Infrastructure Projects: The IIJA is expected to generate numerous jobs over several years in construction, engineering, and related fields.

- Potential for Increased Productivity: Improved infrastructure can boost efficiency and productivity, leading to long-term economic growth. However, realizing these benefits takes time.

- Impact on Inflation due to Increased Demand: The increased government spending associated with the IIJA could contribute to inflationary pressures, although the impact may be less pronounced than the ARP.

- Timeline for Realizing Economic Benefits: The full economic benefits of the IIJA are unlikely to be felt for several years, making its immediate impact on the current economic slowdown minimal.

H3: Other Key Policies

Beyond the ARP and IIJA, other Biden administration policies have influenced the economic landscape. Tax policies, regulatory changes, and trade agreements all play a role. Furthermore, the administration's response to global supply chain disruptions and the war in Ukraine have had significant indirect impacts.

- Specific Tax Policies and Their Effects: Changes to corporate and individual tax rates influence investment and consumer spending.

- Impact of Regulations on Business Investment: Increased regulation can impact business investment and growth.

- Trade Relations and Their Economic Consequences: Trade policies significantly influence international trade flows and domestic economic activity.

H2: External Factors Influencing the US Economy

Attributing the slowing US economy solely to President Biden's policies ignores significant external factors beyond his direct control.

H3: Global Economic Conditions

Global events have profoundly impacted the US economy. These events are largely outside the direct control of any single government.

- Inflationary Pressures from Global Events: The war in Ukraine, for example, has significantly driven up energy prices, contributing to global inflation.

- Energy Price Volatility: Fluctuations in global energy markets directly influence inflation and economic growth in the US.

- Supply Chain Bottlenecks and Their Ripple Effects: Global supply chain disruptions, exacerbated by the pandemic and geopolitical events, continue to impact US businesses and consumers.

H3: Pre-existing Economic Trends

The economic challenges facing the US were not created overnight. Pre-existing trends and conditions played a significant role in shaping the current situation.

- Inflation Rates Prior to Biden's Term: Inflation was already rising before Biden took office, indicating pre-existing inflationary pressures.

- The Ongoing Recovery from the Pandemic: The economic recovery from the Covid-19 pandemic was uneven and faced significant challenges.

- Existing Structural Economic Issues: Pre-existing structural issues, such as income inequality and healthcare costs, have long-term implications for economic stability.

H2: Assessing Biden's Responsibility

Determining Joe Biden's responsibility for the slowing US economy requires carefully considering both direct and indirect influences.

H3: Direct vs. Indirect Influence

It's crucial to distinguish between the direct impact of Biden's policies (like the ARP and IIJA) and the indirect effects of global events and pre-existing economic trends.

- Clear Examples of Direct Policy Impacts: Analyzing the effects of specific policies on inflation, employment, and GDP growth provides a measure of direct impact.

- Analysis of Indirect Influences Stemming from Global Events: The impact of global factors, like the war in Ukraine, must be factored into any assessment of the situation.

- Consider the Interplay of Both: The interplay between direct policy choices and external factors is complex and necessitates a multifaceted approach.

H3: Economic Indicators and Data Analysis

Analyzing key economic indicators provides an objective assessment of the economic situation.

- GDP Growth Rate: Tracking GDP growth provides a measure of overall economic output.

- Inflation Rates (CPI, PCE): Monitoring inflation rates (CPI and PCE) reveals the rate of price increases.

- Unemployment Figures: Unemployment rates reflect the level of joblessness in the economy.

- Consumer Confidence Index: The consumer confidence index indicates consumer sentiment and spending.

3. Conclusion

Assessing Joe Biden's responsibility for the slowing US economy is a complex undertaking. While his administration's policies have undoubtedly played a role, particularly through increased government spending and potential inflationary pressures, external factors such as global economic conditions and pre-existing trends have also significantly influenced the current situation. Attributing cause and effect solely to one factor is an oversimplification. It’s essential to analyze the interplay of these numerous elements to gain a comprehensive understanding. Continue researching and forming your own informed opinion on Joe Biden's responsibility for the slowing US economy and the impact of Biden's economic policies. Explore additional resources and data to deepen your understanding of this multifaceted issue.

Featured Posts

-

Joseph Dans La Creme De La Crim Tf 1 Personnage Et Intrigue

May 03, 2025

Joseph Dans La Creme De La Crim Tf 1 Personnage Et Intrigue

May 03, 2025 -

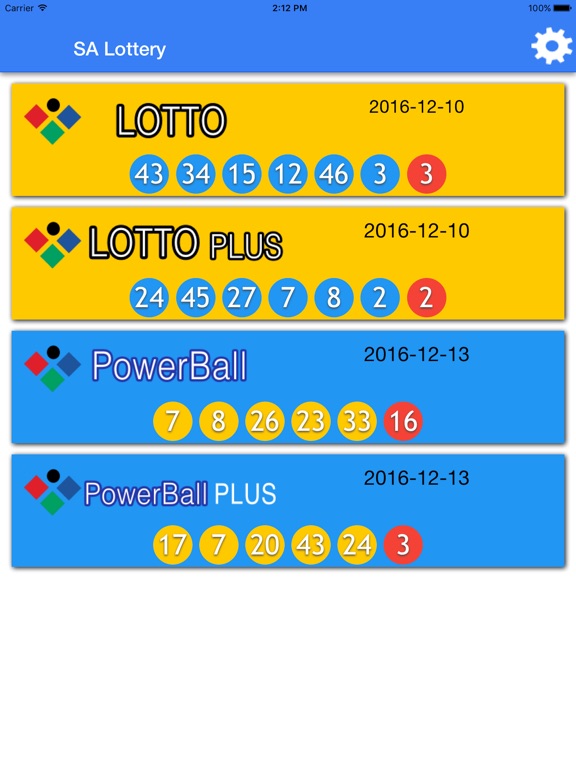

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Check The Latest Draw Results

May 03, 2025 -

Gabon Macron Annonce La Fin De La Francafrique Quelles Implications Pour L Afrique

May 03, 2025

Gabon Macron Annonce La Fin De La Francafrique Quelles Implications Pour L Afrique

May 03, 2025 -

Souness Havertz Still Not The Answer For Arsenals Epl Struggles

May 03, 2025

Souness Havertz Still Not The Answer For Arsenals Epl Struggles

May 03, 2025 -

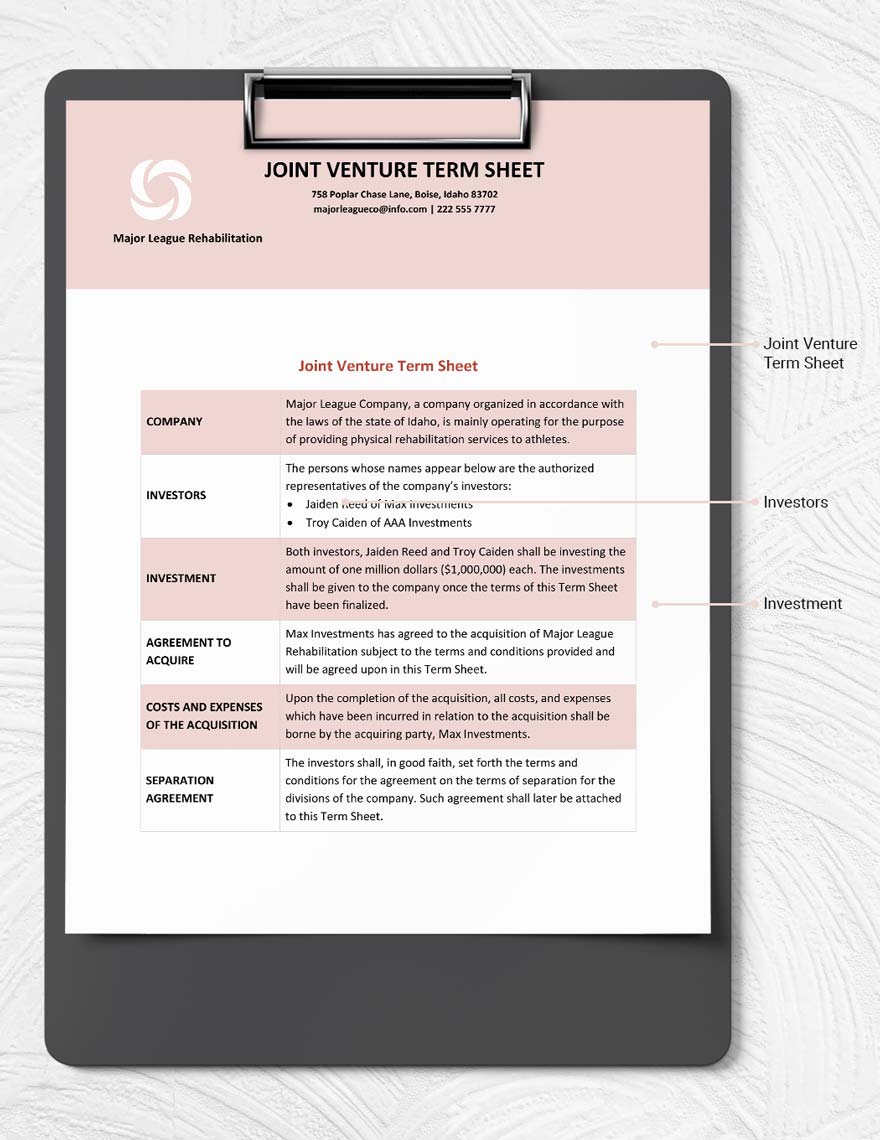

Luxury Middle Eastern Resorts A Joint Venture Between Balsillies Golf Company And Saudi Developer

May 03, 2025

Luxury Middle Eastern Resorts A Joint Venture Between Balsillies Golf Company And Saudi Developer

May 03, 2025