Is Norwegian Cruise Line (NCLH) Stock A Smart Hedge Fund Investment?

Table of Contents

Analyzing NCLH's Financial Performance and Future Projections

Recent Financial Results and Key Metrics

NCLH's recent financial performance offers a mixed bag. Examining recent earnings reports is crucial for assessing the company's financial health. Key metrics to scrutinize include revenue growth, which reflects booking trends and pricing strategies, and profitability, encompassing net income and operating margins. Debt levels and the debt-to-equity ratio are critical indicators of financial stability. A high debt-to-equity ratio could signal increased financial risk. Analyzing these metrics against industry benchmarks and historical data provides a clearer picture of NCLH's financial trajectory. Furthermore, understanding the price-to-earnings ratio (P/E ratio) can provide insight into market valuation relative to earnings.

- Revenue Growth: Analyze the year-over-year and quarter-over-quarter revenue changes.

- Profitability: Examine net income, operating margin, and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

- Debt Levels: Assess the total debt and the debt-to-equity ratio.

- P/E Ratio: Compare NCLH's P/E ratio to its competitors and industry averages.

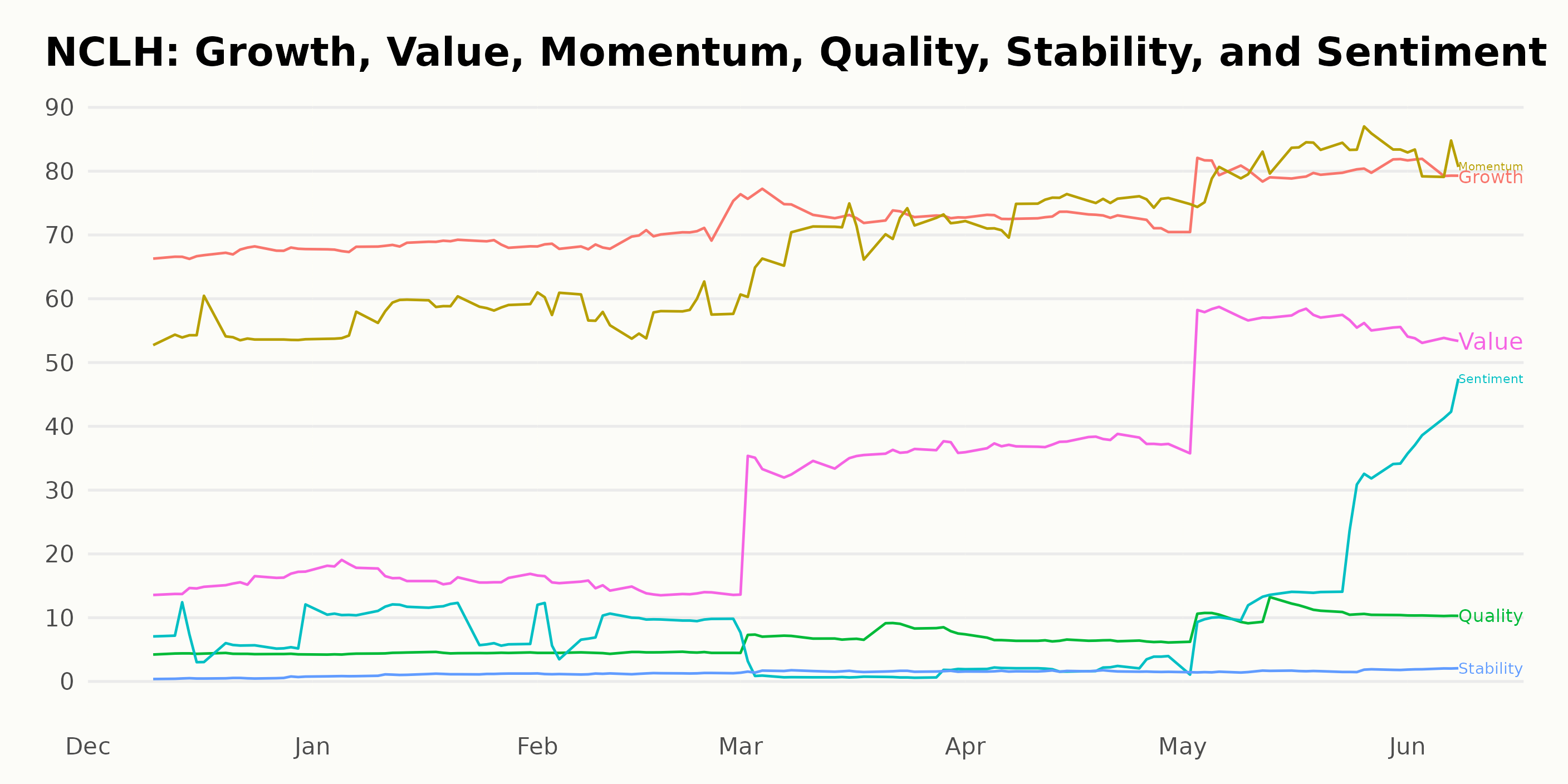

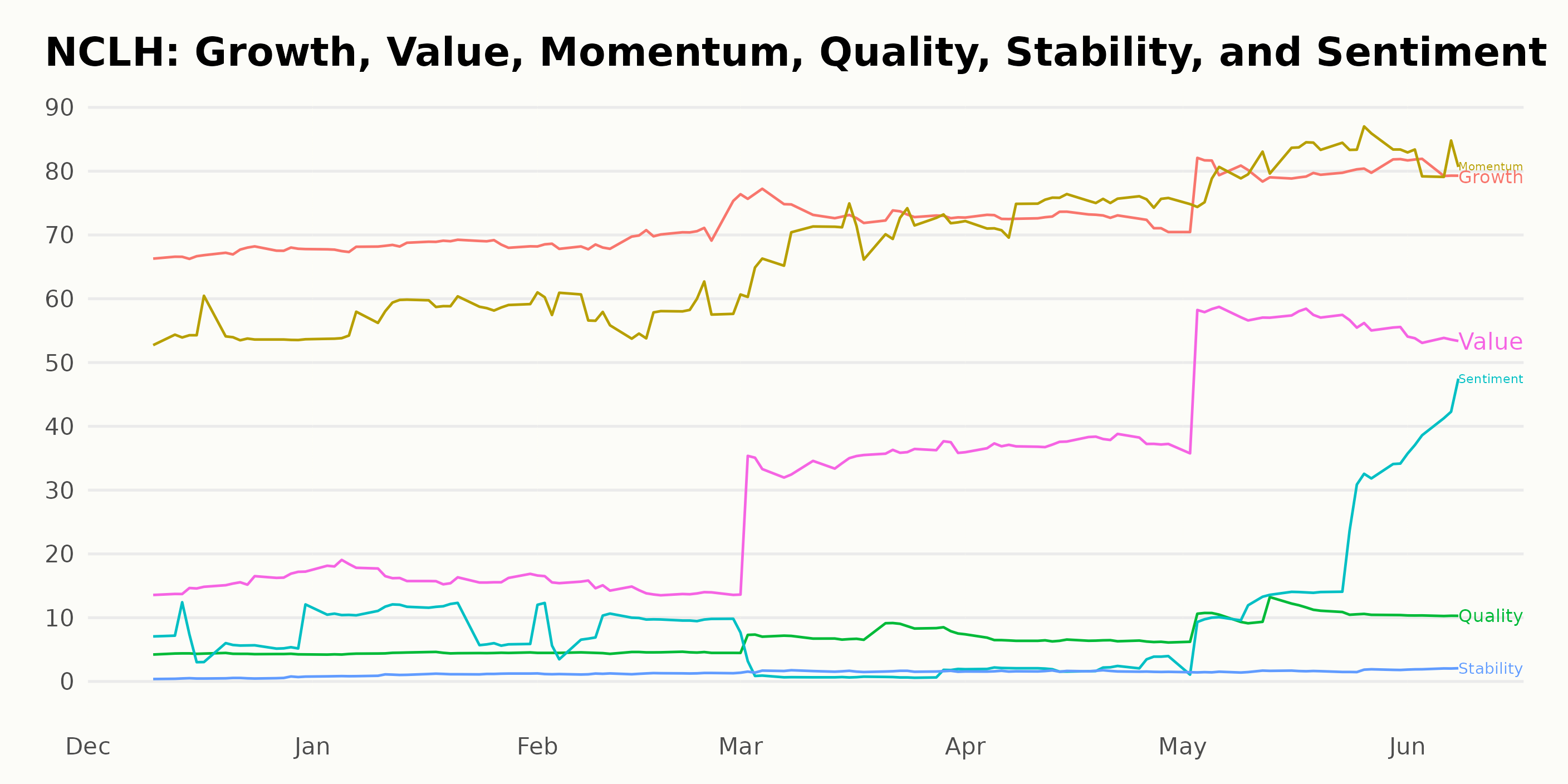

- Visual Aids: Incorporate charts and graphs to illustrate these key financial metrics visually.

Market Outlook and Industry Trends

The cruise industry's future trajectory is pivotal in assessing NCLH's investment viability. Analyzing industry growth projections and market share data is essential. Benchmarking NCLH against competitors like Carnival and Royal Caribbean provides context for its performance and market position. External factors, such as fuel prices (a significant operating expense for cruise lines), geopolitical events (which can disrupt travel patterns), and broader economic conditions (influencing consumer spending on discretionary items like cruises), all significantly impact NCLH's prospects.

- Industry Growth: Research projections for the overall cruise market's growth in the coming years.

- Competitive Analysis: Compare NCLH's performance metrics with those of its main competitors.

- Fuel Price Sensitivity: Analyze the impact of fluctuating fuel costs on NCLH's profitability.

- Geopolitical Risks: Assess the potential impact of global events on the cruise industry and NCLH specifically.

Long-Term Growth Potential and Investment Strategy

NCLH's long-term prospects depend on its strategic initiatives. Expansion plans, including the launch of new ships and the development of innovative itineraries and onboard experiences, are crucial factors. The potential for long-term capital appreciation and dividend payouts needs careful evaluation. Different investment strategies, including long-term buy-and-hold or shorter-term trading approaches, need to be considered within the context of a hedge fund's overall investment strategy.

- New Ship Launches: Evaluate the impact of new ship additions on capacity and revenue generation.

- Innovative Strategies: Analyze the success of new offerings and their potential to attract customers.

- Capital Appreciation Potential: Project potential growth in NCLH's stock price over the long term.

- Dividend Policy: Assess the likelihood and sustainability of dividend payouts.

Risks Associated with Investing in NCLH Stock

Market Volatility and Economic Uncertainty

The cruise industry is inherently cyclical and vulnerable to economic downturns. Recessions and periods of economic uncertainty can significantly reduce consumer spending on discretionary travel, impacting NCLH's revenue. External shocks, such as pandemics or geopolitical instability, can severely disrupt operations and stock prices.

- Economic Sensitivity: Analyze the correlation between economic indicators (GDP, unemployment) and NCLH's stock performance.

- Pandemic Risk: Assess the company’s preparedness for future unforeseen events that might disrupt operations.

- Geopolitical Factors: Evaluate the potential impact of global conflicts or political instability on travel demand.

Operational and Regulatory Risks

Operational challenges, such as ship maintenance, crew management, and port access issues, can negatively affect profitability. Regulatory changes, environmental concerns, and the ever-present risk of litigation or safety incidents pose significant operational and reputational risks.

- Ship Maintenance: Assess the cost and frequency of required ship maintenance and repairs.

- Crew Management: Evaluate the effectiveness of crew recruitment, training, and retention strategies.

- Regulatory Compliance: Analyze the potential impact of environmental regulations and safety standards.

- Litigation Risk: Consider the potential for lawsuits related to accidents or other incidents.

Debt Levels and Financial Leverage

High levels of debt can constrain NCLH's financial flexibility and increase its vulnerability during economic downturns. Analyzing the company's debt burden and its ability to manage its debt obligations is critical.

- Debt-to-Equity Ratio: Evaluate the company's debt level relative to its equity.

- Interest Expense: Analyze the impact of interest payments on profitability.

- Debt Maturity Schedule: Assess the timing of upcoming debt repayments.

NCLH Stock as Part of a Diversified Hedge Fund Portfolio

Risk Mitigation and Portfolio Diversification

Including NCLH stock in a diversified portfolio can reduce overall risk. Analyzing the correlation of NCLH with other asset classes within the portfolio is vital to understanding its contribution to overall portfolio risk and return.

- Correlation Analysis: Examine the historical correlation between NCLH and other asset classes.

- Portfolio Optimization: Assess how NCLH contributes to the overall portfolio's risk-adjusted return.

Hedge Fund Strategies for NCLH Investment

Hedge funds may employ various strategies with NCLH stock. Arbitrage opportunities, options trading (to hedge against price volatility), and even merger arbitrage (in case of potential acquisitions) are possibilities. The choice of strategy depends on the fund's investment objectives and risk tolerance.

- Arbitrage Strategies: Identify potential mispricing opportunities in NCLH's stock.

- Options Trading: Analyze the use of options to manage risk and generate returns.

- Merger Arbitrage: Evaluate the potential for merger or acquisition activity.

Conclusion: Is NCLH Stock a Smart Hedge Fund Investment? A Final Verdict.

Investing in NCLH stock presents a complex proposition. While the company has growth potential stemming from industry recovery and strategic initiatives, significant risks remain, including market volatility, operational challenges, and a substantial debt burden. The suitability of a Norwegian Cruise Line (NCLH) stock hedge fund investment depends heavily on the fund’s risk tolerance, investment horizon, and overall portfolio strategy. A careful analysis of NCLH's financial performance, industry trends, and competitive landscape is crucial. Thorough due diligence and potentially consulting with a financial advisor specializing in both hedge fund management and cruise industry investments are recommended before making any investment decisions regarding Norwegian Cruise Line (NCLH) stock hedge fund investment.

Featured Posts

-

Nba Legend Charles Barkleys Shocking Connection To Drag Race

Apr 30, 2025

Nba Legend Charles Barkleys Shocking Connection To Drag Race

Apr 30, 2025 -

Gia Tieu Thong Tin Cap Nhat Moi Nhat Cho Nong Dan

Apr 30, 2025

Gia Tieu Thong Tin Cap Nhat Moi Nhat Cho Nong Dan

Apr 30, 2025 -

Unpredictable Romance 10 Tv Shows With Jaw Dropping Plot Twists

Apr 30, 2025

Unpredictable Romance 10 Tv Shows With Jaw Dropping Plot Twists

Apr 30, 2025 -

Garcias Blast And Witts Double Secure Royals 4 3 Win Against Guardians

Apr 30, 2025

Garcias Blast And Witts Double Secure Royals 4 3 Win Against Guardians

Apr 30, 2025 -

Disney Layoffs Nearly 200 Abc News Staffers Affected

Apr 30, 2025

Disney Layoffs Nearly 200 Abc News Staffers Affected

Apr 30, 2025