Is Now The Right Time To Buy Palantir Stock?

Table of Contents

Palantir's Current Financial Performance and Growth Prospects

Palantir's financial performance is a crucial factor in determining whether to buy Palantir stock. Understanding its revenue growth, profitability, and the balance between government and commercial contracts is essential for any potential investor.

Revenue Growth and Profitability

Analyzing Palantir's recent financial reports reveals a mixed bag. While the company has demonstrated consistent year-over-year (YoY) revenue growth, profitability remains a challenge.

- YoY Revenue Growth: Palantir has shown consistent, albeit fluctuating, YoY revenue growth in recent quarters. However, investors should carefully examine the specific growth rates and compare them to previous years to identify trends.

- Operating Income and Net Income: While revenue is growing, Palantir's operating income and net income haven't always reflected that growth. This disparity warrants close scrutiny to understand the company's cost structure and its path to profitability. Investors should study the income statements to identify key cost drivers and assess whether these are manageable in the long term.

- Key Performance Indicators (KPIs): Beyond the basic financial statements, examining KPIs like customer acquisition cost (CAC), customer churn rate, and average revenue per user (ARPU) provides a more granular view of Palantir's operational efficiency. Analyzing these metrics provides a more complete picture of Palantir's financial health. A detailed look at these KPIs is crucial for a robust Palantir stock analysis.

[Insert chart visualizing revenue growth, operating income, and net income over the past few years].

Government Contracts vs. Commercial Revenue

Palantir's revenue streams are traditionally divided between government contracts and commercial sales. Understanding the balance and future outlook of each is vital for assessing the long-term viability of a Palantir investment.

- Revenue Stream Breakdown: Historically, government contracts have been a significant revenue driver for Palantir. However, the company is actively pursuing growth in the commercial sector. Understanding the precise percentage breakdown of revenue from each sector will reveal its dependency on government contracts.

- Long-Term Growth Potential: While government contracts offer a degree of stability, the commercial sector potentially offers higher growth. Investors need to assess the future potential of each stream, considering market competition and the long-term sustainability of each segment.

- Risks of Government Contract Reliance: Over-reliance on government contracts can introduce significant risk. Changes in government policy, budget cuts, or shifts in geopolitical landscape could significantly impact Palantir's revenue. Diversification into the commercial sector is a mitigating factor, but its success remains to be fully determined.

Market Sentiment and Valuation

Gauging market sentiment and properly valuing Palantir stock is crucial before considering a purchase.

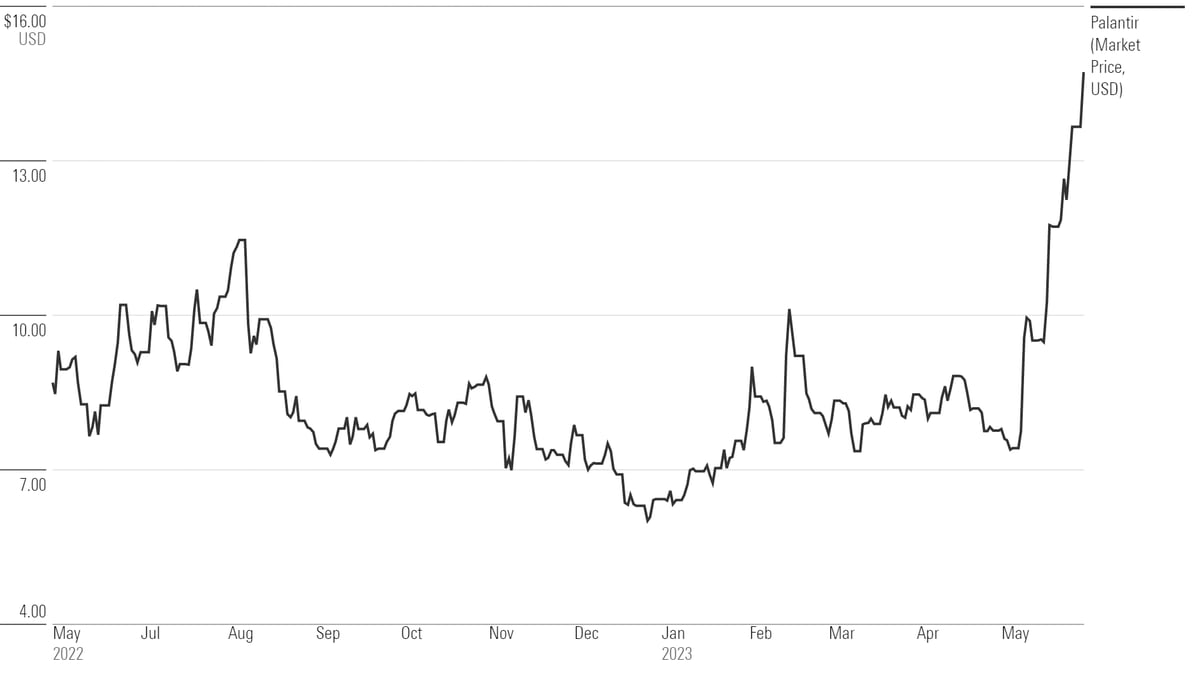

Stock Price Analysis

Palantir's stock price has exhibited considerable volatility since its IPO. Examining past price movements can offer insights but should not be the sole basis for an investment decision.

- Price Trend Charts: Visual representations of Palantir's stock price over time (daily, weekly, and monthly) are invaluable tools. These charts help identify significant price fluctuations and potential trends.

- Impacting Factors: External factors, like news announcements, earnings reports, and broader market sentiment, greatly influence Palantir's stock price. Understanding these influences provides context to the observed volatility. For example, positive news about a major contract win could boost the Palantir stock price, while negative press could trigger a sell-off.

[Insert chart showing Palantir's historical stock price performance].

Valuation Metrics

Evaluating Palantir's valuation relative to its peers and industry benchmarks is critical.

- Key Valuation Ratios: Calculating and comparing key metrics like the Price-to-Sales (P/S) ratio, Price-to-Earnings (P/E) ratio (if applicable), and other relevant valuation multiples provides valuable insight. Comparing these ratios to competitors helps determine if Palantir is overvalued or undervalued.

- Competitor Benchmarking: Comparing Palantir's valuation to similar companies in the data analytics space allows for a relative assessment. This comparative analysis helps to establish whether the current Palantir stock price reflects its potential for future growth.

Risks and Challenges Facing Palantir

While Palantir offers compelling technology, various risks and challenges could hinder its growth and affect the Palantir stock price.

Competition and Market Saturation

The data analytics market is becoming increasingly competitive.

- Key Competitors: Identifying Palantir's main competitors (e.g., companies offering similar data analytics platforms) and analyzing their strengths and weaknesses is necessary. This assessment helps determine Palantir's competitive advantage and its ability to maintain market share.

- Market Saturation: The level of market saturation in specific sectors influences Palantir's potential for future growth. A highly saturated market presents greater challenges to securing new clients and expanding market share.

Dependence on Key Clients

Palantir's reliance on a few large clients presents significant risk.

- Key Client Identification: Identifying Palantir's major clients and the percentage of revenue they contribute helps determine the potential impact of losing one or more significant contracts.

- Impact of Client Loss: The loss of a major client could severely impact Palantir's revenue and profitability, leading to substantial negative effects on the Palantir stock price.

Regulatory and Geopolitical Risks

Regulatory changes and geopolitical events can significantly affect Palantir's operations.

- Regulatory Challenges: Changes in data privacy regulations or government contracting policies could impact Palantir's ability to operate effectively.

- Geopolitical Instability: Geopolitical instability in regions where Palantir operates could disrupt its business and create uncertainty for investors.

Conclusion

Determining whether now is the right time to buy Palantir stock requires a careful evaluation of its financial performance, market valuation, and inherent risks. While Palantir demonstrates growth in revenue, profitability remains a key concern. The company's reliance on government contracts presents risk, though diversification into the commercial sector offers potential upside. The competitive landscape and valuation metrics should be thoroughly considered before making any investment decision.

Call to Action: This analysis provides insights, but it is not financial advice. Before buying Palantir stock, conduct thorough due diligence, consult with a financial advisor, and carefully weigh the potential rewards against the inherent risks. Remember, investing in Palantir stock involves significant risk, and past performance is not indicative of future results. Carefully consider the Palantir stock price and its underlying fundamentals before making your investment decision.

Featured Posts

-

High Potential After 11 Years A Legacy Of Psych Spiritual Success

May 10, 2025

High Potential After 11 Years A Legacy Of Psych Spiritual Success

May 10, 2025 -

Fox News Jeanine Pirro Named Trumps Top D C Prosecutor

May 10, 2025

Fox News Jeanine Pirro Named Trumps Top D C Prosecutor

May 10, 2025 -

Improving Accessibility For Wheelchair Users On The Elizabeth Line

May 10, 2025

Improving Accessibility For Wheelchair Users On The Elizabeth Line

May 10, 2025 -

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025 -

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Tu Nhan Sac Den Tinh Yeu

May 10, 2025