Is Palantir Stock A Buy Before May 5th? Analyst Ratings And Predictions

Table of Contents

Current Market Sentiment and Stock Performance

Palantir stock has experienced significant price fluctuations recently, reflecting the dynamic nature of the tech sector and the company's own performance. Analyzing recent trends is crucial for understanding the current market sentiment towards Palantir. Recent news and events, such as earnings reports, new contract announcements, and overall industry trends, have significantly impacted the stock price. For example, the announcement of a major new government contract could boost investor confidence, driving the price upward, while disappointing earnings could lead to a sell-off.

Technical indicators also provide valuable insight. Moving averages, such as the 50-day and 200-day moving averages, can help determine short-term and long-term trends. The Relative Strength Index (RSI) offers insights into the stock's momentum and potential overbought or oversold conditions.

- Recent high and low stock prices: Tracking these highs and lows reveals the volatility of Palantir stock and potential entry and exit points.

- Trading volume analysis: High trading volume often indicates strong investor interest, while low volume might suggest a lack of momentum.

- Comparison to competitors' stock performance: Comparing Palantir's performance to its competitors in the data analytics and software sector provides context and helps assess its relative strength.

Analyst Ratings and Price Targets for Palantir Stock

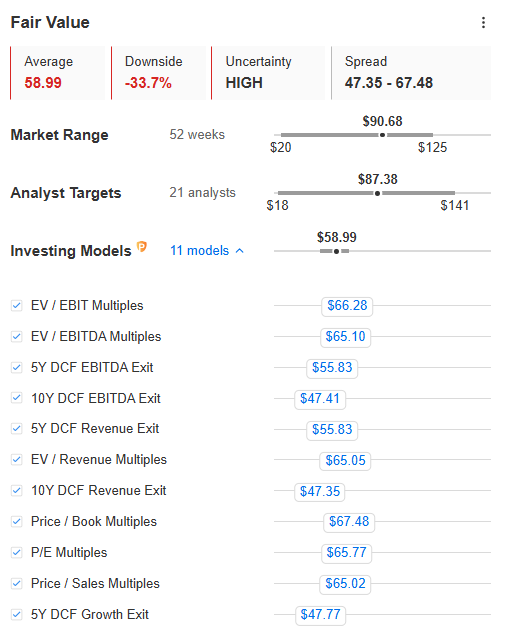

Several reputable financial analysts offer ratings and price targets for Palantir stock. Consulting these sources provides a broader perspective on the investment outlook. Bloomberg, Morningstar, and TipRanks, among others, offer consensus ratings that summarize the overall sentiment among analysts. These ratings often range from "Buy" to "Sell," with "Hold" representing a neutral stance. It's important to note that even within a consensus rating, there's often a range of price targets.

- List of key analyst firms and their ratings: Reviewing individual analyst ratings allows you to understand the nuances behind the overall consensus.

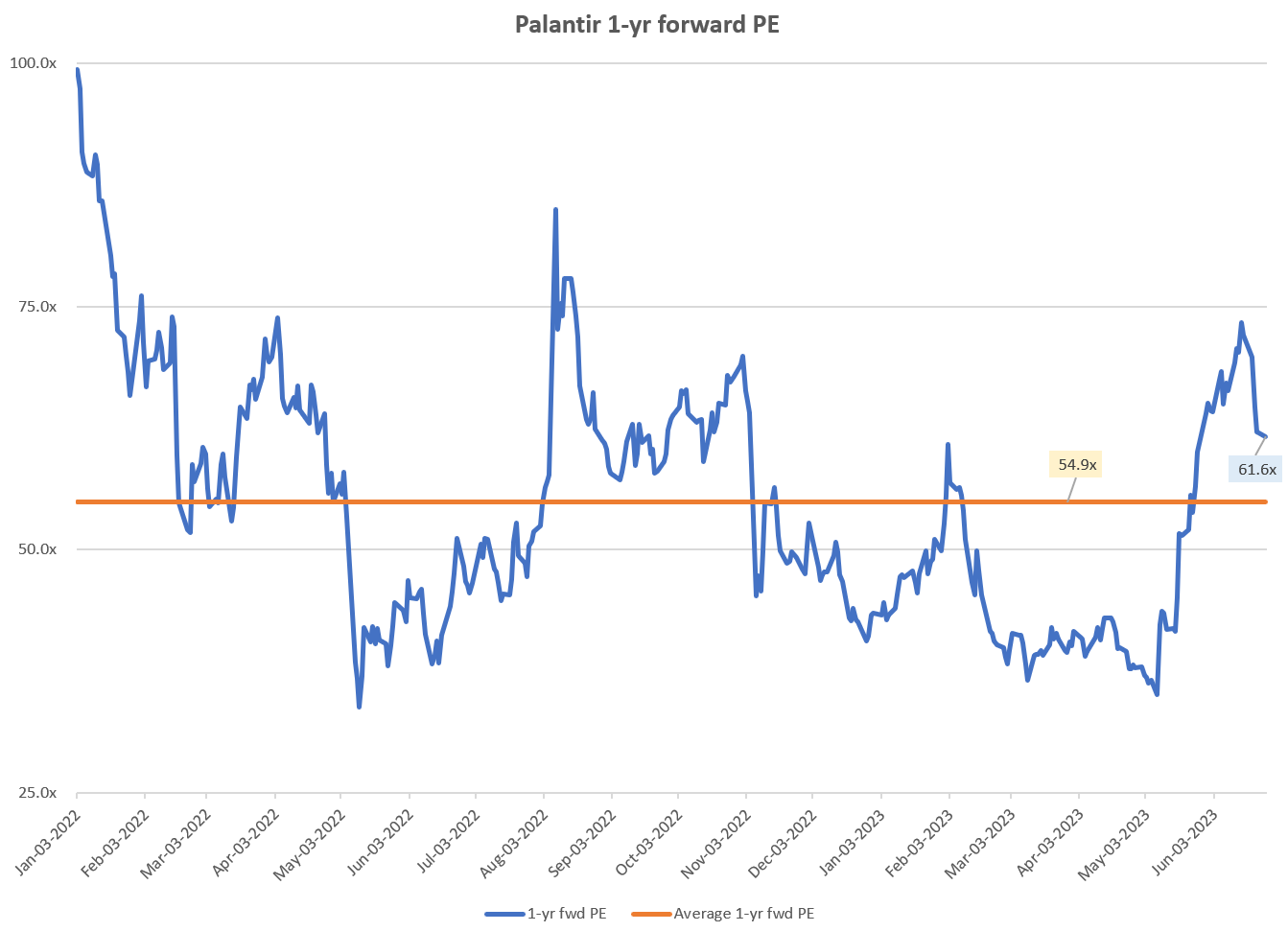

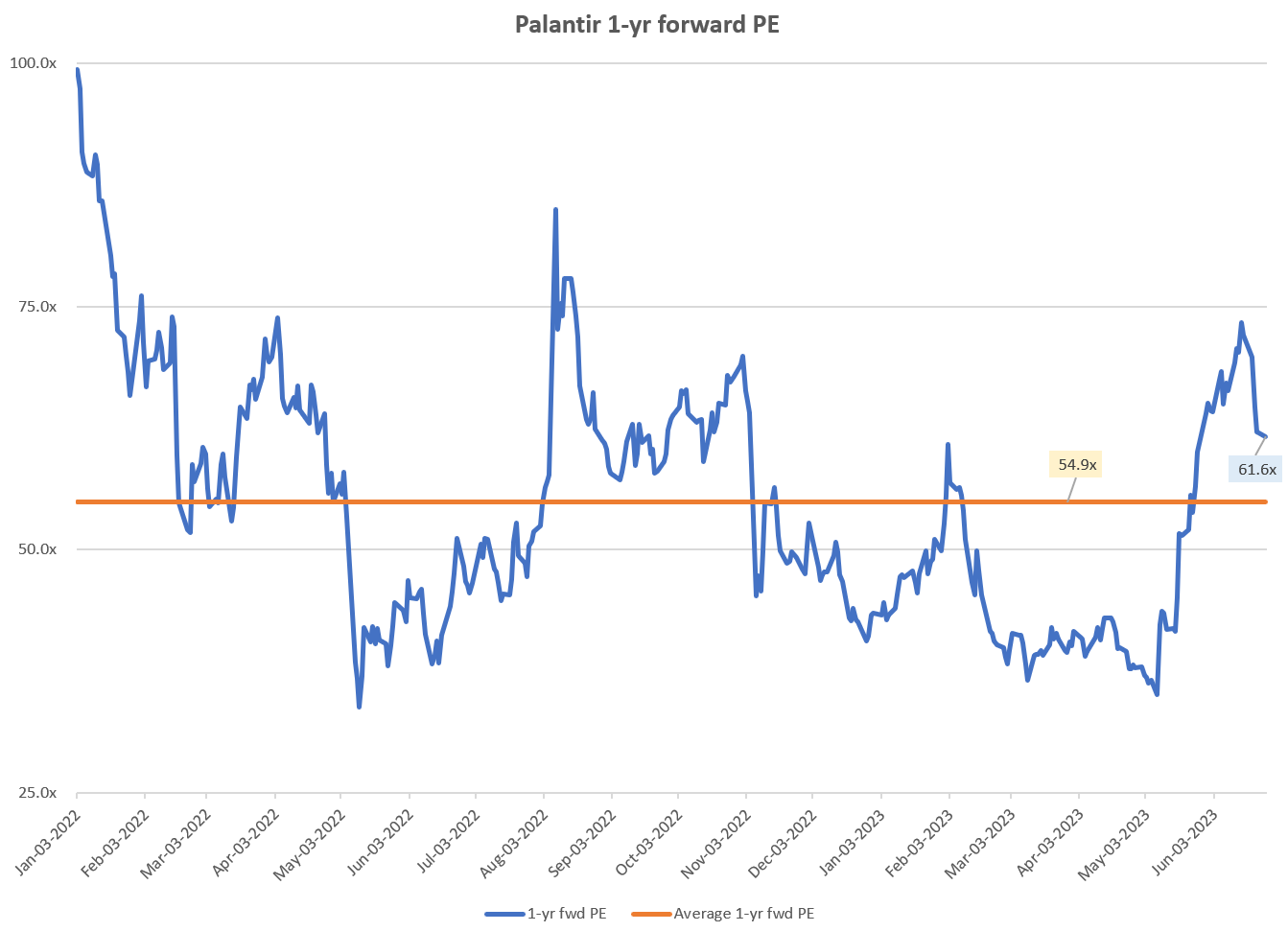

- Average price target and range: The average price target provides a general idea of where analysts believe the stock is headed. The range, however, highlights the uncertainty inherent in these predictions.

- Key arguments supporting bullish and bearish predictions: Understanding the reasoning behind different predictions is crucial for forming your own informed opinion. Bullish analysts might highlight Palantir's growth potential, while bearish analysts might focus on risks and challenges.

Key Financial Indicators and Growth Potential

Analyzing Palantir's financial health is crucial for assessing its long-term growth potential. Key indicators include revenue growth (both year-over-year (YoY) and quarter-over-quarter (QoQ)), profitability margins (gross, operating, and net), and debt-to-equity ratio. Strong revenue growth, healthy margins, and manageable debt levels suggest a financially sound company with potential for future growth.

Palantir's strategic initiatives, such as expansion into new markets and product development, play a significant role in shaping its future trajectory. The company's ability to secure new contracts, particularly in the government and commercial sectors, will be key drivers of future revenue. The long-term sustainability of its business model, focusing on data analytics and software solutions, depends on its ability to adapt to changing technological trends and maintain a competitive edge.

- Revenue growth rate (YoY and QoQ): Consistent and strong revenue growth is a positive sign.

- Profitability margins (gross, operating, net): Healthy margins demonstrate the company's ability to translate revenue into profits.

- Debt-to-equity ratio: A low debt-to-equity ratio indicates lower financial risk.

- Key strategic partnerships and collaborations: Strategic partnerships can significantly enhance growth potential.

Risks and Challenges Facing Palantir

Investing in Palantir stock involves inherent risks. The company faces competition from established players in the data analytics market, regulatory hurdles related to data privacy and security, and dependence on government contracts for a significant portion of its revenue. These factors can influence future stock performance. Analyzing Palantir's ability to mitigate these risks is vital. For example, their diversification into commercial markets could lessen their reliance on government contracts.

- Major competitors and competitive landscape: Understanding the competitive landscape helps assess Palantir's market share and future growth prospects.

- Regulatory risks and compliance challenges: Stringent data privacy regulations could impact Palantir's operations.

- Dependence on specific clients or industries: Over-reliance on specific clients or industries poses a risk.

- Potential for future economic downturns: Economic downturns can negatively impact demand for Palantir's services.

Conclusion

This analysis of Palantir stock before May 5th reveals a mixed outlook, with varying analyst predictions reflecting both growth potential and inherent risks. While Palantir exhibits promising growth in certain areas, particularly in commercial markets, investors should carefully consider the potential challenges, including competition and regulatory hurdles, before making a decision. The company's dependence on government contracts remains a key risk factor.

Call to Action: Ultimately, the decision of whether to buy Palantir stock before May 5th depends on your individual risk tolerance and investment strategy. Conduct thorough research, including a review of recent financial reports and news articles. Consider consulting a financial advisor before making any investment decisions related to Palantir stock or any other security. Remember to carefully evaluate the current market conditions and future outlook for Palantir before making a purchase. Thoroughly assess all factors before buying Palantir stock.

Featured Posts

-

China Sends Top Security Official To Us Trade Talks Exclusive Details

May 10, 2025

China Sends Top Security Official To Us Trade Talks Exclusive Details

May 10, 2025 -

Cheveux Solidaires A Dijon Comment Faire Un Don

May 10, 2025

Cheveux Solidaires A Dijon Comment Faire Un Don

May 10, 2025 -

Uk Government Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka Analysis

May 10, 2025

Uk Government Plans To Restrict Visas From Pakistan Nigeria And Sri Lanka Analysis

May 10, 2025 -

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025

Palantir Stock 30 Down Investment Strategy Considerations

May 10, 2025 -

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025

Ice Detention Case Judge Grants Release For Tufts University Student Rumeysa Ozturk

May 10, 2025