Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies provides advanced data analytics platforms to government and commercial clients. Its success hinges on two primary revenue streams:

Government Contracts

Government contracts form a substantial portion of Palantir's revenue.

- Percentage of Revenue: A significant percentage of Palantir's revenue historically comes from government contracts, particularly in defense and intelligence. (Specific percentage should be researched and inserted here, citing source).

- Key Government Clients: The company boasts a portfolio of significant government clients, both domestically and internationally. (List key clients if publicly available, citing sources).

- Contract Renewal Rates: Analyzing contract renewal rates provides insight into client satisfaction and long-term revenue stability. (Insert data on renewal rates if available, citing source).

- Potential Risks: Over-reliance on government contracts presents inherent risks. Changes in government spending, policy shifts, and competitive bidding can impact revenue streams.

Keywords: Government contracts, Palantir revenue, defense spending, government clients, national security, intelligence agencies.

Commercial Partnerships

Palantir's expansion into the commercial sector is a key driver of its future growth.

- Key Commercial Clients: The company is increasingly securing contracts with large commercial organizations across various industries. (List examples of key commercial clients if publicly available, citing sources).

- Industries Served: Palantir's platform caters to various sectors, including finance, healthcare, and energy. (Expand on which sectors are served and the specific applications of Palantir's technology).

- Growth Trajectory: The commercial market presents significant opportunities for growth, but competition is fierce. (Analyze the growth rate in the commercial sector, citing sources).

- Competitive Landscape: Palantir faces competition from established players and emerging startups in the data analytics space. (Discuss key competitors and their market share).

Keywords: Commercial partnerships, Palantir clients, commercial growth, data analytics market, artificial intelligence, machine learning.

Financial Performance and Valuation

Assessing Palantir's financial health is crucial for any investment decision.

Revenue Growth and Profitability

Examining Palantir's financial performance reveals its growth trajectory and profitability.

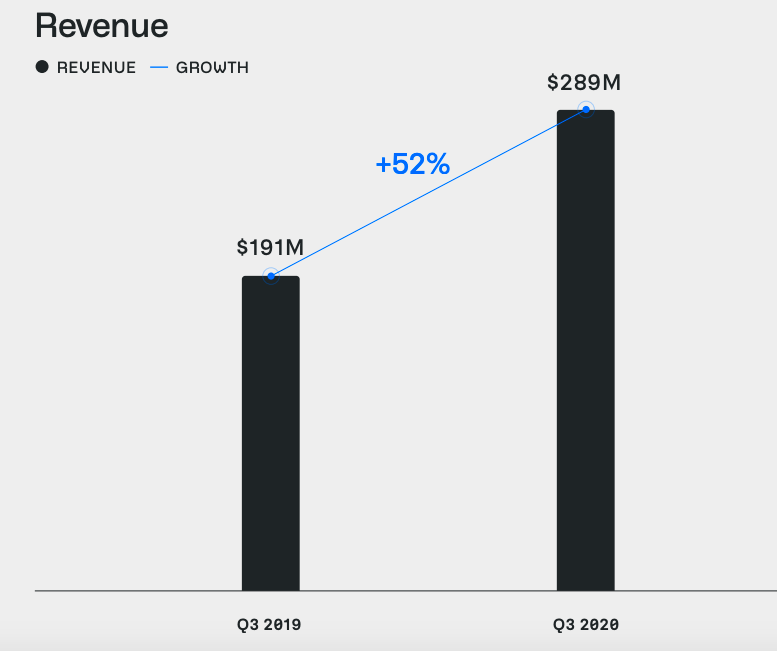

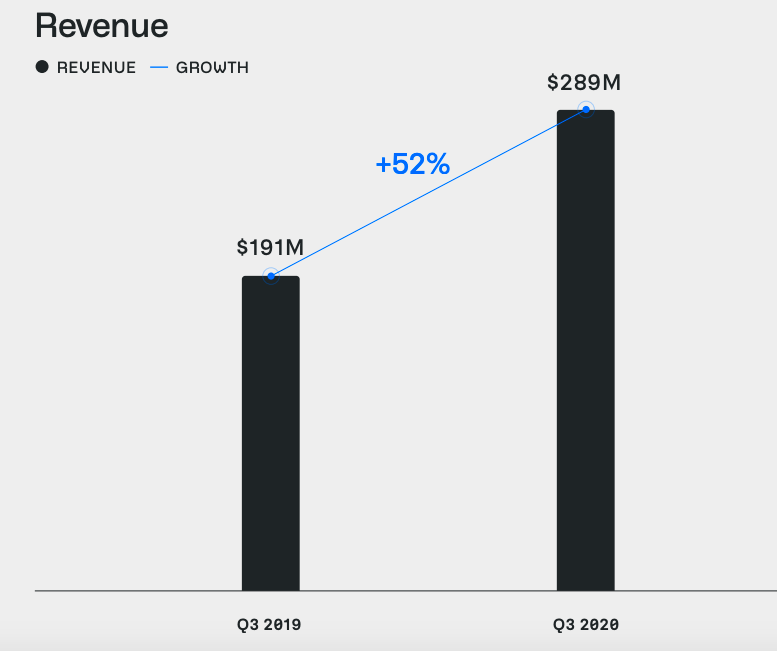

- Year-over-Year Revenue Growth: Analyze the year-over-year revenue growth to understand the company's expansion rate. (Insert data and charts showing revenue growth, citing sources).

- Profitability Metrics: Key metrics such as gross margin, operating margin, and net income highlight Palantir's profitability. (Include data and charts on these metrics, citing sources).

- Cash Flow from Operations: A strong cash flow from operations indicates financial health and sustainability. (Include data on cash flow, citing sources).

Keywords: Palantir financials, revenue growth, profitability, cash flow, financial performance, earnings per share, balance sheet.

Stock Valuation and Price-to-Sales Ratio

Palantir's valuation provides insight into its market perception and potential returns.

- Current P/S Ratio: The current price-to-sales (P/S) ratio provides a comparative valuation metric. (Insert the current P/S ratio and compare it to historical data, citing sources).

- Historical P/S Ratio: Analyzing the historical P/S ratio helps to understand valuation trends.

- Comparison to Industry Peers: Comparing Palantir's P/S ratio to competitors reveals its relative valuation. (Compare to relevant competitors, citing sources).

- Potential for Future Growth: Future growth prospects directly influence the stock's valuation.

Keywords: Palantir valuation, price-to-sales ratio, stock valuation, market capitalization, stock price.

Risks and Challenges

Despite its potential, Palantir faces certain risks and challenges.

Competition and Market Saturation

The data analytics market is highly competitive.

- Key Competitors: Palantir faces competition from established tech giants and nimble startups. (List key competitors and their strengths and weaknesses).

- Market Share: Assessing Palantir's market share and its ability to maintain or increase it is essential.

- Disruptive Technologies: The emergence of new technologies could disrupt Palantir's market position.

- Maintaining a Competitive Edge: Palantir needs to continuously innovate to stay ahead of the curve.

Keywords: Palantir competitors, market competition, data analytics competition, market saturation, competitive advantage.

Dependence on Key Clients

Reliance on a few major clients poses a significant risk.

- Concentration of Revenue: Analyze the concentration of revenue from a small number of clients.

- Impact of Losing a Major Client: Losing a major client could have a substantial negative impact on revenue.

- Strategies to Diversify: Palantir needs to diversify its client base to mitigate this risk.

Keywords: Client concentration, client risk, revenue diversification, risk management.

Future Outlook and Growth Potential

Palantir's future growth depends on several factors.

Product Innovation and New Markets

Innovation and expansion are crucial for long-term growth.

- New Product Releases: Palantir's plans for new product releases will influence its future growth trajectory.

- Planned Market Expansions: Expanding into new markets, both domestically and internationally, offers significant growth potential.

- International Growth: Success in international markets is key to scaling the business.

- Long-Term Growth Strategy: A clear long-term growth strategy is essential for sustained success.

Keywords: Palantir growth, product innovation, market expansion, future outlook, global expansion.

Analyst Ratings and Price Targets

Analyst opinions provide valuable insight into the future of Palantir stock.

- Average Analyst Rating: The average analyst rating summarizes the overall sentiment towards Palantir stock. (Include the average rating and range of ratings, citing sources).

- Range of Price Targets: Analyst price targets provide a range of potential future price outcomes. (Include the range of price targets and their sources).

- Consensus View: Analyze the consensus view among analysts regarding Palantir's future performance.

Keywords: Analyst ratings, Palantir price target, stock forecast, investment recommendations.

Conclusion

Is Palantir Technologies stock a buy now? The answer isn't straightforward. While Palantir possesses a strong technological foundation and operates in a rapidly growing market, it faces challenges related to competition, client concentration, and valuation. The company's substantial government contracts provide revenue stability, but reliance on these contracts also presents risk. Growth in the commercial sector is promising but requires continued innovation and successful market penetration. The current valuation should be carefully considered in light of these risks and opportunities. Based on the analysis presented, a further research recommendation is advised before making any investment decision. Investing in Palantir Technologies stock requires careful consideration of all factors presented. Do your own due diligence before making any investment decisions related to Palantir Technologies stock.

Featured Posts

-

West Bengal Madhyamik Result 2025 Official Merit List

May 09, 2025

West Bengal Madhyamik Result 2025 Official Merit List

May 09, 2025 -

Overtaym Drama Vegas Golden Nayts Oderzhivaet Pobedu Nad Minnesotoy V Pley Off

May 09, 2025

Overtaym Drama Vegas Golden Nayts Oderzhivaet Pobedu Nad Minnesotoy V Pley Off

May 09, 2025 -

9 Maya Bez Makrona Starmera Mertsa I Tuska Kievskie Torzhestva Pod Voprosom

May 09, 2025

9 Maya Bez Makrona Starmera Mertsa I Tuska Kievskie Torzhestva Pod Voprosom

May 09, 2025 -

The Jeffrey Epstein Files Release Weighing The Impact Of Attorney General Bondis Decision

May 09, 2025

The Jeffrey Epstein Files Release Weighing The Impact Of Attorney General Bondis Decision

May 09, 2025 -

Living Legends Of Aviation Event Recognizes Contributions Of Firefighters And Others

May 09, 2025

Living Legends Of Aviation Event Recognizes Contributions Of Firefighters And Others

May 09, 2025